by Calculated Risk on 2/04/2019 02:41:00 PM

Monday, February 04, 2019

Public and Private Sector Payroll Jobs During Presidential Terms

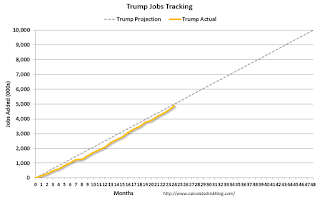

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (24 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 24 months of Mr. Trump's term, the economy has added 4,683,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the first 24 months of Mr. Trump's term, the economy has added 196,000 public sector jobs.

After 24 months of Mr. Trump's presidency, the economy has added 4,879,000 jobs, about 121,000 behind the projection.

Update: Framing Lumber Prices Down Year-over-year

by Calculated Risk on 2/04/2019 11:01:00 AM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down about 25% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through January 18, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 28% from a year ago, and CME futures are down 25% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Black Knight Mortgage Monitor for December

by Calculated Risk on 2/04/2019 08:00:00 AM

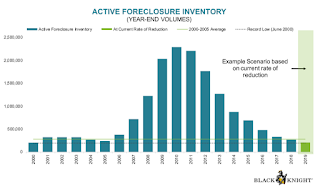

Black Knight released their Mortgage Monitor report for December today. According to Black Knight, 3.88% of mortgages were delinquent in December, down from 4.71% in December 2017. Black Knight also reported that 0.52% of mortgages were in the foreclosure process, down from 0.65% a year ago.

This gives a total of 4.40% delinquent or in foreclosure.

Press Release: BBlack Knight: Active Foreclosure Rate and Inventory End 2018 Below Pre-Recession Averages; Total Year Foreclosure Starts and Sales Hit More Than 18-Year Lows

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon its industry-leading loan-level mortgage performance database. With full-year mortgage performance data in, this month’s report looked at 2018 in review. As explained by Ben Graboske, president of Black Knight’s Data & Analytics division, more than a decade past the start of the financial crisis, most metrics reflect a recovery to their long-term, 2000-2005 pre-recession averages.

“Across the board, 2018 year-end numbers are good news from a mortgage performance perspective,” said Graboske. “All four major performance metrics – delinquencies, serious delinquencies, active foreclosures and total non-current inventory – ended the year below pre-recession averages for the first time since the financial crisis. Just 576,000 foreclosures were initiated throughout the entirety of 2018 – an 18-year low – and the vast majority of these were repeat actions. In fact, first-time foreclosures were down 18 percent from the year before, hitting the lowest point we’ve seen since Black Knight started reporting the metric in 2000. Even repeats – though making up more than 60 percent of all foreclosures – were down 6 percent from 2017.

“These year-end numbers are further proof of what we’ve been observing for some time now. The high credit quality and corresponding lower risk we’ve seen in the post-crisis origination market for the better part of a decade continues to pay dividends in terms of mortgage performance. In addition, the low interest rate environment we’ve enjoyed for so long had – until very recently – resulted in a refinance-heavy blend of originations for years. Refis, as a whole, tend to outperform their purchase mortgage counterparts, which has boosted mortgage performance as well. On top of that, we’ve had the benefit of strong employment and housing markets, which have helped the vast majority of homeowners meet their debt obligations, while those few who may have faced a possible default have gained enough equity to be able to sell rather than face foreclosure.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the year end delinquency rate over time.

From Black Knight:

• While we’ve documented the potential impact of rising interest rates, and talk of a looming recession persists in the market, mortgage performance continues to strengthenThe second graph shows active foreclosure inventory over time.

• The national delinquency rate is down 18% from last year, though that figure is overstated due to hurricane-related effects over the past 18 months

• Still, even excluding hurricane-impacted areas, December's delinquency rate was down an impressive 11% from last year

• Both the national foreclosure rate and the number of loans in active foreclosure have now fallen below long-term normsThere is much more in the mortgage monitor.

• In fact, the national foreclosure rate closed out 2018 below its pre-crisis average for the first time since 2005

• While the rate of improvement has slowed slightly in recent months, at the current rate of decline, both metrics would be near record lows by the end of 2019

Sunday, February 03, 2019

Sunday Night Futures

by Calculated Risk on 2/03/2019 10:40:00 PM

Weekend:

• Schedule for Week of February 3, 2019

• Lawler: Selected Operating Results from Large Publicly-Traded Home Builders

Monday:

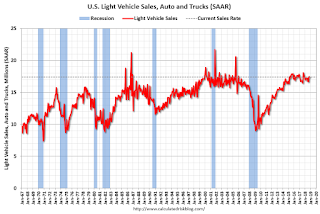

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to be 17.0 million SAAR in January, down from 17.2 million in December (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $55.29 per barrel and Brent at $62.81 per barrel. A year ago, WTI was at $65, and Brent was at $67 - so oil prices are down about 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon. A year ago prices were at $2.60 per gallon, so gasoline prices are down 34 cents per gallon year-over-year.

