by Calculated Risk on 7/03/2019 08:20:00 AM

Wednesday, July 03, 2019

ADP: Private Employment increased 102,000 in June

Private sector employment increased by 102,000 jobs from May to June according to the June ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 150,000 private sector jobs added in the ADP report.

...

“Job growth started to show signs of a slowdown,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “While large businesses continue to do well, small businesses are struggling as they compete with the ongoing tight labor market. The goods producing sector continues to show weakness. Among services, leisure and hospitality’s weakness could be a reflection of consumer confidence.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues to throttle back. Job growth has slowed sharply in recent months, as businesses have turned more cautious in their hiring. Small businesses are the most nervous, especially in the construction sector and at bricks-and-mortar retailers.”

The BLS report will be released Friday, and the consensus is for 165,000 non-farm payroll jobs added in June.

MBA: Mortgage Applications Decreased Slightly in Latest Weekly Survey

by Calculated Risk on 7/03/2019 07:00:00 AM

From the MBA: Mortgage Applications Decreased Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 28, 2019.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“Purchase applications picked up slightly last week, as conventional and government activity were each up around 1 percent. Furthermore, in continuation of the gradual growth trend seen throughout the first half of 2019, purchase activity was almost 10 percent higher than a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “A still-strong job market, improving affordability and lower mortgage rates continue to support growth.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.07 percent from 4.06 percent, with points increasing to 0.36 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

Tuesday, July 02, 2019

Wednesday: Trade Deficit, ADP Employment, Unemployment Claims, ISM Non-Mfg Index

by Calculated Risk on 7/02/2019 05:31:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 150,000 payroll jobs added in June, up from 27,000 added in May.

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, down from 227 thousand last week.

• At 8:30 AM: Trade Balance report for May from the Census Bureau. The consensus is the trade deficit to be $53.2 billion. The U.S. trade deficit was at $50.8 Billion the previous month.

• At 10:00 AM: the ISM non-Manufacturing Index for June. The consensus is for a reading of 55.9, down from 56.9.

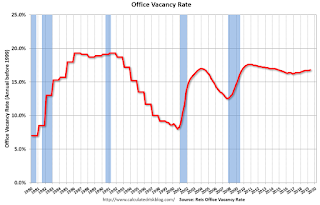

Reis: Office Vacancy Rate increased in Q2 to 16.8%

by Calculated Risk on 7/02/2019 12:31:00 PM

Reis reported that the office vacancy rate was at 16.8% in Q2, up from 16.7% in Q1 2019. This is up from 16.6% in Q2 2018, and down from the cycle peak of 17.6%.

From Reis Chief Economist Victor Calanog:

The office vacancy rate rose slightly over the quarter to 16.8% from 16.7% in the first quarter and 16.6% a year ago. This represents a 50 basis point increase over the sector’s recent low of 16.3% in Q1 2017.

Average asking and effective rents both increased 0.6% in the quarter. At $33.79 per square foot (asking) and $27.43 per square foot (effective), both measures of rent have increased 2.2% from the second quarter of 2018. These rates are in line with previous quarters.

...

As of July 1 we have entered the 121st month in what is now a record-breaking run of economic growth – the longest period of economic expansion in recorded US history. However, despite a healthy job market and strong overall economy, the office market has moved - and continues to move - at a sluggish pace. With vacancies hovering at just 80 basis points below the sector’s cyclical peak of 17.6% in 2010, there is very little to prompt developers to build. Companies are investing in their own owner-occupied space – but few single- and multi-tenant market rate rentals are receiving financing without proof of robust pre-leasing. The office sector is contending with longer-term trends like mechanization and offshoring that are prompting employers to rethink their need for office space.

With relatively flat national numbers, the widening gap between the stronger markets and weaker ones is particularly noteworthy. The underlying data shows that tech firms are fueling much of the growth in the stronger office markets, particularly in west coast metros, parts of Texas and parts of the east coast.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.8% in Q2. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased over the last two years.

Office vacancy data courtesy of Reis.

The Longest Expansions in U.S. History

by Calculated Risk on 7/02/2019 11:39:00 AM

According to NBER, the four longest expansions in U.S. history are:

1) From a trough in June 2009 to today, July 2019 (121 months and counting).

2) From a trough in March 1991 to a peak in March 2001 (120 months).

3) From a trough in February 1961 to a peak in December 1969 (106 months).

4) From a trough in November 1982 to a peak in July 1990 (92 months).

So the current U.S. expansion is the longest on record.

