by Calculated Risk on 8/22/2019 02:36:00 PM

Thursday, August 22, 2019

Philly Fed: State Coincident Indexes increased in 37 states in July

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2019. Over the past three months, the indexes increased in 44 states, decreased in four states, and remained stable in two, for a three-month diffusion index of 80. In the past month, the indexes increased in 37 states, decreased in nine states, and remained stable in four, for a one-month diffusion index of 56.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some grey and red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In July, 37 states had increasing activity (graph includes minor increases).

Kansas City Fed: "Tenth District Manufacturing Declined in August"

by Calculated Risk on 8/22/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Declined in August

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in August, while expectations for future activity edged higher.Another weak report.

“Regional factory activity had its largest monthly drop in over three years, and over 55 percent of firms expect negative impacts from the latest round of U.S. tariffs on Chinese goods,” said Wilkerson. “However, even though many firms expect trade tensions to persist, expectations for future shipments and exports expanded slightly.”

...

The month-over-month composite index was -6 in August, down from -1 in July and 0 in June, and the lowest reading since March 2016. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The drop in manufacturing activity was driven by declines at both durable and nondurable plants, but especially from decreases in primary metal, electrical equipment, appliances, paper, printing, and chemical manufacturing. Most month-over-month indexes decreased in August, and the shipments and supplier delivery time indexes also turned negative. All of the year-over-year factory indexes decreased in August, and the composite index fell from 11 to -1. On the other hand, the future composite index edged higher from 9 to 11, as expectations for shipments, order backlog, employment, and new orders for exports grew slightly.

emphasis added

Black Knight: "Mortgage Delinquencies See Strong Recovery from June Spike"

by Calculated Risk on 8/22/2019 09:30:00 AM

From Black Knight: Black Knight’s First Look: July Prepayment Activity Hits Highest Level Since 2016; Mortgage Delinquencies See Strong Recovery from June Spike

• Prepayment activity jumped 26% from June to its highest level in nearly three years and 58% above this time last year as falling interest rates continue to fuel refinance incentiveAccording to Black Knight's First Look report for July, the percent of loans delinquent decreased 7.3% in July compared to June, and decreased 4.3% year-over-year.

• The national delinquency rate fell by 7% in July, offsetting the bulk of June’s calendar-related spike

• At 3.46%, July 2019’s delinquency rate is the lowest of any July on record (dating back to 2000)

• Both serious delinquencies (-11,000) and active foreclosure inventory (-1,000) fell as well

• Serious delinquencies (all loans 90 or more days delinquent but not in active foreclosure) fell below 445,000 for the first time since June 2006

The percent of loans in the foreclosure process decreased 0.5% in July and were down 13.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.46% in July, down from 3.73% in June.

The percent of loans in the foreclosure process decreased in July to 0.49% from 0.50% in June.

The number of delinquent properties, but not in foreclosure, is down 54,000 properties year-over-year, and the number of properties in the foreclosure process is down 35,000 properties year-over-year.

Note: The "spike" in delinquencies in June was due to timing and seasonal factors. No worries.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jul 2019 | Jun 2019 | Jul 2018 | Jul 2017 | |

| Delinquent | 3.46% | 3.73% | 3.61% | 3.90% |

| In Foreclosure | 0.49% | 0.50% | 0.57% | 0.87% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,807,000 | 1,950,000 | 1,861,000 | 1,986,000 |

| Number of properties in foreclosure pre-sale inventory: | 258,000 | 259,000 | 293,000 | 398,000 |

| Total Properties | 2,065,000 | 2,209,000 | 2,154,000 | 2,384,000 |

Weekly Initial Unemployment Claims decreased to 209,000

by Calculated Risk on 8/22/2019 08:34:00 AM

The DOL reported:

In the week ending August 17, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 220,000 to 221,000. The 4-week moving average was 214,500, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 213,750 to 214,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 214,500.

This was lower than the consensus forecast.

