by Calculated Risk on 7/13/2019 08:11:00 AM

Saturday, July 13, 2019

Schedule for Week of July 14, 2019

The key reports this week are June housing starts and retail sales.

For manufacturing, the Industrial Production report and the July New York and Philly Fed manufacturing surveys will be released.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 0.5, up from -8.6.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.1% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.1% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.0% on a YoY basis in May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 65, up from 64. Any number above 50 indicates that more builders view sales conditions as good than poor.

1:00 PM: Speech, Fed Chair Jerome Powell, Aspects of Monetary Policy in the Post-Crisis Era, At the French G7 Presidency 2019 – Bretton Woods: 75 Years Later, Thinking About the Next 75, Paris, France

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June. This graph shows single and total housing starts since 1968.

The consensus is for 1.260 million SAAR, down from 1.269 million SAAR in May.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 209 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 4.5, up from 0.3.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

10:00 AM: State Employment and Unemployment (Monthly) for June 2019

Friday, July 12, 2019

Q2 Review: Ten Economic Questions for 2019

by Calculated Risk on 7/12/2019 03:42:00 PM

At the end of last year, I posted Ten Economic Questions for 2019. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2019 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q2 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2019: Will housing inventory increase or decrease in 2019?

"I expect to see inventory up again year-over-year in December 2019. My reasons for expecting more inventory are 1) inventory is still historically low (inventory in November 2018 was the second lowest since 2000), 2) higher mortgage rates, and 3) further negative impact in certain areas from new tax law."According to the May NAR report on existing home sales, inventory was up 2.7% year-over-year in May, and the months-of-supply was at 4.3 months. It is early, and the inventory build has slowed recently as mortgage rates declined, but I still expect some increase in inventory this year.

9) Question #9 for 2019: What will happen with house prices in 2019?

"If inventory increases further year-over-year as I expect by December 2019, it seems likely that price appreciation will slow to the low single digits - maybe around 3%."If is very early, but the CoreLogic data for May showed prices up 3.6% year-over-year. The April Case-Shiller data showed prices up 3.5% YoY - and slowing. Currently it appears price gains will slow in 2019.

8) Question #8 for 2019: How much will Residential Investment increase?

"Most analysts are looking for starts and new home sales to increase to slightly in 2019. For example, the NAHB is forecasting a slight increase in starts (to 1.269 million), and no change in home sales in 2019. And Fannie Mae is forecasting a slight increase in starts (to 1.265 million), and for new home sales to increase to 619 thousand in 2019.Through May, starts were down 5.3% year-over-year compared to the same period in 2018. New home sales were up 4.0% year-over-year. It is early, but it appears starts will be down slightly or flat this year, and new home sales will be up.

My sense is the weakness in late 2018 will continue into 2019, and starts will be down year-over-year, but not a huge decline. My guess is starts will decrease slightly in 2019 and new home sales will be close to 600 thousand."

7) Question #7 for 2019: How much will wages increase in 2019?

"As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3.5% in 2019 according to the CES."Through June 2019, nominal hourly wages were up 3.1% year-over-year. It is early, but so far wages have disappointed in 2019.

6) Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

"My current guess is just one hike in the 2nd half of the year."It now appears the Fed will cut rates a few times this year.

5) Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

The Fed is projecting core PCE inflation will increase to 2.0% to 2.1% by Q4 2019. There are risks for higher inflation with the labor market near full employment, however I do think there are structural reasons for low inflation (demographics, few employment agreements that lead to wage-price-spiral, etc).It is early, but inflation several measures of inflation are close to the Fed's target, however core PCE has been soft.

So, although I think core PCE inflation (year-over-year) will increase in 2019 and be around 2% by Q4 2019 (up from 1.9%), I think too much inflation will still not be a serious concern in 2019.

4) Question #4 for 2019: What will the unemployment rate be in December 2019?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the mid 3's by December 2019 from the current 3.7%. My guess is based on the participation rate being mostly unchanged in 2019, and for decent job growth in 2019, but less than in 2018 or 2017.The unemployment rate was at 3.7% in June.

3) Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

So my forecast is for gains of around 133,000 to 167,000 payroll jobs per month in 2019 (about 1.6 million to 2.0 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics.Through June 2019, the economy has added 1,033,000 thousand jobs, or 172,000 per month. This is slightly above my forecast, and it appears job growth will slow this year compared to 2018.

2) Question #2 for 2019: How much will the economy grow in 2019?

"Looking to 2019, fiscal policy will still be a positive for growth - although the boost will fade over the course of the year, and become a drag in 2020. And oil prices declined sharply in late 2018, and this will be a drag on economic growth in 2019. Auto sales are mostly moving sideways, and housing has been under pressure due to higher mortgage rates and the new tax plan.GDP growth was solid in Q1 at 3.1%, although the underlying details were weaker than the headline number. Forecasts for Q2 are around 1.5%. Last year I was forecasting a pickup in growth - and that happened - and this year I expect growth to slow.

