by Calculated Risk on 10/04/2019 08:44:00 AM

Friday, October 04, 2019

September Employment Report: 136,000 Jobs Added, 3.5% Unemployment Rate

From the BLS:

The unemployment rate declined to 3.5 percent in September, and total nonfarm payroll employment rose by 136,000, the U.S. Bureau of Labor Statistics reported today. Employment in health care and in professional and business services continued to trend up.

...

Employment in government continued on an upward trend in September (+22,000). Federal hiring for the 2020 Census was negligible (+1,000).

...

The change in total nonfarm payroll employment for July was revised up by 7,000 from +159,000 to +166,000, and the change for August was revised up by 38,000 from +130,000 to +168,000. With these revisions, employment gains in July and August combined were 45,000 more than previously reported.

...

In September, average hourly earnings for all employees on private nonfarm payrolls, at $28.09, were little changed (-1 cent), after rising by 11 cents in August. Over the past 12 months, average hourly earnings have increased by 2.9 percent.

emphasis added

Click on graph for larger image.

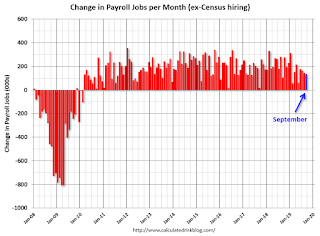

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 135 thousand in September ex-Census (private payrolls increased 114 thousand).

Payrolls for July and August were revised up 45 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 2.147 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in September at 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was unchanged in September at 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio increased to 61.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was declined in September to 3.5%. This is the lowest unemployment rate since 1969.

This was below consensus expectations of 145,000 jobs added, however July and August were revised up by 45,000 combined.

I'll have much more later ...

Thursday, October 03, 2019

Friday: Employment Report, Trade Deficit

by Calculated Risk on 10/03/2019 07:58:00 PM

My September Employment Preview.

Goldman's September Payrolls preview.

Friday:

• At 8:30 AM: Employment Report for September. The consensus is for 145,000 jobs added, up from 130,000 in August (including temporary Census hires). The consensus is the unemployment rate will be unchanged at 3.7%.

• At 8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $54.5 billion in August, from $54.0 billion in July.

• At 2:00 PM: Speech, Fed Chair Jerome Powell, Opening Remarks, At Fed Listens: Perspectives on Maximum Employment and Price Stability, Federal Reserve Board, Washington, D.C.

Goldman: September Payrolls Preview

by Calculated Risk on 10/03/2019 03:45:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 150k in September, compared to consensus of +146k. While employment surveys weakened further on net, their levels are still consistent with above-potential job growth. …CR Note: It will be important to adjust for decennial Census hiring. Ex-Census the Goldman forecast is for about 135K jobs.

We estimate a one tenth decline in the unemployment rate to 3.6%. …

emphasis added

Reis: Mall Vacancy Rate Mixed in Q3 2019

by Calculated Risk on 10/03/2019 01:19:00 PM

Reis reported that the vacancy rate for regional malls was 9.4% in Q3 2019, up from 9.3% in Q2 2019, and up from 9.1% in Q3 2018. This is at the cycle peak of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.1% in Q3, down from 10.2% in Q2, and down from 10.2% in Q3 2018. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

The Retail vacancy rate declined in the quarter to 10.1% from 10.2% in the second quarter. In the third quarter of 2018 it was also 10.2%. Overall vacancy has declined only 0.3% in last five years.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.3% in the third quarter. At $21.45 per square foot (asking) and $18.79 per square foot (effective), the average rents have increased 1.5% and 1.6%, respectively, from the third quarter of 2018.

The Mall vacancy rate increased to 9.4%, from 9.3% last quarter and a low of 7.8% in 2016. Rent growth was positive at 0.2% for the quarter and 0.6% for the year. Although retail store closures and bankruptcies still dominate the news, the overall retail property statistics have held steady as new users fill vacated space of large department stores.

...

Similar to its sibling property types, the retail sector continued to shrug off bad news in the broader sector. Just this week, the news media seemed to yawn when retailing power house Forever 21 declared bankruptcy. Reports said they would close 178 of their 600 stores. The retail sector has withstood numerous store closings, this latest one should not deliver a big blow. Retail spending remains healthy as consumer spending keeps climbing in step with job growth. In short, the retail sector is poised to continue to grow at the current slow but steady rate.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased from an already elevated level.

Mall vacancy data courtesy of Reis

September Employment Preview

by Calculated Risk on 10/03/2019 10:50:00 AM

Special Note on Decennial Census: Temporary Decennial Census hiring will probably impact the September employment report with the Census hiring around 15,000 temporary workers. The headline number should be adjusted for these hires, see: How to Report the Monthly Employment Number excluding Temporary Census Hiring

On Friday at 8:30 AM ET, the BLS will release the employment report for September. The consensus is for an increase of 145,000 non-farm payroll jobs in September, and for the unemployment rate to be unchanged at 3.7%.

Last month, the BLS reported 130,000 jobs added in August (including 25,000 temporary Census hires).

Here is a summary of recent data:

• The ADP employment report showed an increase of 135,000 private sector payroll jobs in September. This was below consensus expectations of 152,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in September to 46.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased 40,000 in September. The ADP report indicated manufacturing jobs increased 2,000 in September.

The ISM non-manufacturing employment index decreased in September to 50.4%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 84,000 in September.

Combined, the ISM surveys suggest employment gains at 44,000 suggesting gains well below consensus expectations.

• Initial weekly unemployment claims averaged 213,000 in September, down from 216,000 in August. For the BLS reference week (includes the 12th of the month), initial claims were at 210,000, down from 211,000 during the reference week the previous month.

