by Calculated Risk on 2/19/2019 03:15:00 PM

Tuesday, February 19, 2019

Lawler: Early Read on Existing Home Sales in January

From housing economist Tom Lawler: Early Read on Existing Home Sales in January

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.92 million in January, down 1.0% from December’s preliminary pace and down 8.6% from last January’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of January was up 6.6% from last January.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 3.0% from last January.

Note: In the upcoming release the NAR will incorporate updated seasonal adjustment factors (as it does every year), which will alter monthly seasonally adjusted sales for the past few years.

CR Note: Existing home sales for January are scheduled to be released on Thursday, Feb 21st. The consensus is for sales of 5.05 million SAAR.

Las Vegas: Convention Attendance and Visitor Traffic Declined Slightly in 2018

by Calculated Risk on 2/19/2019 11:31:00 AM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2018, visitor traffic declined 0.2% compared to 2017, but was still 7.5% above the pre-recession peak.

Convention attendance declined 2.2% in 2018 from the record high in 2017. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the declines in 2017 and 2018 are a little concerning for the Vegas area.

NAHB: Builder Confidence Increases in February

by Calculated Risk on 2/19/2019 10:06:00 AM

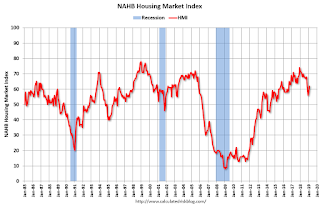

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 62 in February, up from 58 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Lower Interest Rates, Rising Consumer Confidence Boost Builder Sentiment

Builder confidence in the market for newly-built single-family homes rose four points to 62 in February, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today in Las Vegas during the 75th annual International Builders’ Show.

“Ongoing reduction in mortgage rates in recent weeks coupled with continued strength in the job market are helping to fuel builder sentiment,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “In the aftermath of the fall slowdown, many builders are reporting positive expectations for the spring selling season.”

February marked the second consecutive month in which all the HMI indices posted gains. The index measuring current sales conditions rose three points to 67, the component gauging expectations in the next six months increased five points to 68 and the metric charting buyer traffic moved up four points to 48.

“Builder confidence levels moved up in tandem with growing consumer confidence and falling interest rates,” said NAHB Chief Economist Robert Dietz. “The five-point jump on the six-month sales expectation for the HMI is due to mortgage interest rates dropping from about 5 percent in November to 4.4 percent this week. However, affordability remains a critical issue. Rising costs stemming from excessive regulations, a dearth of buildable lots, a persistent labor shortage and tariffs on lumber and other key building materials continue to make it increasingly difficult to produce housing at affordable price points.”

…

Looking at the three-month moving averages for regional HMI scores, the South posted a one-point gain to 63 while the Northeast dropped two points to 43. The Midwest and West each remained unchanged at 52 and 67, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.

Monday, February 18, 2019

Tuesday: NAHB homebuilder survey

by Calculated Risk on 2/18/2019 09:57:00 PM

Weekend:

• Schedule for Week of February 17, 2019

Tuesday:

• 10:00 AM, The February NAHB homebuilder survey. The consensus is for a reading of 59, up from 58. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $55.72 per barrel and Brent at $66.06 per barrel. A year ago, WTI was at $62, and Brent was at $65 - so WTI oil prices are down year-over-year, although Brent is essentially unchanged.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.33 per gallon. A year ago prices were at $2.52 per gallon, so gasoline prices are down 19 cents per gallon year-over-year.

The Housing Bubble, Mortgage Debt as Percent of GDP

by Calculated Risk on 2/18/2019 09:50:00 AM

Two years ago, on Presidents' Day, I excerpted from a post I wrote in February 2005 (yes, 14 years ago).

In that 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.

First, from 2005:

The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion - almost 7% of GDP. ...CR Note: And a serious problem is what happened!

Many homeowners have refinanced their homes, in essence using their homes as an ATM.

It wouldn't take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.

The second graph shows household mortgage debt as a percent of GDP through Q3 2018. Hopefully the graphs have improved!

The second graph shows household mortgage debt as a percent of GDP through Q3 2018. Hopefully the graphs have improved!The "bubble" is pretty obvious on this graph, and the sharp increase in mortgage debt was one of the warning signs.

Sunday, February 17, 2019

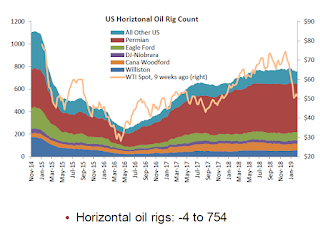

Oil: Rig Counts Rose Again

by Calculated Risk on 2/17/2019 11:10:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on February 17, 2019:

• Oil rig counts rose again, +3 to 857. This is not what oil prices would have suggested.

