by Calculated Risk on 8/27/2019 09:10:00 AM

Tuesday, August 27, 2019

Case-Shiller: National House Price Index increased 3.1% year-over-year in June

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Phoenix Replaces Las Vegas as Top City in Annual Gains According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.1% annual gain in June, down from 3.3% in the previous month. The 10-City Composite annual increase came in at 1.8%, down from 2.2% in the previous month. The 20-City Composite posted a 2.1% year-over-year gain, down from 2.4% in the previous month.

Phoenix, Las Vegas and Tampa reported the highest year-over-year gains among the 20 cities. In June, Phoenix led the way with a 5.8% year-over-year price increase, followed by Las Vegas with a 5.5% increase, and Tampa with a 4.7% increase. Six of the 20 cities reported greater price increases in the year ending June 2019 versus the year ending May 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.6% in June. The 10-City Composite posted a 0.2% increase and the 20-City Composite reported a 0.3% increase for the month. After seasonal adjustment, the National Index recorded a 0.2% month-over-month increase in June. The 10-City and the 20-City Composites did not report any gains. In June, 19 of 20 cities reported increases before seasonal adjustment, while 17 of 20 cities reported increases after seasonal adjustment.

“Home price gains continue to trend down, but may be leveling off to a sustainable level,” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “The average YOY gain declined to 3.0% in June, down from 3.1% the prior month. However, fewer cities (12) experienced lower YOY price gains than in May (13).

“The southwest (Phoenix and Las Vegas) remains the regional leader in home price gains, followed by the southeast (Tampa and Charlotte). With three of the bottom five cities (Seattle, San Francisco, and San Diego), much of the west coast is challenged to sustain YOY gains. For the second month in a row, however, only Seattle experienced outright decline with YOY price change of -1.3%. The U.S. National Home Price NSA Index YOY price change in June 2019 of 3.1% is exactly half of what it was in June 2018. While housing has clearly cooled off from 2018, home price gains in most cities remain positive in low single digits. Therefore, it is likely that current rates of change will generally be sustained barring an economic downturn.”

emphasis added

Click on graph for larger image.

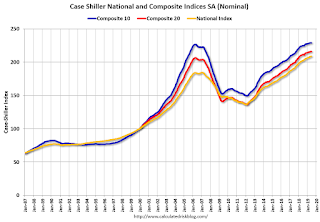

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.0% from the bubble peak, and down slightly in June (SA) from May.

The Composite 20 index is 4.5% above the bubble peak, and up slightly (SA) in June.

The National index is 13.2% above the bubble peak (SA), and up 0.2% (SA) in June. The National index is up 53.1% from the post-bubble low set in December 2011 (SA).

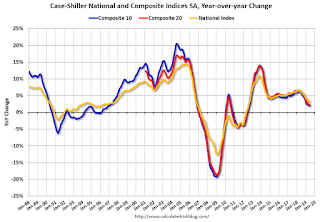

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 1.9% compared to June 2018. The Composite 20 SA is up 2.2% year-over-year.

The National index SA is up 3.1% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, August 26, 2019

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 8/26/2019 07:38:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Mixed Versus Friday, Depending on Lender

Mortgage rates are sort of all over the place at the moment, and almost never where you'd expect. Those who haven't been following the bond market too closely generally expect higher rates than what we've been seeing recently. Those who are well-versed in the longstanding relationship between mortgages and Treasury yields generally expect rates to have fallen MUCH faster than they actually have.Tuesday:

…

All of the above having been said, the average lender is still very close to the lowest levels in 3 years. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]

emphasis added

• At 9:00 AM, S&P/Case-Shiller House Price Index for June. The consensus is for a 2.3% year-over-year increase in the Comp 20 index for June.

• Also at 9:00 AM, FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

Freddie Mac: Mortgage Serious Delinquency Rate declined in July

by Calculated Risk on 8/26/2019 04:35:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 0.61%, down from 0.63% in June. Freddie's rate is down from 0.78% in July 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since November 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for July soon.

Merrill and Goldman on Housing

by Calculated Risk on 8/26/2019 01:03:00 PM

A few excerpts from two research pieces on housing.