As I noted in late 2017 in Is a Recession Imminent? (one of the five questions I'm frequently asked)

Expansions don't die of old age! There is a very good chance this will become the longest expansion in history.A key reason the current expansion has been so long is that housing didn't contribute for the first few years of the expansion. Also the housing recovery was sluggish for a few more years after the bottom in 2011. This was because of the huge overhang of foreclosed properties coming on the market.

CoreLogic: House Prices up 3.6% Year-over-year in May

by Calculated Risk on 7/02/2019 09:28:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: U.S. Home Price Insights Through May 2019 with Forecasts from June 2019

Home prices nationwide, including distressed sales, increased year over year by 3.6% in May 2019 compared with May 2018 and increased month over month by 0.9% in May 2019 compared with April 2019 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for several years, before slowing last year.

The CoreLogic HPI Forecast indicates that home prices will increase by 5.6% on a year-over-year basis from May 2019 to May 2020. On a month-over-month basis, home prices are expected to increase by 0.8% from May 2019 to June 2019.

“Interest rates on fixed-rate mortgages fell by nearly one percentage point between November 2018 and this May. This has been a shot-in-the-arm for home sales. Sales gained momentum in May and annual home-price growth accelerated for the first time since March 2018.”, Dr. Frank Nothaft, Chief Economist for CoreLogic

emphasis added

The year-over-year comparison has been positive for more than seven years since turning positive year-over-year in February 2012.

Monday, July 01, 2019

30 Year Mortgage Rates at 3.875%

by Calculated Risk on 7/01/2019 06:02:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher to Begin Risky Week

Mortgage rates were slightly higher to start the new week, which is a pretty good outcome considering the underlying events. On Friday, we anticipated a pick-up in volatility as rates were at risk of reacting to any meaningful trade news from the G20 summit or any surprises in economic data. [30YR FIXED - 3.875%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac). Go to MND and you can adjust the graph for different time periods.

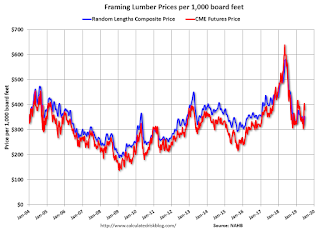

Update: Framing Lumber Prices Down 35% Year-over-year

by Calculated Risk on 7/01/2019 02:11:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down 35% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through May 31, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 35% from a year ago, and CME futures are down 33% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Construction Spending Declined in May

by Calculated Risk on 7/01/2019 11:23:00 AM

From the Census Bureau reported that overall construction spending declined in May:

Construction spending during May 2019 was estimated at a seasonally adjusted annual rate of $1,293.9 billion, 0.8 percent below the revised April estimate of $1,304.0 billion. The May figure is 2.3 percent below the May 2018 estimate of $1,324.3 billion.Both private and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $953.2 billion, 0.7 percent below the revised April estimate of $960.3 billion. ...

In May, the estimated seasonally adjusted annual rate of public construction spending was $340.6 billion, 0.9 percent below the revised April estimate of $343.7 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 26% below the bubble peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 5% above the previous peak in March 2009, and 30% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 11%. Non-residential spending is down slightly year-over-year. Public spending is up 11% year-over-year.

This was below consensus expectations, however spending for April was revised up slightly. Another weak construction spending report.

ISM Manufacturing index Decreased to 51.7 in June

by Calculated Risk on 7/01/2019 10:04:00 AM

The ISM manufacturing index indicated expansion in June. The PMI was at 51.7% in June, down from 52.1% in May. The employment index was at 54.5%, up from 53.7% last month, and the new orders index was at 50.0%, down from 52.7%.

From the Institute for Supply Management: June 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in June, and the overall economy grew for the 122nd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The June PMI® registered 51.7 percent, a decrease of 0.4 percentage point from the May reading of 52.1 percent. The New Orders Index registered 50 percent, a decrease of 2.7 percentage points from the May reading of 52.7 percent. The Production Index registered 54.1 percent, a 2.8-percentage point increase compared to the May reading of 51.3 percent. The Employment Index registered 54.5 percent, an increase of 0.8 percentage point from the May reading of 53.7 percent. The Supplier Deliveries Index registered 50.7 percent, a 1.3-percentage point decrease from the May reading of 52 percent. The Inventories Index registered 49.1 percent, a decrease of 1.8 percentage points from the May reading of 50.9 percent. The Prices Index registered 47.9 percent, a 5.3-percentage point decrease from the May reading of 53.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 51.2%, and suggests manufacturing expanded at a slower pace in June than in May.