by Calculated Risk on 7/18/2019 08:33:00 AM

Thursday, July 18, 2019

Weekly Initial Unemployment Claims increased to 216,000

The DOL reported:

In the week ending July 13, the advance figure for seasonally adjusted initial claims was 216,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 209,000 to 208,000. The 4-week moving average was 218,750, a decrease of 250 from the previous week's revised average. The previous week's average was revised down by 250 from 219,250 to 219,000.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

This was close to the consensus forecast.

Wednesday, July 17, 2019

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 7/17/2019 07:52:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 209 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 4.5, up from 0.3.

Earlier Fed's Beige Book: Economic Growth "Modest", Labor Market "Tight"

by Calculated Risk on 7/17/2019 04:11:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of San Francisco based on information collected on or before July 8, 2019. "

Economic activity continued to expand at a modest pace overall from mid-May through early July, with little change from the prior reporting period. In most Districts, sales of retail goods increased slightly overall, although vehicle sales were flat. Activity in the nonfinancial services sector rose further. Tourism activity was broadly solid, with Atlanta and Richmond recording robust growth in this sector. Although some Districts continued to report healthy expansion in the transportation sector, others noted that activity declined modestly. On balance, home sales picked up somewhat, but residential construction activity was flat. Nonresidential construction activity increased or remained strong in most reporting Districts, and commercial rents rose. Manufacturing production was generally flat, but a few Districts noted a modest pickup in activity since the last reporting period. Agricultural output declined modestly following unusually heavy rainfall in some areas, and oil and gas production fell somewhat. Increased demand for loans was broad-based, with all but two Districts noting some growth in financing activity. The outlook generally was positive for the coming months, with expectations of continued modest growth, despite widespread concerns about the possible negative impact of trade-related uncertainty.

...

On balance, employment grew at a modest pace, slightly slower than the previous reporting period. Labor markets remained tight, with contacts across the country experiencing difficulties filling open positions. The reports noted continued worker shortages across most sectors, especially in construction, information technology, and health care. However, some manufacturing and information technology firms in the Northeast reduced their number of workers. A few reports highlighted concerns about securing and renewing work visas, flagging this as a source of uncertainty for continued employment growth. Compensation grew at a modest-to-moderate pace, similar to the last reporting period, although some contacts emphasized significant increases in entry-level wages. Most District reports also noted that employers expanded benefit packages in response to the tight labor market conditions.

emphasis added

CAR on California: "California home sales retreat in June"

by Calculated Risk on 7/17/2019 03:09:00 PM

The CAR reported: California home sales retreat in June, but 2019 housing market outlook revised upward, C.A.R. reports

After rebounding in May, California home sales fell below the benchmark 400,000 level in June as sales declined from both the previous month and year, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that the YoY increase has been slowing in California.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 389,690 units in June, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

June’s sales figure was down 4.2 percent from the 406,960 level in May and down 5.1 percent from home sales in June 2018 of 410,800. Sales fell below the 400,000 benchmark again after rebounding in May. Sales have been under the benchmark for 10 of the past 11 months.

“With softer price growth and interest rates at the lowest levels in nearly three years, monthly mortgage payments on a median-priced home have fallen for four straight months. This allows homebuyers to save hundreds of dollars a month on the same home or to potentially consider a slightly more expensive home for the same monthly cost,” said C.A.R. President Jared Martin. “Combined with the long-term benefits of homeownership on personal wealth and quality of life, 2019 is a good time to purchase a home for the long haul.”

...

Active listings, which have been decelerating since December 2018, grew 2.4 percent from a year ago — the smallest increase since April 2018.

The number of homes available for sale has moderated significantly, suggesting that market is getting back toward being more balanced between supply and demand — but inventory remains relatively tight from a historical perspective. The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was 3.4 months in June, up from 3.2 months in May and up from 3.0 months in June 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.2% | 19.2% |

| Mar-19 | 1.8% | 13.4% |

| Apr-19 | 1.7% | 10.8% |

| May-19 | 2.7% | 7.4% |

| Jun-19 | NA | 2.4% |

AIA: "Design services demand stalled in June, Project inquiry gains hit a 10-year low"

by Calculated Risk on 7/17/2019 11:24:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Design services demand stalled in June, Project inquiry gains hit a 10-year low

Demand for design services at architecture firms decreased in June in comparison to the previous month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for June was 49.1, which is down from 50.2 in May. Any score below 50 indicates a decrease in billings. Both the project inquiries index and the design contracts index continued to soften in June but remained positive.