From Merrill Lynch: Housing: something for everyone What comes next?

[W]e are making some tweaks to the housing forecast. Housing starts are likely to edge down this year to 1.24mn but recover next year. Existing home sales should also come in lower this year at 5.30 million and hold around this pace in 2020. The story for new home sales is a bit better with 650k this year and 660k next. In other words, further sideways motion for housing activity, leaving it a benign factor for the overall economy.From Goldman Sachs: Can Lower Rates Still Boost Housing?

[O]ur estimate of the lag time between changes in interest rates and housing activity suggests the bulk of the boost is yet to come. ... we update our outlook for the growth boost from housing via both the homebuilding channel and the impact of refinancing, mortgage equity withdrawal, and housing wealth effects on consumer spending. Our model points to a healthy rebound to a 4% growth pace of residential investment in 2019H2 and an increase in the total contribution from housing to GDP growth from -0.05pp in H1 to +0.15pp in H2.CR Notes: This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Click on graph for larger image.

Click on graph for larger image.Year-to-date, starts are down 3.1% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year were the most difficult.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it is possible starts will be unchanged or up slightly in 2019 compared to 2018.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).Year-to-date (through July), sales are up 4.1% compared to the same period in 2018.

The second half comparisons will be easier, so sales should be higher in 2019 than in 2018.

So my view is housing will be a positive for the economy in the 2nd half of 2019.

Dallas Fed: "Texas Manufacturing Expansion Picks Up Pace"

by Calculated Risk on 8/26/2019 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Picks Up Pace

Texas factory activity expanded at a faster clip in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, shot up nine points to 17.9, its highest reading in nearly a year.Some improvement, but another weak regional report.

Other measures of manufacturing activity also suggested faster expansion in August. The shipments index rose seven points to 17.6, and the capacity utilization index rose five points to 15.7, both reaching 11-month highs. The new orders index moved up from 5.5 to 9.3, while the growth rate of orders index was largely unchanged at 1.8.

Perceptions of broader business conditions improved in August. The general business activity index pushed into positive territory for the first time in four months, rising nine points to 2.7. Similarly, the company outlook index rose to 5.0 following three months in negative territory. However, the index measuring uncertainty regarding companies’ outlooks jumped nine points to 18.6, a reading well above average.

Labor market measures suggested slower growth in employment and work hours in August. The employment index remained positive but retreated 11 points to 5.5, a level closer to average. Eighteen percent of firms noted net hiring, while 12 percent noted net layoffs. The hours worked index edged down to 4.0.

emphasis added

Chicago Fed "Index points to slower economic growth in July"

by Calculated Risk on 8/26/2019 08:44:00 AM

From the Chicago Fed: Index points to slower economic growth in July

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.36 in July from +0.03 in June. All four broad categories of indicators that make up the index decreased from June, and all four categories made negative contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved up to –0.14 in July from –0.30 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 25, 2019

Sunday Night Futures

by Calculated Risk on 8/25/2019 08:48:00 PM

Weekend:

• Schedule for Week of August 25, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

• Also at 8:30 AM, Durable Goods Orders for July from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 14 and DOW futures are down 143 (fair value).

Oil prices were up over the last week with WTI futures at $53.22 per barrel and Brent at $58.53 barrel. A year ago, WTI was at $70, and Brent was at $74 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.58 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down 25 cents year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 8/25/2019 12:52:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 17 August

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 11-17 August 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 August 2018, the industry recorded the following:

• Occupancy: -1.0% to 71.7%

• Average daily rate (ADR): +0.4% to US$130.89

• Revenue per available room (RevPAR): -0.6% at US$93.90

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years - but has been a little soft YoY in recent weeks.

Seasonally, the occupancy rate will now start to decline as the peak summer travel season ends.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, August 24, 2019

Schedule for Week of August 25, 2019

by Calculated Risk on 8/24/2019 08:11:00 AM

The key report this week is second estimate of Q2 GDP.

Other key reports include Personal Income and Outlays for July and Case-Shiller house prices for June.

