by Calculated Risk on 7/05/2019 08:40:00 AM

Friday, July 05, 2019

June Employment Report: 224,000 Jobs Added, 3.7% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 224,000 in June, and the unemployment rate was little changed at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, in health care, and in transportation and warehousing.

...

The change in total nonfarm payroll employment for April was revised down from +224,000 to +216,000, and the change for May was revised down from +75,000 to +72,000. With these revisions, employment gains in April and May combined were 11,000 less than previously reported.

...

In June, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $27.90, following a 9-cent gain in May. Over the past 12 months, average hourly earnings have increased by 3.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 224 thousand in June (private payrolls increased 191 thousand).

Payrolls for April and May were revised down 11 thousand combined.

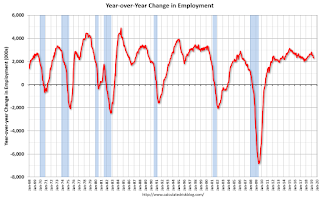

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was 2.301 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased in June to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was increased in June to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 60.6% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

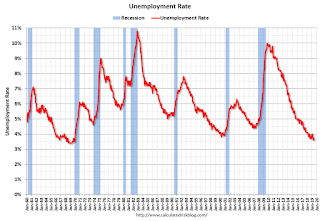

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was increased in June to 3.7%.

This was above the consensus expectations of 165,000 jobs added, however April and May were revised down by 11,000 combined.

I'll have much more later ...

Thursday, July 04, 2019

Friday: Employment Report

by Calculated Risk on 7/04/2019 10:58:00 PM

Happy 4th!

My June Employment Preview

Goldman: June Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for June. The consensus is for 165,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

Wednesday, July 03, 2019

Reis: Mall Vacancy Rate Mostly Unchanged in Q2 2019

by Calculated Risk on 7/03/2019 06:50:00 PM

Reis reported that the vacancy rate for regional malls was 9.3% in Q2 2019, unchanged from 9.3% in Q1 2018, and up from 8.6% in Q2 2018. This is down slightly from a cycle peak of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.1% in Q2, down from 10.2% in Q1, and down from 10.2% in Q2 2018. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

The neighborhood and community shopping center retail vacancy rate fell to 10.1% in the second quarter. In Q2 2018, the rate had risen 20 basis points to 10.2% and had remained flat at that rate through the first quarter of 2019. The second quarter marks the first time in which vacancies have declined since the first quarter of 2016.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.4% in the quarter. Last quarter, asking rent grew by 0.4%, while effective rent grew by 0.5%. At $21.39 per square foot (asking) and $18.73 per square foot (effective), the average rents have both increased 1.7%, from the second quarter of 2018.

The Regional Mall vacancy rate was flat in the quarter at 9.3%. The mall vacancy rate had jumped 0.5% in the third quarter of 2018 due to Sears store closings and it had continued to rise each quarter through the first quarter of 2019. Last quarter saw the vacancy rate rise a further 30 basis points to its current level of 9.3%, hitting the highest rate for mall vacancy since the third quarter of 2011. This came in the midst of a number of chains announcing major store closures, such as JC Penney, Payless, Charlotte Russe and Gymboree. In the second quarter, vacancy for malls has remained flat and rent was up 0.2%.

...

As store closures continue to plague the retail sector, many still fear the “Retail Apocalypse.” Yet, the sector has so far been able to ward off the worst of the premonitions. This by no means indicates the sector is without ongoing challenges as a number of stores are still expected to close in the second half of the year and on-line shopping continues to offer stiff competition to brick and mortar stores. Older stores that are not keeping up with new business strategies or modernizing will likely continue to suffer and close in this tumultuous time.

Still, the retail sector has been able to adapt to industry restructuring in a number of ways. Some stores have had success in adopting new business strategies in effort revitalize their brands. On the supply side, empty big box stores have been converting to Self Storage or been sold to developers for redevelopment, former shopping centers have been demolished and there has been a general slowdown in building within the sector. With minimal construction in the pipeline, vacancy rates were able to stabilize a bit this quarter, though the retail sector will likely see more fluctuation ahead.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased from an already elevated level.

Mall vacancy data courtesy of Reis

Goldman: June Payrolls Preview

by Calculated Risk on 7/03/2019 03:45:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 175k in June, somewhat above consensus of +162k …

We estimate the unemployment rate rebounded a tenth to 3.7% (vs. consensus 3.6%), mirroring the rise in continuing claims. … We estimate that average hourly earnings growth narrowly rounded up to +0.4% in June (consensus +0.3%), which would boost the year-on-year rate by one tenth to +3.2% (consensus also +3.2%).

emphasis added

BEA: June Vehicles Sales decrease to 17.3 Million SAAR

by Calculated Risk on 7/03/2019 02:11:00 PM

The BEA released their estimate of June vehicle sales this morning. The BEA estimated sales of 17.29 million SAAR in June 2019 (Seasonally Adjusted Annual Rate), down 0.6% from the May sales rate, and up slightly from June 2018.

