by Calculated Risk on 7/09/2019 06:37:00 PM

Tuesday, July 09, 2019

Wednesday: Fed Chair Powell Testimony, FOMC Minutes

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C

• At 2:00 PM, FOMC Minutes, Meeting of June 18-19, 2019

Las Vegas Real Estate in June: Sales down 11% YoY, Inventory up 89% YoY

by Calculated Risk on 7/09/2019 11:54:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices increase slightly after three-month holding pattern, GLVAR housing statistics for June 2019

Local home prices broke out of a three-month holding pattern to post a slight increase during June, according to a report released Tuesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 11.3% year-over-year to 3,626 in June 2019.

...

The total number of existing local homes, condos and townhomes sold during June was 3,626. Compared to one year ago, June sales were down 11.1% for homes and down 12.0% for condos and townhomes.

...

At the current sales pace, Carpenter said Southern Nevada still has less than a three-month supply of homes available for sale. While the local housing supply is up from one year ago, she said it’s still below what would normally be considered a balanced market.

By the end of June, GLVAR reported 7,815 single-family homes listed for sale without any sort of offer. That’s up 80.3% from one year ago. For condos and townhomes, the 1,937 properties listed without offers in June represented a 135.6% jump from one year ago.

...

The number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for just 2.2% of all existing local property sales in June. That compares to 2.6% of all sales one year ago and 6.3% two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 5,157 in June 2018 to 9,752 in June 2019. Note: Total inventory was up 89% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Low level of distressed sales.

BLS: Job Openings "Mostly Unchanged" at 7.3 Million in May

by Calculated Risk on 7/09/2019 10:09:00 AM

Notes: In May there were 7.449 million job openings, and, according to the May Employment report, there were 5.888 million unemployed. So, for the fifteenth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (over 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 7.3 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Over the month, hires fell to 5.7 million and separations edged down to 5.5 million. Within separations, the quits and the layoffs and discharges rates were unchanged at 2.3 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in May at 3.4 million. The quits rate was 2.3 percent.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in May to 7.323 million from 7.372 million in April.

The number of job openings (yellow) are up 3% year-over-year.

Quits are up 2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

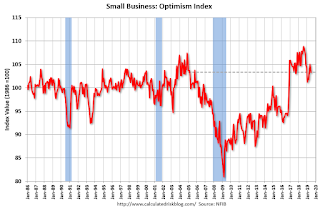

Small Business Optimism Index Decreased in June

by Calculated Risk on 7/09/2019 08:58:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): June 2019 Report: Small Business Optimism Index

Optimism faded modestly in June, with the Small Business Optimism Index slipping 1.7 points to 103.3, reversing the gain posted in May but still leaving optimism at historically high levels.

..

Thirty-six percent of all owners reported job openings they could not fill in the current period, down 2 points from May but still high. A seasonally-adjusted net 19 percent plan to create new jobs, down 2 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 103.3 in June.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, July 08, 2019

Tuesday: Job Openings

by Calculated Risk on 7/08/2019 08:41:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Under Some Pressure

Mortgage rates began the day in slightly lower territory compared to last Friday afternoon, but they'd risen noticeably from Wednesday to Friday. The recovery seen this morning wasn't enough to get them back in line with Wednesday's levels. To make matters slightly worse, by the afternoon, rates started to move up yet again. [Most Prevalent Rates 30YR FIXED - 3.875%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS.

Seattle Real Estate in June: Sales down 3.5% YoY, Inventory up 69% YoY from Low Levels

by Calculated Risk on 7/08/2019 06:39:00 PM

The Northwest Multiple Listing Service reported Buyers Getting "Some Relief" as Key Indicators Point to Strong Summer for Housing Market

Inventory, pending sales and prices all increased during June compared to a year ago, according to the latest report from Northwest Multiple Listing Service. The same report, which covers 23 counties in Washington state, shows year-over-year drops area-wide in both the volume of new listings and closed sales.The press release is for the Northwest. In King County, sales were down 4.1% year-over-year, and active inventory was up 32% year-over-year.

...

House hunters had a broader selection to consider as inventory at month end totaled 16,800 active listings, about 9.5 percent larger than at the same time a year ago. Brokers added 11,977 new listings during the month, a drop from both a year ago when they added, 13,153 new listings, and from May, when they added 14,689 new listings.

About half the counties reported gains in inventory, led by King County where the selection grew nearly 32 percent from a year ago.

...

The Northwest MLS report indicates there is 1.76 months of inventory area-wide (matching May), with eight counties having less than two months of supply.

emphasis added

In Seattle, sales were down 3.5% year-over-year, and inventory was up 69% year-over-year from very low levels. This is another market with inventory increasing sharply year-over-year (but at a much slower rate than the previous months), but months-of-supply in Seattle is still on the low side at 2.1 months.

House Prices to National Average Wage Index

by Calculated Risk on 7/08/2019 04:17:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

For this graph I decided to look at house prices and the National Average Wage Index from Social Security.

Note: For a different look at house prices and income, see this post (using median income).

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2018, house prices were somewhat above the median historical ratio - but far below the bubble peak.

Prices have increased a little more in 2019, but house prices relative to incomes are still way below the 2006 peak (but slightly above the 1989 peak).

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Note: The national wage index for 2018 and 2019 is estimated as increasing at the same rate as in 2017. House prices in 2019 are estimated to increase the same as the Year-over-year change in April (3.5%)

U.S. Heavy Truck Sales up 12% Year-over-year in June, Near All Time High

by Calculated Risk on 7/08/2019 10:51:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2019 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand in May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 479 thousand SAAR in June 2015.

Heavy truck sales declined again - mostly due to the weakness in the oil sector - and bottomed at 366 thousand SAAR in October 2016.

Click on graph for larger image.

Since 2016, heavy truck sales have increased to near the all time high (the high was 561 in April 2006).

Heavy truck sales were at 544 thousand SAAR in June, up from 537 thousand SAAR in May, and up from 485 thousand SAAR in June 2018.

Merrill: "Data cools call for July cuts"

by Calculated Risk on 7/08/2019 09:25:00 AM

A few excerpts from a Merrill Lynch research note:

The June employment report was strong with job growth of 224K ... leaving us comfortable with our view that the Fed will not cut in July and wait until September to deliver the first rate reduction. … last week's data were extremely important in dictating Fed action. So what did we learn? No fireworks from the G20 meeting, the ISM manufacturing index held in expansion territory at 51.7 and job creation was robust. The combination does not point to an immediate cut. At a minimum, this takes a 50bp cut off the table but should also prompt the Fed to argue for waiting for more data.

This puts the spotlight on Fed Chair Powell at the Semi-Annual Monetary Policy testimony on Wednesday. … We would argue that since the June meeting, the evidence suggests more positive news ... Indeed, even on the inflation front, the data have been better with an upward revision to 1Q core PCE inflation to 1.2% q/q saar from 1.0%, and the University of Michigan long-run inflation expectations revised up to 2.3% from 2.2%. … Powell ... can make the case that the data have been better than expected [and] note that the Fed remains vigilant and stands ready to act to prevent below-trend growth.

Sunday, July 07, 2019

Sunday Night Futures

by Calculated Risk on 7/07/2019 06:38:00 PM

Weekend:

• Schedule for Week of July 7, 2019

Monday:

• At 3:00 PM, Consumer Credit from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $57.63 per barrel and Brent at $64.36 barrel. A year ago, WTI was at $74, and Brent was at $77 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.75 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are down about 4% year-over-year.