by Calculated Risk on 8/29/2019 07:32:00 PM

Thursday, August 29, 2019

Friday: Personal Income and Outlays

Friday:

• At 8:30 AM ET, Personal Income and Outlays, July 2019. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for August.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 92.3.

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 8/29/2019 04:21:00 PM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

CR Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 29% under Mr. Trump - compared to up 44% under Mr. Obama for the same number of market days.

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 8/29/2019 01:15:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 24 August

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 18-24 August 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 19-25 August 2018, the industry recorded the following:

• Occupancy: +0.8% to 70.1%

• Average daily rate (ADR): +0.5% to US$128.57

• Revenue per available room (RevPAR): +1.2% at US$90.08

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year), unless there is a strong boost due to hurricane impacted areas.

Seasonally, the occupancy rate will now start to decline as the peak summer travel season ends.

Data Source: STR, Courtesy of HotelNewsNow.com

NAR: "Pending Home Sales Decline 2.5% in July"

by Calculated Risk on 8/29/2019 10:03:00 AM

From the NAR: Pending Home Sales Decline 2.5% in July

ending home sales fell in July, reversing course on two consecutive months of gains, according to the National Association of Realtors®. Of the four major regions, each reported a drop in contract activity, although the greatest decline came in the West.This was well below expectations of a 0.3% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 2.5% to 105.6 in July, down from 108.3 in June. Year-over-year contract signings fell 0.3%, doing an about-face of the prior month’s increase.

...

All regional indices are down from June. The PHSI in the Northeast fell 1.6% to 93.0 in July and is now 0.9% lower than a year ago. In the Midwest, the index dropped 2.5% to 101.0 in July, 1.2% less than July 2018.

Pending home sales in the South decreased 2.4% to an index of 122.7 in July, but that number is 0.1% higher than last July. The index in the West declined 3.4% in July to 93.5 but still increased 0.3% above a year ago.

emphasis added

Weekly Initial Unemployment Claims increased to 215,000

by Calculated Risk on 8/29/2019 08:58:00 AM

The DOL reported:

In the week ending August 24, the advance figure for seasonally adjusted initial claims was 215,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 209,000 to 211,000. The 4-week moving average was 214,500, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 214,500 to 215,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 214,500.

This was close to the consensus forecast.

Q2 GDP Revised Down to 2.0% Annual Rate

by Calculated Risk on 8/29/2019 08:52:00 AM

From the BEA: Gross Domestic Product, Second Quarter 2019 (Second Estimate); Corporate Profits, Second Quarter 2019 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the second quarter of 2019, according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 3.1 percent.PCE growth was revised up from 4.3% to 4.7%. Residential investment was revised down from -1.5% to -2.9%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.1 percent. The revision primarily reflected downward revisions to state and local government spending, exports, private inventory investment, and residential investment that were partly offset by an upward revision to personal consumption expenditures (PCE). Imports which are a subtraction in the calculation of GDP, were unrevised.

emphasis added

Here is a Comparison of Second and Advance Estimates.

Wednesday, August 28, 2019

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 8/28/2019 07:25:00 PM

Thursday:

• At 8:30 AM: Gross Domestic Product, 2nd quarter 2019 (second estimate). The consensus is that real GDP increased 2.0% annualized in Q2, down from the advance estimate of 2.1% in Q2.

• Also at 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 209 thousand last week.

• At 10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.3% decrease in the index.

Black Knight on "Tappable Equity"

by Calculated Risk on 8/28/2019 04:23:00 PM

Here are some comments and two graphs from Black Knight on tappable equity.

Tappable equity grew by >$335B in Q2 2019

• Tappable equity growth had been slowing in recent quarters due to rising interest rates and slowing home price growth

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the Black Knight's estimate of "tappable equity".

• However, its Q2 growth rate was slightly above Q1’s (+4.2% vs. 3%)

• A total of $6.3T in tappable equity is now held by 45M U.S. mortgage holders

• That’s the highest volume ever recorded, and 26% above the mid-2006 peak of $5T

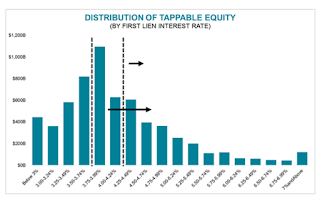

This graph from Black Knight shows the distribution of "tappable equity" by first lien mortgage rate.

This graph from Black Knight shows the distribution of "tappable equity" by first lien mortgage rate.• Nearly half (49%) of the 45M homeowners with tappable equity have 1st lien interest rates ≥4.25%, making refi an attractive option (most also fall into the population of refinance candidates we’ve been tracking)CR Note: A pickup in cash out refinancing could give a small boost to the economy.

• 76% have rates at or above 3.75% – these folks could potentially tap into home equity with little change to their existing 30-year rate, or perhaps even a slight improvement

Zillow Case-Shiller Forecast: Lower YoY Price Gains in July compared to June

by Calculated Risk on 8/28/2019 01:09:00 PM

The Case-Shiller house price indexes for June were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: June Case-Shiller Results and July Forecast: Phoenix Posts Largest YoY Gains

Annual home price gains continued their gradual slowdown in June, although the pace of those declines has slowed from earlier this year. While prices are still climbing, the rate of annual appreciation appears to have leveled off near its long-term average, after consistently falling from a high point reached in the spring of last year.

…

Housing demand remains strong as buyers are encouraged by rising wages and by mortgage rates that just keep falling amid growing economic uncertainty. Would-be buyers stand with pre-approved mortgages in hand. However, they’ve become unwilling to pay escalating prices for the relatively low inventory of homes that are on the market and instead are making sellers wait and even drop list prices.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 2.9% in July, down from 3.1% in June.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 2.9% in July, down from 3.1% in June. The Zillow forecast is for the 20-City index to decline to 1.9% YoY in July from 2.1% in June, and for the 10-City index to decline to 1.6% YoY compared to 1.8% YoY in June.

Real House Prices and Price-to-Rent Ratio in June

by Calculated Risk on 8/28/2019 09:08:00 AM

Here is the post yesterday on Case-Shiller: Case-Shiller: National House Price Index increased 3.1% year-over-year in June

It has been over eleven years since the bubble peak. In the Case-Shiller release last week, the seasonally adjusted National Index (SA), was reported as being 13.2% above the previous bubble peak. However, in real terms, the National index (SA) is still about 7.6% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.6% below the bubble peak.

The year-over-year increase in prices has slowed to 3.1% nationally, and I expect price growth might slow a little more, but not turn negative this year.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $287,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to February 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways to down recently.

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.