by Calculated Risk on 4/29/2019 07:05:00 PM

Monday, April 29, 2019

Tuesday: Case-Shiller House Prices, Chicago PMI, Pending Home Sales

From Matthew Graham at Mortgage News Daily: Mortgage Rates Modestly Higher, But Volatility Could Increase

Mortgage rates moved up today, but at a fairly tame pace in the bigger picture. The rest of the week, however, may not be as tame. There are multiple economic reports on tap with a history of impacting the bond market (which dictates rates). The data gets most serious starting on Wednesday and finally culminates with ... the big jobs report. [30YR FIXED - 4.25-4.375%]Tuesday:

emphasis added

• At 9:00 AM, S&P/Case-Shiller House Price Index for February. The consensus is for a 3.2% year-over-year increase in the Comp 20 index for February.

• At 9:45 AM, Chicago Purchasing Managers Index for April.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 0.6% increase in the index.

Energy expenditures as a percentage of PCE

by Calculated Risk on 4/29/2019 04:05:00 PM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the March 2019 PCE report released this morning.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through March 2019.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In March 2019, energy expenditures as a percentage of PCE increased to 4.04% of PCE, up from the all time low three years ago of 3.6%.

Historically this is a low percentage of PCE for energy expenditures.

Q1 2019 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 4/29/2019 01:02:00 PM

The BEA has released the underlying details for the Q1 initial GDP report.

The BEA reported that investment in non-residential structures decreased at a 0.8% annual pace in Q1. Investment in petroleum and natural gas exploration was mostly unchanged in Q1 compared to Q4, but has increased substantially over the last two years.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices increased in Q1, and is up 7% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 22% year-over-year in Q1. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased in Q1, and lodging investment is up 10% year-over-year.

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top for six years - but home improvement investment exceeded single family in Q1.

Even though investment in single family structures has increased from the bottom, single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases.

Investment in single family structures was $264 billion (SAAR) (about 1.3% of GDP)..

Investment in multi-family structures increased in Q1.

Investment in home improvement was at a $274 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.3% of GDP). Home improvement spending has been solid.

Dallas Fed: "Growth in Texas Manufacturing Activity Picks Up Slightly"

by Calculated Risk on 4/29/2019 10:36:00 AM

From the Dallas Fed: Growth in Texas Manufacturing Activity Picks Up Slightly

Texas factory activity continued to expand in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, ticked up two points to 12.4, indicating output growth accelerated slightly from March.This was the last of the regional Fed surveys for April.

Other measures of manufacturing activity also suggested slightly faster expansion in April. The survey’s demand indicators bounced back after dipping last month: The new orders index rose eight points to 9.8, and the growth rate of orders index rose from -2.0 to 5.2. The capacity utilization index pushed to a seven-month high of 15.6, while the shipments index held fairly steady at 6.3.

Perceptions of broader business conditions continued to improve in April. The general business activity index remained positive for a third month in a row but fell five points to 2.0. Meanwhile, the company outlook index climbed two points to 6.3.

Labor market measures suggested weaker employment growth but slightly stronger growth in workweek length in April. The employment index fell eight points to 4.6, its lowest reading since the end of 2016.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be at about the same level in April as in March, maybe slightly lower. The consensus forecast is for a reading of 55.0, down slightly from 55.3 in March (to be released on Wednesday, May 1st).

Personal Income increased 0.1% in March, Spending increased 0.9%

by Calculated Risk on 4/29/2019 08:36:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $11.4 billion (0.1 percent) in March according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $0.6 billion, (less than 0.1 percent) and personal consumption expenditures (PCE) increased $123.5 billion (0.9 percent).The March PCE price index increased 1.5 percent year-over-year and the March PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI decreased 0.2 percent in March, and real PCE increased 0.7 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased less than 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through September 2018 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was above expectations.

PCE growth was weak in Q1, and inflation is below the Fed's target.

Sunday, April 28, 2019

Sunday Night Futures

by Calculated Risk on 4/28/2019 07:04:00 PM

Weekend:

• Schedule for Week of April 28, 2019

Monday:

• 8:30 AM ET, Personal Income and Outlays, March 2019. The consensus is for a 0.4% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were mixed over the last week with WTI futures at $62.87 per barrel and Brent at $71.63 per barrel. A year ago, WTI was at $68, and Brent was at $76 - so oil prices are down 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.89 per gallon. A year ago prices were at $2.80 per gallon, so gasoline prices are up 9 cents per gallon year-over-year.

April 2019: Unofficial Problem Bank list increased slightly to 73 Institutions

by Calculated Risk on 4/28/2019 11:05:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2019. It was quiet during the month in terms of changes as the list increased by one institution to 73 banks. Aggregate assets increased to $52.1 billion from $51.6 billion a month earlier. A year ago, the list held 94 institutions with assets of $18.9 billion. The addition this month was CFSBANK, Charleroi, PA ($488 million).

Saturday, April 27, 2019

Schedule for Week of April 28, 2019

by Calculated Risk on 4/27/2019 08:11:00 AM

The key report scheduled for this week is the April employment report.

Other key reports include Case-Shiller house prices, ISM Manufacturing survey, Vehicle Sales and Personal Income and Outlays for March.

For manufacturing, the April Dallas manufacturing survey will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

8:30 AM ET: Personal Income and Outlays, March 2019. The consensus is for a 0.4% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

9:00 AM: S&P/Case-Shiller House Price Index for February.

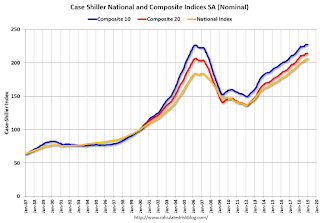

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 3.2% year-over-year increase in the Comp 20 index for February.

9:45 AM: Chicago Purchasing Managers Index for April.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 0.6% increase in the index.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to be 17.0 million SAAR in April, down from 17.5 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to be 17.0 million SAAR in April, down from 17.5 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in April, up from 129,000 added in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 55.0, down from 55.3 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 55.0, down from 55.3 in March.Here is a long term graph of the ISM manufacturing index.

The PMI was at 55.3% in March, up from 54.2% in February. The employment index was at 57.5% and the new orders index was at 57.4%.

10:00 AM: Construction Spending for March. The consensus is for a 0.2% increase in construction spending.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. Last week the DOL reported 230 thousand initial claims.

8:30 AM: Employment Report for April. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

8:30 AM: Employment Report for April. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.There were 196,000 jobs added in March, and the unemployment rate was at 3.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In March the year-over-year change was 2.537 million jobs.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for a reading of 57.2, up from 56.1.

Friday, April 26, 2019

For Fun: Jim the Realtor in 2009

by Calculated Risk on 4/26/2019 06:18:00 PM

Long time readers will remember the hilarious Jim the Realtor videos. Back, during the foreclosure crisis, Jim videoed a number of REO (Bank Real Estate Owned), and this one reminded him of Scarface.

Check out the backyard!

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in March

by Calculated Risk on 4/26/2019 03:31:00 PM

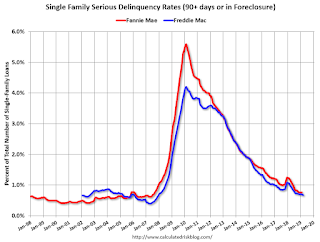

Freddie Mac reported that the Single-Family serious delinquency rate in March was 0.67%, down from 0.69% in February. Freddie's rate is down from 0.97% in March 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since December 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.7% range - so this is close to a bottom.

Note: Fannie Mae will report for March soon.