by Calculated Risk on 9/04/2019 08:43:00 AM

Wednesday, September 04, 2019

Trade Deficit decreased to $54.0 Billion in July

From the Department of Commerce reported:

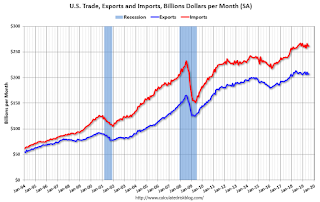

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $54.0 billion in July, down $1.5 billion from $55.5 billion in June, revised.

July exports were $207.4 billion, $1.2 billion more than June exports. July imports were $261.4 billion, $0.4 billion less than June imports.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in July.

Exports are 25% above the pre-recession peak and down 1% compared to July 2018; imports are 13% above the pre-recession peak, and up slightly compared to July 2018.

In general, trade had been picking up, but both imports and exports have moved more sideways recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $56.48 per barrel in July, down from $59.18 in June, and down from $64.54 in July 2018.

The trade deficit with China decreased to $32.8 billion in July, from $37.0 billion in July 2018.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 9/04/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 30, 2019.

... The Refinance Index decreased 7 percent from the previous week and was 152 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 5 percent higher than the same week one year ago.

...

“Ongoing trade tensions between the U.S. and China led to volatile, yet declining Treasury rates last week, causing the 30-year fixed mortgage rate to fall to 3.87 percent, its lowest level since November 2016,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite lower borrowing costs, refinances were down from its recent peak two weeks ago, but still remained over 150 percent higher than last August, when rates were almost a percentage point higher.”

Added Kan, “Purchase applications increased 1 percent last week and were 5 percent higher than a year ago. Consumers continue to act on these lower rates, but the volatility in the market is likely leading some borrowers to pause refinancing and buying decisions.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.87 percent from 3.94 percent, with points decreasing to 0.34 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to under 4%.

With lower rates, we saw a recent sharp increase in refinance activity.

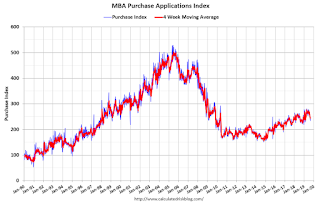

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 5% year-over-year.

Tuesday, September 03, 2019

"Mortgage Rates Set Another Long-Term Low"

by Calculated Risk on 9/03/2019 07:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Set Another Long-Term Low

Mortgage rates had to endure some paradoxical momentum and delayed reaction to the broader bond market rally lately, but now, it's payback time! Not only have mortgagees been able to move lower over the past 4 days, but they've done so even as Treasury yields remained flat. More simply put, 10yr Treasury yields ended the day just over 1.45% on last Wednesday. Today's comparable closing level of 1.46%. Mortgage rates, on the other hand, are down 0.08-0.11% over the same time frame, depending on the lender. While it's not a massive improvement versus Friday's latest levels, today's average offering is nonetheless the best in 3 years. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]Wednesday:

emphasis added

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM: Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be at $55.2 billion in July unchanged from $55.2 billion in June.

• During the Day: The BLS is scheduled to release Labor Force projections through 2028.

• All day: Light vehicle sales for August. The consensus is for light vehicle sales to be 16.9 million SAAR in August, up from 16.8 million in July (Seasonally Adjusted Annual Rate).

• At 2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Update: Framing Lumber Prices Down 20% Year-over-year

by Calculated Risk on 9/03/2019 02:29:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down 15% to 25% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Aug 16, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 22% from a year ago, and CME futures are down 23% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Construction Spending Increased Slightly in July, Down 2.7% YoY

by Calculated Risk on 9/03/2019 11:20:00 AM

From the Census Bureau reported that overall construction spending declined in July:

Construction spending during July 2019 was estimated at a seasonally adjusted annual rate of $1,288.8 billion, 0.1 percent above the revised June estimate of $1,288.1 billion. The July figure is 2.7 percent below the July 2018 estimate of $1,324.8 billion.Private spending decreased and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $963.1 billion, 0.1 percent below the revised June estimate of $963.7 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $325.7 billion, 0.4 percent above the revised June estimate of $324.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 25% below the bubble peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars).

