by Calculated Risk on 7/21/2019 06:56:00 PM

Sunday, July 21, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of July 21, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for June. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $56.17 per barrel and Brent at $63.23 barrel. A year ago, WTI was at $68, and Brent was at $73 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.76 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down about 3% year-over-year.

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 7/21/2019 11:49:00 AM

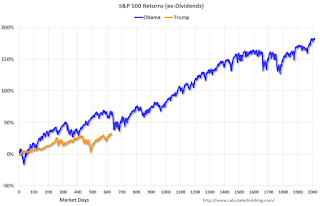

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 31% under Mr. Trump - compared to up 63% under Mr. Obama for the same number of market days.

Note: There was a market sell-off during Mr. Obama's third year, so the market performance might be closer over the next 60 days.

Saturday, July 20, 2019

Schedule for Week of July 21, 2019

by Calculated Risk on 7/20/2019 08:11:00 AM

The key reports this week are the advance estimate of Q2 GDP, and June New and Existing Home Sales.

For manufacturing, the July Richmond and Kansas City Fed manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

9:00 AM: FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.34 million SAAR, unchanged from 5.34 million last month.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.34 million SAAR, unchanged from 5.34 million last month.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report 5.25 million SAAR.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 655 thousand SAAR, up from 626 thousand in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, down from 216 thousand last week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

10:00 AM: The Q2 2019 Housing Vacancies and Homeownership report from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for July. This is the last of regional manufacturing surveys for June.

8:30 AM: Gross Domestic Product, 2nd quarter 2019 (advance estimate), and annual update. The consensus is that real GDP increased 1.9% annualized in Q2, down from 3.1% in Q1.

Friday, July 19, 2019

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/19/2019 01:37:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in June

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.25 million in June, down 1.7% from May’s preliminary estimate and down 2.6% from last June’s seasonally adjusted pace. Unadjusted sales should show a steeper YOY decline, reflecting this June’s lower business day count relative to last June’s.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of June should be about 2.6% higher than last June.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 4.8% from a year earlier.

CR Note: Existing home sales for June are scheduled to be released on Tuesday, July 23rd. The consensus is the NAR will report sales of 5.36 million SAAR.

Q2 GDP Forecasts: 1.4% to 2.3%

by Calculated Risk on 7/19/2019 11:58:00 AM

From Merrill Lynch:

Strong retail sales in June boosted our 2Q GDP tracking by 0.6pp to 2.3% qoq saar. [July 19 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +1.4% (qoq ar). [July 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.4% for 2019:Q2 and 1.9% for 2019:Q3. [July 19 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.6 percent on July 17, unchanged from July 16. [July 17 estimate]CR Note: These estimates suggest real GDP growth will be around 2% annualized in Q2.

BLS: June Unemployment rates at New Series Lows in Alabama, Arkansas, New Jersey, and Texas

by Calculated Risk on 7/19/2019 10:11:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in June in 6 states and stable in 44 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Three states had jobless rate decreases from a year earlier and 47 states and the District had little or no change. The national unemployment rate, 3.7 percent, was little changed from May but was 0.3 percentage point lower than in June 2018.

...

Vermont had the lowest unemployment rate in June, 2.1 percent. The rates in Alabama (3.5 percent), Arkansas (3.5 percent), New Jersey (3.5 percent), and Texas (3.4 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that the series low for Alaska is above 6%. Two states and the D.C. have unemployment rates above 5%; Alaska and Mississippi.

A total of nine states are a series low: Alabama, Arkansas, Iowa, Maine, New Jersey, North Dakota, Pennsylvania, Texas and Vermont.

Thursday, July 18, 2019

California Bay Area Home Sales Decline 4.7% YoY in Q2, Inventory up 11% YoY

by Calculated Risk on 7/18/2019 03:33:00 PM

From Compass chief economist Selma Hepp: How did the spur of IPOs impact Bay Area housing markets?

• Higher-end sales surged. While the total number of homes sold in the second quarter trended below last year by about 5 percent, higher-priced sales, above $3 million, surged again bringing second quarter sales in line with last year’s historical peak.

• Home prices remained flat in the second quarter, except in San Francisco and San Mateo. As noted in previous analyses, home prices in the Bay Area reached a cyclical high last May when the median price topped at $1 million. Since, the prices followed seasonal declines reaching the lowest point in January and have increased since.

