by Calculated Risk on 8/05/2019 05:13:00 PM

Monday, August 05, 2019

Mortgage Rates Fall Sharply, 3.5% 30 Year Fixed

From Matthew Graham at MortgageNewsDaily: Just When You Thought Rates Wouldn't Go Any Lower

Mortgage rates were already in great shape on Friday after having fallen to the lowest levels since November 2016. Rather than draw inspiration from the week's big ticket events (Fed announcement and jobs report), the biggest source of inspiration was a flare-up in trade tensions following Trump's announcement of new tariffs on Chinese imports. Trade war drama flared over the weekend as China's central bank set the country's currency at the weakest levels in more than a decade.

…

Mortgage-backed securities (MBS)--the bonds that directly influence mortgage rates--have a hard time keeping up when financial markets are this volatile. Mortgage lenders also tend to proceed cautiously when dropping rates to multi-year lows in the midst of a these sorts of big market swings. That means mortgage rates haven't dropped nearly as quickly as Treasury yields, but they're nonetheless at the lowest levels since November 2016 today. [30YR FIXED - 3.5% - 3.75% (wider range than normal due to volatility)]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since 2014.

This graph is interactive, and you could view mortgage rates back to the mid-1980s - click here for graph.

Update: Framing Lumber Prices Down 20% Year-over-year

by Calculated Risk on 8/05/2019 02:34:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down 15% to 25% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Aug 2, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 25% from a year ago, and CME futures are down 15% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

CalculatedRisk Speaks! "2020 Economic Forecast featuring the UCI Paul Merage School of Business"

by Calculated Risk on 8/05/2019 11:45:00 AM

On October 23rd, I will be one of three speakers at the "2020 Economic Forecast featuring the UCI Paul Merage School of Business" in Newport Beach, California, sponsored by the Newport Beach Chamber of Commerce.

UCI Finance Professor Christopher Schwarz and I will be discussing the 2020 economic outlook, and Dr. Richard Afable will be discussing "The Future of the Healthcare System".

This is a lunch time event (from 11:15 am to 1:30 pm) at the Balboa Bay Resort.

Click here for more information and tickets. Tickets are $65 for members, and $75 for non-members and includes lunch. (I'm speaking for free).

Best to all.

ISM Non-Manufacturing Index decreased to 53.7% in July

by Calculated Risk on 8/05/2019 10:07:00 AM

The July ISM Non-manufacturing index was at 53.7%, down from 55.1% in June. The employment index increased to 56.2%, from 55.0%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: July 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 114th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 53.7 percent, which is 1.4 percentage points lower than the June reading of 55.1 percent. This represents continued growth in the non-manufacturing sector, at a slower rate. This is the index’s lowest reading since August 2016, when it registered 51.8 percent. The Non-Manufacturing Business Activity Index decreased to 53.1 percent, 5.1 percentage points lower than the June reading of 58.2 percent, reflecting growth for the 120th consecutive month. The New Orders Index registered 54.1 percent; 1.7 percentage points lower than the reading of 55.8 percent in June. The Employment Index increased 1.2 percentage points in July to 56.2 percent from the June reading of 55 percent. The Prices Index decreased 2.4 percentage points from the June reading of 58.9 percent to 56.5 percent, indicating that prices increased in July for the 26th consecutive month. According to the NMI®, 13 non-manufacturing industries reported growth. The non-manufacturing sector’s rate of growth continued to cool off. Respondents indicated ongoing concerns related to tariffs and employment resources. Comments remained mixed about business conditions and the overall economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in July than in June.

Black Knight Mortgage Monitor for June: Increase in Delinquencies due to Timing and Seasonal Factors

by Calculated Risk on 8/05/2019 08:30:00 AM

Black Knight released their Mortgage Monitor report for June today. According to Black Knight, 3.73% of mortgages were delinquent in June, down slightly from 3.74% in June 2018. Black Knight also reported that 0.50% of mortgages were in the foreclosure process, down from 0.56% a year ago.

This gives a total of 4.23% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Affordability Improves on Rate Drops, Reaches an 18-Month High in July; Home Price Growth Deceleration Begins to Level Off

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. After 15 months of declining year-over-year home price growth, the company revisited the home affordability landscape. As Black Knight Data & Analytics President Ben Graboske explained, as a result of falling interest rates and slowing home price appreciation, affordability is the best it’s been in 18 months.

“For much of the past year and a half, affordability pressures have put a damper on home price appreciation,” said Graboske. “Indeed, the rate of annual home price growth has declined for 15 consecutive months. More recently, declining 30-year fixed interest rates have helped to ease some of those pressures, improving the affordability outlook considerably. In November 2018 – when rising interest rates hit a seven-year high and home price growth fell by half a percent in a single month – it took 23.3% of the median household income to make the principal and interest payments when purchasing the average-priced home. As 30-year rates fell to 3.75%, that share fell to 21.3%, the lowest it’s been in 18 months.

