by Calculated Risk on 4/05/2019 10:31:00 AM

Friday, April 05, 2019

Comments on March Employment Report

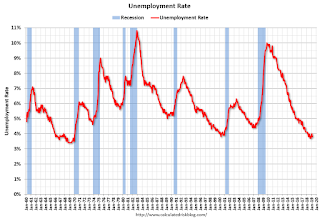

The headline jobs number at 196 thousand for March was above consensus expectations of 169 thousand, and the previous two months were revised up 14 thousand, combined. The unemployment rate was unchanged at 3.8%. Overall this was a solid report.

Earlier: March Employment Report: 196,000 Jobs Added, 3.8% Unemployment Rate

In March, the year-over-year employment change was 2.537 million jobs. That is solid year-over-year growth.

Average Hourly Earnings

Wage growth was slightly below expectations. From the BLS:

"In March, average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents to $27.70, following a 10-cent gain in February. Over the past 12 months, average hourly earnings have increased by 3.2 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.2% YoY in March.

Wage growth has generally been trending up.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in March at 82.5%, and the 25 to 54 employment population ratio was decreased to 79.8%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 4.5 million in March. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in March to 4.499 million from 4.310 million in February. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 7.3% in March.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.305 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 1.271 million in February.

Summary:

The headline jobs number was above expectations, and the previous two months were revised up slightly. The headline unemployment rate was unchanged at 3.8%.

This was a solid jobs report, and was probably boosted by some bounce back from the poor weather in February. The economy added 541 thousand jobs in Q1, down from 683 thousand jobs in Q1 2018. So it appears job growth has slowed somewhat, but is still solid.

This was strong enough to alleviate recession fears (no worries!), but not too strong to change the Fed's view of the economy (stay on hold).

Note that sometime soon the overall participation rate will start declining again due to demographic factors. The overall participation rate has been moving sideways for several years, as the expansion has offset the demographics factors.

March Employment Report: 196,000 Jobs Added, 3.8% Unemployment Rate

by Calculated Risk on 4/05/2019 08:42:00 AM

From the BLS:

Total nonfarm payroll employment increased by 196,000 in March, and the unemployment rate was unchanged at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care and in professional and technical services.

...

The change in total nonfarm payroll employment for January was revised up from +311,000 to +312,000, and the change for February was revised up from +20,000 to +33,000. With these revisions, employment gains in January and February combined were 14,000 more than previously reported.

...

In March, average hourly earnings for all employees on private nonfarm payrolls rose by 4 cents to $27.70, following a 10-cent gain in February. Over the past 12 months, average hourly earnings have increased by 3.2 percent.

emphasis added

Click on graph for larger image.

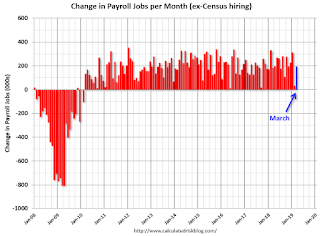

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 196 thousand in March (private payrolls increased 182 thousand).

Payrolls for January and February were revised up 14 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In March the year-over-year change was 2.537 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate declined in March to 63.0%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate declined in March to 63.0%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio declined to 60.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in March at 3.8%.

This was above the consensus expectations of 169,000 jobs added, and January and February were revised up by 14,000 combined. A solid report.

I'll have much more later ...

Thursday, April 04, 2019

Friday: Employment Report

by Calculated Risk on 4/04/2019 07:42:00 PM

My March Employment Preview

Goldman: March Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for March. The consensus is for 169,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

Goldman: March Payrolls Preview

by Calculated Risk on 4/04/2019 02:55:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 190k in March ... Our forecast reflects a boost from weather of around 20k ... While we believe the trend in job growth has slowed from last year’s strong pace, renewed declines in jobless claims and the resilience in business surveys suggest that the trend remains nicely above potential. …

We estimate the unemployment rate was unchanged at 3.8% … We expect a 0.3% rise in average hourly earnings (mom sa) but we look for the year-over-year rate to fall a tenth to 3.3%

emphasis added

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 4/04/2019 01:15:00 PM

From HotelNewsNow.com: STR: U.S. hotel results for week ending 30 March

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 24-30 March 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 25-31 March 2018, the industry recorded the following:

• Occupancy: +4.2% to 69.5%

• Average daily rate (ADR): +0.9% to US$131.77

• Revenue per available room (RevPAR): +5.1% to US$91.53

STR analysts note that performance growth was strong against the comparison with Easter weekend in 2018, when there was significantly less group business around Good Friday.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019 - close, to-date, compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring travel season, and then increase during the Summer.

