by Calculated Risk on 11/13/2018 06:42:00 PM

Tuesday, November 13, 2018

Wednesday: CPI

From Matthew Graham at Mortgage News Daily: Token Improvement For Mortgage Rates

Mortgage rates improved by what could only be described as a token amount today. In other words, we're not talking about any major changes. In fact, mortgage rates themselves will be unchanged from Friday for almost any scenario. As is so often the case, we can only measure the change in terms of "effective rates" (which take upfront costs into consideration). [30YR FIXED - 5.0%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

• During the day, The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

Seasonal Retail Hiring

by Calculated Risk on 11/13/2018 04:30:00 PM

According to the BLS employment report, retailers hired seasonal workers in October at the lowest pace since the great recession.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 123 thousand workers (NSA) net in October. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are a little cautious about the holiday season - or they are having difficulty finding seasonal help.

Last year there was a surge in seasonal hiring in November, and maybe that will happen again this year.

Note: There is a decent correlation between October seasonal retail hiring and holiday retail sales.

Goldman: Unemployment rate down to 3% in early-to-mid 2020

by Calculated Risk on 11/13/2018 02:03:00 PM

A few brief excerpts from a Goldman Sachs research note:

Following the remarkable momentum in job growth, we update our estimate of the breakeven payroll pace that stabilizes the unemployment rate and estimate how long it will likely take before we get there.CR Note: Goldman also thinks the Fed will raise rates by 25bps five more times in this cycle (maybe more).

We estimate the pace of breakeven payrolls at 90k per month, less than half the pace of realized job growth in recent months. ... Combined with our GDP forecasts, the analysis suggests that job creation will reach its breakeven pace in early/mid-2020, when the unemployment rate in our forecast is down to just 3%.

CoreLogic: "Mortgage Delinquency Rate the Lowest Level in More Than 12 Years"

by Calculated Risk on 11/13/2018 11:29:00 AM

From CoreLogic: CoreLogic Loan Performance Insights Find the Overall US Mortgage Delinquency Rate in August Fell to the Lowest Level in More Than 12 Years

The report shows that, nationally, 4 percent of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in August 2018, representing a 0.6 percentage point decline in the overall delinquency rate compared with August 2017, when it was 4.6 percent.CR Note: Mortgage delinquency rates - and foreclosure rates - are close to normal.

As of August 2018, the foreclosure inventory rate – which measures the share of mortgages in some stage of the foreclosure process – was 0.5 percent, down 0.1 percentage point since August 2017. The August 2018 foreclosure inventory rate tied with the April, May, June and July rates this year as the lowest for any month since September 2006, when it was also 0.5 percent.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.8 percent in August 2018, down from 2 percent in August 2017. The share of mortgages that were 60 to 89 days past due in August 2018 was 0.6 percent, down from 0.7 percent in August 2017. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.5 percent in August 2018, down from 1.9 percent in August 2017. This serious delinquency rate was the lowest for August since 2006 when it was 1.4 percent, and the lowest for any month since March 2007 when it was also 1.5 percent.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.8 percent in August 2018, down from 0.9 percent in August 2017. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent, while it peaked in November 2008 at 2 percent.

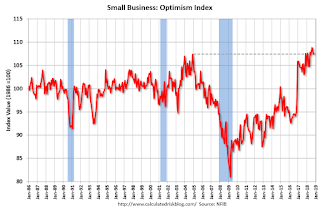

Small Business Optimism Index decreased in October

by Calculated Risk on 11/13/2018 08:33:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): October 2018 Report: Small Business Optimism Index

The Optimism Index shed a modest 0.5 points, with slight declines in five components, no change in four of them, and one increase, landing at 107.4.

..

Job creation was solid in October at a net addition of 0.15 workers per firm (including those making no change in employment), unchanged from September. Sixteen percent (up 3 points) reported increasing employment an average of 3.3 workers per firm and 11 percent (unchanged) reported reducing employment an average of 2.9 workers per firm (seasonally adjusted). Sixty percent reported hiring or trying to hire (down 1 point), but 53 percent (88 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill (unchanged). Twenty-three percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 1 point), 2 points below the record high reached in August. Thirty-eight percent of all owners reported job openings they could not fill in the current period, equal to last month’s record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 107.4 in October.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, November 12, 2018

Long Beach: "Port sees brisk holiday imports, slower exports"

by Calculated Risk on 11/12/2018 02:43:00 PM

From the Port of Long Beach: October Cargo Strong in Long Beach

For the second consecutive year, the Port of Long Beach has broken its October record for cargo, as volumes rose 5.4 percent compared to the same month in 2017. October 2018 was also the third-busiest month in the Port’s 107-year history.Imports are up, exports are down. I'll post a graph once the Port of Los Angeles reports October traffic.

Marine terminals handled 705,408 twenty-foot equivalent units (TEUs) of container cargo in October. Inbound containers increased 7.4 percent, to 364,084 TEUs. Export TEUs totaled 119,837 TEUs, a 5 percent decline. Empty containers shipped overseas grew 8.5 percent, to 221,487 TEUs.

Port of Long Beach Executive Director Mario Cordero said the results illustrate the evolving effects of the U.S.-China trade war.

“Our higher import volumes suggest some retailers expect U.S. consumers will be big spenders this holiday season,” said Cordero. “Other importers are rushing shipments to beat escalating tariffs. At the same time, the trade war has clearly slowed American exports to China.”

emphasis added

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 11/12/2018 11:09:00 AM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 20.9% under Mr. Trump - compared to up 51.4% under Mr. Obama for the same number of market days.

Las Vegas: Visitor Traffic down 1.3%, Convention Attendance down 2.7% compared to same Period in 2017

by Calculated Risk on 11/12/2018 08:55:00 AM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2017, visitor traffic declined 1.7% compared to 2016, but was still 8% above the pre-recession peak.

Convention attendance set a new record in 2017, but is down 2.7% in 2018 compared to the same period in 2017. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention attendance was down 2.7% through September compared to the same period in 2017.

Visitor traffic was down 1.3% through September compared to the same period in 2017.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the declines in 2017 and 2018 are a little concerning for the Vegas area.

Sunday, November 11, 2018

Sunday Night Futures

by Calculated Risk on 11/11/2018 07:48:00 PM

Thank you to all the veterans! Especially to my 96 years young father who flew a Corsair off the USS Bennington in the Pacific during WWII, and also served in Korea and Vietnam.

Weekend:

• Schedule for Week of November 11, 2018

Monday:

• Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $60.81 per barrel and Brent at $71.10 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.68 per gallon. A year ago prices were at $2.55 per gallon, so gasoline prices are up 13 cents per gallon year-over-year.

U.S. Heavy Truck Sales up 18% Year-over-year in October

by Calculated Risk on 11/11/2018 11:47:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2018 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 366 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 515 thousand SAAR in October, down from the recent peak of 539 thousand SAAR in September, and up from 436 thousand SAAR in October 2017.

With the recent decline oil prices, and softness in housing, heavy truck sales will probably decline over the next few months.