by Calculated Risk on 4/10/2019 04:19:00 PM

Wednesday, April 10, 2019

Houston Real Estate in March: Sales up 4% YoY, Inventory Up 18%

From the HAR: The Houston Housing Market Blossoms in March

Lower interest rates pushed fence-sitters into buying mode as single-family home sales rose nearly five percent in March compared to a year earlier. The strongest sales activity was recorded among homes priced between $250,000 and $500,000, followed closely by the luxury segment ($750,000 and above). Once again, renters placed strong demand on single-family and townhome/condo leases across greater Houston. Housing inventory expanded to its highest level in five months, laying fertile ground for consumers as we move further into the spring buying season.CR Note: Total active listings increased 17.5 percent year-over-year to 41,127.

According to the latest monthly report from the Houston Association of Realtors® (HAR), sales of single-family homes increased 4.9 percent in March, with 7,072 homes sold versus 6,740 in March of 2018. Home sales edged up slightly in February following three consecutive months of declines.

...

March sales of all property types totaled 8,475, up 3.6 compared to the same month last year. Total dollar volume for the month jumped 5.7 percent to $2.4 billion.

“Home sales are benefitting from some of the lowest interest rates in years, but we also continue to see tremendous strength in the rental segment, and with inventory growing steadily, the Houston real estate market looks solid,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “We are also encouraged by the Texas Workforce Commission’s latest report about a 2.4-percent increase in employment across metro Houston over the past year, which bodes well for housing.”

...

Single-family homes inventory reached a 3.9-months supply in March. That is up from 3.3 months a year earlier and marks the greatest supply of homes since October 2018. ...

emphasis added

FOMC Minutes: "Patient approach", "Likely ... the target range unchanged for the remainder of the year"

by Calculated Risk on 4/10/2019 02:05:00 PM

Note that some participants think a rate hike later this year might be appropriate.

From the Fed: Minutes of the Federal Open Market Committee, March 19-20, 2019. A few excerpts:

In their discussion of monetary policy decisions at the current meeting, participants agreed that it would be appropriate to maintain the current target range for the federal funds rate at 2-1/4 to 2-1/2 percent. Participants judged that the labor market remained strong, but that information received over the intermeeting period, including recent readings on household spending and business fixed investment, pointed to slower economic growth in the early part of this year than in the fourth quarter of 2018. Despite these indications of softer first-quarter growth, participants generally expected economic activity to continue to expand, labor markets to remain strong, and inflation to remain near 2 percent. Participants also noted significant uncertainties surrounding their economic outlooks, including those related to global economic and financial developments. In light of these uncertainties as well as continued evidence of muted inflation pressures, participants generally agreed that a patient approach to determining future adjustments to the target range for the federal funds rate remained appropriate. Several participants observed that the characterization of the Committee's approach to monetary policy as "patient" would need to be reviewed regularly as the economic outlook and uncertainties surrounding the outlook evolve. A couple of participants noted that the "patient" characterization should not be seen as limiting the Committee's options for making policy adjustments when they are deemed appropriate.

With regard to the outlook for monetary policy beyond this meeting, a majority of participants expected that the evolution of the economic outlook and risks to the outlook would likely warrant leaving the target range unchanged for the remainder of the year. Several of these participants noted that the current target range for the federal funds rate was close to their estimates of its longer-run neutral level and foresaw economic growth continuing near its longer-run trend rate over the forecast period. Participants continued to emphasize that their decisions about the appropriate target range for the federal funds rate at coming meetings would depend on their ongoing assessments of the economic outlook, as informed by a wide range of data, as well as on how the risks to the outlook evolved. Several participants noted that their views of the appropriate target range for the federal funds rate could shift in either direction based on incoming data and other developments. Some participants indicated that if the economy evolved as they currently expected, with economic growth above its longer-run trend rate, they would likely judge it appropriate to raise the target range for the federal funds rate modestly later this year.

emphasis added

Key Measures Show Inflation about the same in March as in February on a YoY basis

by Calculated Risk on 4/10/2019 11:36:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.3% annualized rate) in March. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for March here. Motor fuel increased at a 111.3% annualized rate in March.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (5.0% annualized rate) in March. The CPI less food and energy rose 0.1% (1.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.3%, and the CPI less food and energy rose 1.8%. Core PCE is for February and increased 1.9% year-over-year.

On a monthly basis, median CPI was at 3.3% annualized, trimmed-mean CPI was at 2.8% annualized, and core CPI was at 2.0% annualized.

Using these measures, inflation was about the same in March as in February on a year-over-year basis. Overall, these measures are at or above the Fed's 2% target (Core PCE is below 2%).

