by Calculated Risk on 5/30/2019 10:05:00 AM

Thursday, May 30, 2019

NAR: "Pending Home Sales Trail Off 1.5% in April"

From the NAR: Pending Home Sales Trail Off 1.5% in April

Pending home sales declined in April, a modest change from the growth seen a month before, according to the National Association of Realtors®. Only one of the four major regions – the Midwest – experienced growth, while the remaining three regions reported a drop in their respective contract activity.This was below expectations of a 0.3% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 1.5% to 104.3 in April, down from 105.9 in March. Year-over-year contract signings declined 2.0%, making this the 16th straight month of annual decreases.

...

The PHSI in the Northeast declined 1.8% to 88.9 in April and is now 2.1% below a year ago. In the Midwest, the index grew 1.3% to 96.8 in April, 2.4% lower than April 2018.

Pending home sales in the South fell 2.5% to an index of 124.0 in April, which is 1.8% lower than last April. The index in the West dropped 1.8% in April to 93.5 and fell only 1.5% below a year ago.

emphasis added

Weekly Initial Unemployment Claims Increase to 215,000

by Calculated Risk on 5/30/2019 08:39:00 AM

The DOL reported:

In the week ending May 25, the advance figure for seasonally adjusted initial claims was 215,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 211,000 to 212,000. The 4-week moving average was 216,750, a decrease of 3,750 from the previous week's revised average. The previous week's average was revised up by 250 from 220,250 to 220,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 216,750.

This was below the consensus forecast.

Q1 GDP Revised Down to 3.1% Annual Rate

by Calculated Risk on 5/30/2019 08:35:00 AM

From the BEA: Gross Domestic Product, 1st quarter 2019 (second estimate); Corporate Profits, 1st quarter 2019 (preliminary estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.1 percent in the first quarter of 2019, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.2 percent.PCE growth was revised up from 1.2% to 1.3%. Residential investment was revised down from -2.8% to -3.5%. This was close to the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP in the first quarter was 3.2 percent. Today's estimate reflects downward revisions to nonresidential fixed investment and private inventory investment and upward revisions to exports and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, were revised up; the general picture of economic growth remains the same

emphasis added

Here is a Comparison of Second and Advance Estimates.

Wednesday, May 29, 2019

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 5/29/2019 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 211 thousand last week.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2019 (Second estimate). The consensus is that real GDP increased 3.0% annualized in Q2, down from the advance estimate of 3.2%.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.3% increase in the index.

Zillow Case-Shiller Forecast: Slower YoY Price Gains in April

by Calculated Risk on 5/29/2019 03:01:00 PM

The Case-Shiller house price indexes for March were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: March Case-Shiller Results and April Forecast: Home Buyers Hitting a Breaking Point?

Looking ahead, Zillow’s April Case-Shiller forecast is for continued modest slowdowns in annual home price growth across all three major indices. Annual U.S. home price growth is expected to fall to 3.6%.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.6% in April, lower than in March.

The Zillow forecast is for the 20-City index to decline to 2.4% YoY in April, and for the 10-City index to decline to 2.2% YoY.

The Zillow forecast is for the 20-City index to decline to 2.4% YoY in April, and for the 10-City index to decline to 2.2% YoY.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in April

by Calculated Risk on 5/29/2019 12:14:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in April was 0.65%, down from 0.67% in March. Freddie's rate is down from 0.94% in April 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since December 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for April soon.

Richmond Fed: "Fifth District Manufacturing Was Moderate in May"

by Calculated Risk on 5/29/2019 10:05:00 AM

From the Richmond Fed: Fifth District Manufacturing Was Moderate in May

Fifth District manufacturing activity was moderate in May, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite index inched up from 3 in April to 5 in May, as shipments and new orders had fairly flat reading and the third component, employment, remained positive. Firms reported growth in spending and positive overall business conditions and remained optimistic about growth in the coming months.This was the last of the regional Fed surveys for May.

Survey results indicated that employment and wages grew in May, while the indicator for average workweek recovered from its negative April reading. However, firms continued to struggle to find workers with the necessary skills as this index dropped from −8 in April to −20 in May. Respondents expected this struggle to continue but to see further growth in employment and wages in the next six months.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The surveys were mixed in May, but based on these regional surveys, it seems likely the ISM manufacturing index will be at a higher level in May than in April.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 5/29/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 24, 2019.

... The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 7 percent higher than the same week one year ago.

...

“Concerns over European economic growth and ongoing uncertainty about a trade war with China were some of the main factors that kept mortgage rates low last week. Even with lower rates on three of the five surveyed loan types, refinance activity fell 6 percent, essentially reversing an 8 percent increase the week before,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications decreased for the third straight week, but remained more than 7 percent higher than a year ago. It is possible that the trade dispute is causing potential homeowners to hold off on buying, with the fear that further escalation – or the lack of resolution – may have adverse impacts on the economy and housing market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remained unchanged from 4.33 percent, with points decreasing to 0.42 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Once mortgage rates fell more than 50 bps from the highs of last year, a number of recent buyers were able to refinance. But it would take another significant decrease in rates to see a further increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 7% year-over-year.

Tuesday, May 28, 2019

Wednesday: Richmond Fed Mfg Survey

by Calculated Risk on 5/28/2019 09:34:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Are Great, But They Could Be Greater

The world of mortgage rate analysis is both simple and complicated. On a simple note, rates are near long-term lows and they'll generally continue to follow the broader market for interest rates (which is largely based on US Treasuries, domestically). …Wednesday:

The biggest issue--and the one that's most difficult to explain in simple terms--is that mortgages have not been doing a good job of keeping pace with Treasury yields lately. [30YR FIXED - 4.0% - 4.125%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May. This is the last of regional manufacturing surveys for May.

Real House Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/28/2019 03:49:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 3.7% year-over-year in March

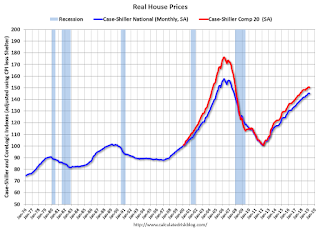

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 12.6% above the previous bubble peak. However, in real terms, the National index (SA) is still about 7.9% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.7% below the bubble peak.

The year-over-year increase in prices has slowed to 3.7% nationally, and I expect price growth will slow a little more.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $287,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.