by Calculated Risk on 3/07/2019 08:44:00 AM

Thursday, March 07, 2019

CoreLogic: Homeowners with Negative Equity Increased by 35,000 in Q4 2018

From CoreLogic:

CoreLogic Reports Homeowners with Negative Equity Increased by 35,000 in the Fourth Quarter of 2018

CoreLogic … today released the Home Equity Report for the fourth quarter of 2018. The report shows that U.S. homeowners with mortgages (which account for roughly 63 percent of all properties) have seen their equity increase by 8.1 percent year over year, representing a gain of nearly $678.4 billion since the fourth quarter of 2017.

Additionally, the average homeowner gained $9,700 in home equity between the fourth quarter of 2017 and the fourth quarter of 2018. While home equity grew in almost every state in the nation, western states experienced the most significant annual increases. Nevada homeowners gained an average of approximately $29,400 in home equity, while Hawaii homeowners gained an average of approximately $26,900 and Idaho homeowners gained an average of $24,700. California homeowners experienced the fourth-highest growth with an average increase of approximately $19,600 in home equity.

From the third quarter of 2018 to the fourth quarter of 2018, the total number of mortgaged homes in negative equity increased 1.6 percent to 2.2 million homes or 4.2 percent of all mortgaged properties. This was the first quarterly increase since the fourth quarter of 2015. Despite that quarter-over-quarter increase, on a year-over-year basis, the number of mortgaged properties in negative equity fell 14 percent, or by 351,000, from 2.6 million homes – or 4.9 percent of all mortgaged properties – in the fourth quarter of 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows Home Equity by LTV distribution comparison between Q3 2018 and Q4 2018.

On a year-over-year basis, the number of homeowners with negative equity has declined by 351,000 (from 2.6 million to 2.2 million).

Weekly Initial Unemployment Claims decreased to 223,000

by Calculated Risk on 3/07/2019 08:32:00 AM

The DOL reported:

In the week ending March 2, the advance figure for seasonally adjusted initial claims was 223,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 225,000 to 226,000. The 4-week moving average was 226,250, a decrease of 3,000 from the previous week's revised average. The previous week's average was revised up by 250 from 229,000 to 229,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 226,250.

This was close to the consensus forecast.

Wednesday, March 06, 2019

Thursday: Unemployment Claims, Q4 Flow of Funds

by Calculated Risk on 3/06/2019 06:53:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, unchanged from 225 thousand the previous week.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

Fed's Beige Book: Economic Growth "Slight to moderate", Labor Market "Tight"

by Calculated Risk on 3/06/2019 02:27:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Kansas City based on information collected on or before February 25, 2019."

Economic activity continued to expand in late January and February, with ten Districts reporting slight-to-moderate growth, and Philadelphia and St. Louis reporting flat economic conditions. About half of the Districts noted that the government shutdown had led to slower economic activity in some sectors including retail, auto sales, tourism, real estate, restaurants, manufacturing, and staffing services. Consumer spending activity was mixed across the country, with contacts from several Districts attributing lower retail and auto sales to harsh winter weather and to higher costs of credit. Manufacturing activity strengthened on balance, but numerous manufacturing contacts conveyed concerns about weakening global demand, higher costs due to tariffs, and ongoing trade policy uncertainty. Activity in the nonfinancial services sector increased at a modest-to-moderate pace in most Districts, driven in part by growth in the professional, scientific, and technical services sub-sector. Residential construction activity was steady or slightly higher across most of the U.S., but residential home sales were generally lower. Several real estate contacts noted that inventories had risen slightly but remained historically low, while home prices continued to appreciate but at a slightly slower pace. Agricultural conditions remained weak, and energy activity was mixed across Districts.

...

Employment increased in most Districts, with modest-to-moderate gains in a majority of Districts and steady to slightly higher employment in the rest. Labor markets remained tight for all skill levels, including notable worker shortages for positions relating to information technology, manufacturing, trucking, restaurants, and construction. Contacts reported labor shortages were restricting employment growth in some areas.

emphasis added

Las Vegas Real Estate in February: Sales Down 7% YoY, Inventory up 105% YoY

by Calculated Risk on 3/06/2019 11:23:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices dip below $300,000 as homes sell at slower pace, GLVAR housing statistics for February 2019

Local home prices dipped below $300,000 in February while fewer properties changed hands and more homes were on the market than one year ago. That’s according to a report released Wednesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 7% year-over-year from 2,704 in February 2018 to 2,508 in February 2019.

...

The total number of existing local homes, condos and townhomes sold during February was 2,508. Compared to one year ago, February sales were down 7.6 percent for homes and down 5.9 percent for condos and townhomes.