Lawler: Selected Operating Results from Large Publicly-Traded Home Builders

by Calculated Risk on 2/03/2019 10:51:00 AM

From housing economist Tom Lawler:

Here are a few observations based on press releases and conference calls (note that NVR provides no “color” in its press release and does not do an earnings conference.)

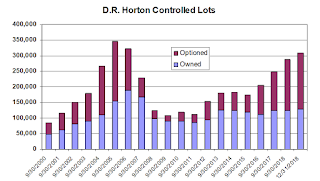

First (and trivially), D.R. Horton’s YOY increase in net orders was boosted slightly by acquisitions of a few smaller builders, and “pro forma” net orders would have been up by close to 2% YOY.

Second, all builders noted that they experienced slower demand last quarter, and most attributed the slowdown to “affordability” concerns, partly but not even mainly association with the increase in mortgage rates during the third and early fourth quarter, but also to the rapid price increases of the past few years in many markets. There appeared to be greater weakness at “higher” price points, and several markets where home prices had risen sharply over the past few years – especially much of California and Colorado – were “especially soft.

Most builders were peppered with questions about sales incentives, and while those reporting incentives on closings said that there was just a “modest” increase from a year ago, many also implied that a further increase in sales incentives in the first part of this year was a distinct possibility. Most builders also seemed to feel that in aggregate home prices, after outpacing income growth for the last seven years, would likely grow by less than income growth in 2019. That is also the consensus among competent housing economists.

| Net Orders | Average Order Price | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/31/18 | 12/31/17 | % Chg | 12/31/18 | 12/31/17 | % Chg |

| D.R. Horton | 11,042 | 10,753 | 2.7% | $292,085 | $299,693 | -2.5% |

| PulteGroup | 4,267 | 4,805 | -11.2% | $424,034 | $422,523 | 0.4% |

| NVR | 3,841 | 4,306 | -10.8% | $376,100 | $380,800 | -1.2% |

| Meritage Homes | 1,653 | 1,795 | -7.9% | $390,000 | $424,000 | -8.0% |

| MDC Holdings | 1,059 | 1,252 | -15.4% | $428,000 | $458,700 | -6.7% |

| Total | 21,862 | 22,911 | -4.6% | $346,587 | $359,125 | -3.5% |

| Closings | Average Closing Price | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/31/18 | 12/31/17 | % Chg | 12/31/18 | 12/31/17 | % Chg |

| D.R. Horton | 11,500 | 10,788 | 6.6% | $296,574 | 295,189 | 0.5% |

| PulteGroup | 6,709 | 6,632 | 1.2% | $430,000 | 410,000 | 4.9% |

| NVR | 5,186 | 4,630 | 12.0% | $376,800 | 384,700 | -2.1% |

| Meritage Homes | 2,505 | 2,253 | 11.2% | $398,000 | 410,000 | -2.9% |

| MDC Holdings | 1,827 | 1,556 | 17.4% | $469,900 | 451,600 | 4.1% |

| Total | 27,727 | 25,859 | 7.2% | $364,448 | $360,076 | 1.2% |

With the exception of D.R. Horton, which began focusing more on the entry-level market several years ago, all of the builders said they have ramped up lot acquisitions designed for the entry-level market, as well as actual building for that market (Meritage and MDC more than Pulte). This shift reflects the growing consensus view that all of the shortfall in single-family housing construction over the past few years has been in the smaller, lower-priced housing market.

All of these builders owned or controlled more lots than was the case a year ago, with D.R. Horton’s owned/controlled lot position hitting a level not seen since 2006 – though today the share of controlled lots optioned is much higher than was the case during last decades housing bubble/bust.

All of these builders owned or controlled more lots than was the case a year ago, with D.R. Horton’s owned/controlled lot position hitting a level not seen since 2006 – though today the share of controlled lots optioned is much higher than was the case during last decades housing bubble/bust.Finally, order cancellation rates (expressed as a % of gross orders), were generally up modestly last quarter from the comparable quarter of 2017.

Saturday, February 02, 2019

Schedule for Week of February 3, 2019

by Calculated Risk on 2/02/2019 08:11:00 AM

Special Note on Government Opening: Now that the Government is open, some of the data releases that were postponed are starting to be released. The BEA and Census will provide further release dates soon (like for Q4 GDP).

The key reports scheduled for this week are the trade deficit and January vehicle sales.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.0 million SAAR in January, down from 17.2 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be 17.0 million SAAR in January, down from 17.2 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate (The BEA hasn't released December sales yet).

10:00 AM: the ISM non-Manufacturing Index for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.

