by Calculated Risk on 8/08/2019 08:35:00 AM

Thursday, August 08, 2019

Weekly Initial Unemployment Claims decreased to 209,000

The DOL reported:

In the week ending August 3, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 215,000 to 217,000. The 4-week moving average was 212,250, an increase of 250 from the previous week's revised average. The previous week's average was revised up by 500 from 211,500 to 212,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 212,250.

This was lower than the consensus forecast.

Wednesday, August 07, 2019

Thursday: Unemployment Claims

by Calculated Risk on 8/07/2019 08:29:00 PM

Note: On October 23rd, I will be one of three speakers at the "2020 Economic Forecast featuring the UCI Paul Merage School of Business" in Newport Beach, California, sponsored by the Newport Beach Chamber of Commerce.

UCI Finance Professor Christopher Schwarz and I will be discussing the 2020 economic outlook, and Dr. Richard Afable will be discussing "The Future of the Healthcare System".

This is a lunch time event (from 11:15 am to 1:30 pm) at the Balboa Bay Resort.

Click here for more information and tickets. Tickets are $65 for members, and $75 for non-members and includes lunch. (I'm speaking for free).

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, unchanged from 215 thousand last week.

Real House Prices and Price-to-Rent Ratio in May

by Calculated Risk on 8/07/2019 03:48:00 PM

Here is the post last week on Case-Shiller: Case-Shiller: National House Price Index increased 3.4% year-over-year in May

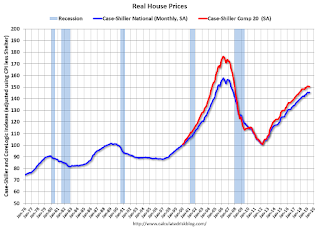

It has been over eleven years since the bubble peak. In the Case-Shiller release last week, the seasonally adjusted National Index (SA), was reported as being 13.2% above the previous bubble peak. However, in real terms, the National index (SA) is still about 7.8% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.7% below the bubble peak.

The year-over-year increase in prices has slowed to 3.4% nationally, and I expect price growth will slow a little more, but not turn negative this year.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $287,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways to down recently.

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Mortgage Rates and Ten Year Yield

by Calculated Risk on 8/07/2019 11:20:00 AM

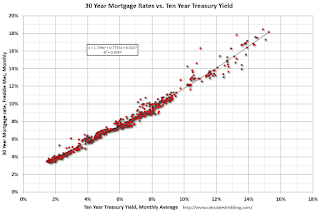

With the ten year yield at 1.63%, and based on an historical relationship, 30-year rates should currently be around 3.5%.

As of yesterday, Mortgage News Daily reported: Lowest Rates Since November 2016

Mortgage rates hit their lowest levels since November 2016 late last week and they've proceeded to set a new long-term low each day since then. [30YR FIXED - 3.5% - 3.75% (wider range than normal due to volatility)]The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

emphasis added

Currently the 10 year Treasury yield is at 1.63%, and 30 year mortgage rates were at 3.75% according to the Freddie Mac survey last week - and rates will probably be lower in the survey for this week.

Currently the 10 year Treasury yield is at 1.63%, and 30 year mortgage rates were at 3.75% according to the Freddie Mac survey last week - and rates will probably be lower in the survey for this week.The record low in the Freddie Mac survey was 3.31% in November 2012 (Survey started in 1971).

To fall to 3.31% on the Freddie Mac survey, and based on the historical relationship, the Ten Year yield would have to fall to around 1.4% (but there is some variability in the relationship).

Las Vegas Real Estate in July: Sales down 2% YoY, Inventory up 71% YoY

by Calculated Risk on 8/07/2019 10:42:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices still higher than one year ago, but not by much, GLVAR housing statistics for July 2019

Local home prices continue to be higher than they were a year ago, but not by much. So says a report released Wednesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 1.8% year-over-year to 3,883 in July 2019 from 3,955 in July 2018.

...

The total number of existing local homes, condos and townhomes sold during July was 3,883. Compared to one year ago, July sales were down 0.8% for homes and down 5.9% for condos and townhomes.

...

By the end of July, GLVAR reported 7,808 single-family homes listed for sale without any sort of offer. That’s up 63.1% from one year ago. For condos and townhomes, the 1,864 properties listed without offers in July represented a 112.3% jump from one year ago.