These factors suggest growth will slow in 2019, probably to the low 2s -and maybe even a 1 handle."

1) Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

My forecasts are based on a limited negative impact from Mr. Trump - and I hope that remains the case. But he is a key downside risk for the economy.This week, Fed Chair Powell highlighted trade and immigration policies as headwinds for the economy. It appears the administration's policies are starting to negatively impact the economy.

The Fed will probably lower rates this year, and it appears new home sales might be higher than I originally expected, and inflation is lower than I expected.

Q2 GDP Forecasts: Around 1.5%

by Calculated Risk on 7/12/2019 11:19:00 AM

From Merrill Lynch:

We continue to track 1.7% for 2Q GDP growth. [July 12 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.5% for 2019:Q2 and 1.8% for 2019:Q3. [July 12 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.4 percent on July 10, up from 1.3 percent on July 3. [July 10 estimate]CR Note: These estimates suggest real GDP growth will be around 1.5% annualized in Q2.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 7/12/2019 09:29:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 6 July

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 30 June through 6 July 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 1-7 July 2018, the industry recorded the following:

• Occupancy: +2.6% to 65.3%

• Average daily rate (ADR): +2.6% to US$127.31

• Revenue per available room (RevPAR): +5.2% to US$83.18

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years.

Seasonally, the occupancy rate will now stay at a high level during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, July 11, 2019

LA area Port Traffic Down Year-over-year in June

by Calculated Risk on 7/11/2019 04:05:00 PM

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

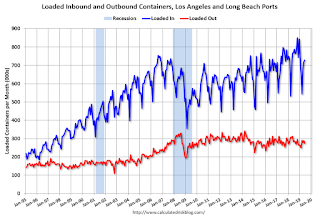

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.4% in June compared to the rolling 12 months ending in May. Outbound traffic was down 0.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 8 years.

Cleveland Fed: Key Measures Show Inflation Close to 2% YoY in June, Core PCE below 2%

by Calculated Risk on 7/11/2019 11:19:00 AM

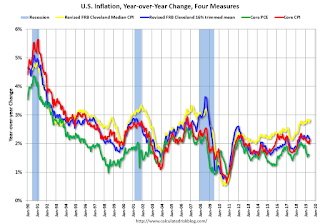

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.7% annualized rate) in June. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for June here. Motor fuel was down 36% annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (0.7% annualized rate) in June. The CPI less food and energy rose 0.3% (3.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 2.1%. Core PCE is for May and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.7% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 3.6% annualized.

Overall, these measures are at or above the Fed's 2% target (Core PCE is below 2%).

First Look at 2020 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/11/2019 10:15:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.4 percent over the last 12 months to an index level of 249.747 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2018, the Q3 average of CPI-W was 246.352.

The 2018 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.4% year-over-year in June, and although this is very early - we need the data for July, August and September - my current guess is COLA will probably be between 1% and 2% this year, the smallest increase since 2016.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2018 yet, but wages probably increased again in 2018. If wages increased the same as in 2017, then the contribution base next year will increase to around $137,600 in 2020, from the current $132,900.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

BLS: CPI increased 0.1% in June, Core CPI increased 0.3%

by Calculated Risk on 7/11/2019 08:39:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in June on a seasonally adjusted basis, the same increase as in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.6 percent before seasonal adjustment.Inflation was above expectations in June. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.3 in June, its largest monthly increase since January 2018.

...

The all items index increased 1.6 percent for the 12 months ending June, a smaller increase than the 1.8-percent rise for the period ending May. The index for all items less food and energy rose 2.1 percent over the last 12 months, and the food index increased 1.9 percent. The energy index, in contrast, declined 3.4 percent over the last 12 months.

emphasis added

Weekly Initial Unemployment Claims decreased to 209,000

by Calculated Risk on 7/11/2019 08:35:00 AM

The DOL reported:

In the week ending July 6, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 221,000 to 222,000. The 4-week moving average was 219,250, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 222,250 to 222,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 219,250.

This was lower than the consensus forecast.

Wednesday, July 10, 2019

Thursday: CPI, Unemployment Claims, Fed Chair Powell Testimony

by Calculated Risk on 7/10/2019 10:31:00 PM

This should be interesting: The BLS told me today that the "newest set of Labor Force projections through 2028 is set to be released Wednesday September 4th 2019".

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 216 thousand initial claims, down from 221 thousand last week.

• At 8:30 AM, The Consumer Price Index for June from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking Committee, Washington, D.C