Wednesday, August 21, 2019

Thursday: Unemployment Claims

by Calculated Risk on 8/21/2019 07:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Pop Higher

Mortgage rates moved higher today, and it had nothing to do with any of the day's events or news headlines. Quite simply put, the bond market (which dictates the rates that can offered by lenders) had already begun to weaken as of yesterday afternoon. Weakness continued overnight as global financial markets dialed back their demand for safe havens. … Safe haven demand has been waxing and waning as the broader market settles in to a new range following the big shake-up in early August. Today was just another minor fluctuation in that regard, but the timing issue (bond market weakness yesterday afternoon followed by more this morning) made for a noticeable adjustment from mortgage lenders. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 220 thousand last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

FOMC Minutes: A Wide Range of Views

by Calculated Risk on 8/21/2019 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, July 30–31, 2019. A few excerpts:

In their discussion of monetary policy decisions at this meeting, those participants who favored a reduction in the target range for the federal funds rate pointed to three broad categories of reasons for supporting that action.

• First, while the overall outlook remained favorable, there had been signs of deceleration in economic activity in recent quarters, particularly in business fixed investment and manufacturing. A pronounced slowing in economic growth in overseas economies—perhaps related in part to developments in, and uncertainties surrounding, international trade—appeared to be an important factor in this deceleration. More generally, such developments were among those that had led most participants over recent quarters to revise down their estimates of the policy rate path that would be appropriate to promote maximum employment and stable prices.A couple of participants indicated that they would have preferred a 50 basis point cut in the federal funds rate at this meeting rather than a 25 basis point reduction. They favored a stronger action to better address the stubbornly low inflation rates of the past several years, recognizing that the apparent low sensitivity of inflation to levels of resource utilization meant that a notably stronger real economy might be required to speed the return of inflation to the Committee's inflation objective.

• Second, a policy easing at this meeting would be a prudent step from a risk-management perspective. Despite some encouraging signs over the intermeeting period, many of the risks and uncertainties surrounding the economic outlook that had been a source of concern in June had remained elevated, particularly those associated with the global economic outlook and international trade. On this point, a number of participants observed that policy authorities in many foreign countries had only limited policy space to support aggregate demand should the downside risks to global economic growth be realized.

• Third, there were concerns about the outlook for inflation. A number of participants observed that overall inflation had continued to run below the Committee's 2 percent objective, as had inflation for items other than food and energy. Several of these participants commented that the fact that wage pressures had remained only moderate despite the low unemployment rate could be a sign that the longer-run normal level of the unemployment rate is appreciably lower than often assumed. Participants discussed indicators for longer-term inflation expectations and inflation compensation. A number of them concluded that the modest increase in market-based measures of inflation compensation over the intermeeting period likely reflected market participants' expectation of more accommodative monetary policy in the near future; others observed that, while survey measures of inflation expectations were little changed from June, the level of expectations by at least some measures was low. Most participants judged that long-term inflation expectations either were already below the Committee's 2 percent goal or could decline below the level consistent with that goal should there be a continuation of the pattern of inflation coming in persistently below 2 percent.

Several participants favored maintaining the same target range at this meeting, judging that the real economy continued to be in a good place, bolstered by confident consumers, a strong job market, and a low rate of unemployment. These participants acknowledged that there were lingering risks and uncertainties about the global economy in general, and about international trade in particular, but they viewed those risks as having diminished over the intermeeting period. In addition, they viewed the news on inflation over the intermeeting period as consistent with their forecasts that inflation would move up to the Committee's 2 percent objective at an acceptable pace without an adjustment in policy at this meeting. Finally, a few participants expressed concerns that further monetary accommodation presented a risk to financial stability in certain sectors of the economy or that a reduction in the target range for the federal funds rate at this meeting could be misinterpreted as a negative signal about the state of the economy.

In their discussion of the outlook for monetary policy beyond this meeting, participants generally favored an approach in which policy would be guided by incoming information and its implications for the economic outlook and that avoided any appearance of following a preset course. Most participants viewed a proposed quarter-point policy easing at this meeting as part of a recalibration of the stance of policy, or mid-cycle adjustment, in response to the evolution of the economic outlook over recent months. A number of participants suggested that the nature of many of the risks they judged to be weighing on the economy, and the absence of clarity regarding when those risks might be resolved, highlighted the need for policymakers to remain flexible and focused on the implications of incoming data for the outlook.

emphasis added

AIA: "Architecture Billings Index Continues Its Streak of Soft Readings"

by Calculated Risk on 8/21/2019 01:19:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Continues Its Streak of Soft Readings

Demand for design services in July remained essentially flat in comparison to the previous month, according to a new report released today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 50.1 in July showed a small increase in design services since June, which was a score of 49.1. Any score above 50 indicates an increase in billings. In July, the design contracts score dipped into negative territory for the first time in almost a year. Additionally, July billings softened in all regions except the West, and at firms of all specializations except multifamily residential.

