by Calculated Risk on 6/25/2019 02:53:00 PM

Tuesday, June 25, 2019

Update: A few comments on the Seasonal Pattern for House Prices

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

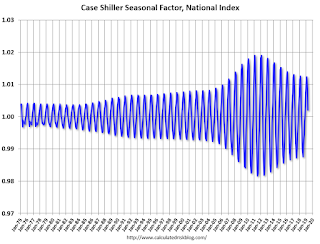

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through April 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

"A Conversation with Jerome H. Powell"

by Calculated Risk on 6/25/2019 01:03:00 PM

Live video for A Conversation with Jerome H. Powell

Speech by Chair Powell on the economic outlook and monetary policy review

The Fed is insulated from short-term political pressures—what is often referred to as our "independence." Congress chose to insulate the Fed this way because it had seen the damage that often arises when policy bends to short-term political interests. Central banks in major democracies around the world have similar independence.And on policy:

Let me turn now from the longer-term issues that are the focus of the review to the nearer-term outlook for the economy and for monetary policy. So far this year, the economy has performed reasonably well. Solid fundamentals are supporting continued growth and strong job creation, keeping the unemployment rate near historic lows. Although inflation has been running somewhat below our symmetric 2 percent objective, we have expected it to pick up, supported by solid growth and a strong job market. Along with this favorable picture, we have been mindful of some ongoing crosscurrents, including trade developments and concerns about global growth. When the FOMC met at the start of May, tentative evidence suggested these crosscurrents were moderating, and we saw no strong case for adjusting our policy rate.

Since then, the picture has changed. The crosscurrents have reemerged, with apparent progress on trade turning to greater uncertainty and with incoming data raising renewed concerns about the strength of the global economy. Our contacts in business and agriculture report heightened concerns over trade developments. These concerns may have contributed to the drop in business confidence in some recent surveys and may be starting to show through to incoming data. For example, the limited available evidence we have suggests that investment by businesses has slowed from the pace earlier in the year.

Against the backdrop of heightened uncertainties, the baseline outlook of my FOMC colleagues, like that of many other forecasters, remains favorable, with unemployment remaining near historic lows. Inflation is expected to return to 2 percent over time, but at a somewhat slower pace than we foresaw earlier in the year. However, the risks to this favorable baseline outlook appear to have grown.

A few Comments on May New Home Sales

by Calculated Risk on 6/25/2019 11:29:00 AM

New home sales for May were reported at 626,000 on a seasonally adjusted annual rate basis (SAAR). Sales for April were revised up slightly, and sales for March were revised down.

Earlier: New Home Sales decreased to 626,000 Annual Rate in May.

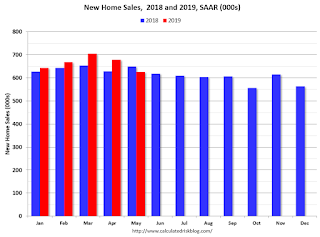

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Sales in May were down 3.7% year-over-year compared to May 2018.

Year-to-date (just through May), sales are up 4.0% compared to the same period in 2018.

This comparison was the most difficult in the first half of 2018, so even with the disappointing sales in May, this is a solid start for 2019.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Even though distressed sales are down significantly, following the bust, new home builders focused on more expensive homes - so the gap has only closed slowly.

I still expect this gap to close. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decreased to 626,000 Annual Rate in May

by Calculated Risk on 6/25/2019 10:14:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 626 thousand.

The previous three months were revised down slightly, combined.

"Sales of new single‐family houses in May 2019 were at a seasonally adjusted annual rate of 626,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent below the revised April rate of 679,000 and is 3.7 percent below the May 2018 estimate of 650,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in May to 6.4 months from 5.9 months in April.

The months of supply increased in May to 6.4 months from 5.9 months in April. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of May was 333,000. This represents a supply of 6.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2019 (red column), 60 thousand new homes were sold (NSA). Last year, 62 thousand homes were sold in May.

The all time high for May was 120 thousand in 2005, and the all time low for May was 30 thousand in 2011.

This was below expectations of 680 thousand sales SAAR, and sales in the three previous months were revised down slightly combined. I'll have more later today.

Case-Shiller: National House Price Index increased 3.5% year-over-year in April

by Calculated Risk on 6/25/2019 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("April" is a 3 month average of February, March and April prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Annual Home Price Gains Continue to Fall According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.5% annual gain in April, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 2.3%, up from 2.2% in the previous month. The 20-City Composite posted a 2.5% year-over-year gain, down from 2.6% in the previous month.

Las Vegas, Phoenix and Tampa reported the highest year-over-year gains among the 20 cities. In April, Las Vegas led the way with a 7.1% year-over-year price increase, followed by Phoenix with a 6.0% increase, and Tampa with a 5.6% increase. Nine of the 20 cities reported greater price increases in the year ending April 2019 versus the year ending March 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.9% in April. The 10-City and 20-City Composites both reported 0.8% increases for the month. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase in April. The 10-City Composite posted a 0.2% month-over-month increases and the 20-City Composite did not report an increase. In April, 19 of 20 cities reported increases before seasonal adjustment, while 14 of 20 cities reported increases after seasonal adjustment.

