by Calculated Risk on 3/14/2019 08:33:00 AM

Thursday, March 14, 2019

Weekly Initial Unemployment Claims increased to 229,000

The DOL reported:

In the week ending March 9, the advance figure for seasonally adjusted initial claims was 229,000, an increase of 6,000 from the previous week's unrevised level of 223,000. The 4-week moving average was 223,750, a decrease of 2,500 from the previous week's unrevised average of 226,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 223,750.

This was slightly above to the consensus forecast.

Wednesday, March 13, 2019

Thursday: New Home Sales, Unemployment Claims

by Calculated Risk on 3/13/2019 06:56:00 PM

Note: Still catching up on New Home sales following the government shutdown. The report released tomorrow will be for January. The February new home sales report is scheduled for March 29th. The March report will be released on the normal schedule.

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 223 thousand the previous week.

• At 10:00 AM, New Home Sales for January from the Census Bureau. The consensus is for 620 thousand SAAR, down from 621 thousand in December.

Houston Real Estate in February: Sales up Slightly YoY, Inventory Up 17%

by Calculated Risk on 3/13/2019 02:00:00 PM

From the HAR: Houston Home Rentals Soar in February While Sales Recover

After a generally mixed performance in January, the Houston housing market showed considerably more vitality in February, particularly among rental properties. Unlike January, which brought declining sales across all pricing segments, sales last month rose among homes priced between $150,000 and $750,000, with the high end of that range performing best. Inventory continued to grow, generating an improved supply of homes for consumers as the spring buying season gets underway.

According to the newest monthly report from the Houston Association of Realtors® (HAR), sales of single-family homes were statistically flat in February, with 5,280 homes sold compared to 5,265 a year earlier, marking the end of three straight months of declines.

...

Sales of all property types totaled 6,388, also statistically flat when compared to last February’s tally of 6,368. Total dollar volume for the month rose 3.1 percent to $1.76 billion.

“The Houston real estate market seems to be emerging from the winter doldrums with improvement in sales volume and an exceptionally strong performance among rental properties in February,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “This suggests that many consumers are opting to rent until they find the right home at the right price at the right interest rate to buy.”

...

Total active listings, or the total number of available properties, jumped 17.4 percent to 39,304.

Single-family homes months of inventory was at a 3.7-months supply, up from 3.1 months last February, but slightly below the national inventory level of 3.9 months ...

emphasis added

Mortgage Rates and Ten Year Yield

by Calculated Risk on 3/13/2019 11:46:00 AM

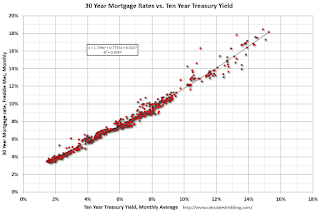

With the ten year yield falling to 2.6%, and based on an historical relationship, 30-year rates should currently be around 4.4%.

As of yesterday, Mortgage News Daily reported: Mortgage Rates Drop to New 14-Month Lows

Mortgage rates dropped convincingly today, bringing them to new long-term lows. The average lender hasn't offered anything lower for more than a year (January 2018). The improvement came on a combination of news headlines, economic data, and the scheduled sale of US 10yr Treasury debt. [30YR FIXED - 4.375% - 4.5%]The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

emphasis added

Currently the 10 year Treasury yield is at 2.62%, and 30 year mortgage rates were at 4.41% according to the Freddie Mac survey last week.

Currently the 10 year Treasury yield is at 2.62%, and 30 year mortgage rates were at 4.41% according to the Freddie Mac survey last week.To fall to 4% on the Freddie Mac survey, and based on the historical relationship, the Ten Year yield would have to fall to around 2.1%

To increase to 5% (on the Freddie Mac survey), based on the historical relationship, the Ten Year yield would have to increase to about 3.3%.

