by Calculated Risk on 2/01/2019 10:13:00 AM

Friday, February 01, 2019

ISM Manufacturing index Increased to 56.6 in January

The ISM manufacturing index indicated expansion in December. The PMI was at 56.6% in January, up from 54.3% in December. The employment index was at 55.5%, down from 56.0% last month, and the new orders index was at 58.2%, up from 51.3%.

From the Institute for Supply Management: January 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in January, and the overall economy grew for the 117th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The January PMI® registered 56.6 percent, an increase of 2.3 percentage points from the December reading of 54.3 percent. The New Orders Index registered 58.2 percent, an increase of 6.9 percentage points from the December reading of 51.3 percent. The Production Index registered 60.5 percent, 6.4-percentage point increase compared to the December reading of 54.1 percent. The Employment Index registered 55.5 percent, a decrease of 0.5 percentage point from the December reading of 56 percent. The Supplier Deliveries Index registered 56.2 percent, a 2.8 percentage point decrease from the December reading of 59 percent. The Inventories Index registered 52.8 percent, an increase of 1.6 percentage points from the December reading of 51.2 percent. The Prices Index registered 49.6 percent, a 5.3-percentage point decrease from the December reading of 54.9 percent, indicating lower raw materials prices for the first time in nearly three years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 54.0%, and suggests manufacturing expanded at a faster pace in January than in December.

January Employment Report: 304,000 Jobs Added, 4.0% Unemployment Rate (Graphs added)

by Calculated Risk on 2/01/2019 09:21:00 AM

From the BLS:

Total nonfarm payroll employment increased by 304,000 in January, and the unemployment rate edged up to 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in several industries, including leisure and hospitality, construction, health care, and transportation and warehousing.

...

Both the unemployment rate, at 4.0 percent, and the number of unemployed persons, at 6.5 million, edged up in January. The impact of the partial federal government shutdown contributed to the uptick in these measures. Among the unemployed, the number who reported being on temporary layoff increased by 175,000. This figure includes furloughed federal employees who were classified as unemployed on temporary layoff under the definitions used in the household survey.

...

The change in total nonfarm payroll employment for November was revised up from +176,000 to +196,000, and the change for December was revised down from +312,000 to +222,000. With these revisions, employment gains in November and December combined were 70,000 less than previously reported.

...

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $27.56, following a 10-cent gain in December. Over the year, average hourly earnings have increased by 85 cents, or 3.2 percent.

…

[Annual Revision] In accordance with annual practice, the establishment survey data released today have been benchmarked to reflect comprehensive counts of payroll jobs for March 2018. These counts are derived principally from the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system. ... The total nonfarm employment level for March 2018 was revised downward by 1,000 (-16,000 on a not seasonally adjusted basis, or less than -0.05 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 304 thousand in January (private payrolls increased 296 thousand).

Payrolls for November and December were revised down 70 thousand combined.

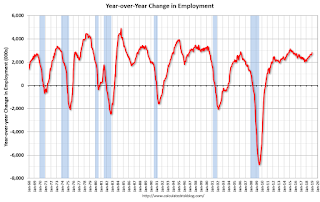

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In January the year-over-year change was 2.807 million jobs.

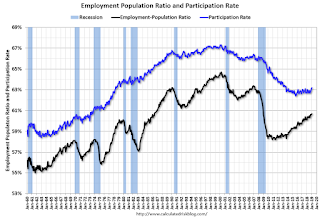

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in January to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate increased in January to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was increased to 60.7% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in January to 4.0%.

This was well above the consensus expectations of 158,000 jobs added, however November and December were down by 70,000 combined. A strong report.

I'll have much more later ...

January Employment Report: 304,000 Jobs Added, 4.0% Unemployment Rate

by Calculated Risk on 2/01/2019 08:34:00 AM

From the BLS:

Total nonfarm payroll employment increased by 304,000 in January, and the unemployment rate edged up to 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in several industries, including leisure and hospitality, construction, health care, and transportation and warehousing.I'll have much more later ...

...

