by Calculated Risk on 9/03/2019 10:05:00 AM

Tuesday, September 03, 2019

ISM Manufacturing index Decreased to 49.1 in August

The ISM manufacturing index indicated contraction in August. The PMI was at 49.1% in August, down from 51.2% in July. The employment index was at 47.4%, down from 51.7% last month, and the new orders index was at 47.2%, down from 50.8%.

From the Institute for Supply Management: August 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in August, and the overall economy grew for the 124th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The August PMI® registered 49.1 percent, a decrease of 2.1 percentage points from the July reading of 51.2 percent. The New Orders Index registered 47.2 percent, a decrease of 3.6 percentage points from the July reading of 50.8 percent. The Production Index registered 49.5 percent, a 1.3-percentage point decrease compared to the July reading of 50.8 percent. The Employment Index registered 47.4 percent, a decrease of 4.3 percentage points from the July reading of 51.7 percent. The Supplier Deliveries Index registered 51.4 percent, a 1.9-percentage point decrease from the July reading of 53.3 percent. The Inventories Index registered 49.9 percent, an increase of 0.4 percentage point from the July reading of 49.5 percent. The Prices Index registered 46 percent, a 0.9-percentage point increase from the July reading of 45.1 percent.

"Comments from the panel reflect a notable decrease in business confidence. August saw the end of the PMI® expansion that spanned 35 months, with steady expansion softening over the last four months. Demand contracted, with the New Orders Index contracting, the Customers' Inventories Index recovering slightly from prior months and the Backlog of Orders Index contracting for the fourth straight month. The New Export Orders Index contracted strongly and experienced the biggest loss among the subindexes. Consumption (measured by the Production and Employment Indexes) contracted at higher levels, contributing the strongest negative numbers (a combined 5.6-percentage point decrease) to the PMI®, driven by a lack of demand. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in August, due to inventory tightening for the third straight month and continued slower supplier deliveries. This resulted in a combined 1.5-percentage point decline in the Supplier Deliveries and Inventories indexes. Imports and new export orders contracted to new lows. Overall, inputs indicate (1) supply chains are responding better and (2) companies are continuing to closely match inventories to new orders, a positive sign for future expansion. Prices contracted for the third consecutive month, indicating lower overall systemic demand.

"Respondents expressed slightly more concern about U.S.-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders. Respondents continued to note supply chain adjustments as a result of moving manufacturing from China. Overall, sentiment this month declined and reached its lowest level in 2019," says Fiore.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 51.5%, and suggests manufacturing contracted in August.

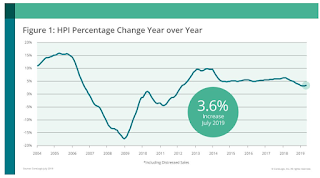

CoreLogic: House Prices up 3.6% Year-over-year in July

by Calculated Risk on 9/03/2019 08:00:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports July Home Prices Increased by 3.6% Year Over Year

Home prices increased nationally by 3.6% from June 2018. On a month-over-month basis, prices increased by 0.5% in July 2019. (June 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Home prices continue to increase on an annual basis with the CoreLogic HPI Forecast indicating annual price growth will increase by 5.4% by July 2020. On a month-over-month basis, the forecast calls for home prices to increase by 0.4% from July 2019 to August 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Sales of new and existing homes this July were up from a year ago, supported by low mortgage rates and rising family income,” said Dr. Frank Nothaft, chief economist at CoreLogic. “With the for-sale inventory remaining low in many markets, the pick-up in buying has nudged price growth up. If low interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year.”

emphasis added

This graph is from CoreLogic and shows the YoY change in their index.

This graph is from CoreLogic and shows the YoY change in their index.CR Note: The YoY change in the CoreLogic index had been decreasing, but increased slightly in July compared to June.

Monday, September 02, 2019

Tuesday: ISM Manufacturing, Construction Spending

by Calculated Risk on 9/02/2019 06:43:00 PM

Weekend:

• Schedule for Week of September 1, 2019

Tuesday:

• At 10:00 AM, ISM Manufacturing Index for August. The consensus is for the ISM to be at 51.5, up from 51.2 in July.

