by Calculated Risk on 4/16/2019 09:17:00 PM

Tuesday, April 16, 2019

Wednesday: Trade Deficit, Beige Book

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Trade Balance report for February from the Census Bureau. The consensus is the trade deficit to be $53.7 billion. The U.S. trade deficit was at $51.1 billion in January.

• During the day, The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

CAR: "California home sales moderate in March"

by Calculated Risk on 4/16/2019 12:19:00 PM

The CAR reported: California home sales, median price moderate in March, C.A.R. reports

The lowest interest rates in more than a year boosted California’s housing market and kept home sales level in March after an exceptionally strong performance the previous month, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that the YoY increase has been slowing in both California and Nationally.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 397,210 units in March, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the March pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

March’s sales figure was down 0.2 percent from the revised 398,040 level in February and down 6.3 percent from home sales in March 2018 of 423,990.

“The lowest interest rates in more than a year gave would-be buyers the confidence to enter the housing market and provided a much-needed push to jump-start the spring homebuying season,” said C.A.R. President Jared Martin. “Pending sales also showed healthy improvement in March, which suggests a brighter market outlook could be in place in the second quarter.”

...

Active listings continued to climb from the prior year, increasing 13.4 percent from last March. It was the 12th consecutive month active listings rose year-over-year and the ninth month in a row they grew double digits from the prior year. The pace of increase, however, was the slowest since July 2018, and the growth rate has been decelerating since December 2018.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, improved on a year-over-year basis but decreased on a month-to-month basis. The Unsold Inventory Index was 3.6 months in March, down from 4.6 months in February but up from 3.0 months in March 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate. The jump in the UII from a year ago can be attributed to the moderate sales decline and the sharp increase in active listings.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.1% | 19.2% |

| Mar-19 | NA | 13.4% |

NAHB: "Builder Confidence Edges Higher in April"

by Calculated Risk on 4/16/2019 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 63 in April, up from 62 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Edges Higher in April

Builder confidence in the market for newly-built single-family homes rose one point to 63 in April, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Sentiment levels have held in the low 60s for the past three months.

“Builders report solid demand for new single-family homes but they are also grappling with affordability concerns stemming from a chronic shortage of construction workers and buildable lots,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn.

“Ongoing job growth, favorable demographics and a low-interest rate environment will help to modestly spark sales growth in the near term,” said NAHB Chief Economist Robert Dietz. “However, supply-side headwinds that are putting upward pressure on housing costs will limit more robust growth in the housing market.”

…

The HMI index gauging current sales conditions increased one point to 69, and the component measuring traffic of prospective buyers rose three points to 47. The measure charting sales expectations in the next six months fell one point to 71.

Looking at the three-month moving averages for regional HMI scores, the Northeast posted a three-point gain to 51, the Midwest increased two points to 53, and the South was up one point to 67. The West remained unchanged at 69.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast.

Industrial Production Decreased 0.1% in March

by Calculated Risk on 4/16/2019 09:35:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged down 0.1 percent in March after edging up 0.1 percent in February; for the first quarter as a whole, the index slipped 0.3 percent at an annual rate. Manufacturing production was unchanged in March after declining in both January and February. The index for utilities rose 0.2 percent, while mining output moved down 0.8 percent. At 110.2 percent of its 2012 average, total industrial production was 2.8 percent higher in March than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in March to 78.8 percent, a rate that is 1.0 percentage point below its long-run (1972–2018) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.8% is 1.0% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in March to 109.7. This is 27% above the recession low, and 4.6% above the pre-recession peak.

The decrease in industrial production and decrease in capacity utilization were below consensus.

Monday, April 15, 2019

Tuesday: Industrial Production, Homebuilder Survey

by Calculated Risk on 4/15/2019 07:03:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Highest in More Than 3 Weeks

Mortgage rates continued higher to start the week, following a relatively sharp increase on Friday. … This brings the average lender to the highest levels seen since before the Fed's rate-friendly announcement back on March 20th. [30YR FIXED - 4.25%]Tuesday:

emphasis added

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 63, up from 62. Any number above 50 indicates that more builders view sales conditions as good than poor.

