by Calculated Risk on 10/28/2018 09:32:00 AM

Sunday, October 28, 2018

Hotels: Occupancy Rate Increased Slightly Year-over-year

From HotelNewsNow.com: US hotel results for week ending 20 October

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 14-20 October 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 15-21 October 2017, the industry recorded the following:

• Occupancy: +0.4% to 73.2%

• Average daily rate (ADR): +3.2% to US$135.67

• Revenue per available room (RevPAR): +3.6% to US$99.32

…

Houston, Texas, registered the steepest declines in each of the three key performance metrics: occupancy (-23.8% to 66.0%), ADR (-8.8% to US$107.41) and RevPAR (-30.6% to US$70.85). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, to date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, October 27, 2018

Schedule for Week of October 28, 2018

by Calculated Risk on 10/27/2018 08:11:00 AM

The key report this week is the October employment report on Friday.

Other key indicators include the October ISM manufacturing index, October auto sales, Personal Income and Outlays for September, Case-Shiller house prices for August, and the September trade deficit.

For manufacturing, the Dallas Fed manufacturing survey will be released this week.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October. This is the last of the regional Fed manufacturing surveys for October.

This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.0% year-over-year increase in the Comp 20 index for August.

10:00 AM: the Q3 2018 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 180,000 jobs added, down from 230,000 in September.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 60.0, down from 60.4 in September.

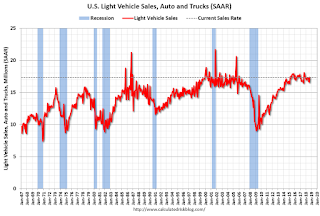

All day: Light vehicle sales for October.

All day: Light vehicle sales for October.The consensus is for 17.0 million SAAR in October, down from the BEA estimate of 17.36 million SAAR in September 2018 (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, down from 215 thousand the previous week.

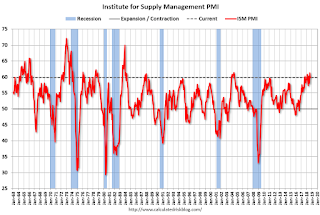

10:00 AM: ISM Manufacturing Index for October. The consensus is for 59.1%, down from 59.8%.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 59.1%, down from 59.8%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 59.8% in September, the employment index was at 58.8%, and the new orders index was at 61.8%.

10:00 AM: Construction Spending for September. The consensus is for 0.3% increase in spending.

8:30 AM: Employment Report for October. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for October. The consensus is for 190,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 134,000 jobs added in September, and the unemployment rate was at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In September the year-over-year change was 2.537 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $53.4 billion. The U.S. trade deficit was at $53.2 billion in August.

Friday, October 26, 2018

October 2018: Unofficial Problem Bank list declines to 75 Institutions

by Calculated Risk on 10/26/2018 04:57:00 PM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for October 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for October 2018. The list had a net decline of four insured institutions to 75 banks after six removals and two additions. Aggregate assets declined during the month by $772 million to $56.2 billion. A year ago, the list held 111 institutions with assets of $26.6 billion.

Actions were terminated against First Chatham Bank, Savannah, GA ($369 million); Bank of Eastman, Eastman, GA ($170 million); Pinnacle Bank, Orange City, FL ($89 million); and American Investors Bank and Mortgage, Eden Prairie, MN ($69 million). Removals through other ways include Sage Bank, Lowell, MA ($143 million) finding a merger partner and Merchants Bank of California, National Association, Carson, CA ($3 million) exiting through a voluntary liquidation.

Additions this month were AllNations Bank, Calumet, OK ($51 million) and Sainte Marie State Bank, Sainte Marie, IL ($20 million).

Lastly, we updated the name of Illinois-Service Federal Savings and Loan Association, Chicago, IL ($133 million) to GN Bank.

Philly Fed: State Coincident Indexes increased in 39 states in September

by Calculated Risk on 10/26/2018 01:14:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2018. Over the past three months, the indexes increased in 44 states, decreased in five states, and remained stable in one, for a three month diffusion index of 78. In the past month, the indexes increased in 39 states, decreased in six states, and remained stable in five, for a one-month diffusion index of 66.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In September, 40 states had increasing activity (including minor increases).

