by Calculated Risk on 8/01/2019 05:20:00 PM

Thursday, August 01, 2019

Hotels: Occupancy Rate Decreased Year-over-year, "Hotels’ rocket is losing fuel"

From Jan Freitag at HotelNewsNow.com: June data shows US hotels’ rocket is losing fuel

Well, it finally happened, 12-month-moving-average occupancy is no longer at record levels. June 12MMA occupancy at 66.2% was below the May result of 66.3%. Occupancy bottomed out in January 2010 (54.5%), and we had reported consecutively higher annualized occupancies ever since. Starting in May 2015 (64.9%), each month we reported the highest annualized occupancy ever—until now. Let’s raise a coffee in salute to the end of a good run, and the end of STR presenters saying on stage “the highest occupancy ever recorded.”From HotelNewsNow.com: STR: US hotel results for week ending 27 July

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 21-27 July 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 22-28 July 2018, the industry recorded the following:

• Occupancy: -1.0% to 77.5%

• Average daily rate (ADR): -0.5% to US$136.00

• Revenue per available room (RevPAR): -1.6% at US$105.43

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years.

Seasonally, the occupancy rate will now stay at a high level during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Goldman: July Payrolls Preview

by Calculated Risk on 8/01/2019 03:04:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 190k in July, 25k above consensus of +165k. While July employer surveys declined on net, jobless claims and job availability measures remain at very strong levels, and we also expect a boost from Census hiring worth 10-20k. …CR Note: It will be important to adjust for decennial Census hiring.

We estimate the unemployment rate was unchanged at 3.7%. … We estimate average hourly earnings increased 0.2% month-over-month and 3.1% year-over-year rate.

emphasis added

July Employment Preview

by Calculated Risk on 8/01/2019 11:57:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for an increase of 156,000 non-farm payroll jobs in July, and for the unemployment rate to decline to 3.6%.

Last month, the BLS reported 224,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 156,000 private sector payroll jobs in July. This was ate consensus expectations of 155,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in July to 51.7%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased 10,000 in July. The ADP report indicated manufacturing jobs increased 1,000 in July.

The ISM non-manufacturing index for July will be released next week.

• Initial weekly unemployment claims averaged 212,000 in July, down from 222,000 in June. For the BLS reference week (includes the 12th of the month), initial claims were at 216,000, down slightly from 217,000 during the reference week the previous month.

This suggest employment growth near expectations.

• The final July University of Michigan consumer sentiment index increased to 98.4 from the June reading of 98.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: Manufacturing was weak in July, however the ADP employment suggests a report close to the consensus. Over the last several years, the BLS has reported about the consensus for July, so my guess is the report will be above the consensus.

ISM Manufacturing index Decreased to 51.2 in July

by Calculated Risk on 8/01/2019 10:25:00 AM

The ISM manufacturing index indicated expansion in July. The PMI was at 51.2% in July, down from 51.7% in June. The employment index was at 51.7%, down from 54.5% last month, and the new orders index was at 50.8%, up from 50.0%.

From the Institute for Supply Management: July 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July, and the overall economy grew for the 123rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The July PMI® registered 51.2 percent, a decrease of 0.5 percentage point from the June reading of 51.7 percent. The New Orders Index registered 50.8 percent, an increase of 0.8 percentage point from the June reading of 50 percent. The Production Index registered 50.8 percent, a 3.3-percentage point decrease compared to the June reading of 54.1 percent. The Employment Index registered 51.7 percent, a decrease of 2.8 percentage points from the June reading of 54.5 percent. The Supplier Deliveries Index registered 53.3 percent, a 2.6-percentage point increase from the June reading of 50.7 percent. The Inventories Index registered 49.5 percent, an increase of 0.4 percentage point from the June reading of 49.1 percent. The Prices Index registered 45.1 percent, a 2.8-percentage point decrease from the June reading of 47.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 51.9%, and suggests manufacturing expanded at a slower pace in July than in June.

