by Calculated Risk on 2/10/2019 07:24:00 PM

Sunday, February 10, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of February 10, 2019

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $52.44 per barrel and Brent at $61.89 per barrel. A year ago, WTI was at $59, and Brent was at $62 - so oil prices are down year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.29 per gallon. A year ago prices were at $2.58 per gallon, so gasoline prices are down 29 cents per gallon year-over-year.

Hotels: Occupancy Rate Increased Slightly Year-over-year

by Calculated Risk on 2/10/2019 10:32:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 2 February

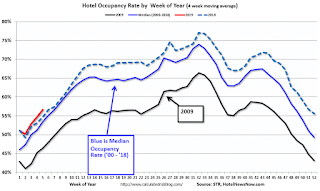

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 27 January through 2 February 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 28 January through 3 February 2018, the industry recorded the following:

• Occupancy: +0.1% to 56.7%

• Average daily rate (ADR): +2.3% to US$124.95

• Revenue per available room (RevPAR): +2.4% to US$70.83

STR analysts note that results were more stabilized than in recent weeks as the government shutdown ended.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A solid start for 2019.

Seasonally, the occupancy rate will increase over the next couple of months.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, February 09, 2019

Schedule for Week of February 10, 2019

by Calculated Risk on 2/09/2019 08:11:00 AM

The key reports this week are January CPI and December retail sales.

For manufacturing, the January Industrial Production report and the February NY Fed manufacturing survey will be released.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for January.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in November to 6.888 million from 7.131 million in October.

The number of job openings (yellow) were up 16% year-over-year, and Quits were up 7% year-over-year.

11:00 AM: NY Fed: Q4 Quarterly Report on Household Debt and Credit

12:45 PM: Speech by Fed Chair Jerome Powell, Economic Development in High Poverty Rural Communities, At the Hope Enterprise Corporation Rural Policy Forum, Itta Bena, Miss.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.1% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 234 thousand the previous week.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.1% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.

8:30 AM: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 7.0, up from 3.9.

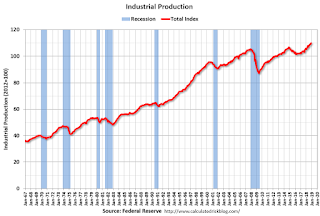

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.8%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 92.5.

Friday, February 08, 2019

Q4 GDP Forecasts: Mid-2s

by Calculated Risk on 2/08/2019 04:09:00 PM

The BEA has announced that the Q4 advanced GDP report will be combined with the 2nd estimate of GDP, and will be released on Feb 28th.

From Merrill Lynch:

Better than expected trade data were offset by soft manufacturing inventories data, leaving our 4Q tracking estimate unchanged at 2.3%. [Feb 8 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.4% for 2018:Q4 and 2.2% for 2019:Q1. [Feb 8 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.7 percent on February 6, up from 2.5 percent on February 1. [Feb 6 estimate]CR Note: These estimates suggest GDP in the mid 2s for Q4.

AAR: January Rail Carloads up 1.7% YoY, Intermodal Up 0.5% YoY

by Calculated Risk on 2/08/2019 10:32:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

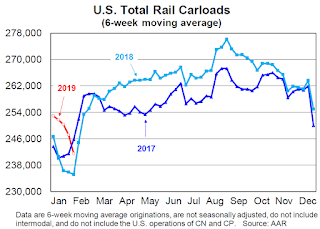

Total U.S. rail carloads were up 1.7%, or 21,054 carloads, in January 2019 over January 2018, while U.S. intermodal volume was up 0.5%, or 6,008 containers and trailers. You can split the five weeks of January 2019 into two parts. In weeks 1-3, total carloads were up 8.1% over last year and intermodal was up 5.7%. In weeks 4-5, though, carloads were down 6.6% (including an 8.4% decline in week 5) and intermodal was down 6.5% (including a 9.6% decline in week 5). Clearly, harsh weather at the end of January hurt rail traffic.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Red is 2019.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads (excluding the U.S. operations of Canadian railroads) originated 1.238 million carloads in January 2019, up 1.7%, or 21,054 carloads, over January 2018. Weekly average total carloads in January 2019 were 247,697, the fewest for any month since January 2018.