Both the unemployment rate, at 4.0 percent, and the number of unemployed persons, at 6.5 million, edged up in January. The impact of the partial federal government shutdown contributed to the uptick in these measures. Among the unemployed, the number who reported being on temporary layoff increased by 175,000. This figure includes furloughed federal employees who were classified as unemployed on temporary layoff under the definitions used in the household survey.

...

The change in total nonfarm payroll employment for November was revised up from +176,000 to +196,000, and the change for December was revised down from +312,000 to +222,000. With these revisions, employment gains in November and December combined were 70,000 less than previously reported.

...

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $27.56, following a 10-cent gain in December. Over the year, average hourly earnings have increased by 85 cents, or 3.2 percent.

emphasis added

Thursday, January 31, 2019

Friday: Employment Report, ISM Manufacturing, Construction Spending, Auto Sales

by Calculated Risk on 1/31/2019 09:17:00 PM

My January Employment Preview

Goldman: January Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for January. The consensus is for 158,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 54.0, down from 54.1 in December.

• At 10:00 AM, Construction Spending for November. The consensus is for a 0.2% increase in construction spending (The December release hasn't been scheduled).

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to be 17.2 million SAAR in January, unchanged from 17.2 million in December (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in December

by Calculated Risk on 1/31/2019 04:11:00 PM

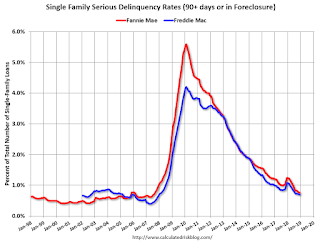

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 0.76% in December, from 0.76% in November. The serious delinquency rate is down from 1.24% in December 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This matches last month ass the lowest serious delinquency rate for Fannie Mae since August 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.69% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.61% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.34% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Goldman: January Payrolls Preview

by Calculated Risk on 1/31/2019 04:06:00 PM

A few brief excerpts from a note by Goldman Sachs economists Choi and Hill:

We estimate nonfarm payrolls increased 180k in January, somewhat above consensus of +165k. … while weather likely contributed to last month’s blockbuster report, January was also relatively warm and dry during the reference week. The BLS has also clarified that furloughed and unpaid government workers will be included in tomorrow’s payroll counts (though contractor layoffs could weigh in some industries).

We estimate the unemployment rate increased one tenth to 4.0% in January (vs. consensus of 3.9%), mostly reflecting the furlough of nearly 400k federal workers that the BLS plans to classify as “unemployed on temporary layoff.” ... Finally, we expect average hourly earnings will increase 0.2% month-over-month and 3.1% year-over-year in tomorrow’s report...

emphasis added

January Employment Preview

by Calculated Risk on 1/31/2019 02:50:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for an increase of 158,000 non-farm payroll jobs in January (with a range of estimates between 140,000 to 183,000), and for the unemployment rate to be unchanged at 3.9%.

Last month, the BLS reported 312,000 jobs added in December.

Note on the government shutdown: the Federal jobs will all be counted in the establishment report (headline jobs number), since the employees will be receiving back pay. However, the furloughed employees will be counted as unemployed (on temporary layoff), so the unemployment rate will probably increase.

Note on Revisions: With the January release, the BLS will introduce revisions to nonfarm payroll employment to reflect the annual benchmark adjustment. The preliminary annual benchmark revision showed an upward adjustment of 43,000 jobs, and the preliminary estimate is usually pretty close.

Here is a summary of recent data:

• The ADP employment report showed an increase of 213,000 private sector payroll jobs in December. This was well above consensus expectations of 167,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing and ISM non-manufacturing employment indexes have not yet been released..

• Initial weekly unemployment claims averaged 220,000 in January, up slightly from 219,000 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 212,000, down from 217,000 during the reference week the previous month.

In general, the unemployment claims suggest a solid employment report.

• The final January University of Michigan consumer sentiment index decreased to 90.7 from the December reading of 98.3. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics. The decline in January is probably related to the government shutdown.

• Looking back at the three previous years:

In January 2017, the consensus was for 175,000 jobs, ADP reported 234,000 private sector jobs added, and the BLS reported 200,000 jobs added.

