by Calculated Risk on 1/29/2019 09:12:00 AM

Tuesday, January 29, 2019

Case-Shiller: National House Price Index increased 5.2% year-over-year in November

S&P/Case-Shiller released the monthly Home Price Indices for November ("October" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Southwest Region Leads in Annual Gains According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.2% annual gain in November, down from 5.3% in the previous month. The 10City Composite annual increase came in at 4.3%, down from 4.7% in the previous month. The 20-City Composite posted a 4.7% year-over-year gain, down from 5.0% in the previous month.

Las Vegas, Phoenix and Seattle reported the highest year-over-year gains among the 20 cities. In November, Las Vegas led the way with a 12.0% year-over-year price increase, followed by Phoenix with an 8.1% increase and Seattle with a 6.3% increase. Seven of the 20 cities reported greater price increases in the year ending November 2018 versus the year ending October 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.1% in November. The 10-City and 20-City Composites both reported a 0.1% decrease for the month. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase in November. The 10-City Composite and the 20-City Composite both posted 0.3% month-over-month increases. In November, eight of 20 cities reported increases before seasonal adjustment, while 15 of 20 cities reported increases after seasonal adjustment.

“Home prices are still rising, but more slowly than in recent months,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The pace of price increases are being dampened by declining sales of existing homes and weaker affordability. Sales peaked in November 2017 and drifted down through 2018. Affordability reflects higher prices and increased mortgage rates through much of last year. Following a shift in Fed policy in December, mortgage rates backed off to about 4.45% from 4.95%.

“Housing market conditions are mixed while analysts’ comments express concerns that housing is weakening and could affect the broader economy. Current low inventories of homes for sale – about a four-month supply – are supporting home prices. New home construction trends, like sales of existing homes, peaked in late 2017 and are flat to down since then. Stable 2% inflation, continued employment growth, and rising wages are all favorable. Measures of consumer debt and debt service do not suggest any immediate problems.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up slightly from the bubble peak, and up 0.3% in November (SA).

The Composite 20 index is 3.7% above the bubble peak, and up 0.3% (SA) in November.

The National index is 11.7% above the bubble peak (SA), and up 0.4% (SA) in November. The National index is up 51.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to November 2017. The Composite 20 SA is up 4.7% year-over-year.

The National index SA is up 5.2% year-over-year.

Note: According to the data, prices increased in 15 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, January 28, 2019

Tuesday: Case-Shiller House Prices

by Calculated Risk on 1/28/2019 06:52:00 PM

Note: The BEA has announced that the Q4 GDP report, along with the Personal Income and Outlays and Trade reports, will not be released this week as scheduled. A new schedule will be published soon.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged at Start of Hectic Week

Mortgage rates didn't move at all today, on average, but that's likely to change throughout the course of the week--possibly several times. Interest rates are driven by bond market trading which, in turn, takes its cues from all manner of inputs. Two of the biggest inputs are economic data and the Federal Reserve (aka "The Fed"). There is plenty to consider on both accounts in the coming days.Tuesday:

The Fed will release one of its periodic policy announcements on Wednesday. No one expects them to raise rates at this meeting, but there are broad-based expectations for the verbiage of the Fed's statement to soften (i.e. to become more friendly toward rates and financial markets in general). Traders are already betting on some softening (which is helping rates stay lower than they otherwise might be over the past few trading days), but there's still plenty of room left for surprises. [30YR FIXED - 4.5%]

emphasis added

• At 9:00 AM ET: S&P/Case-Shiller House Price Index for November. The consensus is for a 4.9% year-over-year increase in the Comp 20 index for November.

• At 10:00 AM: POSTPONED the Q4 2018 Housing Vacancies and Homeownership from the Census Bureau.

Merrill on NFP

by Calculated Risk on 1/28/2019 12:59:00 PM

Here is Merrill Lynch economists forecast for the January non-farm payroll report:

We look for nonfarm payrolls to grow by 185k in January following a strong gain of 312k in December. We expect private payrolls, which excludes government workers to increase by 185k, implying no change in government payrolls in January.This mentions two key points: Government jobs on furlough will be counted in the establishment report since the workers will receive backpay, however those on furlough will be counted as unemployed (on temporary layoff) in the household report - so the unemployment rate might increase a little in January (perhaps to 4.1%).