In terms of rail carloads, January (which consists of weeks 1-5) had two parts. For weeks 1-3, total carloads were up 8.1% this year over last year. For weeks 4-5, though, they were down 6.6%. The extreme cold this year at the end of January in many parts of the country limited rail operations substantially, though it’s impossible to precisely calculate what carloads would have been if weather had been more normal.

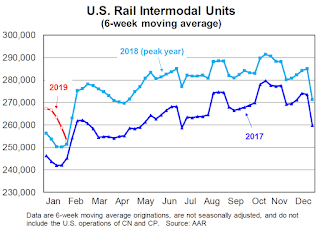

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):In addition to carloads, U.S. railroads originated 1.316 million containers and trailers in January 2019, up 0.5% over January 2018. Weekly average intermodal volume in January 2019 was 263,234 units, the most ever for January.Traffic in 2019 was off to a strong start, but then declined sharply due to the weather. AAR expects some "make-up volume" in February.

Like carloads, intermodal suffered from the weather. In the first three weeks of 2019, intermodal volume was up 5.7% over last year; weeks 2 and 3 this year were the highest-volume intermodal weeks in January in history for U.S. railroads. In weeks 4-5, though, intermodal was down 6.5% this year over last year, including a 9.6% decline in week 5, when weather was especially cold in much of the country. Again, it’s not possibly to precisely quantify the impact, but it’s reasonable to expect some make-up volume in February.

Seattle Real Estate in January: Sales Unchanged YoY, Inventory up 168% YoY from Low Levels

by Calculated Risk on 2/08/2019 10:16:00 AM

The Northwest Multiple Listing Service reported Homebuyers resuming search amid improving inventory, attractive terms

KIRKLAND, Washington (February 7, 2019) - Home buyers around Washington state are making their way back to the market, hoping to take advantage of improving inventory, attractive interest rates, and more approachable sellers, according to officials with Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were down 3.7% year-over-year, and active inventory was up 144% year-over-year.

Northwest MLS statistics for January show year-over-year improvement in the volume of new listings and total inventory, along with moderating selling prices. Although fewer pending sales (mutually accepted offers) were reported than a year ago (down about 3.3 percent), January was the smallest year-over-year decline since May 2018 when the drop was about 2.7 percent.

Commenting on the MLS statistics summarizing last month's activity, broker Gary O'Leyar said January's post-holiday real estate activity doesn't normally pick up until later in the month, but this year the uptick began early. "January started as a bit of a surprise. Open house activity was very robust, and we saw multiple offers in numerous instances again," reported O'Leyar, the owner of Berkshire Hathaway HomeServices Signature Properties in Seattle.

MLS members added 7,090 new listings of single family homes and condos during January, up from the year-ago figure of 6,805 and nearly doubling December's total of 3,631. At month end there were 11,687 active listings in the database, up more than 45 percent from the year-ago total of 8,037. Listing inventory more than doubled in both King and Snohomish counties.

emphasis added

In Seattle, sales were unchanged year-over-year, and inventory was up 168% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year, but months-of-supply in Seattle is still on the low side at 2.4 months.

Thursday, February 07, 2019

Employment: January Diffusion Indexes

by Calculated Risk on 2/07/2019 01:32:00 PM

I haven't posted this in a few months.

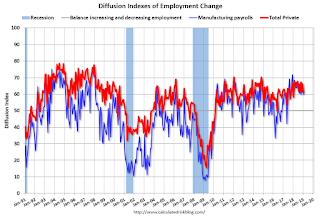

The BLS diffusion index for total private employment was at 61.0 in January, down from 66.3 in December.

For manufacturing, the diffusion index was at 59.9, down from 63.2 in December.

Note: Any reading above 60 is very good.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall both total private and manufacturing job growth was widespread again in January.

Overall both total private and manufacturing job growth was widespread again in January.