Data Source: STR, Courtesy of HotelNewsNow.com

March Employment Preview

by Calculated Risk on 4/04/2019 10:35:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for an increase of 170,000 non-farm payroll jobs in March, and for the unemployment rate to be unchanged at 3.8%.

Last month, the BLS reported 20,000 jobs added in February.

Here is a summary of recent data:

• The ADP employment report showed an increase of 129,000 (Updated: typo corrected, HT Dwight) private sector payroll jobs in March. This was below the consensus expectations of 160,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index increased in March to 57.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 20,000 in March. The ADP report indicated manufacturing jobs decreased 2,000 in March.

The ISM non-manufacturing employment index increased in February to 55.9%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 230,000 in March.

Combined, the ISM surveys suggest employment gains above the consensus expectations.

• Initial weekly unemployment claims averaged 213,000 in March, down from 224,000 in February. For the BLS reference week (includes the 12th of the month), initial claims were at 216,000, down slightly from 217,000 during the reference week the previous month.

The decrease during the reference week suggests a stronger employment report in March than in February.

• The final March University of Michigan consumer sentiment index increased to 98.4 from the February reading of 93.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Weather could have negatively impacted the February report, and there might be some bounce back in March.

• Conclusion: In general these reports suggest a solid employment report. There might be some bounce back from the poor weather in February, so my guess is job growth will above consensus of 170,000.

Weekly Initial Unemployment Claims decreased to 202,000

by Calculated Risk on 4/04/2019 08:32:00 AM

The DOL reported:

In the week ending March 30, the advance figure for seasonally adjusted initial claims was 202,000, a decrease of 10,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 211,000 to 212,000. The 4-week moving average was 213,500, a decrease of 4,000 from the previous week's revised average. The previous week's average was revised up by 250 from 217,250 to 217,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,500.

This was below the consensus forecast.

Wednesday, April 03, 2019

"Low Mortgage Rates Had a Big Impact, But Now They're Moving Back Up"

by Calculated Risk on 4/03/2019 04:47:00 PM

From Matthew Graham at Mortgage News Daily: Super Low Rates Had a Big Impact, But Now They're Moving Back Up

Mortgage rates resumed a week-long move higher today, bringing them to the highest levels since March 19th or 20th, depending on the lender. Between now and then, they'd fallen abruptly to the best levels in more than 15 months. The improvements were meaningful enough to draw out refinance applicants in droves according to weekly mortgage app data released by the Mortgage Bankers Association (MBA) this morning.CR Note: The decline in mortgage rates - from around 5% to just over 4% - really boosted refinance activity in the weekly MBA survey, and also helped with purchase activity.

…

Over the past few days, depending on the lender and scenario, a 30-yr fixed rate quote could be as much as a quarter of a percentage point (0.25%) higher. This would increase the payment on a $300,000 loan by $43/month. [30YR FIXED - 4.125-4.375%]

Merrill: March Employment Report Forecast

by Calculated Risk on 4/03/2019 01:44:00 PM

A few brief excerpts from a Merrill Lynch note:

We expect nonfarm payrolls growth to rebound nicely to 190k in March after a 20k increase in February.

The unemployment rate should remain level at 3.8% … Wage growth should remain strong at 0.3% mom keeping the yoy growth rate at a cyclical high of 3.4%.

ISM Non-Manufacturing Index decreased to 56.1% in March

by Calculated Risk on 4/03/2019 10:05:00 AM

The March ISM Non-manufacturing index was at 56.1%, down from 59.7% in February. The employment index increased to 55.9%, from 55.2%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 110th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 56.1 percent, which is 3.6 percentage points lower than the February reading of 59.7 percent. This represents continued growth in the non-manufacturing sector, at a slower rate. The Non-Manufacturing Business Activity Index decreased to 57.4 percent, 7.3 percentage points lower than the February reading of 64.7 percent, reflecting growth for the 116th consecutive month, at a slower rate in March. The New Orders Index registered 59 percent, 6.2 percentage points lower than the reading of 65.2 percent in February. The Employment Index increased 0.7 percentage point in March to 55.9 percent from the February reading of 55.2 percent. The Prices Index increased 4.3 percentage points from the February reading of 54.4 percent to 58.7 percent, indicating that prices increased in March for the 22nd consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector’s growth cooled off in March after strong growth in February. Respondents remain mostly optimistic about overall business conditions and the economy. They still have underlying concerns about employment resources and capacity constraints.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in March than in February.