...

At the current sales pace, Carpenter said Southern Nevada now has less than a four-month supply of homes available for sale. That’s up sharply from one year ago, but still below what would normally be considered a balanced market. By the end of February, GLVAR reported 7,134 single-family homes listed for sale without any sort of offer. That’s up 95.3 percent from one year ago. For condos and townhomes, the 1,754 properties listed without offers in February represented a 158.3 percent jump from one year ago.

...

The number of so-called distressed sales also continues to drop. GLVAR reported that short sales and foreclosures combined accounted for just 2.6 percent of all existing local property sales in February. That’s down from 3.8 percent of all sales one year ago and 10.6 percent two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,332 in February 2018 to 8,888 in February 2019. Note: Total inventory was up 105% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Fewer distressed sales.

Trade Deficit increased to $59.8 Billion in December

by Calculated Risk on 3/06/2019 08:44:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $59.8 billion in December, up $9.5 billion from $50.3 billion in November, revised.

December exports were $205.1 billion, $3.9 billion less than November exports. December imports were $264.9 billion, $5.5 billion more than November imports.

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in December.

Exports are 24% above the pre-recession peak and unchanged compared to December 2017; imports are 14% above the pre-recession peak, and up 3% compared to December 2017.

In general, trade has been picking up, although exports have declined slightly recently.

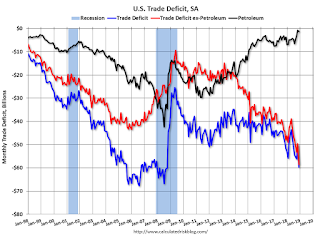

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $50.27 in December, down from $57.54 in November, and down from $52.08 in December 2017.

The trade deficit with China increased to $36.8 billion in December, from $30.8 billion in December 2017.

ADP: Private Employment increased 183,000 in February

by Calculated Risk on 3/06/2019 08:20:00 AM

Private sector employment increased by 183,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 180,000 private sector jobs added in the ADP report.

...

“We saw a modest slowdown in job growth this month,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Midsized companies have been the strongest performer for the past year. There was a sharp decline in small business growth as these firms continue to struggle with offering competitive wages and benefits.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The economy has throttled back and so too has job growth. The job slowdown is clearest in the retail and travel industries, and at smaller companies. Job gains are still strong, but they have likely seen their high watermark for this expansion.”

The BLS report for January will be released Friday, and the consensus is for 178,000 non-farm payroll jobs added in February.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 3/06/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 1, 2019. The results for the week ending February 22, 2019, included an adjustment for the Washington's Birthday (Presidents’ Day) holiday.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 1 percent higher than the same week one year ago.

...

“Slightly higher mortgages rates last week led to a decrease in application volume. Furthermore, the average loan size for purchase applications increased to a record high, led by a rise in the average size of conventional loans. This suggests that move-up and higher-end buyers have so far become a greater share of the spring market,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Overall, conventional purchase loans are up 2.1 percent relative to last year, indicating that homebuyers continue to be inspired by the stable rate environment and the modest increase in housing supply.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.67 percent from 4.65 percent, with points increasing to 0.44 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 1% year-over-year.

Tuesday, March 05, 2019

Wednesday: ADP Employment, Trade Deficit, Beige Book

by Calculated Risk on 3/05/2019 07:05:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in February, down from 213,000 added in January.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $57.6 billion. The U.S. trade deficit was at $49.3 billion in November.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A few Comments on December New Home Sales

by Calculated Risk on 3/05/2019 01:18:00 PM

First, this report was for December; the January report will be released on March 14th.

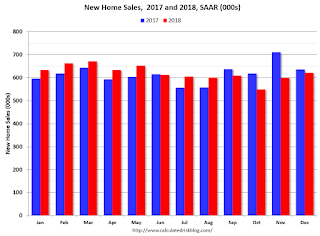

New home sales for December were reported at 621,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, however the three previous months were revised down.

Even with the weakness at the end of 2018, sales increased 1.5% in 2018 compared to 2017. I expect sales to be around the same level in 2019 as in 2018 (not fall off a cliff), and my guess is we haven't seen the peak of this cycle yet.

On Inventory: Months of inventory is now above the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch very closely.

Earlier: New Home Sales increased to 621,000 Annual Rate in December.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

The comparison for November and December were difficult (sales in November 2017 were especially strong).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

The "distressing gap" graph shows existing home sales (left axis) through January and new home sales (right axis) through December 2018. This graph starts in 1994, but the relationship had been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) through January and new home sales (right axis) through December 2018. This graph starts in 1994, but the relationship had been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.