7:00 PM: Fed Chair Jerome Powell, Brief Opening Remarks, At the Conversation with the Chairman: A Teacher Town Hall Meeting, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 253 thousand the previous week.

3:00 PM: Consumer Credit from the Federal Reserve.

No major economic releases scheduled.

Friday, February 01, 2019

Oil: Another large drop in rig counts

by Calculated Risk on 2/01/2019 06:36:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on February 1, 2019:

• Oil rig counts imploded, -15 to 847

• The news on the horizontal oil rig count was not as bad, -7 to 759

• The Permian lost 2, ‘Other US’ was whacked with -7, but all other named plays were flat

• We now have enough data to begin to sketch out this mini-cycle (assuming the historical relationship of rigs to oil prices holds)

• Having fallen by 27 in the last four weeks, the model suggests the horizontal oil rig count will fall by additional 65 or so rigs before bottoming in April. So pencil in 100 total horizontal oil rigs lost in Q1.

• Assuming oil prices crawl back up to $60 WTI – and both the futures curve and recent oil prices trends suggest that is possible – rig counts should stabilize or begin to recover in Q2.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q4 GDP Forecasts: Mid 2s

by Calculated Risk on 2/01/2019 02:02:00 PM

The BEA has not yet announced a new release date for the Q4 advanced GDP report.

From Merrill Lynch:

data cut 0.5pp from 4Q GDP tracking, bringing us down to 2.3% qoq saar. [Feb 1 estimate]From Goldman Sachs:

emphasis added

we left our Q4 GDP tracking estimate unchanged at +2.5% (qoq ar). [Feb 1 estimate]From the NY Fed Nowcasting Report

The GDP release scheduled for this week was postponed as a result of the partial shutdown of the federal government. The New York Fed Staff Nowcast stands at 2.6% for 2018:Q4 and 2.4% for 2019:Q1. [Feb 1 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.5 percent on February 1, down from 2.7 percent on January 31. [Feb 1 estimate]CR Note: These estimates suggest GDP in the mid 2s for Q4.

Comments on January Employment Report

by Calculated Risk on 2/01/2019 12:04:00 PM

The headline jobs number at 304 thousand for January was well above consensus expectations of 158 thousand, however the previous two months were revised down 70 thousand, combined. The unemployment rate increased to 4.0%, due to government employees on furlough being counted as unemployed in the household survey (but jobs counted in the establishment survey). Overall this was a strong report.

Earlier: January Employment Report: 304,000 Jobs Added, 4.0% Unemployment Rate

In January, the year-over-year employment change was 2.807 million jobs. That is solid year-over-year growth.

Average Hourly Earnings

Wage growth was at expectations in January. From the BLS:

"In January, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $27.56, following a 10-cent gain in December. Over the year, average hourly earnings have increased by 85 cents, or 3.2 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.2% YoY in January.

Wage growth has generally been trending up.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in December to 82.6%, and the 25 to 54 employment population ratio was unchanged at 79.9%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by about one-half million to 5.1 million in January. Nearly all of this increase occurred in the private sector and may reflect the impact of the partial federal government shutdown."The number of persons working part time for economic reasons has been generally trending down. The number increased sharply in January, probably as a result of the government shutdown. The number working part time for economic reasons suggests there is still a little slack in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased sharply to 8.1% in January.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.252 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.306 million in January.

Summary:

The headline jobs number was well above expectations, however the previous two months were revised down. The headline unemployment rate increased to 4.0% due to the government shutdown.

Some of the quirky aspects of the employment report were due to the government shutdown (rise in the unemployment rate, sharp rise in "Part Time for Economic Reasons" workers, and the sharp rise in U-6.) My guess is most of the rise in Part Time was related to private sector workers getting fewer hours due to the shutdown, however some of the increase might be related to government workers taking part time jobs to pay the bills (as a reminder, the establishment report is for jobs - and government employees on furlough taking part time jobs would be counted as having two jobs).

Overall, this was a strong report.

Construction Spending increased in November

by Calculated Risk on 2/01/2019 11:25:00 AM

Note: This is for November. The release of the December report has not been scheduled yet.

From the Census Bureau reported that overall construction spending increased in November:

Construction spending during November 2018 was estimated at a seasonally adjusted annual rate of $1,299.9 billion, 0.8 percent above the revised October estimate of $1,289.7 billion. The November figure is 3.4 percent above the November 2017 estimate of $1,257.3 billion.Private spending increased and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $993.4 billion, 1.3 percent above the revised October estimate of $980.4 billion. ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $306.5 billion, 0.9 percent below the revised October estimate of $309.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined recently - and is still 20% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 6% below the peak in March 2009, and 17% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 1%. Non-residential spending is up 4% year-over-year. Public spending is up 7% year-over-year.

This was above consensus expectations, however spending for September and October were revised down.