Our private payrolls tracker based on internal BAC data is looking for somewhat stronger employment growth of 232k but we see a few reasons to fade the strength this month.

...

We also see some downside risk to private payroll employment growth due to the partial federal government shutdown. According to news reports, some government contractors have furloughed or laid off private workers while others employers have paused hiring activity during the shutdown. These disruptions may not be fully captured by our internal data as our data present a degree of selection bias, including but not limited to, income levels and geographies (Note that the BLS will count Federal Government workers that are currently furloughed as on payrolls since they will receive backpay).

…

Elsewhere, we estimate that the unemployment rate should be unchanged at 3.9% in January with a risk of it rising to 4% as furloughed workers will be counted as “unemployed on temporary layoff” in the household survey.

Dallas Fed: "Growth in Texas Manufacturing Activity Accelerates"

by Calculated Risk on 1/28/2019 10:35:00 AM

From the Dallas Fed: Growth in Texas Manufacturing Activity Accelerates

Texas factory activity continued to expand in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 7.3 to 14.5, indicating an acceleration in output growth.This was the last of the regional Fed surveys for December.

Other measures of manufacturing activity also suggested continued expansion in January, although the pace of demand growth slowed a bit. The capacity utilization index rose seven points to 14.8, and the shipments index rose five points to 11.4. Meanwhile, the new orders index edged down to 11.6 and the growth rate of new orders index fell from 5.8 to 1.2.

Perceptions of broader business conditions improved in January. The general business activity index rebounded from a multiyear low of -5.1 in December to 1.0 in January. This near-zero reading suggests manufacturers were fairly balanced in their assessment of whether activity had improved or worsened from last month. The company outlook index also rebounded from negative territory this month, rising more than 10 points to 7.1.

Labor market measures suggested slower growth in employment and workweek length in January. The employment index retreated four points to 6.6, a two-year low. Sixteen percent of firms noted net hiring, compared with 10 percent noting net layoffs. The hours worked index edged down to 3.6.

emphasis added

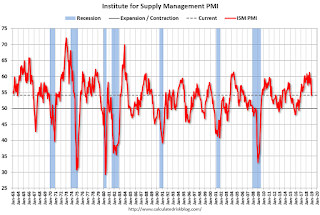

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be at about the same level in January as in December. The consensus forecast is for a reading of 54.0 (to be released on Friday, February 1st).

Chicago Fed "Index Points to a Slight Increase in Economic Growth in December"

by Calculated Risk on 1/28/2019 09:00:00 AM

From the Chicago Fed: Index Points to a Slight Increase in Economic Growth in December

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved up slightly to +0.27 in December from +0.21 in November. Two of the four broad categories of indicators that make up the index increased from November, and two of the four categories made positive contributions to the index in December. The index’s three-month moving average, CFNAI-MA3, edged up to +0.16 in December from +0.12 in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in December (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, January 27, 2019

Sunday Night Futures

by Calculated Risk on 1/27/2019 07:09:00 PM

Weekend:

• Schedule for Week of January 27, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for December. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for January. This is the last of regional manufacturing surveys for January.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 5 and DOW futures are down 35 (fair value).

Oil prices were down over the last week with WTI futures at $53.32 per barrel and Brent at $61.26 per barrel. A year ago, WTI was at $66, and Brent was at $70 - so oil prices are down about 15% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon. A year ago prices were at $2.56 per gallon, so gasoline prices are down 30 cents per gallon year-over-year.

January 2019: Unofficial Problem Bank list increased to 78 Institutions

by Calculated Risk on 1/27/2019 11:55:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for January 2019. During the month, the list increased by a net of one institution to 78 banks after two removals and three additions. Aggregate assets increased slightly to $55.2 billion from $54.8 billion at year-end. A year ago, the list held 101 institutions with assets of $20.7 billion.

This month, actions were terminated against Northside Bank, Adairsville, GA ($126 million) and Millennial Bank, Leeds, AL ($66 million), which was previously known as Covenant Bank.

Additions this month include Southwest Capital Bank, Albuquerque, NM ($369 million) and Beacon Business Bank, National Association, San Francisco, CA ($140 million). In addition, the FDIC issued Gunnison Valley Bank, Gunnison, UT ($71 million) a Prompt Corrective Action in October 2018. Gunnison Valley Bank has the dubious distinction of making a return appearance on the list after being removed in September 2017.

