by Calculated Risk on 8/23/2019 11:58:00 AM

Friday, August 23, 2019

A few Comments on July New Home Sales

New home sales for July were reported at 635,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised up, combined.

Sales for June were revised up to a new cycle high.

Annual sales in 2019 should be the best year for new home sales since 2007.

Earlier: New Home Sales decreased to 635,000 Annual Rate in July, Sales in June revised up to New Cycle High.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Sales in July were up 4.3% year-over-year compared to July 2018.

Year-to-date (through July), sales are up 4.1% compared to the same period in 2018.

The second half comparisons will be easier, so sales should be higher in 2019 than in 2018.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Even though distressed sales are down significantly, following the bust, new home builders focused on more expensive homes - so the gap has only closed slowly.

I still expect this gap to close. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Q3 GDP Forecasts: Around 2%

by Calculated Risk on 8/23/2019 11:46:00 AM

From Merrill Lynch:

We continue to track 2.1% qoq saar for 3Q. 2Q GDP growth is likely to be revised modestly lower in the second release to 1.8% from the advance estimate of 2.1%. [Aug 23 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.8% for 2019:Q3. [Aug 23 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 2.2 percent on August 16, unchanged from August 15 after rounding. [Aug 16 estimate] (next update on Aug 26th)CR Note: These early estimates suggest real GDP growth will be around 2% annualized in Q3.

Fed Chair Powell: "Challenges for Monetary Policy"

by Calculated Risk on 8/23/2019 10:25:00 AM

From Fed Chair Powell: Challenges for Monetary Policy A few excerpts:

Through the FOMC's setting of the federal funds rate target range and our communications about the likely path forward for policy and the economy, we seek to influence broader financial conditions to promote maximum employment and price stability. In forming judgments about the appropriate stance of policy, the Committee digests a broad range of data and other information to assess the current state of the economy, the most likely outlook for the future, and meaningful risks to that outlook. Because the most important effects of monetary policy are felt with uncertain lags of a year or more, the Committee must attempt to look through what may be passing developments and focus on things that seem likely to affect the outlook over time or that pose a material risk of doing so. Risk management enters our decision making because of both the uncertainty about the effects of recent developments and the uncertainty we face regarding structural aspects of the economy, including the natural rate of unemployment and the neutral rate of interest. It will at times be appropriate for us to tilt policy one way or the other because of prominent risks. Finally, we have a responsibility to explain what we are doing and why we are doing it so the American people and their elected representatives in Congress can provide oversight and hold us accountable.

We have much experience in addressing typical macroeconomic developments under this framework. But fitting trade policy uncertainty into this framework is a new challenge. Setting trade policy is the business of Congress and the Administration, not that of the Fed. Our assignment is to use monetary policy to foster our statutory goals. In principle, anything that affects the outlook for employment and inflation could also affect the appropriate stance of monetary policy, and that could include uncertainty about trade policy. There are, however, no recent precedents to guide any policy response to the current situation. Moreover, while monetary policy is a powerful tool that works to support consumer spending, business investment, and public confidence, it cannot provide a settled rulebook for international trade. We can, however, try to look through what may be passing events, focus on how trade developments are affecting the outlook, and adjust policy to promote our objectives.

This approach is illustrated by the way incoming data have shaped the likely path of policy this year. The outlook for the U.S. economy since the start of the year has continued to be a favorable one. Business investment and manufacturing have weakened, but solid job growth and rising wages have been driving robust consumption and supporting moderate growth overall.

As the year has progressed, we have been monitoring three factors that are weighing on this favorable outlook: slowing global growth, trade policy uncertainty, and muted inflation. The global growth outlook has been deteriorating since the middle of last year. Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States. Inflation fell below our objective at the start of the year. It appears to be moving back up closer to our symmetric 2 percent objective, but there are concerns about a more prolonged shortfall.

Committee participants have generally reacted to these developments and the risks they pose by shifting down their projections of the appropriate federal funds rate path. Along with July's rate cut, the shifts in the anticipated path of policy have eased financial conditions and help explain why the outlook for inflation and employment remains largely favorable.

Turning to the current context, we are carefully watching developments as we assess their implications for the U.S. outlook and the path of monetary policy. The three weeks since our July FOMC meeting have been eventful, beginning with the announcement of new tariffs on imports from China. We have seen further evidence of a global slowdown, notably in Germany and China. Geopolitical events have been much in the news, including the growing possibility of a hard Brexit, rising tensions in Hong Kong, and the dissolution of the Italian government. Financial markets have reacted strongly to this complex, turbulent picture. Equity markets have been volatile. Long-term bond rates around the world have moved down sharply to near post-crisis lows. Meanwhile, the U.S. economy has continued to perform well overall, driven by consumer spending. Job creation has slowed from last year's pace but is still above overall labor force growth. Inflation seems to be moving up closer to 2 percent. Based on our assessment of the implications of these developments, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

emphasis added

New Home Sales decreased to 635,000 Annual Rate in July, Sales in June revised up to New Cycle High

by Calculated Risk on 8/23/2019 10:15:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 635 thousand.

The previous three months were revised up combined. June was revised up to a new cycle high.

"Sales of new single‐family houses in July 2019 were at a seasonally adjusted annual rate of 635,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.8 percent below the revised June rate of 728,000, but is 4.3 percent above the July 2018 estimate of 609,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in July to 6.4 months from 5.5 months in June.

The months of supply increased in July to 6.4 months from 5.5 months in June. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of July was 337,000. This represents a supply of 6.4 months at the current sales rate."

