by Calculated Risk on 8/11/2019 04:51:00 PM

Sunday, August 11, 2019

Goldman: "A Bigger Growth Hit from the Trade War"

A few brief excerpts from a Goldman Sachs research note:

We expect tariffs targeting the remaining $300bn of US imports from China to go into effect and no longer expect a trade deal before the 2020 election. …CR Note: This isn't enough drag to take the economy into recession, but the trade war appears to be slowing growth. Also, the Fed can't offset all of the negative impacts of the trade war.

Overall, we have increased our estimate of the growth impact of the trade war. In our baseline policy scenario, we now estimate a peak cumulative drag on the level of GDP of 0.6%, including a 0.2% drag from the latest escalation. The drivers of this modest change are that we now include an estimate of the sentiment and uncertainty effects and that financial markets have responded notably to recent trade news. Based on our estimates, we have taken down our Q4 growth forecast by 0.2pp to 1.8% (qoq ar).

Saturday, August 10, 2019

Schedule for Week of August 11, 2019

by Calculated Risk on 8/10/2019 08:11:00 AM

The key reports this week are July CPI, Housing starts and Retail sales.

For manufacturing, the Industrial Production report and the August New York and Philly Fed manufacturing surveys will be released.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for July.

8:30 AM: The Consumer Price Index for July from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 209 thousand last week.

8:30 AM: Retail sales for July is scheduled to be released. The consensus is for 0.3% increase in retail sales.

8:30 AM: Retail sales for July is scheduled to be released. The consensus is for 0.3% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis in June.

8:30 AM: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 2.5, down from 4.3.

8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 11.1, down from 21.8.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to decrease to 77.8%.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 66, up from 65. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM ET: Housing Starts for July.

8:30 AM ET: Housing Starts for July. This graph shows single and total housing starts since 1968.

The consensus is for 1.260 million SAAR, up from 1.253 million SAAR in June.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for August).

10:00 AM: State Employment and Unemployment (Monthly) for July 2019

Friday, August 09, 2019

Vehicle Sales: Fleet Turnover Ratio

by Calculated Risk on 8/09/2019 03:50:00 PM

Back in early 2009, I wrote a couple of posts arguing there would be an increase in auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). This was an out-of-the-consensus call and helped me call the bottom for the US economy in mid-2009.

I wrote an update in 2014, and argued vehicle sales would "mostly move sideways" for the next few years.

Here is another update to the U.S. fleet turnover graph.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through July 2019 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet). Note: the number of registered vehicles is estimated for 2018 and 2019.

The wild swings in 2009 were due to the "cash for clunkers" program.

The estimated ratio for July close to 16 years - back to a more normal level.

Note: in 2009, I argued the turnover ratio would "probably decline to 15 or so eventually" and that happened.

The current sales rate is now close to the top (excluding one month spikes) of the '98/'06 auto boom.

Light vehicle sales were at a 16.8 million seasonally adjusted annual rate (SAAR) in July.

I continue to expect vehicle sales to mostly move sideways.

BEA: July Vehicles Sales decreased to 16.8 Million SAAR

by Calculated Risk on 8/09/2019 03:20:00 PM

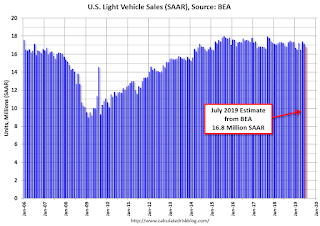

The BEA released their estimate of July vehicle sales on Tuesday. The BEA estimated sales of 16.82 million SAAR in July 2019 (Seasonally Adjusted Annual Rate), down 1.8% from the June sales rate, and down slightly from July 2018.

Sales in 2019 are averaging 16.9 million (average of seasonally adjusted rate), down 1.5% compared to the same period in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for July (red).

A small decline in sales to date this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 16.82 million SAAR.

Q3 GDP Forecasts: 1.6% to 1.9%

by Calculated Risk on 8/09/2019 11:17:00 AM

From Merrill Lynch:

We continue to track 1.8% for 2Q GDP and 1.7% for 3Q. [Aug 9 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.6% for 2019:Q3. [Aug 9 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 1.9 percent on August 8, unchanged from August 2. [Aug 8 estimate]CR Note: These early estimates suggest real GDP growth will be in the high 1% range annualized in Q3.