Sales in 2019 are averaging 16.9 million (average of seasonally adjusted rate), down 1.4% compared to the same period in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for June (red).

This was above the consensus forecast for June.

A small decline in sales to date this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 17.29 million SAAR.

June Employment Preview

by Calculated Risk on 7/03/2019 11:06:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for an increase of 165,000 non-farm payroll jobs in June, and for the unemployment rate to be unchanged at 3.6%.

Last month, the BLS reported 75,000 jobs added in May.

Here is a summary of recent data:

• The ADP employment report showed an increase of only 102,000 private sector payroll jobs in June. This was below the consensus expectations of 150,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index increased in June to 54.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased 5,000 in June. The ADP report indicated manufacturing jobs increased 7,000 in May.

The ISM non-manufacturing employment index decreased in June to 55.0%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 200,000 in June.

Combined, the ISM surveys suggest employment gains above the consensus expectations.

• Initial weekly unemployment claims averaged 222,000 in June, up from 213,000 in May. For the BLS reference week (includes the 12th of the month), initial claims were at 217,000, up from 211,000 during the reference week the previous month.

The increase during the reference week suggests employment growth below expectations.

• The final May University of Michigan consumer sentiment index decreased to 98.2 from the May reading of 100.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: The ISM reports combined were strong, however the ADP was weak. Opposite readings once again. Also the increase in unemployment claims during the reference week suggests a report below the consensus. Usually I put a little more emphasis on the ISM reports than the ADP report, but that was incorrect last month. My guess is the report will be below the consensus, but there could be some bounce back from the weak report last month.

ISM Non-Manufacturing Index decreased to 55.1% in June

by Calculated Risk on 7/03/2019 10:09:00 AM

The June ISM Non-manufacturing index was at 55.1%, down from 56.9% in May. The employment index decreased to 55.0%, from 58.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 113th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 55.1 percent, which is 1.8 percentage points lower than the May reading of 56.9 percent. This represents continued growth in the non-manufacturing sector, at a slower rate. This is the index’s lowest reading since July 2017, when it registered 55.1 percent. The Non-Manufacturing Business Activity Index decreased to 58.2 percent, 3 percentage points lower than the May reading of 61.2 percent, reflecting growth for the 119th consecutive month. The New Orders Index registered 55.8 percent; 2.8 percentage points lower than the reading of 58.6 percent in May. The Employment Index decreased 3.1 percentage points in June to 55 percent from the May reading of 58.1 percent. The Prices Index increased 3.5 percentage points from the May reading of 55.4 percent to 58.9 percent, indicating that prices increased in June for the 25th consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. Although the non-manufacturing sector’s growth rate dipped in June, the sector continues to reflect strength. The comments from the respondents reflect mixed sentiment about business conditions and the overall economy. A degree of uncertainty exists due to trade and tariffs.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in June than in May.

Trade Deficit increased to $55.5 Billion in May

by Calculated Risk on 7/03/2019 08:47:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $55.5 billion in May, up $4.3 billion from $51.2 billion in April, revised.

May exports were $210.6 billion, $4.2 billion more than April exports. May imports were $266.2 billion, $8.5 billion more than April imports.

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in May.

Exports are 27% above the pre-recession peak and down 1% compared to May 2018; imports are 15% above the pre-recession peak, and up 3% compared to May 2018.

In general, trade had been picking up, but both imports and exports have moved more sideways recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $60.56 per barrel in May, up from $57.16 in April, and up from $58.38 in May 2018.

The trade deficit with China decreased to $30.2 billion in May, from $33.5 billion in May 2018.

Weekly Initial Unemployment Claims decreased to 221,000

by Calculated Risk on 7/03/2019 08:32:00 AM

The DOL reported:

In the week ending June 29, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 227,000 to 229,000. The 4-week moving average was 222,250, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 221,250 to 221,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 222,250.

This was close to the consensus forecast.

ADP: Private Employment increased 102,000 in June

by Calculated Risk on 7/03/2019 08:20:00 AM

Private sector employment increased by 102,000 jobs from May to June according to the June ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 150,000 private sector jobs added in the ADP report.

...

“Job growth started to show signs of a slowdown,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “While large businesses continue to do well, small businesses are struggling as they compete with the ongoing tight labor market. The goods producing sector continues to show weakness. Among services, leisure and hospitality’s weakness could be a reflection of consumer confidence.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues to throttle back. Job growth has slowed sharply in recent months, as businesses have turned more cautious in their hiring. Small businesses are the most nervous, especially in the construction sector and at bricks-and-mortar retailers.”

The BLS report will be released Friday, and the consensus is for 165,000 non-farm payroll jobs added in June.