“The data is not the same as what we saw leading up to the last economic downturn but the continued, slowing across the board will undoubtedly impact architecture firms and the broader construction industry in the coming months,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “A growing number of architecture firms are reporting that the ongoing volatility in the trade situation, the stock market, and interest rates are causing some of their clients to proceed more cautiously on current projects.”

...

• Regional averages: West (51.2); Midwest (48.9); South (48.3); Northeast (48.3)

• Sector index breakdown: multi-family residential (50.6); institutional (49.8); commercial/industrial (49.2); mixed practice (48.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.1 in July, up from 49.1 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 10 of the previous 12 months, suggesting some further increase in CRE investment in 2019 - but this is the weakest five month stretch since 2012.

Comments on July Existing Home Sales

by Calculated Risk on 8/21/2019 10:53:00 AM

Earlier: NAR: Existing-Home Sales Increased to 5.42 million in July

A few key points:

1) Existing home sales were up 0.6% year-over-year (YoY) in July. This was the first YoY increase since early 2018.

2) Inventory is still low, and was down 1.6% year-over-year (YoY) in July.

3) As usual, housing economist Tom Lawler's forecast was closer (barely this month) to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in July. The consensus was for sales of 5.39 million SAAR. Lawler estimated the NAR would report 5.40 million SAAR in July, and the NAR actually reported 5.42 million SAAR.

4) Year-to-date sales are down about 2.9% compared to the same period in 2018. On an annual basis, that would put sales around 5.20 million in 2019. Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown.

The comparisons will be easier towards the end of this year, and with lower mortgage rates, sales might even finish the year unchanged or even up from 2018.

Sales NSA in July (540,000, red column) were above sales in July 2018 (528,000, NSA), and were the highest sales for July since 2015.

Employment: Preliminary annual benchmark revision shows downward adjustment of 501,000 jobs

by Calculated Risk on 8/21/2019 10:19:00 AM

The BLS released the preliminary annual benchmark revision showing 501,000 fewer payroll jobs as of March 2019. The final revision will be published when the January 2019 employment report is released in February 2020. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2020 with the publication of the January 2020 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2019 was 501,000 lower than originally estimated. In February 2020, the payroll numbers will be revised down to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2018).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For national CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus two-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2019 total nonfarm employment of -501,000 (-0.3 percent).

emphasis added

Construction was revised down by 9,000 jobs, and manufacturing revised down by 3,000 jobs.

This preliminary estimate showed 514,000 fewer private sector jobs, and 13,000 more government jobs (as of March 2019).

NAR: Existing-Home Sales Increased to 5.42 million in July

by Calculated Risk on 8/21/2019 10:11:00 AM

From the NAR: Existing-Home Sales Climb 2.5% in July

Existing-home sales strengthened in July, a positive reversal after total sales were down slightly in the previous month, according to the National Association of Realtors®. Although Northeast transactions declined, the other three major U.S. regions recorded sales increases, including vast growth in the West last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 2.5% from June to a seasonally adjusted annual rate of 5.42 million in July. Overall sales are up 0.6% from a year ago (5.39 million in July 2018).

...

Total housing inventory at the end of July decreased to 1.89 million, down from 1.92 million existing-homes available for sale in June, and a 1.6% decrease from 1.92 million one year ago. Unsold inventory is at a 4.2-month supply at the current sales pace, down from the 4.4 month-supply recorded in June and down from the 4.3-month supply recorded in July of 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.42 million SAAR) were up 2.5% from last month, and were 0.6% above the July 2018 sales rate.

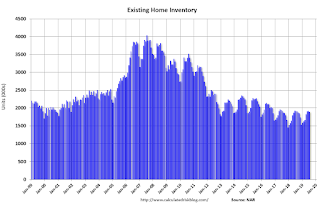

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.89 million in July from 1.92 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.89 million in July from 1.92 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 1.6% year-over-year in July compared to July 2018.

Inventory was down 1.6% year-over-year in July compared to July 2018. Months of supply decreased to 4.2 months in July.

This was at the consensus forecast. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later …