Construction Spending Declined in June

by Calculated Risk on 8/01/2019 10:16:00 AM

From the Census Bureau reported that overall construction spending declined in June:

Construction spending during June 2019 was estimated at a seasonally adjusted annual rate of $1,287.0 billion, 1.3 percent below the revised May estimate of $1,303.4 billion. The June figure is 2.1 percent below the June 2018 estimate of $1,314.8 billion.Both private and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $962.9 billion, 0.4 percent below the revised May estimate of $967.0 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $324.1 billion, 3.7 percent below the revised May estimate of $336.4 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 25% below the bubble peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars).

Public construction spending is at the previous peak in March 2009, and 24% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 8%. Non-residential spending is down slightly year-over-year. Public spending is up 6% year-over-year.

This was below consensus expectations, however spending for April and May was revised up. Another weak construction spending report.

Weekly Initial Unemployment Claims increased to 215,000

by Calculated Risk on 8/01/2019 08:35:00 AM

The DOL reported:

In the week ending July 27, the advance figure for seasonally adjusted initial claims was 215,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 206,000 to 207,000. The 4-week moving average was 211,500, a decrease of 1,750 from the previous week's revised average. The previous week's average was revised up by 250 from 213,000 to 213,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 211,500.

This was higher than the consensus forecast.

Wednesday, July 31, 2019

Thursday: Unemployment Claims, ISM Mfg Index, Construction Spending

by Calculated Risk on 7/31/2019 09:07:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 206 thousand last week.

• At 10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 51.9, up from 51.7 in June. The employment index was at 54.5 in June, and the new orders index was at 50.0%.

• At 10:00 AM: Construction Spending for June. The consensus is for a 0.4% increase in construction spending.

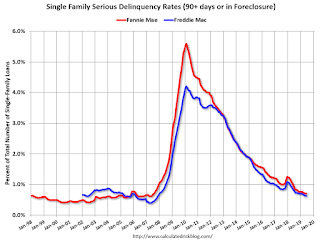

Fannie Mae: Mortgage Serious Delinquency Rate Unchanged in June

by Calculated Risk on 7/31/2019 04:20:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 0.70% in June, from 0.70% in May. The serious delinquency rate is down from 0.97% in June 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This equals last month as the lowest serious delinquency rate for Fannie Mae since July 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.61% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.45% are seriously delinquent, For recent loans, originated in 2009 through 2018 (93% of portfolio), only 0.32% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

FOMC Statement: 25bp Decrease

by Calculated Risk on 7/31/2019 02:01:00 PM

Information received since the Federal Open Market Committee met in June indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although growth of household spending has picked up from earlier in the year, growth of business fixed investment has been soft. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

The Committee will conclude the reduction of its aggregate securities holdings in the System Open Market Account in August, two months earlier than previously indicated. Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against the action were Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

emphasis added

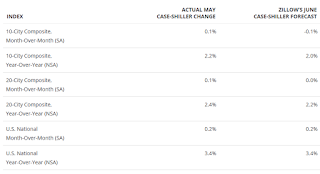

Zillow Case-Shiller Forecast: Mostly Lower YoY Price Gains in June compared to May

by Calculated Risk on 7/31/2019 10:45:00 AM

The Case-Shiller house price indexes for May were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: May Case-Shiller Results and June Forecast: Still Tapping on the Brakes

Low mortgage rates and consumer demand typically would create a bonanza for builders and the housing market overall. In recent years, builders have faced high land and labor costs that prevented them from putting up homes fast enough, particularly at the less expensive end of the market where first-time buyers search.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.4% in June, the same as in May.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 3.4% in June, the same as in May. The Zillow forecast is for the 20-City index to decline to 2.2% YoY in June from 2.4% in May, and for the 10-City index to decline to 2.0% YoY compared to 2.2% YoY in May.