Public construction spending is at the previous peak in March 2009, and 24% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 7%. Non-residential spending is down 3% year-over-year. Public spending is up 4% year-over-year.

This was below consensus expectations. Another weak construction spending report.

ISM Manufacturing index Decreased to 49.1 in August

by Calculated Risk on 9/03/2019 10:05:00 AM

The ISM manufacturing index indicated contraction in August. The PMI was at 49.1% in August, down from 51.2% in July. The employment index was at 47.4%, down from 51.7% last month, and the new orders index was at 47.2%, down from 50.8%.

From the Institute for Supply Management: August 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in August, and the overall economy grew for the 124th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The August PMI® registered 49.1 percent, a decrease of 2.1 percentage points from the July reading of 51.2 percent. The New Orders Index registered 47.2 percent, a decrease of 3.6 percentage points from the July reading of 50.8 percent. The Production Index registered 49.5 percent, a 1.3-percentage point decrease compared to the July reading of 50.8 percent. The Employment Index registered 47.4 percent, a decrease of 4.3 percentage points from the July reading of 51.7 percent. The Supplier Deliveries Index registered 51.4 percent, a 1.9-percentage point decrease from the July reading of 53.3 percent. The Inventories Index registered 49.9 percent, an increase of 0.4 percentage point from the July reading of 49.5 percent. The Prices Index registered 46 percent, a 0.9-percentage point increase from the July reading of 45.1 percent.

"Comments from the panel reflect a notable decrease in business confidence. August saw the end of the PMI® expansion that spanned 35 months, with steady expansion softening over the last four months. Demand contracted, with the New Orders Index contracting, the Customers' Inventories Index recovering slightly from prior months and the Backlog of Orders Index contracting for the fourth straight month. The New Export Orders Index contracted strongly and experienced the biggest loss among the subindexes. Consumption (measured by the Production and Employment Indexes) contracted at higher levels, contributing the strongest negative numbers (a combined 5.6-percentage point decrease) to the PMI®, driven by a lack of demand. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in August, due to inventory tightening for the third straight month and continued slower supplier deliveries. This resulted in a combined 1.5-percentage point decline in the Supplier Deliveries and Inventories indexes. Imports and new export orders contracted to new lows. Overall, inputs indicate (1) supply chains are responding better and (2) companies are continuing to closely match inventories to new orders, a positive sign for future expansion. Prices contracted for the third consecutive month, indicating lower overall systemic demand.

"Respondents expressed slightly more concern about U.S.-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders. Respondents continued to note supply chain adjustments as a result of moving manufacturing from China. Overall, sentiment this month declined and reached its lowest level in 2019," says Fiore.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 51.5%, and suggests manufacturing contracted in August.

CoreLogic: House Prices up 3.6% Year-over-year in July

by Calculated Risk on 9/03/2019 08:00:00 AM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

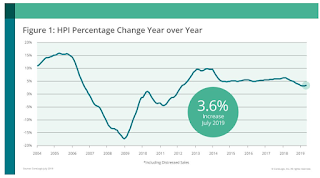

From CoreLogic: CoreLogic Reports July Home Prices Increased by 3.6% Year Over Year

Home prices increased nationally by 3.6% from June 2018. On a month-over-month basis, prices increased by 0.5% in July 2019. (June 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Home prices continue to increase on an annual basis with the CoreLogic HPI Forecast indicating annual price growth will increase by 5.4% by July 2020. On a month-over-month basis, the forecast calls for home prices to increase by 0.4% from July 2019 to August 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Sales of new and existing homes this July were up from a year ago, supported by low mortgage rates and rising family income,” said Dr. Frank Nothaft, chief economist at CoreLogic. “With the for-sale inventory remaining low in many markets, the pick-up in buying has nudged price growth up. If low interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year.”

emphasis added

This graph is from CoreLogic and shows the YoY change in their index.

This graph is from CoreLogic and shows the YoY change in their index.CR Note: The YoY change in the CoreLogic index had been decreasing, but increased slightly in July compared to June.

