by Calculated Risk on 2/06/2019 02:58:00 PM

Wednesday, February 06, 2019

BEA: Q4 GDP to be Released Feb 28th, And Census Update

From the BEA: New Dates Set for GDP, Personal Income, and International Trade

Bureau of Economic Analysis data on U.S. gross domestic product, personal income and outlays, and international trade in goods and services that were delayed by the recent lapse in federal funding will be released in late February and early March.CR Note: It appears Q4 GDP will be in the mid-2s. Unfortunately it takes some time to catch up on the data releases.

A report called Initial Gross Domestic Product for the 4th Quarter and Annual 2018 will be released on Feb. 28 at 8:30 a.m. This “initial” report will take the place of two previously scheduled estimates of 4th quarter GDP – the advance estimate originally set for Jan. 30 and the second estimate that would normally be released Feb. 28.

The combined Feb. 28 report will contain one set of GDP numbers based on the data available from BEA’s data suppliers, including the U.S. Census Bureau, which also was affected by the funding lapse. This will include source data that would have gone into producing BEA’s advance estimate of 4th quarter and annual GDP for 2018, and some – but not all – of the source data that typically feed the second estimate.

A few updated release dates from Census:

Advance Monthly Retail Sales, December [originally scheduled for 01/16/19] 02/14/19

Advance Report on Durable Goods, December [originally scheduled for 01/25/19] 02/21/19

New Residential Construction, December [originally scheduled for 01/17/19] 02/26/19

Housing Vacancies and Home Ownership, 4th Quarter 2018 [originally scheduled for 01/29/19] 02/28/19

Construction Put in Place, December [originally scheduled for 02/01/19] 03/04/19

New Residential Sales, December [originally scheduled for 01/25/19] 03/05/19

Las Vegas Real Estate in January: Sales Down 18% YoY, Inventory up 106% YoY

by Calculated Risk on 2/06/2019 10:57:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices bounce back to $300,000; GLVAR housing statistics for January 2019

Local home prices bounced back to the $300,000 mark for the first time since September while fewer properties changed hands and more homes were on the market than one year ago. So says a report released Wednesday by the Greater Las Vegas Association of REALTORS® (GLVAR) covering activity in the local housing market through January.1) Overall sales were down 18% year-over-year from 2,812 in January 2018 to 2,305 in January 2019.

...

The total number of existing local homes, condos and townhomes sold during January was 2,305. Compared to one year ago, January sales were down 19.4 percent for homes and down 12.5 percent for condos and townhomes. GLVAR reported a total of 42,876 property sales in 2018, down from 45,388 in all of 2017, so Carpenter expects sales numbers may continue to slip this year.

...

With nearly a four-month supply of homes now available for sale, she said the number of local homes listed for sale without offers on them has been increasing for several months. However, she said that is still below what would normally be considered a balanced market. By the end of January, GLVAR reported 7,254 single-family homes listed for sale without any sort of offer. That’s up 95.1 percent from one year ago. For condos and townhomes, the 1,703 properties listed without offers in January represented a 168.6 percent jump from one year ago.

...

The number of so-called distressed sales also continues to drop each year. GLVAR reported that short sales and foreclosures combined accounted for just 2.8 percent of all existing local property sales in January. That’s down from 4.3 percent of all sales one year ago and 11 percent two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,352 in January 2018 to 8,957 in January 2019. Note: Total inventory was up 106% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Fewer distressed sales.

Trade Deficit decreased to $49.3 Billion in November

by Calculated Risk on 2/06/2019 08:47:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $49.3 billion in November, down $6.4 billion from $55.7 billion in October, revised.

November exports were $209.9 billion, $1.3 billion less than October exports. November imports were $259.2 billion, $7.7 billion less than October imports.

Click on graph for larger image.

Click on graph for larger image.Exports and imports decreased in December.

Exports are 27% above the pre-recession peak and up 4% compared to November 2017; imports are 12% above the pre-recession peak, and up 3% compared to November 2017.