• Also at 10:00 AM, Construction Spending for July. The consensus is for a 0.3% increase in construction spending

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 20 and DOW futures are down 167 (fair value).

Oil prices were up over the last week with WTI futures at $54.82 per barrel and Brent at $58.66 barrel. A year ago, WTI was at $70, and Brent was at $77 - so oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.56 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down 27 cents year-over-year.

Looking Ahead August NFP: Decennial Census Hiring and August Employment Revisions

by Calculated Risk on 9/02/2019 09:32:00 AM

CR Note: Decennial Census will impact the August employment report. See: How to Report the Monthly Employment Number excluding Temporary Census Hiring

From the Census Bureau: U.S. Census Bureau Announces the Start of First Major Field Operation for 2020 Census

Today, the U.S. Census Bureau briefed the media on the launch of address canvassing, the first major field operation of the 2020 Census. Address canvassing improves and refines the Census Bureau’s address list of households nationwide, which is necessary to deliver invitations to respond to the census. The address list plays a vital role in ensuring a complete and accurate count of everyone living in the United States.The Census hiring will lead to some confusion in reporting. For the underlying trend, the correct method is to report the employment change ex-Census hiring.

...

“We were able to verify 65% of addresses using satellite imagery — a massive accomplishment for us,” said Census Bureau Geography Division Chief Deirdre Bishop during the briefing. “In 2010 we had to hire 150,000 people to verify 100% of the addresses in the field, this decade we will only have to hire about 40,000 employees around the nation to verify the remaining 35% of addresses.”

emphasis added

And here is a look at historical employment revisions for August since 2005. Note that most of the revisions have been up. This doesn't mean that the August 2019 revision will be up, but it does seem likely. I'm not sure why the BLS has underestimated job growth in August (possibly because of the timing of seasonal teacher hiring and the end of the summer jobs).

Note: In 2008, the BLS significantly under reported job losses. That wasn't surprising since the initial models the BLS used missed turning points (something I wrote about in 2007). The BLS has since improved this model.

| August Employment Report (000s) | |||

|---|---|---|---|

| Year | Initial | Revised | Revision |

| 2005 | 169 | 203 | 34 |

| 2006 | 128 | 175 | 47 |

| 2007 | -4 | -23 | -19 |

| 2008 | -84 | -279 | -195 |

| 2009 | -216 | -184 | 32 |

| 2010 | -54 | -5 | 49 |

| 2011 | 0 | 122 | 122 |

| 2012 | 96 | 170 | 74 |

| 2013 | 169 | 242 | 73 |

| 2014 | 142 | 188 | 46 |

| 2015 | 173 | 122 | -51 |

| 2016 | 151 | 135 | -16 |

| 2017 | 156 | 187 | 31 |

| 2018 | 201 | 282 | 81 |

| 2019 | --- | --- | --- |

Sunday, September 01, 2019

August 2019: Unofficial Problem Bank list increased to 76 Institutions

by Calculated Risk on 9/01/2019 09:41:00 AM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for August 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for August 2019. During the month, the list increased by a net of one institution to 76 banks after three removals and two additions. Aggregate assets were little changed finishing the month at $55.6. A year ago, the list held 82 institutions with assets of $57.3 billion. This month, FDIC terminated against Enterprise Bank of South Carolina, Ehrhardt, SC ($336 million) and Talbot State Bank, Woodland, GA ($60 million). Added this month was Citizens Bank & Trust Co., Marks, MS ($143 million); The First National Bank of Hope, Hope, KS ($83 million); and Independence Bank, East Greenwich, RI ($66 million).The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and then steadily declined to below 100 institutions.

Saturday, August 31, 2019

Schedule for Week of September 1, 2019

by Calculated Risk on 8/31/2019 08:11:00 AM

The key report this week is the August employment report on Friday.

Other key indicators include the August ISM manufacturing and non-manufacturing indexes, August auto sales, and the July trade deficit.

Fed Chair Jerome Powell will participate in a discussion on Friday.

For data nerds, the BLS will release their update Labor Force Projections on Wednesday.

All US markets will be closed in observance of the Labor Day holiday.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 51.5, up from 51.2 in July.

