by Calculated Risk on 5/12/2019 09:56:00 PM

Sunday, May 12, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of May 12, 2019

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 22 and DOW futures are down 200 (fair value).

Oil prices were up over the last week with WTI futures at $61.58 per barrel and Brent at $70.73 per barrel. A year ago, WTI was at $71, and Brent was at $78 - so oil prices are down 10% to 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.85 per gallon. A year ago prices were at $2.86 per gallon, so gasoline prices are unchanged per gallon year-over-year.

Q2 GDP Forecasts: Around 2%

by Calculated Risk on 5/12/2019 09:55:00 AM

From Merrill Lynch:

We are tracking 3.0% for 1Q GDP. ... 2Q remains at 2.1%. [May 10 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.2% for 2019:Q2. [May 10 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.6 percent on May 9, down from 1.7 percent on May 3. [May 9 estimate]CR Note: These early estimates suggest real GDP growth will be around 2% annualized in Q2.

Saturday, May 11, 2019

Schedule for Week of May 12, 2019

by Calculated Risk on 5/11/2019 08:11:00 AM

The key reports this week are April housing starts and retail sales.

For manufacturing, the April Industrial Production report and the May NY and Philly Fed manufacturing surveys will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for April.

11:00 AM: NY Fed: Q1 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for April is scheduled to be released. The consensus is for 0.3% increase in retail sales.

8:30 AM: Retail sales for April is scheduled to be released. The consensus is for 0.3% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.65% on a YoY basis in March.

8:30 AM: The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 9.9, down from 10.1.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a no change in Industrial Production, and for Capacity Utilization to be unchanged at 78.8%.

10:00 AM: The May NAHB homebuilder survey. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 219 thousand initial claims, down from 228 thousand last week.

8:30 AM ET: Housing Starts for April.

8:30 AM ET: Housing Starts for April. This graph shows single and total housing starts since 1968.

The consensus is for 1.200 million SAAR, up from 1.139 million SAAR in March.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 9.3, up from 8.5.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for May).

10:00 AM: State Employment and Unemployment (Monthly) for April 2019

Friday, May 10, 2019

Mortgage Rates and Ten Year Yield

by Calculated Risk on 5/10/2019 02:43:00 PM

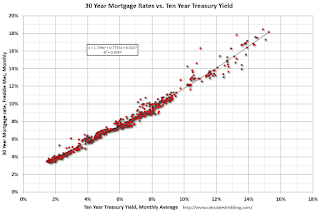

With the ten year yield at 2.45%, and based on an historical relationship, 30-year rates should currently be around 4.4%.

As of yesterday, Mortgage News Daily reported: Mortgage Rates Unchanged to Slightly Lower

Mortgage rates were just slightly lower on average today with some lenders flat and others distinctly lower. [30YR FIXED - 4.25%]The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

emphasis added

Currently the 10 year Treasury yield is at 2.45%, and 30 year mortgage rates were at 4.10% according to the Freddie Mac survey this week.

Currently the 10 year Treasury yield is at 2.45%, and 30 year mortgage rates were at 4.10% according to the Freddie Mac survey this week.To fall to 4% on the Freddie Mac survey, and based on the historical relationship, the Ten Year yield would have to fall to around 2.1%

To increase to 5% (on the Freddie Mac survey), based on the historical relationship, the Ten Year yield would have to increase to about 3.3%.

Cleveland Fed: Key Measures Show Inflation Close to 2% in April

by Calculated Risk on 5/10/2019 11:13:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.4% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for April here. Motor fuel increased at a 93.3% annualized rate in April.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.9% annualized rate) in April. The CPI less food and energy rose 0.1% (1.7% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.3%, and the CPI less food and energy rose 2.1%. Core PCE is for March and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.4% annualized, trimmed-mean CPI was at 2.0% annualized, and core CPI was at 1.7% annualized.

Using these measures, inflation was about the same in April as in March on a year-over-year basis. Overall, these measures are at or above the Fed's 2% target (Core PCE is below 2%).

BLS: CPI increase 0.3% in April, Core CPI increased 0.1%

by Calculated Risk on 5/10/2019 08:37:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis after rising 0.4 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.0 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy increased 0.1 percent for the third consecutive month.

...

The all items index increased 2.0 percent for the 12 months ending April, the largest 12-month increase since the period ending November 2018. The index for all items less food and energy rose 2.1 percent over the last 12 months, and the food index rose 1.8 percent.

emphasis added

Thursday, May 09, 2019

Friday: CPI

by Calculated Risk on 5/09/2019 07:42:00 PM

Merrill on US-China Trade:

As the US-China trade war enters a decisive phase, we outline three scenarios to help clients navigate the economic and market implications. The most favorable outcome is a near-term trade deal, with no additional tariffs. ... in our second scenario there is another round of tit-for-tat tariffs. After a brief period of uncertainty, an agreement is reached. The last and most unlikely scenario is a full-blown trade war.Friday:

An imminent trade deal should allow the global economy to continue to grow above trend. ... In the brinkmanship scenario we see downside risks to growth from higher tariffs and elevated uncertainty. A trade war, with across-the-board tariffs on US-China trade, would push the global economy towards recession.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.4% increase in CPI, and a 0.2% increase in core CPI.

California Bay Area Home Sales Decline 4% YoY in April, Inventory up 18% YoY

by Calculated Risk on 5/09/2019 04:52:00 PM

From Pacific Union chief economist Selma Hepp: Bay Area housing market shifting in anticipation of IPO demand

• IPO expectations are already showing up in home sales activity, particularly in San Francisco and San Mateo

• Sales of homes in San Francisco, San Mateo and Alameda have solidly exceeded last year – up 7 percent, 4 percent and 2 percent respectively year-over-year in April

• Santa Clara, Wine Country and Contra Costa remain slower compared to last year

• Homes priced between $1 million and $2 million continue to struggle, except in San Francisco and San Mateo, likely a result of tax reform changes and reduced state and local tax (SALT)and mortgage interest deductions

• Nevertheless, sales of homes priced above $3 million have surged again, posting a 5 percent year-over-year increase, matching last year’s peaks

• While growth in inventory of homes for sales is broad based, availability of homes priced above $3 million accelerated again to a 26 percent annual growth in April

• While price growth remains flat in most regions, San Francisco median prices up 2 percent year-over-year in April

• A 9 percent annual increase in homes under contract suggests buyers are back in droves, especially for homes priced over $3 million, up 44 percent year-over-year

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 5/09/2019 12:34:00 PM

From HotelNewsNow.com: STR: U.S. hotel results for week ending 4 May

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 28 April through 4 May 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 29 April through 5 May 2018, the industry recorded the following:

• Occupancy: +1.2% to 69.1%

• Average daily rate (ADR): +2.3% to US$133.43

• Revenue per available room (RevPAR): +3.6% to US$92.21

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019, close - to-date - compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring, and then increase during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Trade Deficit Increased to $50.0 Billion in March

by Calculated Risk on 5/09/2019 08:49:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $50.0 billion in March, up $0.7 billion from $49.3 billion in February, revised.

March exports were $212.0 billion, $2.1 billion more than February exports. March imports were $262.0 billion, $2.8 billion more than February imports.

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in March.

Exports are 28% above the pre-recession peak and up 1% compared to March 2018; imports are 13% above the pre-recession peak, and up 2% compared to March 2018.

In general, trade had been picking up, although both imports and exports have moved mostly sideways recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $53.10 per barrel in March, up from $46.89 in February, and down from $54.00 in March 2018.

The trade deficit with China decreased to $20.7 billion in March, from $25.9 billion in March 2018.