by Calculated Risk on 9/05/2019 07:57:00 PM

Thursday, September 05, 2019

Friday: Employment Report, Fed Chair Powell Speaks

Friday:

• At 8:30 AM: Employment Report for August. The consensus is for an increase of 158,000 non-farm payroll jobs in August, down from the 164,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to be unchanged at 3.7%.

• At 12:30 PM: Discussion with Fed Chair Jerome Powell, Economic Outlook and Monetary Policy, Discussion with Thomas J. Jordan, Chairman of the Swiss National Bank, hosted by the Swiss Institute of International Studies, University of Zurich, Zurich, Switzerland

Goldman: August Payrolls Preview

by Calculated Risk on 9/05/2019 04:52:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 150k in August … Our forecast reflects a 15-20k boost from Census canvassing activities, but a slower underlying pace of private-sector job gains in part reflecting the return of the trade war. …CR Note: It will be important to adjust for decennial Census hiring. Ex-Census the Goldman forecast is for 130K to 135K jobs.

We estimate the unemployment rate was unchanged at 3.7%. … We estimate average hourly earnings increased 0.2% month-over-month—a tenth below consensus—and we expect the year-over-year rate to fall by two tenths to 3.0%.

emphasis added

August Employment Preview

by Calculated Risk on 9/05/2019 12:27:00 PM

Special Note on Decennial Census: Temporary Decennial Census hiring will probably impact the August employment report with the Census hiring as many as 40,000 temporary workers. The headline number should be adjusted for these hires, see: How to Report the Monthly Employment Number excluding Temporary Census Hiring

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for an increase of 158,000 non-farm payroll jobs in August, and for the unemployment rate to be unchanged at 3.7%.

Last month, the BLS reported 164,000 jobs added in July.

Here is a summary of recent data:

• The ADP employment report showed an increase of 195,000 private sector payroll jobs in August. This was above consensus expectations of 150,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in August to 47.4%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased 35,000 in August. The ADP report indicated manufacturing jobs increased 8,000 in August.

The ISM non-manufacturing employment index decreased in August to 53.1%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 155,000 in August.

Combined, the ISM surveys suggest employment gains at 120,000 suggesting gains below consensus expectations.

• Initial weekly unemployment claims averaged 216,000 in August, up from 212,000 in July. For the BLS reference week (includes the 12th of the month), initial claims were at 211,000, down from 216,000 during the reference week the previous month.

This suggest employment growth close to expectations.

• The final August University of Michigan consumer sentiment index decreased sharply to 89.8 from the July reading of 98.4. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker was weak in August suggesting 102K jobs added in August.

• Conclusion: The ISM employment indexes were weak in August, especially the manufacturing index. However the ADP employment suggests a report above the consensus. Employment reports for August are frequently revised up, suggesting the initial report will be lower than expectations. Also the BofA jobs tracker was especially weak in August, and consumer sentiment decreased significantly.

My guess is the jobs number (ex-Census hiring) will be below expectations.

BEA: August Vehicles Sales increased to 17.0 Million SAAR

by Calculated Risk on 9/05/2019 11:30:00 AM

The BEA released their estimate of August vehicle sales this morning. The BEA estimated sales of 16.97 million SAAR in August 2019 (Seasonally Adjusted Annual Rate), up 0.7%% from the July sales rate, and up 0.7% from August2018.

Sales in 2019 are averaging 16.9 million (average of seasonally adjusted rate), down 1.2% compared to the same period in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for July (red).

A small decline in sales to date this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 16.97 million SAAR.

ISM Non-Manufacturing Index increased to 56.4% in August

by Calculated Risk on 9/05/2019 10:05:00 AM

The August ISM Non-manufacturing index was at 56.4%, up from 53.7% in July. The employment index decreased to 53.1%, from 56.2%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 115th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 56.4 percent, which is 2.7 percentage points higher than the July reading of 53.7 percent. This represents continued growth in the non-manufacturing sector, at a faster rate. The Non-Manufacturing Business Activity Index increased to 61.5 percent, 8.4 percentage points higher than the July reading of 53.1 percent, reflecting growth for the 121st consecutive month. The New Orders Index registered 60.3 percent; 6.2 percentage points higher than the reading of 54.1 percent in July. The Employment Index decreased 3.1 percentage points in August to 53.1 percent from the July reading of 56.2 percent. The Prices Index increased 1.7 percentage points from the July reading of 56.5 percent to 58.2 percent, indicating that prices increased in August for the 27th consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector’s rate of growth rebounded after two consecutive months of cooling off. The respondents remain concerned about tariffs and geopolitical uncertainty; however, they are mostly positive about business conditions.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in August than in July.

Weekly Initial Unemployment Claims increased to 217,000

by Calculated Risk on 9/05/2019 08:32:00 AM

The DOL reported:

In the week ending August 31, the advance figure for seasonally adjusted initial claims was 217,000, an increase of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 215,000 to 216,000. The 4-week moving average was 216,250, an increase of 1,500 from the previous week's revised average. The previous week's average was revised up by 250 from 214,500 to 214,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 216,250.

This was close to the consensus forecast.

ADP: Private Employment increased 195,000 in August

by Calculated Risk on 9/05/2019 08:19:00 AM

Private sector employment increased by 195,000 jobs from July to August according to the August ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 150,000 private sector jobs added in the ADP report.

...

“In August we saw a rebound in private-sector employment,” said Ahu Yildirmaz, vice president and cohead of the ADP Research Institute. “This is the first time in the last 12 months that we have seen balanced job growth across small, medium and large-sized companies.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Businesses are holding firm on their payrolls despite the slowing economy. Hiring has moderated, but layoffs remain low. As long as this continues recession will remain at bay.”

The BLS report will be released Friday, and the consensus is for 158,000 non-farm payroll jobs added in August.

Wednesday, September 04, 2019

Thursday: ADP Employment, Unemployment Claims, ISM Non-Mfg Index

by Calculated Risk on 9/04/2019 07:00:00 PM

Thursday:

• At 8:15 AM, The ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 150,000 payroll jobs added in August, down from 156,000 added in July.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, unchanged from 215 thousand the previous week.

• At 10:00 AM, the ISM non-Manufacturing Index for August. The consensus is for index to increase to 54.0 from 53.7 in July.

Fed's Beige Book: Economic Growth "Modest", Labor Market "Tight"

by Calculated Risk on 9/04/2019 02:03:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Atlanta based on information collected on or before August 23, 2019."

On balance, reports from Federal Reserve Districts suggested that the economy expanded at a modest pace through the end of August. Although concerns regarding tariffs and trade policy uncertainty continued, the majority of businesses remained optimistic about the near-term outlook. Reports on consumer spending were mixed, although auto sales for most Districts grew at a modest pace. Tourism activity since the previous report remained solid in most reporting Districts. On balance, transportation activity softened, which some reporting Districts attributed to slowing global demand and heightened trade tensions. Home sales remained constrained in the majority of Districts due primarily to low inventory levels, and new home construction activity remained flat. Commercial real estate construction and sales activity were steady, while the pace of leasing increased slightly over the prior period. Overall manufacturing activity was down slightly from the previous report. Among reporting Districts, agricultural conditions remained weak as a result of unfavorable weather conditions, low commodity prices, and trade-related uncertainties. Lending volumes grew modestly across several Districts. Reports on activity in the nonfinancial services sector were positive, with reporting Districts noting similar or improved activity from the last report.

...

Overall, Districts indicated that employment grew at a modest pace, on par with the previous reporting period. While employment growth varied by industry, some Districts noted manufacturing employment was flat to down. Firms and staffing agencies universally cited tightness across various labor market segments and skill levels, which continued to constrain growth in overall business activity. On balance, Districts reported that the pace of wage growth remained modest to moderate, similar to the previous reporting period. Districts continued to report strong upward pressure on pay for entry-level and low-skill workers, as well as for technology, construction, and some professional services positions. In addition to wage increases, some Districts noted other efforts—such as enhanced benefits offerings, work arrangement flexibility, and signing bonuses—to attract and retain employees.

emphasis added

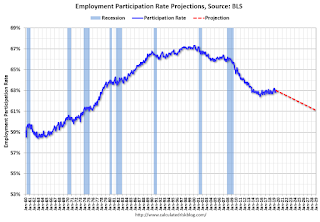

BLS: Employment Projections: 2018-2028

by Calculated Risk on 9/04/2019 11:41:00 AM

The BLS released today their updated Labor Force projections through 2028.

Their projections show the overall Labor Force Participation Rate (LFPR) declining to 61.2% in 2018 from the 63.0%.

Their projections also show that the Prime (25 to 54 year old) LFPR will decline slightly to 81.7% in 2028.

From the BLS: Employment Projections: 2018-2028 Summary

Employment is projected to grow by 8.4 million jobs to 169.4 million jobs over the 2018–28 decade, the U.S. Bureau of Labor Statistics (BLS) reported today. This expansion reflects an annual growth rate of 0.5 percent, which is slower than the 2008–18 annual growth rate of 0.8 percent. An aging population and labor force will contribute to changes expected over the coming decade including a continued decline in the labor force participation rate and continued growth in employment in healthcare and related industries and occupations.

…

The labor force is projected to increase at an annual rate of 0.5 percent from 2018 to 2028. This growth represents an increase of 8.9 million over the decade to 171 million by 2028. The labor force participation rate is projected to decline to 61.2 percent.

…

Much of the projected decline in the overall labor force participation rate from 2018 to 2028 is due to a decrease in the participation rate for men, from 69.1 percent to 66.1 percent. However, the participation rate for women is also expected to decline over the decade, from 57.1 percent to 56.6 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual overall Labor Force Participation Rate (blue), and the updated BLS projections (Red). Note: these projections were drawn as a line - it is possible that the overall LFPR could move sideways for some time prior to declining to the lower rate in 2028.

In general, these projections are similar to my own projections for both the overall LFPR and the Prime LFPR.