Saturday, January 26, 2019

Schedule for Week of January 27th

by Calculated Risk on 1/26/2019 08:11:00 AM

Special Note on Government Opening: Now that the Government is open, the data releases that were postponed will be released soon. The BEA and Census will probably provide an updated schedule early next week. Some releases on the weekly schedule below will probably be delayed (like Q4 GDP).

The key reports scheduled for this week are the January employment report and Q4 GDP. Other key indicators include December Personal Income and Outlays, November Case-Shiller house prices, and January vehicle sales.

For manufacturing, the January ISM manufacturing survey, and the Dallas Fed manufacturing survey will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of regional manufacturing surveys for January.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.9% year-over-year increase in the Comp 20 index for November.

10:00 AM: the Q4 2018 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 167,000 payroll jobs added in January, down from 271,000 added in December.

8:30 AM: Gross Domestic Product, 4th quarter 2018 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q4, down from 3.4% in Q3.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.1% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 213 thousand the previous week.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 62.5, down from 65.4 in December.

8:30 AM: Employment Report for January. The consensus is for 158,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

8:30 AM: Employment Report for January. The consensus is for 158,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.There were 213,000 jobs added in December, and the unemployment rate was at 3.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In December the year-over-year change was 2.638 million jobs.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 54.0, down from 54.1 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 54.0, down from 54.1 in December.Here is a long term graph of the ISM manufacturing index.

The PMI was at 54.1% in December, the employment index was at 56.2%, and the new orders index was at 51.1%.

10:00 AM: Construction Spending for December. The consensus is for a 0.2% increase in construction spending.

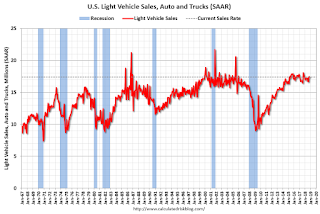

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.2 million SAAR in January, unchanged from 17.2 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.2 million SAAR in January, unchanged from 17.2 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate (The BEA hasn't released December sales yet).

Friday, January 25, 2019

NMHC: Apartment Market Tightness Index remained negative for 13th Consecutive Quarter

by Calculated Risk on 1/25/2019 03:53:00 PM

The National Multifamily Housing Council (NMHC) released their January report: January NMHC Quarterly Survey Shows Little Overall Change

Apartment market conditions were mixed in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for January. The Market Tightness (46) and Equity Financing (50) indexes showed little change in those conditions from October, while the Debt Financing Index (59) showed improving conditions. By contrast, the Sales Volume Index (33) showed further slowing in property sales.This index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. And it also helped me call the bottom in vacancy rate more recently.

Notably, a significant majority of respondents found that recent tariffs have driven up costs across the board and in a variety of markets throughout the country. "While the four indexes each changed somewhat over the last quarter, overall market conditions remained fairly static. Debt market financing conditions improved somewhat over the last three months," said NMHC Chief Economist Mark Obrinsky. "By contrast equity market financing conditions are little changed, as considerable capital continues to seek investment in the apartment sector."

The Market Tightness Index increased from 41 to 46. Less than one-quarter (22 percent) of respondents reported looser market conditions than three months prior, compared to 13 percent who reported tighter conditions. Nearly two-thirds (64 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

This is the thirteenth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Q4 GDP Forecasts: Mid-to-High 2s

by Calculated Risk on 1/25/2019 11:44:00 AM

Update: GDPNow model has been updated.

The Q4 advanced GDP release is scheduled for next Wednesday, but even if the government is opened this weekend, that release will probably be delayed.

From Merrill Lynch:

4Q GDP tracking remains at 2.8%. With the shutdown ongoing, we revise down 1Q GDP to 2.0% from 2.2% [Jan 25 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.6% for 2018:Q4 and 2.2% for 2019:Q1. [Jan 25 estimate]And from the Altanta Fed: GDPNow

The current GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.7 percent, down from 2.8 percent on January 18. The nowcast of fourth-quarter real residential investment growth declined from -2.6 percent to -4.3 after the existing-home sales release on Tuesday, January 22, from the National Association of Realtors. [Jan 25 estimate]CR Note: These estimates suggest GDP in the mid-to-high 2s for Q4.