“This has changed the affordability landscape significantly. Whereas nine states were less affordable than their long-term norms back in November – a key driver behind the subsequent deceleration in home prices – only California and Hawaii remained so as of July. And despite the average home price rising by more than $12K since November, today’s lower fixed interest rates have worked out to a $108 lower monthly payment when purchasing the average-priced home with 20% down. Lower rates have also increased the buying power for prospective homebuyers looking to purchase the average-priced home by the equivalent of 15%, meaning that they could effectively buy $45,000 ‘more house’ while still keeping their payments the same as they would have been last fall. As affordability pressures have eased, it also appears to be putting the brakes on the home price deceleration we’ve been tracking since February 2018. After 15 consecutive monthly declines, the national home price growth rate for June stayed level from May at 3.78%.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National delinquency rate over time.

From Black Knight:

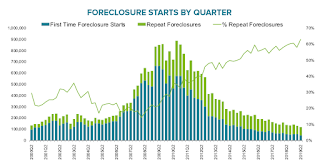

• June's nearly 11% jump in delinquencies was one of the top five such single-month increases in the past decade and one of the top 15 on record back to 2000The second graph shows foreclosure starts:

• However, while significant, it wasn’t unexpected given the seasonal and calendar-related pressures weighing on the market

• On average, over the past 20 years, the national delinquency rate has increased by 2.5% in June

• More impactful is that the month ended on a Sunday, which means servicing operations are closed on the last two calendar days of the month and cannot process last-minute payments

• June has ended on a Sunday three times in the past 20 years; the last two (2002 and 2013) saw an average monthly delinquency rate increase of 11.1%, nearly identical to this year

• Delinquencies tend to improve in the month following a Sunday month-end, which may help to counter the seasonal rise typically seen in July

• First-time foreclosure starts accounted for just 37% of all activity, marking the lowest such volume and share of foreclosure activity of any quarter on recordThere is much more in the mortgage monitor.

• A total of 120K foreclosure starts were initiated in Q2 2019, down 7% from Q1 and down 12% year-over-year, marking the lowest quarterly total since the turn of the century

• First-time foreclosure starts were down 20% year-over-year, while repeat foreclosures saw only a 7% decline

Sunday, August 04, 2019

Sunday Night Futures

by Calculated Risk on 8/04/2019 06:55:00 PM

Weekend:

• Schedule for Week of Aug 4, 2019

Monday:

• At 10:00 AM ET, the ISM non-Manufacturing Index for July. The consensus is for a reading of 55.5, up from 55.1.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $55.53 per barrel and Brent at $61.33 barrel. A year ago, WTI was at $69, and Brent was at $73 - so oil prices are down about 15%to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.70 per gallon. A year ago prices were at $2.86 per gallon, so gasoline prices are down about 6% year-over-year.

Only Voters can Stop Gun Violence

by Calculated Risk on 8/04/2019 01:31:00 PM

I've written about gun violence several times. For example, back in 2015, I wrote:

And we also hear "nothing can be done" about the ongoing mass shooting in the U.S., even though most Americans support stricter background checks, longer waiting periods, and restricting certain types of weapons.And that was written before the Las Vegas massacre, Parkland Florida attack, and the very recent mass shooting in Dayton, El Paso, and at the Garlic Festival in Gilroy (that was just a week ago) and many many more.

We can debate policy forever, but we need politicians in the White House, Senate and House who will support gun control. This is something almost all Americans support, so make it a voting litmus test - only vote for candidates that support gun control legislation. Something can be done, and it starts with the voters.

Saturday, August 03, 2019

Schedule for Week of August 4, 2019

by Calculated Risk on 8/03/2019 08:11:00 AM

This will be a light week for economic data.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for a reading of 55.5, up from 55.1.

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in May to 7.323 million from 7.372 million in April.

The number of job openings (yellow) were up 3% year-over-year, and Quits were up 2% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer Credit from the Federal Reserve.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, unchanged from 215 thousand last week.

8:30 AM: The Producer Price Index for July from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

Friday, August 02, 2019

Q3 GDP Forecasts: 1.6% to 1.9%

by Calculated Risk on 8/02/2019 02:00:00 PM

From Merrill Lynch:

The collapse in construction spending and soft inventories cut 0.3pp from 2Q GDP tracking, bringing our estimate down to 1.8% qoq saar from the advance 2.1% print. … we revise up our 3Q GDP forecast to a trend-like 1.7% qoq saar from 1.2%. [Aug 2 estimate]From Goldman Sachs:

emphasis added

We lowered our Q3 GDP tracking estimate by one tenth to +1.8% (qoq ar). [Aug 2 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.6% for 2019:Q3. [Aug 2 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 1.9 percent August 2, down from 2.2 percent on August 1. [Aug 2 estimate]CR Note: These very early estimates suggest real GDP growth will be in the high 1% range annualized in Q3.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 8/02/2019 12:26:00 PM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (30 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 30 months of Mr. Trump's term, the economy has added 5,504,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the first 30 months of Mr. Trump's term, the economy has added 232,000 public sector jobs.

After 30 months of Mr. Trump's presidency, the economy has added 5,736,000 jobs, about 514,000 behind the projection.