Phoenix Real Estate in March: Sales down 11% YoY, Active Inventory up 9% YoY

by Calculated Risk on 4/15/2019 04:11:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales declined to 8,344 in March, from 9,402 in March 2018. Sales were UP 30.2% from February 2019, but down 11.3% from March 2018.

2) Active inventory was at 18,182, up from 16,645 in March 2018. This is up 9.2% year-over-year. This is the fifth consecutive month with a YoY increase in active inventory.

The last five months - with a YoY increase - followed twenty-four consecutive months with a YoY decrease in inventory in Phoenix.

Months of supply decreased from 3.63 in February to 2.78 in March. This is still low.

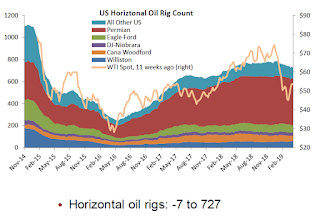

Oil: Rig Counts increased Slightly

by Calculated Risk on 4/15/2019 01:43:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on April 14, 2019:

• Oil rigs rose 2, to 833

• Horizontal oil rigs gave back almost their entire gains of last week, -7 to 727

• The Permian gave back 3 of last week’s 8 gains in horizontal oil rig adds: -3 to 423

• Last week’s bottom for the mini-cycle is holding, but just barely

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Looking Back: What is a Depression?

by Calculated Risk on 4/15/2019 12:00:00 PM

Sometimes it is fun to look back. I remember watching CNBC in March 2009, and it seemed every talking head was bearish - and many were predicting a depression. Below is an excerpt from one of a series of my more positive posts in 2009 (after being very negative for several years). Not perfect, but clearly my outlook was changing.

Those of us looking for the economy to bottom were definitely in the minority!

In early March 2009, I wrote: What is a depression?

It seems like the "D" word is everywhere. And that raises a question: what is a depression? Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.Note:

...

I still think a depression is very unlikely. More likely the economy will bottom later this year or at least the rate of economic decline will slow sharply. I also still believe that the eventual recovery will be very sluggish, and it will take some time to return to normal growth.

...

It is possible - see Looking for the Sun - that new home sales and housing starts will bottom in 2009, but any recovery in housing will probably be sluggish.

That leaves Personal Consumption Expenditures (PCE) - and as households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

1) The recession ended in June 2009 according to NBER.

2) Housing starts bottomed in 2009, but new home sales didn't bottom until 2010-2011. Note: I predicted house prices would continue to decline, and finally called the bottom for house prices in Feb 2012.

3) The recovery was sluggish - for housing, PCE, and the overall economy.

NY Fed: Manufacturing "Business activity grew modestly in New York State"

by Calculated Risk on 4/15/2019 08:40:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew modestly in New York State, according to firms responding to the April 2019 Empire State Manufacturing Survey. The headline general business conditions index rose six points to 10.1, indicating that growth picked up somewhat but remained fairly subdued. New orders rose slightly, and shipments continued to grow modestly. Delivery times and inventories both increased. Labor market indicators pointed to ongoing employment gains and a small increase in hours worked.This was slightly above the consensus forecast.

Optimism about the six-month outlook was much lower than last month. The index for future business conditions dropped seventeen points to 12.4—its lowest level in more than three years.

emphasis added

Sunday, April 14, 2019

Sunday Night Futures

by Calculated Risk on 4/14/2019 09:06:00 PM

Weekend:

• Schedule for Week of April 14, 2019

Monday:

• 8:30 AM, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 6.8, up from 3.7.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $63.45 per barrel and Brent at $71.24 per barrel. A year ago, WTI was at $67, and Brent was at $73 - so oil prices are down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.70 per gallon, so gasoline prices are up 13 cents per gallon year-over-year.