by Calculated Risk on 4/03/2019 08:20:00 AM

Wednesday, April 03, 2019

ADP: Private Employment increased 129,000 in March

Private sector employment increased by 129,000 jobs from February to March according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 160,000 private sector jobs added in the ADP report.

...

“March posted the slowest employment increase in 18 months,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Although some service sectors showed continued strength, we saw weakness in the goods producing sector.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is weakening, with employment gains slowing significantly across most industries and company sizes. Businesses are hiring cautiously as the economy is struggling with fading fiscal stimulus, the trade uncertainty, and the lagged impact of Fed tightening. If employment growth weakens much further, unemployment will begin to rise.”

The BLS report will be released Friday, and the consensus is for 169,000 non-farm payroll jobs added in March.

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

by Calculated Risk on 4/03/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 18.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 29, 2019.

... The Refinance Index increased 39 percent from the previous week, and was at its highest level since January 2016. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“There was a tremendous surge in overall applications activity, as mortgage rates fell for the fourth week in a row – with rates for some loan types reaching their lowest levels since January 2018. Refinance borrowers with larger loan balances continue to benefit, as we saw another sizeable increase in the average refinance loan size to $438,900 – a new survey record,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “We had expected factors such as the ongoing strong job market and favorable demographics to help lift purchase activity this year, and the further decline in rates is providing another tailwind. Purchase applications were almost 10 percent higher than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.36 percent from 4.45 percent, with points increasing to 0.44 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Now that mortgage rates have fallen more than 50 bps from the highs last year, a number of recent buyers are able to refinance.

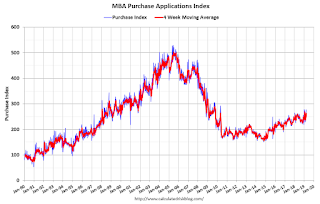

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

Tuesday, April 02, 2019

Wednesday: ADP Employment, ISM non-Mfg Survey

by Calculated Risk on 4/02/2019 08:59:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 160,000 payroll jobs added in March, down from 183,000 added in February.

• At 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for a reading of 58.0, down from 59.7.

Philly Fed: State Coincident Indexes increased in 38 states in January

by Calculated Risk on 4/02/2019 12:27:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2019. Over the past three months, the indexes increased in 44 states, decreased in one state, and remained stable in five, for a three-month diffusion index of 86. In the past month, the indexes increased in 38 states, decreased in seven states, and remained stable in five, for a one-month diffusion index of 62.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red and grey (unchanged) states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In January, 43 states had increasing activity (including minor increases).

Reis: Regional Mall Vacancy Rate increased Sharply in Q1 2019

by Calculated Risk on 4/02/2019 10:30:00 AM

Reis reported that the vacancy rate for regional malls was 9.3% in Q1 2019, up from 9.0% in Q4 2018, and up from 8.4% in Q1 2018. This is down slightly from a cycle peak of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.2% in Q1, unchanged from 10.2% in Q4, and up from 10.0% in Q1 2018. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

The neighborhood and community shopping center retail vacancy rate was unchanged at 10.2% in the first quarter. It was 10.0% a year ago.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.4% in the quarter. At $21.30 per square foot (asking) and $18.65 per square foot (effective), the average rents have both increased 1.6% from the first quarter of 2018.

With the closing of more than two dozen Sears stores, the Regional Mall vacancy rate increased 0.3% to 9.3%. The average rent, however, was flat in the quarter. A number of other Sears stores closed in the quarter, but they were not included in the regional mall trends, either because they are owner occupied or they are outside of our geographic coverage. The mall vacancy rate had jumped 0.5% in the third quarter of 2018 due to earlier Sears store closings. Many Sears stores remain in operation.

…

As the retail sector continues to undergo restructuring, a number of retail real estate markets face more vacancies and falling rents. This pattern is expected to continue as more stores will close this year. At the same time, we continue to see stores opening in every metro. A number of other big box vacancies have been converted to self storage and/or sold to developers for redevelopment.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased from an already elevated level.

