by Calculated Risk on 6/28/2019 11:32:00 AM

Friday, June 28, 2019

Q2 GDP Forecasts: Around 1.5%

From Goldman Sachs:

The May core PCE price index increased 0.19% month-over-month, close to expectations, but the year-over-year exceeded consensus by a tenth reflecting the price revisions in yesterday’s GDP report. Personal spending increased by 0.4% and was revised higher in April, and the personal saving rate remained flat at 6.1%. We left our Q2 GDP tracking estimate unchanged at +1.5% (qoq ar). [June 28 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.3% for 2019:Q2 and 1.2% for 2019:Q3. [June 28 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.5 percent on June 28, down from 1.9 percent on June 26. After this morning’s personal income and outlays release from the U.S. Bureau of Economic Analysis (BEA), the nowcast of second-quarter real personal consumption expenditures growth decreased from 3.9 percent to 3.7 percent. [June 28 estimate]CR Note: These estimates suggest real GDP growth will be around 1.5% annualized in Q2.

Philly Fed: State Coincident Indexes increased in 41 states in May

by Calculated Risk on 6/28/2019 11:09:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2019. Over the past three months, the indexes increased in 45 states, decreased in four states, and remained stable in one, for a three-month diffusion index of 82. In the past month, the indexes increased in 41 states, decreased in five states, and remained stable in four, for a one-month diffusion index of 72.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In May, 43 states had increasing activity (including minor increases).

Personal Income increased 0.5% in May, Spending increased 0.4%

by Calculated Risk on 6/28/2019 08:39:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $88.6 billion (0.5 percent) in May according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $72.6 billion (0.5 percent) and personal consumption expenditures (PCE) increased $59.7 billion (0.4 percent).The May PCE price index increased 1.5 percent year-over-year and the May PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI increased 0.3 percent in May, and real PCE increased 0.2 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through May 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above expectations, and the increase in PCE was at expectations.

Note that core PCE inflation was slightly above expectations.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 5.4% annual rate in Q2 2019. (using the mid-month method, PCE was increasing at 4.3%). This suggests strong PCE growth in Q2.

Thursday, June 27, 2019

Friday: Personal Income & Outlays, Chicago PMI

by Calculated Risk on 6/27/2019 06:25:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, May 2019. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for June.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 97.9.

Reis: Apartment Vacancy Rate unchanged in Q2 at 4.7%

by Calculated Risk on 6/27/2019 01:18:00 PM

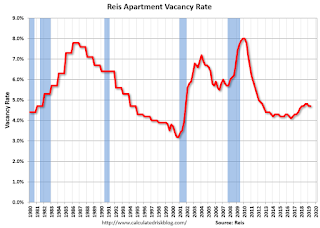

Reis reported that the apartment vacancy rate was at 4.7% in Q2 2019, unchanged from 4.7% in Q1, and unchanged from 4.7% in Q2 2018. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From chief economist Victor Calanog at Reis:

The apartment vacancy rate was flat in the quarter at 4.7% - a zero net change from a year ago. After climbing 60 basis points from a low of 4.1% in Q3 2016, the vacancy rate has remained near 4.7% since the first quarter of 2018.

The national average asking rent increased 1.2% in the second quarter while effective rent, which nets out landlord concessions, increased 1.3%. At $1,471 per unit (asking) and $1,400 per unit (effective), the average rents both increased 4.3%, from the second quarter of 2018.

...

Apartment occupancy growth had accelerated in 2018 after slowing a bit in 2017. At the same time, the housing market slumped in the latter half of 2018 after gaining some heat in 2017. Thus far, in 2019, existing home sales have fluctuated a bit, yet at higher levels than year-end 2018; apartment occupancy growth has once again been subdued. We had attributed the acceleration in the apartment market in 2018 to the tax cut at the end of 2017 that reduced the incentive to buy a home. Many have cited falling mortgage rates to the housing market spikes that occurred in February and again in May.