In general, trade has been picking up, although trade has declined slightly recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $57.54 in November, down from $61.23 in October, and up from $50.10 in November 2017.

The trade deficit with China increased to $37.9 billion in November, from $35.4 billion in November 2017.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/06/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

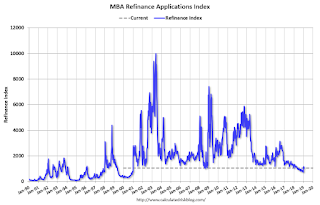

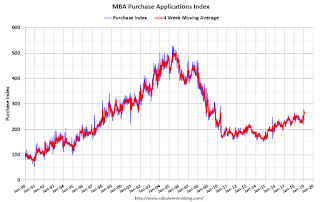

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 1, 2019. The previous week’s results included an adjustment for the Martin Luther King Jr. Day holiday.

... The Refinance Index increased 0.3 from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 2 percent lower than the same week one year ago.

...

“Mortgage rates for all loan types declined last week, with the 30-year fixed mortgage rate falling seven basis points to 4.69 percent – the lowest rate since April 2018,” said Joel Kan, Associate Vice President of Industry Surveys and Forecasts. “Despite more favorable borrowing costs, and after a three-week surge in activity, purchase applications have slowed over the past two weeks, and are now almost 2 percent lower than a year ago. However, moderating price gains and the strong job market, including evidence of faster wage growth, should help purchase growth going forward.”

Added Kan, “Refinance applications saw a very slight increase compared to the previous week, despite the broad decline in rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.69 percent from 4.76 percent, with points decreasing to 0.45 from 0.47 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 2% year-over-year.

Tuesday, February 05, 2019

Wednesday: Trade Deficit

by Calculated Risk on 2/05/2019 06:44:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM: Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.

• At 7:00 PM: Fed Chair Jerome Powell, Brief Opening Remarks, At the Conversation with the Chairman: A Teacher Town Hall Meeting, Washington, D.C.

BEA: January Vehicles Sales at 16.6 Million SAAR, 2018 Annual Sales slightly higher than 2017

by Calculated Risk on 2/05/2019 04:05:00 PM

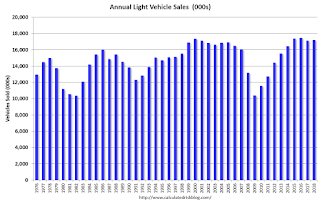

The BEA released their estimate of January vehicle sales. The BEA estimated sales of 16.60 million SAAR in January 2019 (Seasonally Adjusted Annual Rate), down 5.1% from the December sales rate, and down 3.0% from January 2018.

Total annual sales were 17.21 million in 2018, up slightly from 17.14 million in 2017.

So 2018 was the fourth best year on record after 2016, 2015, and 2000.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 were the fourth best ever.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was a weak start to 2019, but a small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Update: The Endless Parade of Recession Calls

by Calculated Risk on 2/05/2019 01:11:00 PM

It was over three years ago that I wrote: The Endless Parade of Recession Calls. In that post, I pointed out that I wasn't "even on recession watch". Here is a repeat of that post with a few updates in italics.

Note: I've made one recession call since starting this blog. One of my predictions for 2007 was a recession would start as a result of the housing bust (made it by one month - the recession started in December 2007). That prediction was out of the consensus for 2007 and, at the time, ECRI was saying a "recession is no longer a serious concern". Ouch.

For the last 6+ years [now 9+ years], there have been an endless parade of incorrect recession calls. The most reported was probably the multiple recession calls from ECRI in 2011 and 2012.

In May of [2015], ECRI finally acknowledged their incorrect call, and here is their admission : The Greater Moderation

In line with the old adage, “never say never,” [ECRI's] September 2011 U.S. recession forecast did turn out to be a false alarm.I disagreed with that call in 2011; I wasn't even on recession watch!

