by Calculated Risk on 7/31/2019 09:07:00 PM

Wednesday, July 31, 2019

Thursday: Unemployment Claims, ISM Mfg Index, Construction Spending

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 206 thousand last week.

• At 10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 51.9, up from 51.7 in June. The employment index was at 54.5 in June, and the new orders index was at 50.0%.

• At 10:00 AM: Construction Spending for June. The consensus is for a 0.4% increase in construction spending.

Fannie Mae: Mortgage Serious Delinquency Rate Unchanged in June

by Calculated Risk on 7/31/2019 04:20:00 PM

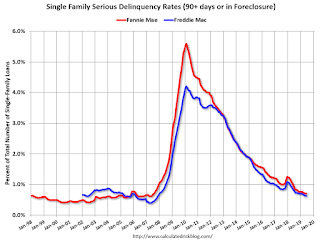

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 0.70% in June, from 0.70% in May. The serious delinquency rate is down from 0.97% in June 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This equals last month as the lowest serious delinquency rate for Fannie Mae since July 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.61% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.45% are seriously delinquent, For recent loans, originated in 2009 through 2018 (93% of portfolio), only 0.32% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

FOMC Statement: 25bp Decrease

by Calculated Risk on 7/31/2019 02:01:00 PM

Information received since the Federal Open Market Committee met in June indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although growth of household spending has picked up from earlier in the year, growth of business fixed investment has been soft. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

The Committee will conclude the reduction of its aggregate securities holdings in the System Open Market Account in August, two months earlier than previously indicated. Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against the action were Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

emphasis added

Zillow Case-Shiller Forecast: Mostly Lower YoY Price Gains in June compared to May

by Calculated Risk on 7/31/2019 10:45:00 AM

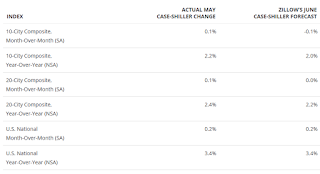

The Case-Shiller house price indexes for May were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: May Case-Shiller Results and June Forecast: Still Tapping on the Brakes

Low mortgage rates and consumer demand typically would create a bonanza for builders and the housing market overall. In recent years, builders have faced high land and labor costs that prevented them from putting up homes fast enough, particularly at the less expensive end of the market where first-time buyers search.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.4% in June, the same as in May.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.4% in June, the same as in May. The Zillow forecast is for the 20-City index to decline to 2.2% YoY in June from 2.4% in May, and for the 10-City index to decline to 2.0% YoY compared to 2.2% YoY in May.

Chicago PMI "Softens to 44.4 in July"

by Calculated Risk on 7/31/2019 10:24:00 AM

From the Chicago PMI: Chicago Business Barometer™ – Softens to 44.4 in July

The Chicago Business BarometerTM, produced with MNI, eased further to 44.4 in July from 49.7 last month, the second sub-50 reading in 30 months.

The weakness in the Barometer observed in Q2 continued into the current quarter, with the latest outturn making it the weakest start to Q3 since 2009.

...

This month’s special question asked firms about their views on the US economy’s growth in the second half of the year. Two in five firms expected the economy to see slower growth than currently, with some holding tariffs responsible for the slowdown. The majority, at 46%, did not expect any change while only 14% expected the economy pick up.

“Sentiment faded further with firms facing weakness across the board. Global risks, trade tensions, slowdown in demand and sombre growth expectations, all jeopardize business conditions. Firms are not panicking yet, but the latest report isn’t adding to the cheer. The above risks lend weight to a monetary easing approach by the Fed, albeit a gradual one,” said Shaily Mittal, Senior Economist at MNI.

emphasis added

ADP: Private Employment increased 156,000 in July

by Calculated Risk on 7/31/2019 08:19:00 AM

Private sector employment increased by 156,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was at the consensus forecast for 155,000 private sector jobs added in the ADP report.

...

“While we still see strength in the labor market, it has shown signs of weakening,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “A moderation in growth is expected as the labor market tightens further.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is healthy, but steadily slowing. Small businesses are suffering the brunt of the slowdown. Hampering job growth are labor shortages, layoffs at bricks-and-mortar retailers, and fallout from weaker global trade.”

The BLS report will be released Friday, and the consensus is for 156,000 non-farm payroll jobs added in July.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 7/31/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 26, 2019.

... The Refinance Index increased 0.1 percent from the previous week and was 84 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

“Mortgage applications were lower last week, driven by a 3 percent decrease in purchase applications. While purchase activity was still up 6 percent from a year ago, the index has now decreased for three straight weeks and reached its lowest point since March. Despite healthy demand, inadequate supply levels continue to hold back some would-be buyers,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Rate movements were mixed, with the 30-year fixed rate remaining unchanged (at 4.08 percent), but the FHA rate decreasing to its lowest level since 2017 to 3.94 percent.”

Added Kan, “Refinance applications were essentially flat, but the components told different stories. Conventional refinances were up 1.1 percent, but government refinances were down almost 3 percent – led by a drop in VA applications.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remained unchanged at 4.08 percent, with points increasing to 0.34 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 6% year-over-year.

Tuesday, July 30, 2019

Wednesday: FOMC Announcement, ADP Employment, Chicago PMI

by Calculated Risk on 7/30/2019 09:22:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in July, up from 102,000 added in June.

• At 9:45 AM, Chicago Purchasing Managers Index for July.

• At 2:00 PM, FOMC Meeting Announcement. The Fed is expected to announce a 25bps cut to the Fed Funds rate at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Energy expenditures as a percentage of PCE

by Calculated Risk on 7/30/2019 02:30:00 PM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the June 2019 PCE report released this morning.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through June 2019.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In June 2019, energy expenditures as a percentage of PCE increased to 3.91% of PCE, up from the all time low of 3.65% in February 2016.

Energy as a percent of GDP has been generally trending down, and historically this is a low percentage of PCE for energy expenditures.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 7/30/2019 12:16:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through May 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.