by Calculated Risk on 7/10/2019 03:19:00 PM

Wednesday, July 10, 2019

FOMC Minutes: "the case for somewhat more accommodative policy had strengthened"

From the Fed: Minutes of the Federal Open Market Committee, June 18-19, 2019. A few excerpts:

In their discussion of monetary policy decisions at this meeting, participants noted that, under their baseline outlook, the labor market was likely to remain strong with economic activity growing at a moderate pace. However, they judged that the risks and uncertainties surrounding their outlooks, particularly those related to the global economic outlook, had intensified in recent weeks. Moreover, inflation continued to run below the Committee's 2 percent objective; similarly, inflation for items other than food and energy had remained below 2 percent as well. In addition, some readings on inflation expectations had been low. The increase in risks and uncertainties surrounding the outlook was quite recent and nearly all participants agreed that it would be appropriate to maintain the current target range for the federal funds rate at 2-1/4 to 2-1/2 percent at this meeting. However, they noted that it would be important to monitor the implications of incoming information and global economic developments for the U.S. economic outlook. A couple of participants favored a cut in the target range at this meeting, judging that a prolonged period with inflation running below 2 percent warranted a more accommodative policy response to firmly center inflation and inflation expectations around the Committee's symmetric 2 percent objective.

With regard to the outlook for monetary policy beyond this meeting, nearly all participants had revised down their assessment of the appropriate path for the federal funds rate over the projection period in their SEP submissions, and some had marked down their estimates of the longer-run normal level of the funds rate as well. Many participants indicated that the case for somewhat more accommodative policy had strengthened. Participants widely noted that the global developments that led to the heightened uncertainties about the economic outlook were quite recent. Many judged additional monetary policy accommodation would be warranted in the near term should these recent developments prove to be sustained and continue to weigh on the economic outlook. Several others noted that additional monetary policy accommodation could well be appropriate if incoming information showed further deterioration in the outlook. Participants stated a variety of reasons that would call for a lower path of the federal funds rate. Several participants noted that a near-term cut in the target range for the federal funds rate could help cushion the effects of possible future adverse shocks to the economy and, hence, was appropriate policy from a risk-management perspective. Some participants also noted that the continued shortfall in inflation risked a softening of inflation expectations that could slow the sustained return of inflation to the Committee's 2 percent objective. Several participants pointed out that they had revised down their estimates of the longer-run normal rate of unemployment and, as a result, saw a smaller upward contribution to inflation pressures from tight resource utilization than they had earlier. A few participants were concerned that inflation expectations had already moved below levels consistent with the Committee's symmetric 2 percent objective and that it was important to provide additional accommodation in the near term to bolster inflation expectations. A few participants judged that allowing inflation to run above 2 percent for some time could help strengthen the credibility of the Committee's commitment to its symmetric 2 percent inflation objective.

emphasis added

Houston Real Estate in June: Sales down 5% YoY, Inventory Up 11%

by Calculated Risk on 7/10/2019 12:27:00 PM

From the HAR: Houston Home Sales Fall Shy of Last June's Record, But Continue to Outpace 2018

Despite continued strength in the Houston real estate market fueled by more robust inventory and low interest rates, June home sales could not match the historic levels of a year earlier, in June of 2018. According to the latest monthly report from the Houston Association of REALTORS® (HAR), single-family home sales were down 3.4 percent. However, on a year-to-date basis, sales are still outpacing 2018’s record volume.Still on pace for record sales in Houston.

June marked the first month of 2019 with declining single-family home sales, due to the record-breaking levels of one year earlier. Realtors sold a total of 8,097 units versus 8,385 a year earlier. That translates to a 3.4 percent decline. On a year-to-date basis, however, single-family home sales are running 1.4 percent ahead of 2018’s record pace.

...

June sales of all property types totaled 9,461. That is down 5.1 percent compared to the same month last year. Total dollar volume for the month declined 3.1 percent to $2.9 billion.

“We knew it would be difficult to top last June’s record-breaking sales volume, but the Houston real estate market remains strong and now offers prospective buyers an even greater selection of housing than they’ve had in some time,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “Consumers also continue to show interest in rental properties, which had another impressive performance in June.

...

Total active listings, or the total number of available properties, climbed 11.0 percent to 45,262. ...

emphasis added

Merrill: "The Fed cut is on for July"

by Calculated Risk on 7/10/2019 12:06:00 PM

A few excerpts from a Merrill Lynch research note: The Fed cut is on for July

Fed Chair Powell delivered a dovish testimony, hinting strongly at an upcoming cut. We now expect a 25bp cut at the July 31st meeting followed by two more cuts at the next two meetings. We are sticking with our forecast of a cumulative 75bp of easing … The Fed seems to be willing to dismiss the better data from the US and instead is focusing on the weaker global data. Indeed, when Powell was asked if the strong jobs report changed his views on cuts, he stated "no". Rather Powell emphasized that "it appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook. Inflation pressures remain muted."