For manufacturing, the August Richmond and Dallas Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August.

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.3% year-over-year increase in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 2nd quarter 2019 (second estimate). The consensus is that real GDP increased 2.0% annualized in Q2, down from the advance estimate of 2.1% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 209 thousand last week.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.3% decrease in the index.

8:30 AM ET: Personal Income and Outlays, July 2019. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 92.3.

Friday, August 23, 2019

Lawler: Updated “Demographic” Outlook Using Recent Population Estimates by Age

by Calculated Risk on 8/23/2019 04:00:00 PM

From housing economist Tom Lawler: Updated “Demographic” Outlook Using Recent Population Estimates by Age

Executive Summary: Analysts who use intermediate or long term population projections to forecast key economic variables such as labor force growth, household growth, etc. should recognize that the latest official Census intermediate and long term population projections (produced in 2017 and referred to as “Census 2017”) are out of date. Specifically, Census 2017 materially over-predicted births, materially under-predicted deaths (mainly for non-elderly adults), and somewhat over-predicted net international migration (NIM) for each of the last several years. In addition, the assumptions in Census 2017 projections over the next several years (and more) are almost certainly too high for births, too low for deaths, and too high for NIM. As a result, population growth, household growth, and labor force growth over the next few years will be lower than forecasts based on the Census 2017 population projections. How much lower depends critically on net international migration, which in the current environment is a big unknown.

Using more realistic assumptions on births and deaths by age, I have developed updated population projections by age through 2021 assuming (1) net international migration in each year is the same as in 2018; and (2) there is no international migration in 2020 or 2021. I did the latter scenario to highlight the importance of net international migration assumptions on population projections.

--------------------------------------------------------------------------------------------

Earlier this year the Census Bureau released its latest (“Vintage 2018) estimates of the US resident population by single year of age for July 1, 2018, as well as for July of each of the previous 8 years. These latest estimates give analysts a new starting point that can be used to update population projections by age using assumptions about births, deaths by age, and net international migration by age. These population projections are key inputs into forecasts of other key economic variables such as the labor force and US households.

While many analysts prefer to use “official” Census population projections in forecasting other key economic variables, there are several reasons why this is often not a good idea. First, official Census population projections are only released every couple of years, and may be out of date. And second, such projections may have assumptions about the key drivers of population growth that may not be viewed as “reasonable.”

The latest official Census population projections were done in late 2017 and released to the public in early 2018. The “starting point” for these projections was the “Vintage 2016” population estimates, and population estimates for 2016 have since been revised. In addition, current estimates of births, deaths, and net international migration from 2016 to 2018 are significantly different from the “Census 2017” projections. And finally, the assumptions in the “Census 2017” projections for the key drivers of population changes, especially death rates by age, are not realistic or consistent with recent actual death rates by age.

The latest estimate of the US resident population on July 1, 2018 was 327,167,434, which is 724,477 lower than the Census 2017 projection for that date. Fewer births, more deaths, and lower international migration all contributed to the projection shortfall. Below is a table showing the differences between the latest July 1 2018 population estimate and the July 1, 2018 forecast from the Census 2017 projection by key component.

| Census 2017 Projections | Vintage 2018 Estimates | Difference | |

|---|---|---|---|

| 7/1/2016 | 323,127,513 | 323,071,342 | (56,171) |

| Births: 7/1/2016 - 6/30/2018 | 8,129,169 | 7,757,482 | (371,687) |

| Deaths: 7/1/2016 - 6/30/2018 | 5,363,099 | 5,593,449 | 230,350 |

| Net Int'l Migration: 7/1/2016 - 6/30/2018 | 1,998,328 | 1,932,059 | (66,269) |

| 7/1/2018 | 327,891,911 | 327,167,434 | (724,477) |

Births from 7/1/2016 to 6/30/2018 were significantly below projected levels from Census 2017. In addition, the National Center for Health Statistics (NCHS) recently estimated that US births in 2018 (calendar year) totaled just 3,788,235, the lowest annual number of births in 32 years, and a whopping 306,730 below the Census 2017 projection for the 12 month period ending June 2019.