“Home price gains continued in a trend of broad-based moderation,” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “Year-over-year price gains remain positive in most cities, though at diminishing rates of change. Seattle is a notable exception, where the YOY change has decreased from 13.1% in April 2018 to 0.0% in April 2019.“

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up slightly from the bubble peak, and up 0.2% in April (SA).

The Composite 20 index is 4.4% above the bubble peak, and unchanged (SA) in April.

The National index is 12.9% above the bubble peak (SA), and up 0.3% (SA) in April. The National index is up 52.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.3% compared to April 2018. The Composite 20 SA is up 2.5% year-over-year.

The National index SA is up 3.5% year-over-year.

Note: According to the data, prices increased in 16 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, June 24, 2019

Tuesday: New Home Sales, Case-Shiller House Prices, Fed Chair Powell Speech

by Calculated Risk on 6/24/2019 05:10:00 PM

From Matthew Graham at Mortgage News Daily: Rates Catch a Break to Remain Near Long-Term Lows

Mortgage rates were generally flat today, depending on the lender. Some were noticeably better while others were a hair worse. In both cases, rates are very close to the lowest levels since late 2016. Changes from Friday would most likely be measured in terms of upfront costs as opposed to differences in the quoted "note rate" itself (the rate most people are talking about when they talk about mortgage rates). [Most Prevalent Rates 30YR FIXED - 3.625% OR 3.875%]Tuesday:

emphasis added

• At 9:00 AM: S&P/Case-Shiller House Price Index for April. The consensus is for a 2.5% year-over-year increase in the Comp 20 index for April.

• At 9:00 AM: FHFA House Price Index for April 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM: New Home Sales for May from the Census Bureau. The consensus is for 680 thousand SAAR, up from 673 thousand in April.

• At 10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

• At 1:00 PM: Speech by Fed Chair Jerome H. Powell, Economic Outlook and Monetary Policy Review, At C. Peter McColough Series on International Economics: A Conversation with Jerome H. Powell, New York, N.Y.

Housing Inventory Tracking

by Calculated Risk on 6/24/2019 12:14:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 2.7% year-over-year (YoY) in May this was the tenth consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, and Sacramento and Phoenix, and total existing home inventory as reported by the NAR (through May).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 98% YoY in Las Vegas in May (red), the tenth consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY last year as oil prices increased. Inventory was up 10.5% year-over-year in Houston in May.

Inventory is a key for the housing market. Right now it appears the inventory build that started last year is slowing.

Also note that inventory in Seattle was up 124% year-over-year in May (not graphed)!

Dallas Fed: "Texas Manufacturing Expansion Continues but Pace Slows"

by Calculated Risk on 6/24/2019 10:34:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues but Pace Slows

Texas factory activity continued to expand in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 6.3 to 8.9, indicating output growth accelerated slightly from May.Another weak regional report. This was the worst reading for the general activity index since 2016.

Other measures of manufacturing activity exhibited mixed movements in June. The new orders index edged up to 3.7, a reading still below average. The growth rate of orders index fell eight points to -6.7, reaching its lowest reading in nearly three years. The capacity utilization index inched up to 9.6, while the shipments index retreated six points to 1.7, a two-year low. The capital expenditures index posted a double-digit decline, falling 11 points to 6.9, also a two-year low.

Perceptions of broader business conditions shifted down again in June. The general business activity index pushed further into negative territory as more firms noted worsened activity this month than last. The index declined from -5.3 to -12.1, hitting a three-year low. Similarly, the company outlook index fell from -1.7 to -5.5, also a three-year low. The index measuring uncertainty regarding companies’ outlooks pushed up to 21.6, its highest reading since the question was added to the survey in January 2018.

Labor market measures suggested solid, but somewhat slower, growth in employment and work hours in June. The employment index slipped from 11.6 to 8.8 but remained slightly above average.

emphasis added

Chicago Fed "Index points to a pickup in economic growth in May"

by Calculated Risk on 6/24/2019 08:41:00 AM

From the Chicago Fed: Index points to a pickup in economic growth in May

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to –0.05 in May from –0.48 in April. Three of the four broad categories of indicators that make up the index increased from April, but only one of the four categories made a positive contribution to the index in May. The index’s three-month moving average, CFNAI-MA3, moved up to –0.17 in May from –0.37 in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in May (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, June 23, 2019

Sunday Night Futures

by Calculated Risk on 6/23/2019 08:48:00 PM

Weekend:

• Schedule for Week of June 23, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 1 and DOW futures are up 13 (fair value).

Oil prices were up over the last week with WTI futures at $57.87 per barrel and Brent at $65.56 barrel. A year ago, WTI was at $69, and Brent was at $73 - so oil prices are down about 10% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.65 per gallon. A year ago prices were at $2.84 per gallon, so gasoline prices are down about 7% year-over-year.