by Calculated Risk on 5/09/2019 08:34:00 AM

Thursday, May 09, 2019

Weekly Initial Unemployment Claims Decrease to 228,000

The DOL reported:

In the week ending May 4, the advance figure for seasonally adjusted initial claims was 228,000, a decrease of 2,000 from the previous week's unrevised level of 230,000. The 4-week moving average was 220,250, an increase of 7,750 from the previous week's unrevised average of 212,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 220,250.

This was well above the consensus forecast.

Wednesday, May 08, 2019

Thursday: Unemployment Claims, Trade Deficit, PPI

by Calculated Risk on 5/08/2019 08:21:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 230 thousand last week.

• At 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is the trade deficit to be $50.1 billion. The U.S. trade deficit was at $49.4 Billion in February.

• At 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

NAHB: Builder Confidence Increased to Record High for the 55+ Housing Market in Q1

by Calculated Risk on 5/08/2019 04:21:00 PM

This index is similar to the overall NAHB housing market index (HMI), but only released quarterly. The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low.

From the NAHB: 55+ Housing Market Opens First Quarter with Record High

Builder confidence in the single-family 55+ housing market continued to strengthen in the first quarter of 2019 with a reading of 72, up six points from the previous quarter, according to the National Association of Home Builders' (NAHB) 55+ Housing Market Index (HMI) released today. This is the highest reading since the inception of the index in 2008.

...

"Overall, demand for homes in 55+ communities remain strong as more buyers and renters in that market search for simpler living arrangements,” said Karen Schroeder, chair of NAHB's 55+ Housing Industry Council and vice president of Mayberry Homes in East Lansing, Mich. “However, there are still headwinds that are impacting the market, such as rising construction costs and a lack of skilled labor.”

All three index components of the 55+ single-family HMI posted increases from the previous quarter: Present sales rose four points to 76, expected sales for the next six months increased seven points to 77 and traffic of prospective buyers climbed eight points to 61.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q1 2019. Any reading above 50 indicates that more builders view conditions as good than as poor. The index increased to 72 in Q1 up from 66 in Q4.

There are two key drivers in addition to the improved economy: 1) there is a large cohort that recently moved into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics are favorable for the 55+ market.

Houston Real Estate in April: Sales up 8% YoY, Inventory Up 14%

by Calculated Risk on 5/08/2019 11:52:00 AM

From the HAR: The Luxury Market Leads the Way in Houston's April Home Sales Gains

Lower mortgage interest rates, improving oil prices, steady economic growth and a more plentiful supply of housing translated to a strong month for home sales throughout greater Houston in April. Luxury homes (priced at $750,000 and above) drew the greatest volume of sales followed closely by homes in the $150,000 to $250,000 range. Housing inventory grew to its highest level since last September, keeping up with consumer demand midway through the spring buying season.On pace for record sales in Houston.

According to the latest monthly report from the Houston Association of Realtors (HAR), sales of single-family homes increased 7.8 percent in April, with 7,586 homes sold compared to 7,035 in April 2018. That marks the third straight month of positive sales and the biggest volume gain of 2019. On a year-to-date basis, home sales are 2.2 percent ahead of last year’s record pace.

...

April sales of all property types totaled 9,063, up 7.8 percent compared to the same month last year. Total dollar volume for the month jumped 9.6 percent to about $2.7 billion.

“Consumers have been taking advantage of optimal conditions for homebuying, with low interest rates and a growing supply of properties, and that has powered Houston to a strong springtime performance,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “The rental market also remains healthy, and we’re relieved to see sales finally turning around among townhomes and condominiums.”

...

Total active listings, or the total number of available properties, jumped 13.8 percent to 42,086. ...

emphasis added

Las Vegas Real Estate in April: Sales Up 2% YoY, Inventory up 101% YoY

by Calculated Risk on 5/08/2019 10:22:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices hovering around $300,000, with more homes on the market; GLVAR housing statistics for April 2019

Local home prices are hovering around $300,000, while the number of homes on the market continues to increase. So says a report released Wednesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were up 1.5% year-over-year from 3,571 in April 2018 to 3,625 in April 2019.

...

The total number of existing local homes, condos and townhomes sold during April was 3,625. Compared to one year ago, April sales were down 0.2% for homes, but up 8.7% for condos and townhomes.

...

At the current sales pace, Carpenter said Southern Nevada now has less than a three-month supply of homes available for sale. That’s up from one year ago, but still below what would normally be considered a balanced market. By the end of April, GLVAR reported 7,435 single-family homes listed for sale without any sort of offer. That’s up 94.8% from one year ago. For condos and townhomes, the 1,826 properties listed without offers in April represented a 131.1% jump from one year ago.

...