“With billings declining or flat for the last five months, it appears that we are settling in for a period of soft demand for design services,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “With the new design contracts score reaching a 10-month low and the project inquiries score hitting a 10-year low, work in the pipeline may start to get worked off, despite current robust backlogs.”

...

• Regional averages: South (51.9); West (49.3); Midwest (48.9); Northeast (46.1)

• Sector index breakdown: mixed practice (54.3); commercial/industrial (52.3); institutional (47.0); multi-family residential (46.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.1 in June, down from 50.2 in May. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 10 of the previous 12 months, suggesting some further increase in CRE investment in 2019 - but this is the weakest five month stretch since 2012.

Comments on June Housing Starts

by Calculated Risk on 7/17/2019 08:52:00 AM

Earlier: Housing Starts at 1.253 Million Annual Rate in June

Total housing starts in June were slightly below expectations, and starts for April and May were revised down.

The housing starts report showed starts were down 0.9% in June compared to May, and starts were up 6.2% year-over-year compared to June 2018.

Single family starts were down 0.8% year-over-year, and multi-family starts were up 25.3%.

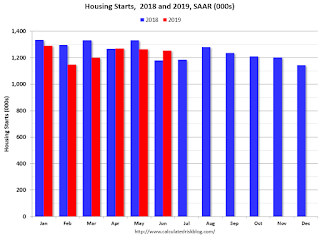

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were up 6.2% in June compared to June 2018.

Year-to-date, starts are down 3.7% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year were the most difficult.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it looks like starts might be up slightly in 2019 compared to 2018.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now.

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Housing Starts at 1.253 Million Annual Rate in June

by Calculated Risk on 7/17/2019 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in June were at a seasonally adjusted annual rate of 1,253,000. This is 0.9 percent below the revised May estimate of 1,265,000, but is 6.2 percent above the June 2018 rate of 1,180,000. Single‐family housing starts in June were at a rate of 847,000; this is 3.5 percent above the revised May figure of 818,000. The June rate for units in buildings with five units or more was 396,000.

Building Permits:

Privately‐owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,220,000. This is 6.1 percent below the revised May rate of 1,299,000 and is 6.6 percent below the June 2018 rate of 1,306,000. Single‐family authorizations in June were at a rate of 813,000; this is 0.4 percent above the revised May figure of 810,000. Authorizations of units in buildings with five units or more were at a rate of 360,000 in June.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were down in June compared to May. Multi-family starts were up 24% year-over-year in June.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) increased in June, and were down 0.8% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in June were slightly below expectations, and starts for April and May were revised down.

I'll have more later …

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 7/17/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 12, 2019. Last week’s results included an adjustment for the Fourth of July holiday.

... The Refinance Index increased 2 percent from the previous week and was 87 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index increased 21 percent compared with the previous week and was 7 percent higher than the same week one year ago.

...

“Mortgage rates increased across the board, with the 30-year fixed rate mortgage rising to its highest level in a month to 4.12 percent, which is still below this year’s average of 4.45 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Coming out of the July 4th holiday, applications were lower overall, with purchase activity slipping almost 4 percent. Refinance applications increased, with activity reaching its highest level in a month, driven mainly by FHA refinance applications. Historically, government refinance activity lags slightly in response to rate changes.”

Added Kan, “Buyer interest at the start of the second half of the year continues to outpace year ago levels, with activity last week up 7 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.12 percent from 4.04 percent, with points increasing to 0.38 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 7% year-over-year.

Tuesday, July 16, 2019

Wednesday: Housing Starts, Beige Book

by Calculated Risk on 7/16/2019 07:40:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for June. The consensus is for 1.260 million SAAR, down from 1.269 million SAAR in May.

• During the day, The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Phoenix Real Estate in June: Sales up 2.6% YoY, Active Inventory Down 4% YoY

by Calculated Risk on 7/16/2019 05:36:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales increased to 9,313 in June, up from 9,079 in June 2018. Sales were down 9.9% from May 2019 (last month), and up 2.6% from June 2018.

2) Active inventory was at 15,188, down from 15,851 in June 2018. That is down 4.2% year-over-year. This YoY decline in inventory follows seven consecutive months with a YoY increase in active inventory.

Months of supply increased from 2.07 in May to 2.12 in June. This is low.