Deaths from 7/1/2016 to 6/30/2018 were significantly above projected levels from Census 2017. While the Census Bureau did not release estimates of deaths (or net international migration) by age in its “Vintage 2018” release, Census does use data from the NCHS on deaths by age, and these data indicate that most of the higher than projected deaths from Census 2017 were in the 20-74 year old age groups.

The Census 2017 population projections were based on a dated “death rate” table, as well as on projections that death rates for most age groups would decline each year. In fact, however, death rates for many age groups have increased over the past few years. The assumptions on deaths from Census 2017 over the next several years are almost certainly way too low, especially for the 20-74 year old age groups.

Finally the latest Census estimates of net international migration (NIM) from 7/1/2016 to 6/30/2018 are somewhat below the Census 2017 projections. Moreover, updated estimates for NIM (which are, unfortunately, subject to considerable error) suggest a materially different age distribution than that assumed in the Census 2017 projections.

Below is a table comparing the latest Census estimates of the US resident population for 2018 with the projections from Census 2017 for 2018 by 5-year ago groups.

| US Resident Population, 7/1/2018 | |||

|---|---|---|---|

| Vintage 2018 Estimate | Census 2017 Projection | Difference | |

| Total | 327,167,434 | 327,891,911 | -724,477 |

| 0-4 | 19,810,275 | 20,172,617 | -362,342 |

| 5-9 | 20,195,642 | 20,166,270 | 29,372 |

| 10-14 | 20,879,527 | 20,866,300 | 13,227 |

| 15-19 | 21,097,221 | 21,084,451 | 12,770 |

| 20-24 | 21,873,579 | 21,966,919 | -93,340 |

| 25-29 | 23,561,756 | 23,601,976 | -40,220 |

| 30-34 | 22,136,018 | 22,125,395 | 10,623 |

| 35-39 | 21,563,587 | 21,556,772 | 6,815 |

| 40-44 | 19,714,301 | 19,728,816 | -14,515 |

| 45-49 | 20,747,135 | 20,786,395 | -39,260 |

| 50-54 | 20,884,564 | 20,923,227 | -38,663 |

| 55-59 | 21,940,985 | 22,012,901 | -71,916 |

| 60-64 | 20,331,651 | 20,408,221 | -76,570 |

| 65-69 | 17,086,893 | 17,127,778 | -40,885 |

| 70-74 | 13,405,423 | 13,418,850 | -13,427 |

| 75-79 | 9,267,066 | 9,274,592 | -7,526 |

| 80-84 | 6,127,308 | 6,131,125 | -3,817 |

| 85+ | 6,544,503 | 6,539,306 | 5,197 |

As the table shows, there are significant differences between the “Vintage 2018” population estimates and the projections from Census 2017, not just in the total but also in the age distribution.

In “Vintage 2018” Census also provided updated population projections for 2019, which are used (among other things) as “controls” for the household employment estimates for 2019. Below is a table comparing the Vintage 2018 population projections for 2019 with the Census 2017 projections for 2019.