The number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for just 3.0% of all existing local property sales in April. That compares to 2.5% of all sales one year ago and 8.4% two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,606 in April 2018 to 9,261 in April 2019. Note: Total inventory was up 101% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Low level of distressed sales, but up slightly YoY.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 5/08/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 3, 2019.

... The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 5 percent higher than the same week one year ago.

...

“We saw a good week for the spring homebuying season, as a 5 percent increase in purchase applications – both weekly and year-over-year – drove the results,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Average loan amounts also stayed elevated, with government purchase applications rising to the highest in the survey. Even with slower price appreciation in higher-priced markets, home prices are still rising enough to push average loan sizes higher.”

Added Kan, “With purchase activity increasing and mortgage rate movements mostly unchanged, the refinance share of applications were at their lowest level since last November.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.41 percent from 4.42 percent, with points increasing to 0.47 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

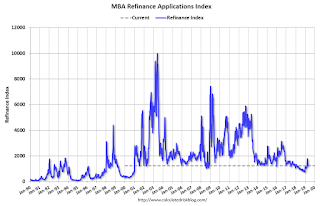

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Once mortgage rates fell more than 50 bps from the highs of last year, a number of recent buyers were able to refinance. But it would take another significant decrease in rates to see a further increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 5% year-over-year.

Tuesday, May 07, 2019

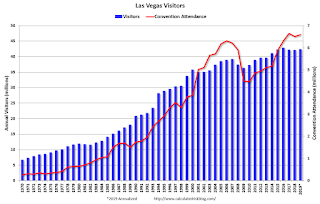

Las Vegas: Convention Attendance and Visitor Traffic up Slightly in Q1 2019

by Calculated Risk on 5/07/2019 04:46:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2018, visitor traffic declined 0.2% compared to 2017, but was still 7.5% above the pre-recession peak.

Convention attendance declined 2.2% in 2018 from the record high in 2017. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). 2019 is estimate based on Q1 data.

Convention attendance was up 1.5% in Q1 2019 compared to Q1 2018.

Visitor traffic was up 0.8% in Q1 2019 compared to Q1 2018.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the slight declines over the last two years was concerning.

Seattle Real Estate in April: Sales unchanged YoY, Inventory up 124% YoY from Low Levels

by Calculated Risk on 5/07/2019 01:48:00 PM

The Northwest Multiple Listing Service reported Northwest MLS Housing Report for April Signals Good News for Home Buyers

Housing activity during April signaled good news for buyers in Western Washington as inventory continued to grow, the rate of price increases was slowing in many areas (and even decreasing in a few counties), and mortgage rates remained low.The press release is for the Northwest. In King County, sales were down 1% year-over-year, and active inventory was up 78% year-over-year.

Northwest Multiple Listing Service statistics for last month show a 28.5 percent overall increase in active listings compared to the same month a year ago, a 5.8 percent gain in pending sales, and a 2.4 percent rise in median prices for sales of single family homes and condos that closed during April. The volume of closings dipped slightly (down 1.9 percent).

emphasis added

In Seattle, sales were unchanged year-over-year, and inventory was up 124% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year, but months-of-supply in Seattle is still on the low side at 1.9 months.

BLS: Job Openings Increased to 7.5 Million in March

by Calculated Risk on 5/07/2019 10:08:00 AM

Notes: In March there were 7.488 million job openings, and, according to the March Employment report, there were 6.211 million unemployed. So, for the thirteen consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (over 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings rose to 7.5 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.7 million and 5.4 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in March at 3.4 million. The quits rate was 2.3 percent. The quits level was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in March to 7.488 million from 7.142 million in February.

The number of job openings (yellow) are up 9% year-over-year.

Quits are up 3% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was still a solid report.

CoreLogic: House Prices up 3.7% Year-over-year in March

by Calculated Risk on 5/07/2019 09:16:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports March Home Prices Increased by 3.7% Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.7% year over year from March 2018. On a month-over-month basis, prices increased by 1% in March 2019. (February 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, after some initial moderation in early 2019, the CoreLogic HPI Forecast indicates home prices will begin to pick up and increase by 4.8% on a year-over-year basis from March 2019 to March 2020. On a month-over-month basis, home prices are expected to decrease by 0.3% from March 2019 to April 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The U.S. housing market continues to cool, primarily due to some of our priciest markets moving into frigid waters,” said Dr. Ralph McLaughlin, deputy chief economist at CoreLogic. “But the broader market looks more temperate as supply and demand come into balance. With mortgage rates flat and inventory picking up, we expect more buyers to take advantage of easing housing market headwinds.”

emphasis added

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since 2012.

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since 2012.The year-over-year comparison has been positive for seven consecutive years since turning positive year-over-year in February 2012.