A few Tips on Business Cycle Forecasting

by Calculated Risk on 2/07/2019 09:46:00 AM

Because of my track record, I'm frequently asked about forecasting methods, my current views and what models I use. So here are a few tips.

First, why should someone care about the business cycle? If you are in a cyclical industry, forecasting is helpful with planning. Of course, if you forecast wrong - as people frequently do - then a company might hold back on investments and miss out on some opportunities. Another possible reason to forecast the business cycle is to improve investing performance. If someone could predict recessions and recoveries with reasonable accuracy, they could significantly improve their returns - but, once again, the track record for forecasters is pretty poor. Also forecasting is important for policymakers too (but most of us aren't policymakers).

I've successfully used forecasting as part of a cyclical business planning and also for my own investing. But it only helps if you are correct - so I don't recommend it for most investors - in general, for investing, it is better to just ride out the downturns then to try to time the business cycle. As an example, imagine if you had used ECRI forecasts for investing. You would have been late selling prior to the 2007 recession, and you would have missed a large percentage of the 2009 - 2019 bull market. Not a good result.

Second, many forecasters have an agenda, so be careful. For example, many newsletter writers and bloggers make frequent bearish forecasts. Perhaps they really believe their forecasts, or perhaps they are blinded by the incentives since being bearish garners publicity (and generates clicks and newsletter subscriptions).

Tip #1: Don't bother forecasting the business cycle (for most people). And don't rely on me - I could miss the next down turn (although I'll try to forecast the next recession).

If you are still reading, rely on history. Any reasonably intelligent person can almost always make a cogent argument that a recession is imminent. And yet, most of the time the economy is in expansion and stocks are in a bull market. This means forecasters have to fight through the tendency to be bearish. The economy and market don't care that you have a strong argument for a recession. Expansion is the norm.

Tip #2: Have a bias towards expansion.

Many forecasters start with the results of a model, and then based on the model, start warning that the sky is falling. A recent example was the focus on the yield curve inverting late last year.

This is backwards. My view is a forecaster should start with a story. For example, the Fed is overtightening, or the stock bubble burst will lead to less business investment, or the housing bust will lead to a collapse in the residential investment and a financial crisis. Those were some key stories prior to previous recessions.

Examples of possible stories now: If the Fed kept raising 25 bps a quarter (like last year), maybe rates would be too tight later this year or next year - and a recession might follow. But that doesn't seem to be the current course. Another possible story is the trade war might lead the economy into recession (but the negative impact doesn't seem large enough). Or perhaps the huge fiscal deficit - due to the new tax policy - will lead to much higher rates. Or there is too much corporate debt … and on and on.

This is why I track so many pieces of economic data - it helps me think about possible stories. And when data surprises, I try to take a closer look.

As I noted above, it is always possible to make an argument that a recession is coming, but it is usually wrong.

Tip #3: Start with a story (and try to see if the story makes sense - and the impact large enough to derail the expansion).

When a story makes sense, then it is time to start looking at some leading models. My favorite model uses residential investment as a leading indicator (not perfect, but pretty good). I also follow the yield curve (but it isn't currently as useful in a low interest rate environment).

When I'm on recession watch (due to a strong story and some modeling), then I start looking at some coincident indicators and models that are useful in timing a recession. For example, I start looking at unemployment claims, and some models based on the work of Hamilton, Chauvet, Piger and others.

Tip #4: Use models, but don't be a slave to the models.

Currently I'm not on recession watch. But I could be wrong!

Weekly Initial Unemployment Claims decreased to 234,000

by Calculated Risk on 2/07/2019 08:34:00 AM

The DOL reported:

In the week ending February 2, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 19,000 from the previous week's unrevised level of 253,000. The 4-week moving average was 224,750, an increase of 4,500 from the previous week's unrevised average of 220,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 224,750.

This was higher than the consensus forecast.

Wednesday, February 06, 2019

Thursday: Unemployment Claims

by Calculated Risk on 2/06/2019 08:58:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 253 thousand the previous week.

• At 3:00 PM, Consumer Credit from the Federal Reserve.