Fed Chair Powell: "Semiannual Monetary Policy Report to the Congress"

by Calculated Risk on 7/10/2019 08:39:00 AM

From Fed Chair Powell: Semiannual Monetary Policy Report to the Congress

Our baseline outlook is for economic growth to remain solid, labor markets to stay strong, and inflation to move back up over time to the Committee's 2 percent objective. However, uncertainties about the outlook have increased in recent months. In particular, economic momentum appears to have slowed in some major foreign economies, and that weakness could affect the U.S. economy. Moreover, a number of government policy issues have yet to be resolved, including trade developments, the federal debt ceiling, and Brexit. And there is a risk that weak inflation will be even more persistent than we currently anticipate. We are carefully monitoring these developments, and we will continue to assess their implications for the U.S economic outlook and inflation.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 7/10/2019 07:00:00 AM

From the MBA: Mortgage Applications Decreased in Latest MBA Weekly Survey

Mortgage applications decreased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 5, 2019. This week’s results include an adjustment for the Fourth of July holiday.

... The Refinance Index decreased 7 percent from the previous week and was 88 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 18 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

“Mortgage applications were down slightly, even after adjusting for the July 4th holiday, as we saw opposing moves in purchase and refinance applications over the week. Purchase applications increased from the previous week and were up 5 percent from a year ago, a continuation of the strong annual growth that we saw in the first half of 2019. Refinance activity decreased over 6 percent and the refinance share of applications fell back below 50 percent, even as the 30-year, fixed-rate declined 3 basis points to 4.04 percent," said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. "Borrowers have been less sensitive to low rates as many borrowers have either recently refinanced or are likely waiting for rates to fall even further. Other mortgage rates in our survey were unchanged or slightly higher than in the previous week.”

...

The average contract interest rate for 30-year, fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.04 percent from 4.07 percent, with points increasing to 0.37 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

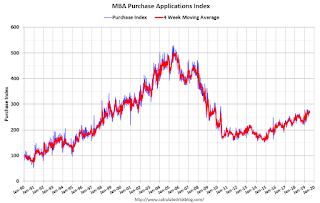

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 6% year-over-year.

Tuesday, July 09, 2019

Wednesday: Fed Chair Powell Testimony, FOMC Minutes

by Calculated Risk on 7/09/2019 06:37:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C

• At 2:00 PM, FOMC Minutes, Meeting of June 18-19, 2019

Las Vegas Real Estate in June: Sales down 11% YoY, Inventory up 89% YoY

by Calculated Risk on 7/09/2019 11:54:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices increase slightly after three-month holding pattern, GLVAR housing statistics for June 2019

Local home prices broke out of a three-month holding pattern to post a slight increase during June, according to a report released Tuesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 11.3% year-over-year to 3,626 in June 2019.

...

The total number of existing local homes, condos and townhomes sold during June was 3,626. Compared to one year ago, June sales were down 11.1% for homes and down 12.0% for condos and townhomes.

...

At the current sales pace, Carpenter said Southern Nevada still has less than a three-month supply of homes available for sale. While the local housing supply is up from one year ago, she said it’s still below what would normally be considered a balanced market.

By the end of June, GLVAR reported 7,815 single-family homes listed for sale without any sort of offer. That’s up 80.3% from one year ago. For condos and townhomes, the 1,937 properties listed without offers in June represented a 135.6% jump from one year ago.

...

The number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for just 2.2% of all existing local property sales in June. That compares to 2.6% of all sales one year ago and 6.3% two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 5,157 in June 2018 to 9,752 in June 2019. Note: Total inventory was up 89% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Low level of distressed sales.

BLS: Job Openings "Mostly Unchanged" at 7.3 Million in May

by Calculated Risk on 7/09/2019 10:09:00 AM

Notes: In May there were 7.449 million job openings, and, according to the May Employment report, there were 5.888 million unemployed. So, for the fifteenth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (over 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 7.3 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Over the month, hires fell to 5.7 million and separations edged down to 5.5 million. Within separations, the quits and the layoffs and discharges rates were unchanged at 2.3 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in May at 3.4 million. The quits rate was 2.3 percent.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in May to 7.323 million from 7.372 million in April.

The number of job openings (yellow) are up 3% year-over-year.

Quits are up 2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

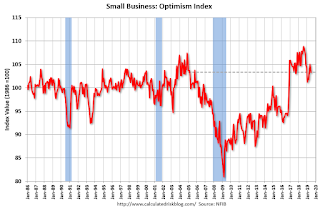

Small Business Optimism Index Decreased in June

by Calculated Risk on 7/09/2019 08:58:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): June 2019 Report: Small Business Optimism Index

Optimism faded modestly in June, with the Small Business Optimism Index slipping 1.7 points to 103.3, reversing the gain posted in May but still leaving optimism at historically high levels.

..

Thirty-six percent of all owners reported job openings they could not fill in the current period, down 2 points from May but still high. A seasonally-adjusted net 19 percent plan to create new jobs, down 2 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 103.3 in June.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, July 08, 2019

Tuesday: Job Openings

by Calculated Risk on 7/08/2019 08:41:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Under Some Pressure

Mortgage rates began the day in slightly lower territory compared to last Friday afternoon, but they'd risen noticeably from Wednesday to Friday. The recovery seen this morning wasn't enough to get them back in line with Wednesday's levels. To make matters slightly worse, by the afternoon, rates started to move up yet again. [Most Prevalent Rates 30YR FIXED - 3.875%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS.