by Calculated Risk on 8/29/2019 08:52:00 AM

Thursday, August 29, 2019

Q2 GDP Revised Down to 2.0% Annual Rate

From the BEA: Gross Domestic Product, Second Quarter 2019 (Second Estimate); Corporate Profits, Second Quarter 2019 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the second quarter of 2019, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 3.1 percent.PCE growth was revised up from 4.3% to 4.7%. Residential investment was revised down from -1.5% to -2.9%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.1 percent. The revision primarily reflected downward revisions to state and local government spending, exports, private inventory investment, and residential investment that were partly offset by an upward revision to personal consumption expenditures (PCE). Imports which are a subtraction in the calculation of GDP, were unrevised.

emphasis added

Here is a Comparison of Second and Advance Estimates.

Wednesday, August 28, 2019

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 8/28/2019 07:25:00 PM

Thursday:

• At 8:30 AM: Gross Domestic Product, 2nd quarter 2019 (second estimate). The consensus is that real GDP increased 2.0% annualized in Q2, down from the advance estimate of 2.1% in Q2.

• Also at 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 209 thousand last week.

• At 10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.3% decrease in the index.

Black Knight on "Tappable Equity"

by Calculated Risk on 8/28/2019 04:23:00 PM

Here are some comments and two graphs from Black Knight on tappable equity.

Tappable equity grew by >$335B in Q2 2019

• Tappable equity growth had been slowing in recent quarters due to rising interest rates and slowing home price growth

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the Black Knight's estimate of "tappable equity".

• However, its Q2 growth rate was slightly above Q1’s (+4.2% vs. 3%)

• A total of $6.3T in tappable equity is now held by 45M U.S. mortgage holders

• That’s the highest volume ever recorded, and 26% above the mid-2006 peak of $5T

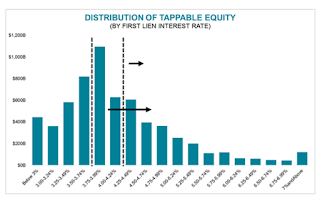

This graph from Black Knight shows the distribution of "tappable equity" by first lien mortgage rate.

This graph from Black Knight shows the distribution of "tappable equity" by first lien mortgage rate.• Nearly half (49%) of the 45M homeowners with tappable equity have 1st lien interest rates ≥4.25%, making refi an attractive option (most also fall into the population of refinance candidates we’ve been tracking)CR Note: A pickup in cash out refinancing could give a small boost to the economy.

• 76% have rates at or above 3.75% – these folks could potentially tap into home equity with little change to their existing 30-year rate, or perhaps even a slight improvement

Zillow Case-Shiller Forecast: Lower YoY Price Gains in July compared to June

by Calculated Risk on 8/28/2019 01:09:00 PM

The Case-Shiller house price indexes for June were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: June Case-Shiller Results and July Forecast: Phoenix Posts Largest YoY Gains

Annual home price gains continued their gradual slowdown in June, although the pace of those declines has slowed from earlier this year. While prices are still climbing, the rate of annual appreciation appears to have leveled off near its long-term average, after consistently falling from a high point reached in the spring of last year.

…

Housing demand remains strong as buyers are encouraged by rising wages and by mortgage rates that just keep falling amid growing economic uncertainty. Would-be buyers stand with pre-approved mortgages in hand. However, they’ve become unwilling to pay escalating prices for the relatively low inventory of homes that are on the market and instead are making sellers wait and even drop list prices.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 2.9% in July, down from 3.1% in June.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 2.9% in July, down from 3.1% in June. The Zillow forecast is for the 20-City index to decline to 1.9% YoY in July from 2.1% in June, and for the 10-City index to decline to 1.6% YoY compared to 1.8% YoY in June.

Real House Prices and Price-to-Rent Ratio in June

by Calculated Risk on 8/28/2019 09:08:00 AM

Here is the post yesterday on Case-Shiller: Case-Shiller: National House Price Index increased 3.1% year-over-year in June

It has been over eleven years since the bubble peak. In the Case-Shiller release last week, the seasonally adjusted National Index (SA), was reported as being 13.2% above the previous bubble peak. However, in real terms, the National index (SA) is still about 7.6% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.6% below the bubble peak.

The year-over-year increase in prices has slowed to 3.1% nationally, and I expect price growth might slow a little more, but not turn negative this year.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $287,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to February 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways to down recently.

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 8/28/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 23, 2019.

... The Refinance Index decreased 8 percent from the previous week and was 167 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

“U.S. Treasury yields were volatile over the course of the week, as the ongoing trade dispute between the U.S. and China continued to generate uncertainty among investors. Rates increased for the first time since the week of July 12, but were still 80 basis points lower than the beginning of the year,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With rates edging higher, refinances and purchase applications fell, at 8 percent and 6 percent, respectively.”

Added Kan, “Purchase applications were still up around 2 percent year-over-year last week, but the drop in rates this summer have not yet led to a significant boost in activity. Uncertainty over the near-term economic outlook and low supply continue to be the predominant headwinds for prospective homebuyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 3.94 percent from 3.90 percent, with points increasing to 0.38 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to under 4%.

With lower rates, we saw a recent sharp increase in refinance activity.

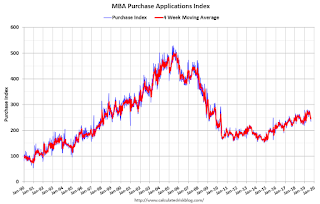

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.

Tuesday, August 27, 2019

2020 Economic Forecast featuring the UCI Paul Merage School of Business

by Calculated Risk on 8/27/2019 09:40:00 PM

On October 23rd, I will be one of three speakers at the "2020 Economic Forecast featuring the UCI Paul Merage School of Business" in Newport Beach, California, sponsored by the Newport Beach Chamber of Commerce.

UCI Finance Professor Christopher Schwarz and I will be discussing the 2020 economic outlook, and Dr. Richard Afable will be discussing "The Future of the Healthcare System".

This is a lunch time event (from 11:15 am to 1:30 pm) at the Balboa Bay Resort.

Click here for more information and tickets. Tickets are $65 for members, and $75 for non-members and includes lunch. (I'm speaking for free).

Or click on the banner below.

"Chemical Activity Barometer Down in August"

by Calculated Risk on 8/27/2019 02:04:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Down in August

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), fell 0.1 percent in August on a three-month moving average (3MMA) basis following a similar drop in July and four months of gains. On a year-over-year (Y/Y) basis, the barometer was flat at 0.0 percent (3MMA).

The unadjusted measure of the CAB fell 0.5 percent in August after a 0.1 percent gain in July. The diffusion index was 59 percent in August. The diffusion index marks the number of positive contributors relative to the total number of indicators monitored. The CAB reading for July was revised upward by 0.58 points and that for June by 0.62 points.

“A pattern of fluctuating CAB readings – months up followed by months down – indicates late-cycle activity,” said Kevin Swift, chief economist at ACC. “The barometer signals gains in U.S. commerce into early 2020, but at a slow pace, while rising volatility suggests change may be coming.”

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year change in the CAB suggests that the YoY increase in industrial production will probably slow further.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/27/2019 12:34:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through June 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Richmond Fed: "Manufacturing Activity Was Moderate in August"

by Calculated Risk on 8/27/2019 10:10:00 AM

From the Richmond Fed: Manufacturing Activity Was Moderate in August

Fifth District manufacturing activity was moderate in August, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite index rose from −12 in July to 1 in August, buoyed by increases in the indexes for shipments and new orders. However, the third component, employment, fell.This was the last of the regional Fed surveys for August.

...

Survey results suggested that many firms saw employment decline while the average workweek increased in August. Respondents reported persistent wage growth but still struggled to find workers with the necessary skills.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

The regional surveys were weak again in August, but slightly better than in July.

Based on these regional surveys, it seems likely the ISM manufacturing index for August will be weak again.