In January 2016, the consensus was for 175,000 jobs, ADP reported 246,000 private sector jobs added, and the BLS reported 227,000 jobs added.

In January 2015, the consensus was for 188,000 jobs, ADP reported 205,000 private sector jobs added, and the BLS reported 151,000 jobs added.

It appears the ADP report is usually too high for January.

• Conclusion: In general these reports suggest a solid employment report, although I expect the unemployment rate to increase due to the government shutdown. My guess is the report will be at or below the consensus, due to good weather in December (some payback in January), and possibly some private sector impact from the government shutdown.

A few Comments on November New Home Sales

by Calculated Risk on 1/31/2019 11:45:00 AM

First, this report was for November (it was almost ready to release when the government shutdown began in December). The December report will probably be released soon, but no release date has been announced yet. Based on other data, I'd expect sales to be weak in December, but talking to builders, I expect a rebound in January.

New home sales for November were reported at 657,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the three previous months were revised up.

Sales in November were down 7.2% year-over-year compared to November 2017.

On Inventory: Months of inventory is now at the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch very closely.

Earlier: New Home Sales increased to 657,000 Annual Rate in November.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are only up 2.7% through November compared to the same period in 2017.

The comparison for November was difficult (sales in November 2017 were very strong). And the comparison in December will also be somewhat difficult. Overall sales might finish the year down from 2017, but it should be close.

This is below my forecast for 2018 for an increase of about 6% over 2017. As I noted early this year, there were downside risks to that forecast, primarily higher mortgage rates, but also higher costs (labor and material), the impact of the new tax law, and other possible policy errors.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 657,000 Annual Rate in November

by Calculated Risk on 1/31/2019 10:14:00 AM

Note: This release is for November (this was delayed due to the government shutdown). The December report is not yet rescheduled, but will probably be released soon.

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 657 thousand.

The previous three months were revised up significantly.

"Sales of new single‐family houses in November 2018 were at a seasonally adjusted annual rate of 657,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 16.9 percent above the revised October rate of 562,000, but is 7.7 percent below the November 2017 estimate of 712,000."

emphasis added

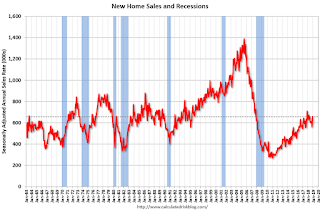

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

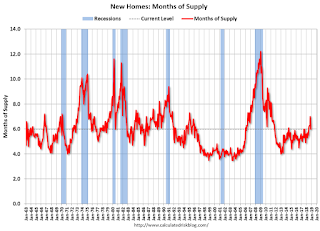

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 6.0 months from 7.0 months in October.

The months of supply decreased in November to 6.0 months from 7.0 months in October. The all time record was 12.1 months of supply in January 2009.

This is above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of November was 330,000. This represents a supply of 6.0 months at the current sales rate."

On inventory, according to the Census Bureau:

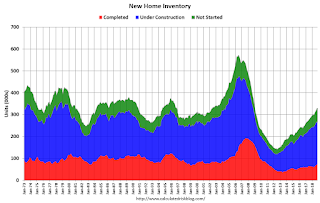

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is a little low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2018 (red column), 48 thousand new homes were sold (NSA). Last year, 50 thousand homes were sold in November.

The all time high for November was 86 thousand in 2005, and the all time low for November was 20 thousand in 2010.

This was well above expectations of 560,000 sales SAAR, and the previous months were revised up. I'll have more later today.

Weekly Initial Unemployment Claims increased to 253,000

by Calculated Risk on 1/31/2019 08:34:00 AM

The DOL reported:

In the week ending January 26, the advance figure for seasonally adjusted initial claims was 253,000, an increase of 53,000 from the previous week's revised level. This is the highest level for initial claims since September 30, 2017 when it was 254,000. The previous week's level was revised up by 1,000 from 199,000 to 200,000. The 4-week moving average was 220,250, an increase of 5,000 from the previous week's revised average. The previous week's average was revised up by 250 from 215,000 to 215,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 220,250.

This was much higher than the consensus forecast - and is probably related to the government shutdown.