Monday, September 02, 2019

Tuesday: ISM Manufacturing, Construction Spending

by Calculated Risk on 9/02/2019 06:43:00 PM

Weekend:

• Schedule for Week of September 1, 2019

Tuesday:

• At 10:00 AM, ISM Manufacturing Index for August. The consensus is for the ISM to be at 51.5, up from 51.2 in July.

• Also at 10:00 AM, Construction Spending for July. The consensus is for a 0.3% increase in construction spending

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 20 and DOW futures are down 167 (fair value).

Oil prices were up over the last week with WTI futures at $54.82 per barrel and Brent at $58.66 barrel. A year ago, WTI was at $70, and Brent was at $77 - so oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.56 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down 27 cents year-over-year.

Looking Ahead August NFP: Decennial Census Hiring and August Employment Revisions

by Calculated Risk on 9/02/2019 09:32:00 AM

CR Note: Decennial Census will impact the August employment report. See: How to Report the Monthly Employment Number excluding Temporary Census Hiring

From the Census Bureau: U.S. Census Bureau Announces the Start of First Major Field Operation for 2020 Census

Today, the U.S. Census Bureau briefed the media on the launch of address canvassing, the first major field operation of the 2020 Census. Address canvassing improves and refines the Census Bureau’s address list of households nationwide, which is necessary to deliver invitations to respond to the census. The address list plays a vital role in ensuring a complete and accurate count of everyone living in the United States.The Census hiring will lead to some confusion in reporting. For the underlying trend, the correct method is to report the employment change ex-Census hiring.

...

“We were able to verify 65% of addresses using satellite imagery — a massive accomplishment for us,” said Census Bureau Geography Division Chief Deirdre Bishop during the briefing. “In 2010 we had to hire 150,000 people to verify 100% of the addresses in the field, this decade we will only have to hire about 40,000 employees around the nation to verify the remaining 35% of addresses.”

emphasis added

And here is a look at historical employment revisions for August since 2005. Note that most of the revisions have been up. This doesn't mean that the August 2019 revision will be up, but it does seem likely. I'm not sure why the BLS has underestimated job growth in August (possibly because of the timing of seasonal teacher hiring and the end of the summer jobs).

Note: In 2008, the BLS significantly under reported job losses. That wasn't surprising since the initial models the BLS used missed turning points (something I wrote about in 2007). The BLS has since improved this model.

| August Employment Report (000s) | |||

|---|---|---|---|

| Year | Initial | Revised | Revision |

| 2005 | 169 | 203 | 34 |

| 2006 | 128 | 175 | 47 |

| 2007 | -4 | -23 | -19 |

| 2008 | -84 | -279 | -195 |

| 2009 | -216 | -184 | 32 |

| 2010 | -54 | -5 | 49 |

| 2011 | 0 | 122 | 122 |

| 2012 | 96 | 170 | 74 |

| 2013 | 169 | 242 | 73 |

| 2014 | 142 | 188 | 46 |

| 2015 | 173 | 122 | -51 |

| 2016 | 151 | 135 | -16 |

| 2017 | 156 | 187 | 31 |

| 2018 | 201 | 282 | 81 |

| 2019 | --- | --- | --- |

Sunday, September 01, 2019

August 2019: Unofficial Problem Bank list increased to 76 Institutions

by Calculated Risk on 9/01/2019 09:41:00 AM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for August 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for August 2019. During the month, the list increased by a net of one institution to 76 banks after three removals and two additions. Aggregate assets were little changed finishing the month at $55.6. A year ago, the list held 82 institutions with assets of $57.3 billion. This month, FDIC terminated against Enterprise Bank of South Carolina, Ehrhardt, SC ($336 million) and Talbot State Bank, Woodland, GA ($60 million). Added this month was Citizens Bank & Trust Co., Marks, MS ($143 million); The First National Bank of Hope, Hope, KS ($83 million); and Independence Bank, East Greenwich, RI ($66 million).The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and then steadily declined to below 100 institutions.