• Horizontal oil rig counts fell modestly, -4 to 754

• After last week’s loss of 3 horizontal oil rigs, the Permian lost an additional 5 this week

• Breakeven to add rigs fell to $54 WTI compared to $55.50 WTI on the screen as of the writing of this report. This is the first time breakeven has been below the posted oil price in months.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Hotels: Occupancy Rate Increased Slightly Year-over-year

by Calculated Risk on 2/17/2019 11:24:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 9 February

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 3-9 February 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 4-10 February 2018, the industry recorded the following:

• Occupancy: +0.2% to 59.9%

• Average daily rate (ADR): +1.5% to US$126.68

• Revenue per available room (RevPAR): +1.7% to US$75.84

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019.

Seasonally, the occupancy rate will increase over the next couple of months.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, February 16, 2019

Schedule for Week of February 17, 2019

by Calculated Risk on 2/16/2019 08:11:00 AM

The key report this week is January existing home sales.

For manufacturing, the February Philly Fed manufacturing survey will be released.

All US markets will be closed in observance of Washington's Birthday Holiday.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 59, up from 58. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of January 29-30, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 239 thousand the previous week.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

8:30 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 14.5, down from 17.0.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.00 million SAAR, up from 4.99 million.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.00 million SAAR, up from 4.99 million.The graph shows existing home sales from 1994 through the report last month.

No major economic releases scheduled.

Friday, February 15, 2019

Q4 GDP Forecasts: High-1s, Low-2s, 2018 Annual GDP around 2.8%

by Calculated Risk on 2/15/2019 11:58:00 AM

The BEA has announced that the Q4 advanced GDP report will be combined with the 2nd estimate of GDP, and will be released on Feb 28th.

From Merrill Lynch:

Weak retail sales data and inventory build caused a 0.8pp decline in our 4Q GDP tracking estimate to 1.5% from 2.3% [Feb 14 estimate]From Goldman Sachs:

emphasis added

The retail sales report indicated a considerably weaker pace of fourth quarter consumption growth than we had previously assumed. Reflecting this and lower-than-expected November business inventories, we lowered our Q4 GDP tracking estimate by five tenths to +2.0% (qoq ar). [Feb 14 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.2% for 2018:Q4 and 1.1% for 2019:Q1. [Feb 15 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 1.5 percent on February 14, down from 2.7 percent on February 6. [Feb 14 estimate]CR Note: These estimates suggest GDP in the high 1s for Q4.

Using the middle of these four forecasts (about 1.8% real GDP growth in Q4), that would put 2018 annual GDP growth at around 2.8%. This would be the best year since 2015, but lower than many forecasts.

MBA: "Mortgage Delinquencies Dropped to 18-Year Low in the Fourth Quarter of 2018"

by Calculated Risk on 2/15/2019 10:44:00 AM

From the MBA: Mortgage Delinquencies Dropped to 18-Year Low in the Fourth Quarter of 2018

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.06 percent of all loans outstanding at the end of the fourth quarter of 2018, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 41 basis points from the third quarter of 2018 and 111 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter rose by two basis points to 0.25 percent.

“The overall national mortgage delinquency rate in the fourth quarter was at its lowest level since the first quarter of 2000,” said Marina Walsh, MBA’s Vice President of Industry Analysis. “What’s even more noteworthy, the delinquency rate dropped from the previous quarter and on a year-over-year basis across all loan types and stages of delinquency."

Added Walsh, “With the unemployment rate near a 50-year low, wage growth trending higher and household debt levels relative to disposable incomes at a 35-year low, homeowners are in great shape, and mortgage performance is quite strong.”

...

In relation to the third quarter of 2018, mortgage delinquencies decreased across all stages of delinquency. The 30-day delinquency rate decreased 22 basis points to 2.29 percent, the 60-day delinquency rate decreased three basis points to 0.74 percent, and the 90-day delinquency bucket decreased 15 basis points to 1.03 percent.

...

The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent, down four basis points from the third quarter of 2018 and 24 basis points lower than one year ago. This was the lowest foreclosure inventory rate since the first quarter of 1996.

...

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.06 percent – a decrease of seven basis points from last quarter – and a decrease of 85 basis points from last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans delinquent decreased in Q4 and is at the lowest rate since Q1 2000.

The percent of loans in the foreclosure process continues to decline, and is now at the lowest level since 1996.