Construction Spending increased in January

by Calculated Risk on 3/13/2019 10:11:00 AM

From the Census Bureau reported that overall construction spending decreased in December:

Construction spending during January 2019 was estimated at a seasonally adjusted annual rate of $1,279.6 billion, 1.3 percent above the revised December estimate of $1,263.1 billion. The January figure is 0.3 percent above the January 2018 estimate of $1,276.3 billion.Both private and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $966.0 billion, 0.2 percent above the revised December estimate of $964.2 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $313.6 billion, 4.9 percent above the revised December estimate of $299.0 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined recently - and is still 25% below the bubble peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 4% below the peak in March 2009, and 20% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 6%. Non-residential spending is up 2% year-over-year. Public spending is up 8% year-over-year.

This was above consensus expectations, however spending for November and December were revised up.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 3/13/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 8, 2019.

... The Refinance Index decreased 0.2 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

“Led by a 5.5 percent increase in FHA loan applications, purchase activity picked up last week and was almost 2 percent higher than a year ago,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Purchase applications have now increased year-over-year for four weeks, which signals healthy demand entering the busy spring buying season. However, the pick-up in the average loan size continues, with the average balance reaching another record high. With more inventory in their price range compared to first-time buyers, move-up and higher-end buyers continue to have strong success finding a home.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.64 percent from 4.67 percent, with points increasing to 0.47 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.

Tuesday, March 12, 2019

Wednesday: Durable Goods, PPI, Construction Spending

by Calculated Risk on 3/12/2019 05:45:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

• At 8:30 AM, The Producer Price Index for February from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, Construction Spending for January. The consensus is for a 0.3% increase in construction spending.

Goldman: "The Housing Rebound"

by Calculated Risk on 3/12/2019 12:54:00 PM

Goldman Sachs economists Struyven and Young write: The Housing Rebound.

They see three reasons for a rebound in 2019:

1) Recently high frequently indicators (like starts and permits) have picked up.

2) Mortgage rates have fallen year-over-year. Struyven and Young note: "the headwind from higher interest rates should gradually diminish, as mortgage rates likely peaked late last year." emphasis added

3) Demographics are favorable as a large cohort is moving into the prime home buying age. This is a point I made in Demographics: Renting vs. Owning This is what I wrote:

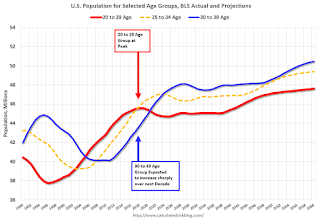

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023. This suggests demand for apartments will soften somewhat.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

Demographics are now positive for home buying, and this is a key reason I expect single family housing starts to continue to increase.

Key Measures Show Inflation about the same in February as in January on a YoY basis

by Calculated Risk on 3/12/2019 11:21:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in February. The 16% trimmed-mean Consumer Price Index rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for February here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.1% annualized rate) in February. The CPI less food and energy rose 0.1% (1.3% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.1%. Core PCE is for December and increased 1.9% year-over-year (January has not been released yet).

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.3% annualized.

Using these measures, inflation was about the same in February as in January on a year-over-year basis. Overall, these measures are at or above the Fed's 2% target (Core PCE is below 2%).

Small Business Optimism Index increased slightly in February

by Calculated Risk on 3/12/2019 09:04:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): February 2019 Report: Small Business Optimism Index

The NFIB Small Business Optimism Index improved modestly in February, increasing 0.5 points to 101.7. Views about future business conditions and the current period as a good time to expand improved as did plans to make capital outlays. Earnings trends weakened, as a million laid off workers and others affected by the shutdown cut back on spending.

..

Job creation broke the 45-year record in February with a net addition of 0.52 workers per firm (including those making no change in employment), up from 0.25 in December, and 0.33 in January. The previous record was 0.51 reached in May 1998.

Twenty-two percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, only 3 points below the record high. Thirtyseven percent of all owners reported job openings they could not fill in the current period, up 2 points from January and 2 points below the record high. br /> emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 101.7 in February.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.