And here is another call [from December 2015] via CNBC: US economy recession odds '65 percent': Investor

Raoul Pal, the publisher of The Global Macro Investor, reiterated his bearishness ... "The economic situation is deteriorating fast." ... [The ISM report] "is showing that the U.S. economy is almost at stall speed now," Pal said. "It gives us a 65 percent chance of a recession in the U.S.Clearly that forecast was incorrect. And there were many more at the end of 2018.

More recently Looking at the economic data, the odds of a recession in 2016 [written in late 2015] are very low (extremely unlikely in my view). [My view now: a recession in 2019 is very unlikely]. Someday I'll make another recession call, but I'm not even on recession watch now.

[I'm still not on recession watch!]

ISM Non-Manufacturing Index decreased to 56.7% in January

by Calculated Risk on 2/05/2019 10:05:00 AM

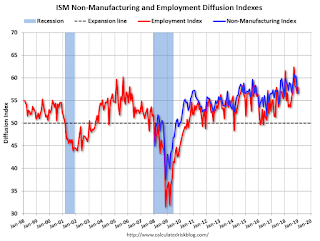

The January ISM Non-manufacturing index was at 56.7%, down from 58.0% in December. The employment index increased in January to 57.8%, from 56.6%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 108th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 56.7 percent, which is 1.3 percentage points lower than the December reading of 58 percent. This represents continued growth in the non-manufacturing sector, at a slower rate. The Non-Manufacturing Business Activity Index decreased to 59.7 percent, 1.5 percentage points lower than the December reading of 61.2 percent, reflecting growth for the 114th consecutive month, at a slower rate in January. The New Orders Index registered 57.7 percent, 5 percentage points lower than the reading of 62.7 percent in December. The Employment Index increased 1.2 percentage points in January to 57.8 percent from the December reading of 56.6 percent. The Prices Index increased 1.4 percentage points from the December reading of 58 percent to 59.4 percent, indicating that prices increased in January for the 20th consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth. The non-manufacturing sector’s growth rate cooled off in January. Respondents are concerned about the impacts of the government shutdown but remain mostly optimistic about overall business conditions.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in January than in December.

CoreLogic: House Prices up 4.7% Year-over-year in December

by Calculated Risk on 2/05/2019 08:58:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports December Home Prices Increased by 4.7 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4.7 percent year over year from December 2017. On a month-over-month basis, prices increased by 0.1 percent in December 2018. (November 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, the CoreLogic HPI Forecast indicates home prices will increase by 4.6 percent on a year-over-year basis from December 2018 to December 2019. Comparing the annual average HPI and HPI forecast for 2018 and 2019, average price growth is forecasted to slow from 5.8 percent to 3.4 percent. On a month-over-month basis, home prices are expected to decrease by 1 percent from December 2018 to January 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Higher mortgage rates slowed home sales and price growth during the second half of 2018,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Annual price growth peaked in March and averaged 6.4 percent during the first six months of the year. In the second half of 2018, growth moderated to 5.2 percent. For 2019, we are forecasting an average annual price growth of 3.4 percent.”

emphasis added

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.The year-over-year comparison has been positive for almost seven consecutive years since turning positive year-over-year in February 2012.

Monday, February 04, 2019

Tuesday: ISM non-Mfg Index

by Calculated Risk on 2/04/2019 05:59:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Quickly Retreating After Hitting Long-Term Lows

Mortgage rates continued moving higher today as Fridays unfortunate series of events seems to have motivated a big bounce. What events are those? Namely, we're talking about several important economic reports including the big jobs report and the most closely-watched manufacturing report from ISM. These were joined by two other supporting actors (Consumer Sentiment and Factory Orders) to round out an entire morning of data that came in much stronger than expected.Tuesday:

...

The good news is that US Treasury yields have been suffering more than mortgages. Apart from the last 3 business days, rates are still in line with their lowest levels in months. [30YR FIXED - 4.5%]

emphasis added

• At 8:00 AM ET: CoreLogic House Price Index for December.

• At 10:00 AM: the ISM non-Manufacturing Index for January.