Merrill: "We are worried, Recession risks are rising"

by Calculated Risk on 8/09/2019 09:14:00 AM

A few brief excerpts from a Merrill Lynch research note: Recession risks are rising

Our baseline is that this is simply the third mini-cycle in this expansion and that the economy will return to above-trend growth at the end of next year after a soft patch. ... However, we are worried that the economy will not be as lucky this time around for a few reasons: 1) later stages in the cycle - the economy has returned to full capacity and we no longer have "easy growth"; 2) monetary policy tools are limited; 3) there is a persistent external shock hitting the global economy - the trade war - creating high uncertainty across the global economy.CR Note: I'm not currently on recession watch, but I agree the risks have increased.

…

As we have consistently noted, expansions do not die of old age, but they can die from a policy mistake. And we are ripe for a policy mistake today.

…

We now have a number of early indicators starting to signal heightened risk of recession. Our official model has the probability of a recession over the next 12 months only pegged at about 20%, but our subjective call based on the slew of data and events leads us to believe it is closer to a 1-in-3 chance.

Thursday, August 08, 2019

"No, Mortgage Rates Are No Longer "Sharply Lower" This Week!"

by Calculated Risk on 8/08/2019 07:11:00 PM

From Matthew Graham at Mortgage News Daily: No, Mortgage Rates Are No Longer "Sharply Lower" This Week!

Mortgage rates were sharply higher today, with the average 30yr fixed rate quote rising by almost an eighth of a percentage point in some cases. A move of that magnitude in one day is the sort of thing that only happens a few times a year. [Most Prevalent Rates 30YR FIXED - 3.75%]Friday:

emphasis added

• At 8:30 AM ET, The Producer Price Index for July from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

Fannie and Freddie: Combined REO inventory declined in Q2, Down 18% Year-over-year

by Calculated Risk on 8/08/2019 03:01:00 PM

Fannie and Freddie earlier reported results for Q2 2019. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 5,869 at the end of Q2 2019 compared to 7,135 at the end of Q2 2018.

For Freddie, this is down 92% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 17,913 at the end of Q2 2019 compared to 22,007 at the end of Q2 2018.

For Fannie, this is down 89% from the 166,787 peak number of REOs in Q3 2010.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q2 2019, and combined inventory is down 18% year-over-year.

This is close to normal levels of REOs.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 8/08/2019 12:58:00 PM

From HotelNewsNow.com: STR: U.S. hotel results for week ending 3 August

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 28 July through 3 August 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 29 July through 4 August 2018, the industry recorded the following:

• Occupancy: -0.8% to 74.8%

• Average daily rate (ADR): -0.3% to US$133.03

• Revenue per available room (RevPAR): -1.1% at US$99.45

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years.

Seasonally, the occupancy rate will now stay at a high level during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Seattle Real Estate in July: Sales up 1.3% YoY, Inventory up 45% YoY from Low Levels

by Calculated Risk on 8/08/2019 10:39:00 AM

The Northwest Multiple Listing Service reported Northwest MLS brokers report mixed activity during July, as volume of closed sales reaches 12-month high

July provided mixed messages on housing activity, noted one industry veteran when commenting on the latest report from Northwest Multiple Listing Service. The newly released MLS figures show last month's closed sales reached a 12-month high. Member-brokers also reported the number of new listings (11,193) nearly matched pending sales (11,139).The press release is for the Northwest. In King County, sales were up slightly year-over-year, and active inventory was up 12% year-over-year.

A closer look at new listing activity shows last month's total was down from both the previous month (-6.7%) and the same month a year ago (-8.2%). The total number of active listings of single family homes and condos, at 16,787, was about the same as June's inventory (16,680) and the selection of a year ago (16,773 listings). A comparison of the 23 counties in the Northwest MLS report shows about half the counties have more inventory than a year ago, and half have less.

System-wide there is 1.76 months of inventory, with King, Kitsap, Mason, Pierce, Snohomish and Whatcom counties all reporting less than two months of supply.

emphasis added

In Seattle, sales were up 1.3% year-over-year, and inventory was up 45% year-over-year from very low levels. The year-over-year increase in inventory has slowed sharply (although still up 45%), and the months of supply is still low in Seattle (2.0 months). In many areas it appears the inventory build that started last year is ending.