This suggest employment growth close to expectations.

• The final September University of Michigan consumer sentiment index increased to 93.2 from the August reading of 89.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker was weak in August suggesting 123K jobs added in September.

• Conclusion: The ISM employment indexes were especially weak in September, as was the ADP employment report. Also the BofA jobs tracker was weak in September, although consumer sentiment rebound slightly and unemployment claims during the reference week were low.

My guess is the jobs number (ex-Census hiring) will be below expectations.

ISM Non-Manufacturing Index decreased to 52.6% in September

by Calculated Risk on 10/03/2019 10:04:00 AM

The September ISM Non-manufacturing index was at 52.6%, down from 56.4% in August. The employment index decreased to 50.4%, from 53.1%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: September 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in September for the 116th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 52.6 percent, which is 3.8 percentage points below the August reading of 56.4 percent. This represents continued growth in the non-manufacturing sector, at a slower rate. The Non-Manufacturing Business Activity Index decreased to 55.2 percent, 6.3 percentage points lower than the August reading of 61.5 percent, reflecting growth for the 122nd consecutive month. The New Orders Index registered 53.7 percent; 6.6 percentage points lower than the reading of 60.3 percent in August. The Employment Index decreased 2.7 percentage points in September to 50.4 percent from the August reading of 53.1 percent. The Prices Index increased 1.8 percentage points from the August reading of 58.2 percent to 60 percent, indicating that prices increased in September for the 28th consecutive month. According to the NMI®, 13 non-manufacturing industries reported growth. The non-manufacturing sector pulled back after reflecting strong growth in August. The respondents are mostly concerned about tariffs, labor resources and the direction of the economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in September than in August. This was a weak report.

Weekly Initial Unemployment Claims increased to 219,000

by Calculated Risk on 10/03/2019 08:42:00 AM

The DOL reported:

In the week ending September 28, the advance figure for seasonally adjusted initial claims was 219,000, an increase of 4,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 213,000 to 215,000. The 4-week moving average was 212,500, unchanged from the previous week's revised average. The previous week's average was revised up by 500 from 212,000 to 212,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 212,500.

This was higher than the consensus forecast.

Wednesday, October 02, 2019

Thursday: Unemployment Claims, ISM non-Mfg

by Calculated Risk on 10/02/2019 08:08:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 213,000 last week.

• At 10:00 AM, the ISM non-Manufacturing Index for September.

• Early, Reis Q3 2019 Mall Survey of rents and vacancy rates.

Reminder on Temporary Decennial Census Hiring; Expect about 15,000 Temp Jobs in September Report

by Calculated Risk on 10/02/2019 04:15:00 PM

In the August employment report, the BLS reported

In August, employment in federal government increased by 28,000. The gain was mostly due to the hiring of 25,000 temporary workers to prepare for the 2020 Census.Earlier, on August 12th, from the Census Bureau: U.S. Census Bureau Announces the Start of First Major Field Operation for 2020 Census

emphasis added

“We were able to verify 65% of addresses using satellite imagery — a massive accomplishment for us,” said Census Bureau Geography Division Chief Deirdre Bishop during the briefing. “In 2010 we had to hire 150,000 people to verify 100% of the addresses in the field, this decade we will only have to hire about 40,000 employees around the nation to verify the remaining 35% of addresses.”Based on this information, we can estimate:

…

Census Bureau employees (listers) have started walking through neighborhoods across the country checking addresses not verified using BARCA software. In-field address canvassing will continue through mid-October.

• An additional 15,000 or so temporary Census workers will be reported in the September BLS report, bringing the total for this operation to around 40,000.

• There probably be little impact from the Census on the October report (the operation concludes in "mid-October"). However, it is possible some temporary jobs will be terminated prior to the reference week in October.

• There will probably be 30,000 to 40,000 Census jobs terminated in November, and maybe December.

• The major Census hiring will start early next year, and will really ramp up in April and May of 2020.

• The major Decennial Census terminations will happen in June through September of 2020.

Here is the Census webpage listing jobs added and terminated by month for the last several Census (1990, 2000, 2010, and now 2020).

Here is How to Report the Monthly Employment Number excluding Temporary Census Hiring

Lawler: “Off-Calendar” Census Population Projection Update Coming; To Include Alternative Migration Scenarios

by Calculated Risk on 10/02/2019 02:32:00 PM

CR Note: This is a technical "heads-up" for data nerds.

From housing economist Tom Lawler: “Off-Calendar” Census Population Projection Update Coming; To Include Alternative Migration Scenarios

According to a Census “Tip Sheet,” Census next week will be releasing several new and updated population reports. Here is the Census release:

“The U.S. Census Bureau will be releasing several new and updated population projection reports that cover projected life expectancy by nativity, projected population by alternative migration scenarios, and updated population projections by demographic characteristics. Supplemental data files for the alternative migration scenarios and input datasets for the main projections series will be released as well. For more information on past projection reports, go to www.census.gov/programs-surveys/popproj.html. (Tentatively scheduled for release Oct. 10.)”

As I have documented in earlier reports, the latest available “official” intermediate- and long-term population projections, released in early 2018, are out of date. They are based on dated population estimates, have unrealistic assumptions about deaths rates by age, and have projections about net international migration that at least in the short-to-intermediate term are probably too high. Hopefully these new estimates will incorporate updated population estimates (Vintage 2018) and more timely data on deaths than was the case in the latest projections. It will also be interesting to see Census’ population projections under alternative migration scenarios, given the highly uncertain outlook for immigration over the next few years.