This is the fewest states with increasing activity in almost 9 years.

Q3 GDP: Investment

by Calculated Risk on 10/26/2018 10:21:00 AM

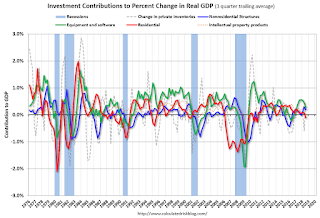

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) decreased in Q3 (-4.0% annual rate in Q3). Equipment investment increased slightly at a 0.4% annual rate, and investment in non-residential structures decreased at a 7.9% annual rate.

On a 3 quarter trailing average basis, RI (red) is down slightly, equipment (green) is positive, and nonresidential structures (blue) is also up.

Recently RI has been soft, but the decrease is fairly small.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP decreased in Q3, however RI has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase further in this cycle.

The increase is now primarily coming from single family investment and home remodeling.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

BEA: Real GDP increased at 3.5% Annualized Rate in Q3

by Calculated Risk on 10/26/2018 08:36:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2018 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.5 percent in the third quarter of 2018, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.2 percent.The advance Q3 GDP report, with 3.5% annualized growth, was close to expectations.

The Bureau emphasized that the third-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see “Source Data for the Advance Estimate” on page 2). The "second" estimate for the third quarter, based on more complete data, will be released on November 28, 2018.

...

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by negative contributions from exports and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the third quarter reflected a downturn in exports and a deceleration in nonresidential fixed investment. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.

emphasis added

Note the Change in Private Inventories contributed 2.07 percentage points to GDP growth in Q3, and this will probably unwind in Q4.

Personal consumption expenditures (PCE) increased at 4.0% annualized rate in Q3, up from 3.8% in Q2. Residential investment (RI) decreased 4.0% in Q3. Equipment investment increased at a 0.4% annualized rate, and investment in non-residential structures decreased at a 7.9% pace.

I'll have more later ...

Thursday, October 25, 2018

Freddie Mac: Mortgage Serious Delinquency Rate Unchanged in September

by Calculated Risk on 10/25/2018 07:46:00 PM

Friday:

• At 8:30 AM ET, Gross Domestic Product, 3nd quarter 2018 (Advance estimate). The consensus is that real GDP increased 3.3% annualized in Q3, down from 4.2% in Q2.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 99.0.

Freddie Mac reported that the Single-Family serious delinquency rate in September was 0.73%, unchanged from 0.73% in August. Freddie's rate is down from 0.86% in September 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This ties the lowest serious delinquency rate for Freddie Mac since January 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate late last year was due to the hurricanes (These are serious delinquencies, so it took three months late to be counted). We will probably see another, smaller, bump following hurricanes Florence and Michael.

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.7% range - but this is close to a bottom.

Note: Fannie Mae will report for September soon.

Brad Hunter on Homebuilding

by Calculated Risk on 10/25/2018 04:21:00 PM

CR Note: I've asked Brad Hunter for his thoughts on housing.

Hunter has been in the economic forecasting business for 32 years, and has made a name for himself tracking and forecasting the homebuilding business. He led a nationwide team of consultants in advising home builders (and their financiers) during his long tenure at Metrostudy.

He made several key calls of important turns (he warned his builder and financial clients of the dangers of overpaying for land in 2004/05, and he advised institutional investors to speculate heavily on land in 2009-2012). Here he lays out some of the key factors he sees driving the homebuilding business today. You can follow him at @bradleyhunter.

Home sales are reacting negatively to higher mortgage rates much the same way they did during the "Taper Tantrum" of 2013, when bond markets got the jitters and home sales dropped sharply as a result. Monthly-payment concern is about to become more of an issue for home sales.

A key question is how the home building companies will adjust to a rising-rate environment.

Homebuilders: "Lots" to Talk About

One of the main headwinds for homebuilding has been the supply (and therefore the price) of developed lots in locations where the builders want to build. The pace of lot development has not kept up with the need, particularly for builders who would like to build in a price range that middle-class people can afford.

