by Calculated Risk on 5/19/2019 08:05:00 PM

Sunday, May 19, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of May 19, 2019

Monday:

• 8:30 AM ET, Chicago Fed National Activity Index for April. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 8 and DOW futures are up 88 (fair value).

Oil prices were up over the last week with WTI futures at $63.35 per barrel and Brent at $72.85 per barrel. A year ago, WTI was at $71, and Brent was at $78 - so oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $2.92 per gallon, so gasoline prices are down 8 cents per gallon year-over-year.

Hotels: Occupancy Rate Decreased Slightly Year-over-year

by Calculated Risk on 5/19/2019 12:07:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 11 May

The U.S. hotel industry reported mostly positive year-over-year results in the three key performance metrics during the week of 5-11 May 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 6-12 May 2018, the industry recorded the following:

• Occupancy: -0.3% to 68.3%

• Average daily rate (ADR): +1.2% to US$131.72

• Revenue per available room (RevPAR): +0.9% to US$89.94

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019, close - to-date - compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring, and then increase during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, May 18, 2019

Schedule for Week of May 19, 2019

by Calculated Risk on 5/18/2019 08:11:00 AM

The key reports this week are April New and Existing Home Sales.

For manufacturing, the May Kansas City manufacturing survey will be released.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.21 million.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.21 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.31 million SAAR for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of April 30-May 1, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 212 thousand last week.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 678 thousand SAAR, down from 692 thousand in March.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 2.0% decrease in durable goods orders.

Friday, May 17, 2019

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/17/2019 07:19:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in April

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.31 million in April, up 1.9% from March’s preliminary estimate (which was below what state and local realtor data would have suggested), and down 2.2% from last April’s seasonally adjusted pace. Unadjusted sales last month should be relatively flat from last April, with the SA/NSA gap reflecting this April’s higher business day count relative to last April’s.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of March should be about 4.4% higher than last March.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 3.5% from a year earlier.

CR Note: Existing home sales for April are scheduled to be released on Tuesday, May 21st. The consensus is NAR will report sales of 5.36 million SAAR.

Sacramento Housing in April: Sales Down 6% YoY, Active Inventory up slightly YoY

by Calculated Risk on 5/17/2019 03:04:00 PM

The Sacramento Housing Statistics:

1) Overall sales increased to 1,496 in April, down from 1,587 in April 2018. Sales were up 13.3% from March 2019 (last month), and down 5.7% from April 2018.

2) Active inventory was at 2,094, up from 2,082 in April 2018. That is up slightly, 0.6% year-over-year. This is the nineteenth consecutive month with a YoY increase in active inventory.

Inventory is still low - months of inventory is at 1.4 months, probably closer to 4 months would be normal.

Q2 GDP Forecasts: 1% to 2%

by Calculated Risk on 5/17/2019 12:47:00 PM

From Merrill Lynch:

Based on the latest high frequency data, 2Q GDP is already tracking only 1.8%, down 0.3pp from our prior forecast. [May 17 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.8% for 2019:Q2. [May 17 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.2 percent on May 16, up from 1.1 percent on May 15. [May 16 estimate]CR Note: These early estimates suggest real GDP growth will be under 2% annualized in Q2.

BLS: Unemployment Rates in April at New Series Lows in Pennsylvania, Vermont, and Wisconsin

by Calculated Risk on 5/17/2019 10:24:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in April in 10 states and stable in 40 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today.

...

Vermont had the lowest unemployment rate in April, 2.2 percent. The rates in Pennsylvania (3.8 percent), Vermont (2.2 percent), and Wisconsin (2.8 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.5 percent.

emphasis added

Click on graph for larger image.

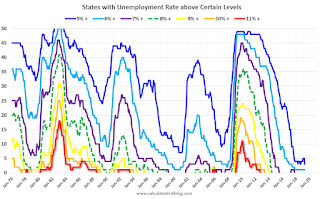

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that the series low for Alaska is above 6%. Two states and the D.C. have unemployment rates above 5%; Alaska and New Mexico.

A total of nine states are at the series low.

Phoenix Real Estate in April: Sales up 6% YoY, Active Inventory up 7% YoY

by Calculated Risk on 5/17/2019 08:55:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales increased to 9,493 in April, up from 8,990 in April 2018. Sales were up 13.8% from March 2019 (last month), and up 5.6% from April 2018.

2) Active inventory was at 17,804, up from 16,568 in April 2018. That is up 7.5% year-over-year. This is the sixth consecutive month with a YoY increase in active inventory.

The last six months - with a YoY increase - followed twenty-four consecutive months with a YoY decrease in inventory in Phoenix.

Months of supply decreased from 2.78 in March to 2.43 in April. This is still low.

Thursday, May 16, 2019

Comments on April Housing Starts

by Calculated Risk on 5/16/2019 04:30:00 PM

Earlier: Housing Starts Increased to 1.235 Million Annual Rate in April

Total housing starts in April were above expectations, and starts for February and March were revised up.

The housing starts report showed starts were up 5.7% in April compared to March, and starts were down 2.5% year-over-year compared to April 2018.

Single family starts were down 4.3% year-over-year, and multi-family starts were up 1.4%.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were down 2.5% in April compared to April 2018.

The year-over-year weakness in April was in the single family sector.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year are the most difficult.

My guess is starts will be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY decline we saw in February and March.

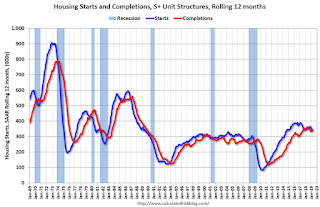

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now.

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

CAR: "California home sales stumble into spring home buying season"

by Calculated Risk on 5/16/2019 03:14:00 PM

The CAR reported: California home sales stumble into spring home buying season as median price sets another record

California home sales remained muted entering the spring homebuying season as soft buyer demand continues to challenge the market, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that the YoY increase has been slowing in both California and Nationally.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 396,760 units in April, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the April pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

April’s sales figure was down 0.1 percent from the 397,210 level in March and down 4.8 percent from home sales in April 2018 of 416,750. Sales remained below the 400,000 level for the ninth consecutive month and have fallen on a year-over-year basis for a full year.

“Weak buyer demand, largely prompted by elevated home prices, is playing a role in the softening housing market,” said C.A.R. President Jared Martin. “However, with low interest rates, cooling competition and an increase in homes to choose from, buyers can take advantage of a more balanced housing market.”

...

Encouragingly, the growth in active listings from the year prior decelerated for the fourth straight month. The number of homes available for sale increased only 10.8 percent from last April, but still enough to provide a much-needed supply of homes for sale. The growth in active listings has fallen from more than 30 percent at the end of 2018 suggesting that the market is becoming more balanced, rather than experiencing a full-scale exodus of sellers in California.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, dipped on a month-to-month basis but edged up on a year-over-year basis. The Unsold Inventory Index was 3.4 months in April, down from 3.6 months in March but up from 3.2 months in April 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate. The jump in the UII from a year ago can be attributed to the moderate sales decline and the sharp increase in active listings.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.2% | 19.2% |

| Mar-19 | 2.4% | 13.4% |

| Apr-19 | NA | 10.8% |