Despite having vacancies rise from 4.1% in the middle of 2016 to its current 4.7%, the apartment market has weathered the relatively strong influx of new supply very well. Performance has not been as brisk as recent peak years of 2014 (for lease-up velocity, when new buildings were achieving stabilization to market occupancy in 3 to 6 months - today it is closer to 9 to 15 months) and 2015 (for rent growth, which peaked at 5.8% for asking rents and 5.7% for effective rents). However, with construction slowing as soon as later this year and throughout 2020 for many major markets, continuing robust demand for rentals will likely manifest in vacancy rates that stay well in the 4s, or at most, rise to the low 5s. What may complicate this story is if the economy runs into any kind of contraction in the next 18 months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had mostly moved sideways for the last year and half - after increasing from the low in 2016..

Apartment vacancy data courtesy of Reis.

Kansas City Fed: "Tenth District Manufacturing Activity Flat"

by Calculated Risk on 6/27/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Flat

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity was flat in June, while expectations for future activity remained solid.This was the last of the regional Fed surveys for June.

“Regional factory growth was relatively flat,” said Wilkerson. “However, nearly 70 percent of manufacturing contacts reported confidence in the U.S. economy, and a majority have not changed their 2019 plans for employment and capital spending.”

...

The month-over-month composite index was 0 in June, slightly lower than 4 in May and 5 in April. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The change in manufacturing activity was mostly driven by a decline at durable production plants, especially for computers, electronic products, and transportation equipment. Most month-over-month indexes edged lower in June, with a number of indexes decreasing, including the materials inventory index. However, the new orders index inched higher. Nearly all of the year-over-year factory indexes decreased to their lowest levels since late 2016, and the composite index fell from 23 to 4.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

The regional surveys were mostly weak in June, and based on these regional surveys, it seems likely the ISM manufacturing index will be lower in June than in May - perhaps close to 50.

NAR: "Pending Home Sales Bounce Back 1.1% in May"

by Calculated Risk on 6/27/2019 10:03:00 AM

From the NAR: Pending Home Sales Bounce Back 1.1% in May

Pending home sales increased in May, a positive variation from the minor sales dip seen in the previous month, according to the National Association of Realtors®. Three of the four major regions saw growth in contract activity, with the West experiencing a slight sales decline.This was above expectations of a 0.6% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, climbed 1.1% to 105.4 in May, up from 104.3 in April. Year-over-year contract signings declined 0.7%, marking the 17th straight month of annual decreases.

...

The PHSI in the Northeast rose 3.5% to 92.0 in May and is now 0.5% below a year ago. In the Midwest, the index grew 3.6% to 100.3 in May, 1.2% lower than May 2018.

Pending home sales in the South inched up 0.1% to an index of 124.1 in May, which is 0.7% higher than last May. The index in the West dropped 1.8% in May to 91.8 and decreased 3.1% below a year ago.

emphasis added

Weekly Initial Unemployment Claims increased to 227,000

by Calculated Risk on 6/27/2019 08:35:00 AM

The DOL reported:

In the week ending June 22, the advance figure for seasonally adjusted initial claims was 227,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 216,000 to 217,000. The 4-week moving average was 221,250, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 218,750 to 219,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 221,250.

This was higher than the consensus forecast.

Wednesday, June 26, 2019

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 6/26/2019 07:19:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 216 thousand last week.

• At 8:30 AM: Gross Domestic Product, 1st quarter 2019 (Third estimate). The consensus is that real GDP increased 3.1% annualized in Q1, unchanged from the second estimate of 3.1%.

• At 10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.6% increase in the index.

• At 11:00 AM: the Kansas City Fed manufacturing survey for June. This is the last of regional manufacturing surveys for June.

Zillow Case-Shiller Forecast: Same YoY Price Gains in May as in April

by Calculated Risk on 6/26/2019 04:31:00 PM

The Case-Shiller house price indexes for April were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: April Case-Shiller Results and May Forecast: Getting Back to Normal

The housing market has continued to normalize throughout the spring, finding more balance between buyers and sellers and slowing to a pace of growth much more in line with historic norms.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.5% in May, the same as in April.

The Zillow forecast is for the 20-City index to decline to 2.4% YoY in May from 2.5% in April, and for the 10-City index to decline to 2.2% YoY compared to 2.3% YoY in April.