Mall vacancy data courtesy of Reis

CoreLogic: House Prices up 4.0% Year-over-year in February

by Calculated Risk on 4/02/2019 08:52:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports February Home Prices Increased by 4 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4 percent year over year from February 2018. On a month-over-month basis, prices increased by 0.7 percent in February 2019. (January 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, after some initial moderation in early 2019, the CoreLogic HPI Forecast indicates home prices will begin to pick up and increase by 4.7 percent on a year-over-year basis from February 2019 to February 2020. On a month-over-month basis, home prices are expected to decrease by 0.5 percent from February 2019 to March 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“During the first two months of the year, home-price growth continued to decelerate,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This is the opposite of what we saw the last two years when price growth accelerated early. With the Federal Reserve’s announcement to keep short-term interest rates where they are for the rest of the year, we expect mortgage rates to remain low and be a boost for the spring buying season. A strong buying season could lead to a pickup in home-price growth later this year.”

emphasis added

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since 2012.

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since 2012.The year-over-year comparison has been positive for seven consecutive years since turning positive year-over-year in February 2012.

Monday, April 01, 2019

Tuesday: Vehicle Sales, Durable Goods and More

by Calculated Risk on 4/01/2019 07:21:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Surge 0.125% Higher

Mortgage rates spiked quickly today, capping a 3-day run leading back up from the lowest levels in more than a year. Today's move was by far the biggest and it leaves the average lender offering rates that are at least an eighth of a percentage point (0.125%) higher compared to most of last week. [30YR FIXED - 4.00-4.125%]Tuesday:

emphasis added

• All day, Light vehicle sales for March. The consensus is for light vehicle sales to be 16.8 million SAAR in March, up from 16.5 million in February (Seasonally Adjusted Annual Rate).

• Early, Reis Q1 2019 Mall Survey of rents and vacancy rates.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.9% decrease in durable goods orders.

• At 10:00 AM, Corelogic House Price index for February.

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in February

by Calculated Risk on 4/01/2019 04:28:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 0.76% in February, from 0.76% in January. The serious delinquency rate is down from 1.22% in January 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This matches the last three months as the lowest serious delinquency rate for Fannie Mae since August 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.72% are seriously delinquent. For loans made in 2005 through 2008 (5% of portfolio), 4.58% are seriously delinquent, For recent loans, originated in 2009 through 2018 (92% of portfolio), only 0.34% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Reis: Office Vacancy Rate decreased in Q1 to 16.6%

by Calculated Risk on 4/01/2019 12:13:00 PM

Reis reported that the office vacancy rate was at 16.6% in Q1, down from 16.7% in Q4 2018. This is up from 16.5% in Q1 2018, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

The office vacancy rate fell slightly in the quarter to 16.6% from 16.7% last quarter and 16.5% a year ago. The office vacancy rate had bottomed at 16.3% in Q1 2017.

The national average asking rent increased 0.4% in the first quarter while the effective rent, which nets out landlord concessions, increased 0.5% in the quarter. At $33.58 per square foot (asking) and $27.26 per square foot (effective), the average rents have increased 2.2% and 2.3%, respectively, from the first quarter of 2018.

...

In the tenth year of the expansion, the office market continues to move at a snail’s pace. That said, the widening gap between the stronger markets and weaker ones is particularly noteworthy and is otherwise obscured by the flat national numbers. The underlying data shows that tech firms are fueling much of the growth in the stronger office markets, particularly in west coast metros, parts of Texas and parts of the east coast.

With more construction underway in 2019, vacancy is expected to increase a bit more while rent growth should continue to stay below the rate of inflation.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.6% in Q1. The office vacancy rate had been mostly moving sideways at an elevated level.

Office vacancy data courtesy of Reis.

Construction Spending increased 1.0% in February

by Calculated Risk on 4/01/2019 10:19:00 AM

From the Census Bureau reported that overall construction spending decreased in February:

Construction spending during February 2019 was estimated at a seasonally adjusted annual rate of $1,320.3 billion, 1.0 percent above the revised January estimate of $1,307.3 billion.Both private and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $994.5 billion, 0.2 percent above the revised January estimate of $993.0 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $325.8 billion, 3.6 percent above the revised January estimate of $314.4 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although declined in the 2nd half of 2018 - and is still 20% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now back to the previous peak in March 2009, and 25% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 3%. Non-residential spending is up slightly year-over-year. Public spending is up 1% year-over-year.

This was well above consensus expectations, and spending for December and January were revised up.