While the local housing supply is up from one year ago, Carpenter said it’s still below what would normally be considered a balanced market. At the current sales pace, she said Southern Nevada still has less than a three-month supply of homes available for sale.

...

The number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for just 2.0% of all existing local property sales in July. That compares to 2.9% of all sales one year ago and 6.4% two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 5,665 in July 2018 to 9,752 in July 2019. Note: Total inventory was up 71% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Low level of distressed sales.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 8/07/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 2, 2019.

... The Refinance Index increased 12 percent from the previous week and was 116 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 7 percent higher than the same week one year ago.

...

“The Federal Reserve cut rates as expected last week, but the bigger influence on the financial markets was the beginning of a trade war with China. The result was a sharp drop in mortgage rates, which will likely draw many refinance borrowers into the market in the coming weeks,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “The 30-year fixed rate mortgage fell to its lowest level since November 2016, and the drop resulted in an almost 12 percent increase in refinance application volume, bringing the index to a reading over 2,000 – its highest over the same time period. We fully expect that refinance volume will jump even higher this week given the further drop in rates.”

Added Fratantoni, “Lower mortgage rates did not pull more homebuyers into the market, as purchase volume slipped a bit last week, but still remains around 7 percent ahead of last year’s pace.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.01 percent from 4.08 percent, with points increasing to 0.37 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 3.6% this week (expect a further drop in rates in the MBA survey next week).

We should see a further increase in refinance activity next week.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 7% year-over-year.

Tuesday, August 06, 2019

Summer Teen Employment

by Calculated Risk on 8/06/2019 01:13:00 PM

Here is a look at the change in teen employment over time.

The graph below shows the participation rate and employment-population ratio for those 16 to 19 years old.

The graph is Not Seasonally Adjusted (NSA), to show the seasonal hiring of teenagers during the summer.

A few observations:

1) Although teen employment has recovered some since the great recession, overall teen employment had been trending down. This is probably because more people are staying in school (a long term positive for the economy).

2) A smaller percentage of teenagers are seeking summer employment. The seasonal spikes are smaller than in previous decades. So a smaller percentage of teenagers are joining the labor force during the summer as compared to previous years. This could be because of fewer employment opportunities, or because teenagers are pursuing other activities during the summer.

3) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate has declined over the last 20 years).

BLS: Job Openings "Little Changed" at 7.3 Million in June

by Calculated Risk on 8/06/2019 10:06:00 AM

Notes: In June there were 7.348 million job openings, and, according to the June Employment report, there were 5.975 million unemployed. So, for the sixteenth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (over 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 7.3 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.7 million and 5.5 million, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in June at 3.4 million. The quits rate was 2.3 percent. The quits level was little changed for total private and decreased for government (-19,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in June to 7.348 million from 7.384 million in May.

The number of job openings (yellow) are down 1% year-over-year.

Quits are up 2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

CoreLogic: House Prices up 3.4% Year-over-year in June

by Calculated Risk on 8/06/2019 09:19:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: U.S. Home Price Insights Through June 2019 with Forecasts from July 2019

Home prices nationwide, including distressed sales, increased year over year by 3.4% in June 2019 compared with June 2018 and increased month over month by 0.4% in June 2019 compared with May 2019 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for several years, before slowing last year.

The CoreLogic HPI Forecast indicates that home prices will increase by 5.2% on a year-over-year basis from June 2019 to June 2020. On a month-over-month basis, home prices are expected to increase by 0.5% from June 2019 to July 2019.

“Tepid home sales have caused home prices to rise at the slowest pace for the first half of a year since 2011. Price growth continues to be faster for lower-priced homes, as first-time buyers and investors are both actively seeking entry-level homes. With incomes up and current mortgage rates about 0.8 percentage points below what they were one year ago, home sales should have a better sales pace in the second half of 2019 than a year earlier, leading to a quickening in price growth over the next year.”, Dr. Frank Nothaft, Chief Economist for CoreLogic

emphasis added

The year-over-year comparison has been positive for more than seven years since turning positive year-over-year in February 2012.

Monday, August 05, 2019

Tuesday: Job Openings

by Calculated Risk on 8/05/2019 09:39:00 PM

Tuesday:

• At 10:00 AM ET: Job Openings and Labor Turnover Survey for June from the BLS. Jobs openings decreased in May to 7.323 million from 7.372 million in April.