BLS: CPI increase 0.4% in March, Core CPI increased 0.1%

by Calculated Risk on 4/10/2019 08:37:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in March on a seasonally adjusted basis after rising 0.2 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.9 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy increased 0.1 percent in March, the same increase as in February.

..

The all items index increased 1.9 percent for the 12 months ending March, a larger increase than the 1.5-percent rise for the period ending February. The index for all items less food and energy rose 2.0 percent over the last 12 months.

emphasis added

MBA: Mortgage Purchase Applications up 13% YoY

by Calculated Risk on 4/10/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 5, 2019.

... The Refinance Index decreased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 13 percent higher than the same week one year ago.

...

“Mortgage rates inched back up last week, but remain substantially lower than they were in the second half of last year,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “As quickly as refinance activity increased in recent weeks, it backed down again in response to the rise in rates. However, this spring’s lower borrowing costs, coupled with the strong job market, continue to push purchase application volume much higher. Purchase applications are now up more than 13 percent compared to last year at this time.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.40 percent from 4.36 percent, with points increasing to 0.47 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Once mortgage rates fell more than 50 bps from the highs of last year, a number of recent buyers were able to refinance. But it would take another significant decrease in rates to see further refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 13% year-over-year.

Tuesday, April 09, 2019

Wednesday: CPI, FOMC Minutes

by Calculated Risk on 4/09/2019 07:15:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for 0.3% increase in CPI, and a 0.2% increase in core CPI.

• At 2:00 PM, FOMC Minutes, Meeting of March 19-20, 2019

Seattle Real Estate in March: Sales down 7.8% YoY, Inventory up 136% YoY from Low Levels

by Calculated Risk on 4/09/2019 02:36:00 PM

The Northwest Multiple Listing Service reported Housing Market Rebounds From February Freeze

Both pending sales and new listing activity around Western Washington surged during March as buyers, sellers, and brokers emerged from February's record snowfall.The press release is for the Northwest. In King County, sales were down 8.3% year-over-year, and active inventory was up 36% year-over-year.

...

At month end, there were 12,017 active listings of single family homes and condos in the Northwest MLS database. That represents an increase of more than 36 percent from a year ago when there were only 8,825 active listings. Inventory more than doubled in King County compared to a year ago, rising from 2,060 active listings to 4,263 at the end of March. Nine counties reported less inventory than 12 months ago.

emphasis added

In Seattle, sales were down 7.8% year-over-year, and inventory was up 136% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year, but months-of-supply in Seattle is still on the low side at 2.0 months.

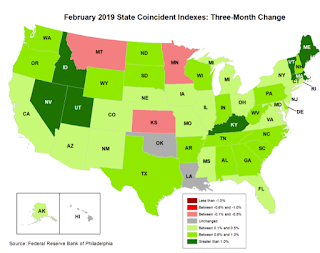

Philly Fed: State Coincident Indexes increased in 42 states in February

by Calculated Risk on 4/09/2019 12:22:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2019. Over the past three months, the indexes increased in 44 states, decreased in three states, and remained stable in three, for a three month diffusion index of 82. In the past month, the indexes increased in 42 states, decreased in four states, and remained stable in four, for a one-month diffusion index of 76.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red and grey (unchanged) states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In February, 45 states had increasing activity (including minor increases).

BLS: Job Openings Decreased to 7.1 Million in February

by Calculated Risk on 4/09/2019 10:07:00 AM

Notes: In February there were 7.581 million job openings, and, according to the February Employment report, there were 6.235 million unemployed. So, for the twelfth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (over 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings fell to 7.1 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.7 million and 5.6 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in February at 3.5 million. The quits rate was 2.3 percent. The quits level was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in February to 7.087 million from 7.625 million in January.

The number of job openings (yellow) are up 9% year-over-year.

Quits are up 10% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. Despite the decrease in job openings, this was still a solid report.

Small Business Optimism Index increased slightly in March

by Calculated Risk on 4/09/2019 08:47:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): March 2019 Report: Small Business Optimism Index

The Small Business Optimism Index improved slightly, increasing 0.1 points to 101.8. Three Index components fell, two were unchanged, and five improved. The major soft spot was in inventories: stocks were viewed as too large (a negative in the Index) and plans to invest in inventories turned slightly negative (e.g. more firms plan reductions than additions). The labor market indicators improved, capital spending plans held steady, and the outlook for expansion and real sales gained ground as did reports of rising earnings.

..

Job creation was solid in March with a net addition of 0.50 workers per firm (including those making no change in employment), close to February’s record of 0.52, and up from 0.33 in January.

Twenty-one percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, only 4 points below the record high. Thirty-nine percent of all owners reported job openings they could not fill in the current period, up 2 points from February and equal to the record high set in December.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 101.8 in March.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.