by Calculated Risk on 6/01/2019 08:11:00 AM

Saturday, June 01, 2019

Schedule for Week of June 2, 2019

The key report scheduled for this week is the May employment report.

Other key reports include the ISM Manufacturing and non-manufacturing surveys, Vehicle Sales and the Trade Deficit for April.

Fed Chair Jerome Powell speaks on Tuesday, and the Fed's Q1 Flow of Funds report will be released on Thursday.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 52.9, up from 52.8 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 52.9, up from 52.8 in April.Here is a long term graph of the ISM manufacturing index.

The employment index was at 52.4% in April, and the new orders index was at 51.7%.

10:00 AM: Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in April, up from 16.4 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 16.9 million SAAR in April, up from 16.4 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

9:55 AM: Speech by Fed Chair Jerome Powell, Monetary Policy Strategy, Tools, and Communication Practices, At the Conference on Monetary Policy Strategy, Tools, and Communication Practices (A Fed Listens Event), Federal Reserve Bank of Chicago, Chicago, Illinois

10:00 AM: Corelogic House Price index for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in May, down from 175,000 added in April.

10:00 AM: the ISM non-Manufacturing Index for May. The consensus is for a reading of 55.7, up from 55.5.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, unchanged from 215 thousand last week.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $50.7 billion. The U.S. trade deficit was at $50.0 Billion the previous month.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to increase to 3.7%.

8:30 AM: Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to increase to 3.7%.There were 263,000 jobs added in March, and the unemployment rate was at 3.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In April, the year-over-year change was 2.620 million jobs.

Friday, May 31, 2019

"Mortgage Rates Drop Well Into the High 3's"

by Calculated Risk on 5/31/2019 06:50:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drop Well Into the High 3's

Mortgage rates were decisively lower today, following a massive market movement on news of new tariffs to be imposed on Mexico. In general, trade wars are economically negative. They hurt stocks and help bonds. When bonds are improving, it means bond prices are rising and yields (another word for "rates") are falling.CR Note: The decline in mortgage rates - from around 5% late last year, to under 4% now - is a positive for new home sales.

…

The average lender improved by the biggest amount of the past several weeks with top tier scenarios now easily seeing quotes of 3.875%. [30YR FIXED - 3.875% - 4.0%]

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in April, Lowest Since August 2007

by Calculated Risk on 5/31/2019 04:17:00 PM

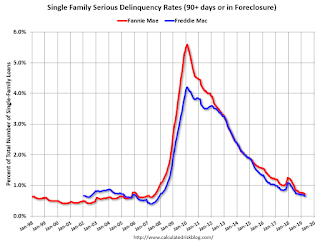

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 0.72% in April, from 0.74% in March. The serious delinquency rate is down from 1.09% in April 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency rate for Fannie Mae since August 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.64% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.45% are seriously delinquent, For recent loans, originated in 2009 through 2018 (93% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase late last year in the delinquency rate was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Still Not on Recession Watch

by Calculated Risk on 5/31/2019 02:47:00 PM

Several readers have asked me if I'm on "recession watch".

The answer is no.

First, a slow growth economy is not a recession. Since the Great Recession ended in 2009, we've seen several mini-slowdowns and even a few random quarters of negative GDP growth (but employment and other indicators stayed positive).

Second, the tariffs on goods from China should not have a huge negative impact on U.S. GDP, however the announced tariffs on goods from Mexico appear more significant. I'm relying on the analysis of others to estimate the size of the negative impact, but it doesn't appear large enough to drag the economy into recession. This could have a significant impact on the auto industry.

A key positive is that lower mortgage rates, and solid employment growth should be supportive of housing.

Note: In my ten questions for 2019, I listed trade wars as a key downside risk (along with other administration policies).