• For-sale inventory growth slowed considerably. While overall inventory is about 11 percent ahead of last year, inventory growth and addition of new listings has slowed, suggesting that acute lack of homes for sale continues to hang over Bay Area housing markets.

• Lastly, tax reform is likely putting a damper on the market by dragging down sales priced between $1 million and $2 million. While the quarter ended with 5 percent fewer sales than last year, or 876 fewer sales, 84 percent of the decline, or 738 units, was due to fewer homes sold priced between $1 million and $2 million.

NMHC: Apartment Market Tightness Index Increased in July

by Calculated Risk on 7/18/2019 11:15:00 AM

The National Multifamily Housing Council (NMHC) released their July report: July NMHC Quarterly Survey Finds Strong Ongoing Demand

The enduring strength of the apartment market was the main takeaway of the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for July 2019, as the Market Tightness (60), Equity Financing (56), and Debt Financing (80) indexes all came in above the breakeven level (50). The Sales Volume Index (48) indicated a continued softness in property sales, albeit with considerable disagreement among respondents.

"These latest figures illustrate that, in spite of construction levels hovering near recent highs, there remains significant pent-up demand for apartments," noted NMHC Chief Economist Mark Obrinsky. "Nearly a third (32 percent) of respondents reported stronger rents and occupancy levels, while just 11 percent indicated looser market conditions."

While the industry outlook is positive, political and regulatory threats like rent control threaten to upend regional markets. Among respondents to the NMHC Quarterly Survey, sixty-two percent operate in jurisdictions that have either recently imposed rent control or is seriously considering doing so. Of this group, a fifth (20 percent) has already cut back on investment or development in these markets, while an additional 60 percent is considering making changes in the future.

The Market Tightness Index increased from 52 to 60, indicating overall improving conditions for the second consecutive quarter. Nearly one-third (32%) of respondents reported tighter market conditions than three months prior, compared to 11 percent who reported looser conditions. Over half (57 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates market conditions were tighter over the last quarter.

This is the second consecutive reading over 50, following thirteen consecutive quarterly surveys indicating looser conditions.

Sacramento Housing in June: Sales Down 13.6% YoY, Active Inventory DOWN 11% YoY

by Calculated Risk on 7/18/2019 10:39:00 AM

From SacRealtor.org: June sales price inches towards August 2005 high

June closed with 1,527 total sales, a 6.3% [decrease] from the 1,630 sales of May. [Sales down 13.6% YoY]1) Overall sales decreased to 1,527 in June, down from 1,767 in June 2018. Sales were down 6.3% from May 2019 (last month), and down 13.6% from June 2018.

...

The Active Listing Inventory increased 2.1% from 2,314 to 2,362 units. The Months of Inventory, increased from 1.4 to 1.5 Months. [Note: Compared to June 2018, inventory is down 11.2%] .

...

The Median DOM (days on market) remained at 10 from May to June. The Average DOM decreased from 25 to 22. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 2,362, down from 2,660 in June 2018. That is down 11.2% year-over-year. This is the second consecutive YoY decline following 20 months of YoY increases in inventory.

Inventory is still low - months of inventory is at 1.5 months, probably closer to 4 months would be normal.

Philly Fed Mfg "Current Manufacturing Indicators Suggest Continued Growth in July"

by Calculated Risk on 7/18/2019 08:44:00 AM

From the Philly Fed: July 2019 Manufacturing Business Outlook Survey

Manufacturing conditions in the region showed improvement this month, according to firms responding to the July Manufacturing Business Outlook Survey. The survey’s indexes for general activity, new orders, shipments, and employment remained positive and increased from their June readings. Most of the survey’s future activity indexes increased, suggesting improved optimism about growth for the next six months.This was well above the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity more than recovered from its decline last month, increasing from 0.3 in June to 21.8 this month.

...

The firms reported increases in manufacturing employment and longer workweeks this month. Over 36 percent of the firms reported higher employment, compared with 25 percent last month. Only 6 percent reported decreases in employment this month. The current employment index increased 15 points to 30.0, its highest reading since October 2017.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

These early reports suggest the ISM manufacturing index will bounce back in July.