| Resident Population Projections for 7/1/2019 | |||

|---|---|---|---|

| Vintage 2018 | Census 2017 | Difference | |

| Total | 329,158,518 | 330,268,840 | -1,110,322 |

| 0-4 | 19,702,853 | 20,304,120 | -601,267 |

| 5-9 | 20,222,613 | 20,180,503 | 42,110 |

| 10-14 | 20,829,999 | 20,814,198 | 15,801 |

| 15-19 | 21,114,493 | 21,100,800 | 13,693 |

| 20-24 | 21,744,207 | 21,861,558 | -117,351 |

| 25-29 | 23,612,082 | 23,693,302 | -81,220 |

| 30-34 | 22,510,095 | 22,522,671 | -12,576 |

| 35-39 | 21,798,813 | 21,798,185 | 628 |

| 40-44 | 19,979,623 | 20,003,487 | -23,864 |

| 45-49 | 20,443,042 | 20,491,118 | -48,076 |

| 50-54 | 20,515,438 | 20,559,577 | -44,139 |

| 55-59 | 21,912,472 | 22,001,226 | -88,754 |

| 60-64 | 20,608,057 | 20,712,610 | -104,553 |

| 65-69 | 17,487,028 | 17,543,604 | -56,576 |

| 70-74 | 14,060,332 | 14,076,777 | -16,445 |

| 75-79 | 9,678,247 | 9,685,598 | -7,351 |

| 80-84 | 6,327,181 | 6,329,092 | -1,911 |

| 85+ | 6,611,943 | 6,590,414 | 21,529 |

(Note: The Vintage 2018 projection for 2019 appears to have assumed the same number as births as for 2018, though recent data suggest that births were lower.)

If analysts had used the Census 2017 population projections to forecast the US labor force and the number of US households, and had been accurate in their forecasts of labor force participation rates and headship rates, they would have over-predicted the size of the labor force in mid-2019 by about 400,000, and over-predicted the number of households in mid-2019 by about 260,000.

Obviously, Census 2017 population projections have not tracked recent estimates and projections very well. In addition, Census 2017 assumptions for births, deaths, and net international migration are likely to be considerable off from likely “actuals” for the years ahead.

For analysts who use intermediate and long term population projections to forecast other key economic or social variables such as household growth, labor force growth, social security/medicare enrollment/payments, college enrollment, etc., it seems clear that it would not be appropriate to use the Census 2017 population projections. However, these are the latest “official” projections that have been released, and many analysts prefer to use “official” projections. Moreover, formulating one’s own population projections by age requires one to make assumptions not just on total births, deaths, and NIM, but also deaths and NIM by single year of age, and there aren’t timely publicly-released data on either of the latter.

To help some of these analysts, I have, using some unpublished data on recent trends, produced US resident population projections through 2021 using the following assumptions:

1. Annual births from 2019 through 2021 are the same as those in calendar year 2018 (3,788,235);

2. Deaths rates by age are similar to those in 2018 (though somewhat lower for age groups that saw a sizable increase over the last few years); and

3. Net International Migration by age is the same each year as the Census estimates for 2018.

Note that the biggest “wild card” in assumptions is NIM; not only are recent estimates subject to much higher uncertainty than the other two key drivers of population growth, but it is also virtually impossible in the current political environment to make a reasonable projection for NIM. For example, recent actions by the Administration set to take effect in mid-October would, if implemented, have a significantly negative impact on immigration over the next few years.

I also have produced population projections by age assuming no international migration (this is not necessarily the same as no immigration, as a lot of people leave the country for abroad each year). I did this to highlight the importance of NIM on the outlook for the population.

Note that I did not use the Vintage 2018 projections for 2019, but instead used the assumptions discussed above.

These alternative projections are shown on the next page for select age groups.

| US Resident Population: Alternative Projections | ||||

|---|---|---|---|---|

| Census 2017 Projections | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | 327,891,911 | 330,268,840 | 332,639,102 | 334,998,398 |

| 0-14 | 61,205,187 | 61,298,821 | 61,408,926 | 61,510,603 |

| 15-24 | 43,051,370 | 42,962,358 | 42,937,831 | 43,004,867 |

| 25-34 | 45,727,371 | 46,215,973 | 46,491,403 | 46,716,390 |

| 35-44 | 41,285,588 | 41,801,672 | 42,351,795 | 43,006,437 |

| 45-54 | 41,709,622 | 41,050,695 | 40,615,037 | 40,324,022 |

| 55-64 | 42,421,122 | 42,713,836 | 42,782,544 | 42,593,657 |

| 65-74 | 30,546,628 | 31,620,381 | 32,789,437 | 33,953,050 |

| 75+ | 21,945,023 | 22,605,104 | 23,262,129 | 23,889,372 |

| Flat Births, More Realistic Death Rates, Flat NIM | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | 327,167,434 | 329,072,705 | 330,917,403 | 332,700,753 |