On inventory, according to the Census Bureau:

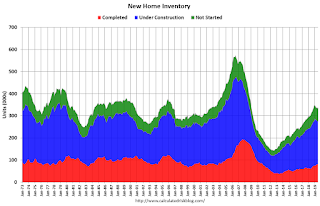

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2019 (red column), 53 thousand new homes were sold (NSA). Last year, 52 thousand homes were sold in July.

The all time high for July was 117 thousand in 2005, and the all time low for July was 26 thousand in 2010.

This was slightly below expectations of 645 thousand sales SAAR, however sales in the three previous months were revised up, combined. I'll have more later today.

Thursday, August 22, 2019

Friday: New Home Sales, Fed Chair Powell

by Calculated Risk on 8/22/2019 06:18:00 PM

Friday:

• At 10:00 AM ET, New Home Sales for July from the Census Bureau. The consensus is for 645 thousand SAAR, down from 646 thousand in June.

• Also at 10:00 AM, Speech, Fed Chair Jerome Powell, Challenges for Monetary Policy, At the Jackson Hole Economic Policy Symposium: Challenges for Monetary Policy, Jackson Hole, Wyo.

Philly Fed: State Coincident Indexes increased in 37 states in July

by Calculated Risk on 8/22/2019 02:36:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2019. Over the past three months, the indexes increased in 44 states, decreased in four states, and remained stable in two, for a three-month diffusion index of 80. In the past month, the indexes increased in 37 states, decreased in nine states, and remained stable in four, for a one-month diffusion index of 56.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some grey and red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In July, 37 states had increasing activity (graph includes minor increases).

Kansas City Fed: "Tenth District Manufacturing Declined in August"

by Calculated Risk on 8/22/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Declined in August

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in August, while expectations for future activity edged higher.Another weak report.

“Regional factory activity had its largest monthly drop in over three years, and over 55 percent of firms expect negative impacts from the latest round of U.S. tariffs on Chinese goods,” said Wilkerson. “However, even though many firms expect trade tensions to persist, expectations for future shipments and exports expanded slightly.”

...

The month-over-month composite index was -6 in August, down from -1 in July and 0 in June, and the lowest reading since March 2016. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The drop in manufacturing activity was driven by declines at both durable and nondurable plants, but especially from decreases in primary metal, electrical equipment, appliances, paper, printing, and chemical manufacturing. Most month-over-month indexes decreased in August, and the shipments and supplier delivery time indexes also turned negative. All of the year-over-year factory indexes decreased in August, and the composite index fell from 11 to -1. On the other hand, the future composite index edged higher from 9 to 11, as expectations for shipments, order backlog, employment, and new orders for exports grew slightly.

emphasis added

Black Knight: "Mortgage Delinquencies See Strong Recovery from June Spike"

by Calculated Risk on 8/22/2019 09:30:00 AM

From Black Knight: Black Knight’s First Look: July Prepayment Activity Hits Highest Level Since 2016; Mortgage Delinquencies See Strong Recovery from June Spike

• Prepayment activity jumped 26% from June to its highest level in nearly three years and 58% above this time last year as falling interest rates continue to fuel refinance incentiveAccording to Black Knight's First Look report for July, the percent of loans delinquent decreased 7.3% in July compared to June, and decreased 4.3% year-over-year.

• The national delinquency rate fell by 7% in July, offsetting the bulk of June’s calendar-related spike

• At 3.46%, July 2019’s delinquency rate is the lowest of any July on record (dating back to 2000)

• Both serious delinquencies (-11,000) and active foreclosure inventory (-1,000) fell as well

• Serious delinquencies (all loans 90 or more days delinquent but not in active foreclosure) fell below 445,000 for the first time since June 2006

The percent of loans in the foreclosure process decreased 0.5% in July and were down 13.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.46% in July, down from 3.73% in June.

The percent of loans in the foreclosure process decreased in July to 0.49% from 0.50% in June.

The number of delinquent properties, but not in foreclosure, is down 54,000 properties year-over-year, and the number of properties in the foreclosure process is down 35,000 properties year-over-year.

Note: The "spike" in delinquencies in June was due to timing and seasonal factors. No worries.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jul 2019 | Jun 2019 | Jul 2018 | Jul 2017 | |

| Delinquent | 3.46% | 3.73% | 3.61% | 3.90% |

| In Foreclosure | 0.49% | 0.50% | 0.57% | 0.87% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,807,000 | 1,950,000 | 1,861,000 | 1,986,000 |

| Number of properties in foreclosure pre-sale inventory: | 258,000 | 259,000 | 293,000 | 398,000 |

| Total Properties | 2,065,000 | 2,209,000 | 2,154,000 | 2,384,000 |

Weekly Initial Unemployment Claims decreased to 209,000

by Calculated Risk on 8/22/2019 08:34:00 AM

The DOL reported:

In the week ending August 17, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 220,000 to 221,000. The 4-week moving average was 214,500, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 213,750 to 214,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 214,500.

This was lower than the consensus forecast.

Wednesday, August 21, 2019

Thursday: Unemployment Claims

by Calculated Risk on 8/21/2019 07:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Pop Higher

Mortgage rates moved higher today, and it had nothing to do with any of the day's events or news headlines. Quite simply put, the bond market (which dictates the rates that can offered by lenders) had already begun to weaken as of yesterday afternoon. Weakness continued overnight as global financial markets dialed back their demand for safe havens. … Safe haven demand has been waxing and waning as the broader market settles in to a new range following the big shake-up in early August. Today was just another minor fluctuation in that regard, but the timing issue (bond market weakness yesterday afternoon followed by more this morning) made for a noticeable adjustment from mortgage lenders. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 220 thousand last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.