10:00 AM: ISM Manufacturing Index for August. The consensus is for the ISM to be at 51.5, up from 51.2 in July.Here is a long term graph of the ISM manufacturing index.

The PMI was at 51.2% in July, the employment index was at 51.7%, and the new orders index was at 50.8%.

10:00 AM: Construction Spending for July. The consensus is for a 0.3% increase in construction spending.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $55.2 billion in July unchanged from $55.2 billion in June.

During the Day: The BLS is scheduled to release Labor Force projections through 2028.

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.8 million in July (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.8 million in July (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:15 AM: The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 150,000 payroll jobs added in August, down from 156,000 added in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, unchanged from 215 thousand the previous week.

10:00 AM: the ISM non-Manufacturing Index for August. The consensus is for index to increase to 54.0 from 53.7 in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 158,000 non-farm payroll jobs in August, down from the 164,000 non-farm payroll jobs added in July.

8:30 AM: Employment Report for August. The consensus is for an increase of 158,000 non-farm payroll jobs in August, down from the 164,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to be unchanged at 3.7%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In July the year-over-year change was 2.246 million jobs.

A key will be the change in wages.

12:30 PM: Discussion with Fed Chair Jerome Powell, Economic Outlook and Monetary Policy, Discussion with Thomas J. Jordan, Chairman of the Swiss National Bank, hosted by the Swiss Institute of International Studies, University of Zurich, Zurich, Switzerland

Friday, August 30, 2019

Fannie Mae: Mortgage Serious Delinquency Rate Declined in July, Lowest Since June 2007

by Calculated Risk on 8/30/2019 04:18:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency declined to 0.67% in July, from 0.70% in June. The serious delinquency rate is down from 0.88% in July 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

This is the lowest serious delinquency rate for Fannie Mae since June 2007.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 2.51% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.22% are seriously delinquent, For recent loans, originated in 2009 through 2018 (93% of portfolio), only 0.32% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Hurricanes and Economic Data

by Calculated Risk on 8/30/2019 01:33:00 PM

For everyone in Florida - stay safe!

Frequently there is a temporary slowdown in several growth indicators following a large natural disaster. And usually there is a pretty rapid bounce back following the disaster.

Hurricane Dorian might negatively impact Q3 GDP, and September auto sales and housing.

Since this coming week is not the BLS reference week (includes the 12th of the month), there will probably be limited impact on September employment.

The first economic indicator to be impacted by the hurricane will probably be weekly unemployment claims.

The dashed line on the graph is the current 4-week average. Several events are labeled (9/11, Hurricanes Katrina, Sandy, Harvey and Irma, and the 2013 government shutdown). The great recession is obvious.

In 2017, weekly claims jumped from 238,000 to 293,000 following hurricane Harvey.

However, last year, following Hurricane Florence making landfall along the Carolina's coast as a category 1 hurricane, there was little impact on employment claims - despite significant rainfall and loss of life.

If Dorian makes landfall as a major hurricane, I expect some increase in weekly unemployment claims.

We might also see an impact on housing and auto sales in September. These will not be indicators of a recession, and we should expect any impacted indicator to rebound fairly quickly.

Stay safe.

Q3 GDP Forecasts: Around 2%

by Calculated Risk on 8/30/2019 11:17:00 AM

From Merrill Lynch:

3Q GDP tracking rose 0.2pp to 2.1% qoq saar [Aug 29 estimate]From Goldman Sachs:

emphasis added

We boosted our Q3 GDP tracking estimates by two tenths to +2.2% (qoq ar). [Aug 29 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.8% for 2019:Q3. [Aug 30 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 2.0 percent on August 30, down from 2.3 percent on August 26. [Aug 30 estimate]CR Note: These early estimates suggest real GDP growth will be around 2% annualized in Q3.

Personal Income increased 0.1% in July, Spending increased 0.6%

by Calculated Risk on 8/30/2019 08:35:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $23.9 billion (0.1 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $44.4 billion (0.3 percent) and personal consumption expenditures (PCE) increased $93.1 billion (0.6 percent).The July PCE price index increased 1.4 percent year-over-year and the July PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI increased 0.1 percent in July and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through July 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was slightly above expectations.

Note that core PCE inflation was at expectations.