| 0-14 | 60,885,444 | 60,698,571 | 60,507,167 | 60,290,588 |

| 15-24 | 42,970,800 | 42,861,557 | 42,822,738 | 42,882,730 |

| 25-34 | 45,697,774 | 46,128,836 | 46,337,496 | 46,484,660 |

| 35-44 | 41,277,888 | 41,786,370 | 42,323,937 | 42,961,919 |

| 45-54 | 41,631,699 | 40,958,397 | 40,507,001 | 40,198,337 |

| 55-64 | 42,272,636 | 42,516,252 | 42,534,068 | 42,293,993 |

| 65-74 | 30,492,316 | 31,537,868 | 32,667,883 | 33,780,930 |

| 75+ | 21,938,877 | 22,584,854 | 23,217,113 | 23,807,596 |

| Flat Births, More Realistic Death Rates, No International Migration | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | 327,167,434 | 329,072,705 | 329,940,031 | 330,747,524 |

| 0-14 | 60,885,444 | 60,698,571 | 60,284,355 | 59,860,569 |

| 15-24 | 42,970,800 | 42,861,557 | 42,537,458 | 42,330,317 |

| 25-34 | 45,697,774 | 46,128,836 | 46,069,155 | 45,934,117 |

| 35-44 | 41,277,888 | 41,786,370 | 42,209,180 | 42,720,399 |

| 45-54 | 41,631,699 | 40,958,397 | 40,468,714 | 40,117,461 |

| 55-64 | 42,272,636 | 42,516,252 | 42,507,588 | 42,241,276 |

| 65-74 | 30,492,316 | 31,537,868 | 32,649,225 | 33,742,244 |

| 75+ | 21,938,877 | 22,584,854 | 23,214,356 | 23,801,141 |

Below are tables showing the differences between the latter two scenarios and the Census 2017 population projections.

| Alternate Population Projections vs. Census 2017 Projections | ||||

|---|---|---|---|---|

| Flat Births, More Realistic Death Rates, Flat NIM | ||||

| Total | -724,477 | -1,196,135 | -1,721,699 | -2,297,645 |

| 0-14 | -319,743 | -600,250 | -901,759 | -1,220,015 |

| 15-24 | -80,570 | -100,801 | -115,093 | -122,137 |

| 25-34 | -29,597 | -87,137 | -153,907 | -231,730 |

| 35-44 | -7,700 | -15,302 | -27,858 | -44,518 |

| 45-54 | -77,923 | -92,298 | -108,036 | -125,685 |

| 55-64 | -148,486 | -197,584 | -248,476 | -299,664 |

| 65-74 | -54,312 | -82,513 | -121,554 | -172,120 |

| 75+ | -6,146 | -20,250 | -45,016 | -81,776 |

| Flat Births, More Realistic Death Rates, No International Migration | ||||

| 7/1/2018 | 7/1/2019 | 7/1/2020 | 7/1/2021 | |

| Total | -724,477 | -1,196,135 | -2,699,071 | -4,250,874 |

| 0-14 | -319,743 | -600,250 | -1,124,571 | -1,650,034 |

| 15-24 | -80,570 | -100,801 | -400,373 | -674,550 |

| 25-34 | -29,597 | -87,137 | -422,248 | -782,273 |

| 35-44 | -7,700 | -15,302 | -142,615 | -286,038 |

| 45-54 | -77,923 | -92,298 | -146,323 | -206,561 |

| 55-64 | -148,486 | -197,584 | -274,956 | -352,381 |

| 65-74 | -54,312 | -82,513 | -140,212 | -210,806 |

| 75+ | -6,146 | -20,250 | -47,773 | -88,231 |

Obviously, the outlook for population growth, labor force growth, household formations, and other economic variables over the next few years depends critically on one’s assumptions about net international migration. The “flat births/flat NIM” scenario is probably a “high” forecast, given, recent Trump administration actions/policies, while the “no international migration” scenario is more designed to show what population growth would look like without international migration. In the “flat births/flat NIM” scenarios growth in the labor force over the next two years would be about 0.1% lower per year than forecasts based on Census 2017, while household growth would be about 120,000 lower per year. In the no international migration scenario labor force growth over the next two years would be 0.4% lower per year, and household growth would be about 370,000 per year lower per year, than Census 2017-based forecasts.