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 5/31/2019 12:41:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 25 May

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 19-25 May 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 20-26 May 2018, the industry recorded the following:

• Occupancy: +0.9% to 71.2%

• Average daily rate (ADR): +2.1% to US$133.81

• Revenue per available room (RevPAR): +3.1% to US$95.22

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy is solid in 2019, close - to-date - compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways for several more weeks, and then increase during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Q2 GDP Forecasts: mid-1% Range

by Calculated Risk on 5/31/2019 11:18:00 AM

From Merrill Lynch:

The data bumped up our 2Q GDP tracking estimate by 0.2pp to 1.8% qoq saar. [May 31 estimate]From Goldman Sachs:

emphasis added

We lowered our Q2 GDP tracking estimate by two tenths to +1.1% (qoq ar). [Updated: May 30 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.5% for 2019:Q2. News from this week's data releases increased the nowcast for 2019:Q2 by 0.1 percentage point. [May 31 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.2 percent on May 31, down from 1.3 percent on May 24. A slight increase in the nowcast of the contribution of personal consumption expenditures to second-quarter real GDP growth from 1.99 percentage points to 2.03 percentage points after this morning’s personal income and outlays report from the U.S. Bureau of Economic Analysis was more than offset by a decline in the nowcast of second-quarter real nonresidential equipment investment growth from 0.7 percent to -1.4 percent after yesterday’s and today’s economic releases. [May 31 estimate]CR Note: These early estimates suggest real GDP growth will be in the 1% to 2% range annualized in Q2.

Personal Income Increased 0.5% in April, Real PCE declined slightly

by Calculated Risk on 5/31/2019 08:36:00 AM

The BEA released the Personal Income and Outlays, April 2019:

Personal income increased $92.8 billion (0.5 percent) in April according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $69.3 billion (0.4 percent) and personal consumption expenditures (PCE) increased $40.8 billion (0.3 percent).The increases in personal income and spending were above expectations. However real PCE declined slightly in April.

Real DPI increased 0.1 percent in April and Real PCE decreased less than 0.1 percent. The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

Core PCE was up 1.6% YoY in April (compared to 1.5% in March)

Thursday, May 30, 2019

Friday: Personal Income and Outlays, Chicago PMI

by Calculated Risk on 5/30/2019 07:44:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, April 2019. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for May.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 101.0.

May Vehicle Sales Forecast: "Sales Slow, Discounts Rise"

by Calculated Risk on 5/30/2019 05:21:00 PM

From JD Power: Sales Slow, Discounts Rise—But Average Prices Break Records

New-vehicle retail sales in May are expected to fall from a year ago, according to a forecast developed jointly by J.D. Power and LMC Automotive. Retail sales are projected to reach 1,226,800 units, a 3.1% decrease compared with May 2018. The seasonally adjusted annualized rate (SAAR) for retail sales is expected to be 13.5 million units, down nearly 200,000 from a year ago.This forecast is for sales to be up from April, but down from 17.2 million SAAR in May 2018.

May will be the fifth consecutive month in 2019 to experience a sales decline, with calendar year-to-date sales through May expected to be down 5.2% compared with the same period in 2018.

Total sales in May are projected to reach 1,558,800 units, a 2.1% decrease compared with May 2018. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 17.0 million units, down 200,000 from a year ago.

…

“May is one of the highest volume months of the year and its performance typically indicates how the year will play out. The expected sales decline in May, coupled with weak sales year-to-date has left the industry with rising inventories of unsold vehicles. Manufacturers are responding with larger discounts to take advantage of the Memorial Day weekend which is one of the busiest car-buying periods of the year.”

emphasis added

Merrill on May NFP: "A modest slowing in employment activity"

by Calculated Risk on 5/30/2019 12:29:00 PM

A few excerpts from a Merrill Lynch research note:

We forecast nonfarm payroll employment growth of 180k in the May Bureau of Labor Statistics (BLS) employment report … If our nonfarm payrolls forecast proves correct, it would suggest a modest slowing in employment activity in May ...

We see reasons for some slowing in employment activity in May. The latest escalation of trade tensions... Also, the cyclical slowdown in the auto sector.

Elsewhere, we expect the unemployment rate to be unchanged at 3.6%