Homebuilders are reporting fairly high levels of confidence these days, but they do say that lot prices are a major issue for them, as are material and labor costs. Most of these higher costs have been passed on to home buyers. At least so far. Lot costs have had the biggest negative effect on production of homes priced under $300,000, where there is the largest amount of under-served demand.

I discuss this, along with the threat to affordability and home sales posed by tariffs, in my latest interview on Bloomberg Radio: Tariffs Are Big Concern For Homebuilders As Costs Rise (Radio)

My forecast of single-family home sales for the entire year 2018 is 613,000, virtually unchanged versus 2017, reflecting the rapid rate at which builders boosted prices this year. I am forecasting only a modest increase in single-family home sales and housing starts in 2019, reflecting increased affordability problems.

Builders will have to consider land parcels that are farther from the traditional urban cores in order to continue to produce homes that large numbers of households can afford.

The household formation numbers are once again strong. The demand is there. The builders who figure out how to capture that demand are the ones that will come out on top.

Home Price Appreciation: Tapping the Brakes

New data from the S&P CoreLogic Case-Shiller Index of home prices shows that the pace of home price increase is still elevated, but is finally starting to slow, as expected. Appreciation is in the 6% range, according to this measure of home prices, still much higher than the rate of income growth.

Las Vegas, Seattle and San Francisco currently lead the pack, all with double-digit rates of home appreciation.

We are seeing the beginning of a larger slowdown in appreciation. Home prices and monthly payments cannot continue to outrun buyers’ incomes for much longer.

I hasten to clarify that what I see coming is a slower rate of increase; not a nationwide decline in home prices. While a few markets may see some price declines in the months ahead, the overwhelming majority will continue to appreciate, just at a much slower pace.

My prediction going forward is that income ratios and rising interest rates will drive a leveling off of home prices, particularly in the most expensive markets in the country. My forecast is for home price appreciation of existing homes to slow to 4% in 2019, and I believe it could fall to the 2% range shortly after, on average.

Apartment Construction Pace is Finally Easing (a Good Thing)

Apartment construction boomed during the past seven years, and it is slowing now, so as not to get into an overbuilt situation. The apartment market is much more cyclical than single-family housing, more prone to getting ahead of demand. The slowdown in apartment construction is a helpful shift, in that it will reduce the likelihood or impact of a downturn.

Chemical Activity Barometer "Begins to Cool" in October

by Calculated Risk on 10/25/2018 01:48:00 PM

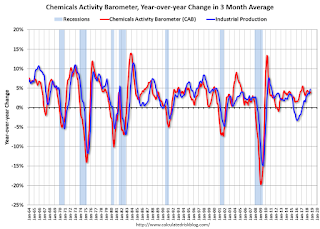

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Begins To Cool At Start of 4th Quarter; Year-Over-Year Growth Continues To Ease

he Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), posted a 0.2 percent gain in October on a three-month moving average (3MMA) basis. The barometer is up 3.8 percent (3MMA) year-over-year. The pace of growth has slowed form earlier in the year. The unadjusted measure of the CAB declined 0.2 percent in October.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production in 2018 and early 2019, but at a slower pace.

Kansas City Fed: Regional Manufacturing Activity "Expanded at a Slower Pace" in October

by Calculated Risk on 10/25/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Slightly Slower Pace

The Federal Reserve Bank of Kansas City released the October Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand, but at a slower pace. Expectations for future activity eased slightly, but remained positive.This is the lowest level for this index since 2016. The regional surveys for October have mostly indicated slower growth in October as compared to September, and these surveys suggest the ISM index will still be solid, but could be close to the lowest level this year.

“While regional factories reported another month of growth, a number of firms engaged in international trade noted negative effects of tariffs on supply chains,” said Wilkerson.

...

The month-over-month composite index was 8 in October, down from 13 in September and 14 in August. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The decline in factory growth was driven by slower expansion at durable goods plants, especially for machinery, computer and electronic products, and transportation equipment, while activity at nondurable goods plants increased. Month-over-month indexes were mixed in September, but positive overall. The production and new orders indexes declined slightly, while the order backlog and new orders for exports indexes inched up. The shipments and employment indexes both increased. The materials inventory index declined and the finished goods inventory index was unchanged from last month’s reading.

emphasis added