by Calculated Risk on 10/07/2019 12:05:00 PM

Monday, October 07, 2019

Update: Framing Lumber Prices Mostly Unchanged Year-over-year

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now mostly unchnaged year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Aug 16, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 7% from a year ago, and CME futures are up 1% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Black Knight Mortgage Monitor for August: National Delinquency Rate near Series Low

by Calculated Risk on 10/07/2019 08:55:00 AM

Black Knight released their Mortgage Monitor report for August today. According to Black Knight, 3.45% of mortgages were delinquent in August, down from 3.52% in August 2018. Black Knight also reported that 0.48% of mortgages were in the foreclosure process, down from 0.54% a year ago.

This gives a total of 3.93% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Lower Interest Rate Environment Boosts Home Affordability to Nearly Three-Year High; Home Price Growth Flat in August

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, Black Knight’s analysts examined the impact of recent interest rate declines on home affordability, finding yet another situation where rate shifts in either direction have profound impact. As Black Knight Data & Analytics President Ben Graboske explained, the current lower interest rate environment has provided a boost to potential homebuyers.

“Back in November 2018, we were reporting on home affordability hitting a nine-year low,” said Graboske. “Interest rates were nearing 5%, pushing the share of national median income required to make the principal and interest (P&I) payments on the purchase of the average-priced home to 23.7%. While still below long-term averages, that made housing the least affordable it had been since 2009, spurring a noticeable and extended slowdown in home price growth. In the time since, rates have tumbled and the affordability outlook has improved significantly. That payment-to-income ratio is now 20.7%, which is the second lowest it has been in 20 months, behind only August of this year, and about 4.5% below the long-term, pre-crisis norm. To help quantify the boost this has given to homebuyers, consider that today’s prevailing 30-year rate has cut the monthly P&I payment to purchase the average-priced home by 10% – about $124 per month – from November. Put another way, the decline in rates since November has been enough to boost buying power by $46,000 while keeping monthly P&I payments the same.

“Despite falling interest rates and steadily improving affordability over the preceding eight months, annual home price growth held flat in August at 3.8% after rising for the first time in 17 months in July. It remains to be seen if this is merely a lull in what could be a reheating housing market, or a sign that low interest rates and stronger affordability may not be enough to muster another meaningful rise in home price growth across the U.S. That the strongest gains in – and strongest levels of – affordability were in August and early September could bode well for September/October housing numbers. As such, we’ll be keeping a close eye on the numbers coming out of the Black Knight Home Price Index over the coming months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National delinquency rate over time.

From Black Knight:

• The national delinquency rate currently stands at 3.45%, within 0.09% of the record low set in May 2019 and 0.94% below the pre-recession August average of 4.39%The second graph shows 90-day defaults vs foreclosure starts:

• The month’s relatively flat movement in mortgage delinquencies (-0.15%) is fairly typical behavior for August

• Over the past 18 years, delinquencies have fallen by 0.2% on average for the month, making August the most seasonally neutral month

• In contrast, September tends to see the largest seasonal upward pressure on delinquency rates of any month (+5.2% on average since 2000), so upward movement next month would not be surprising

• Foreclosure starts hit an 18-year low in August, but defaults have shown signs of upward movement in recent monthsThere is much more in the mortgage monitor.

• While August’s 85K defaults were 15% below the prerecession (2000-2005) average for this time of year, default volume was up by 6% from the same time last year

• Defaults have been relatively flat year-over-year or up slightly in each of the past five months

• One contributing factor has been the severe early-2018 flooding in the Midwest, with defaults in the region rising by 10% from the year prior » August also saw defaults increase in the south (+8%) and the Northeast (+4.5%)

• Though default activity remains historically low, this is a trend worth watching

Sunday, October 06, 2019

Sunday Night Futures

by Calculated Risk on 10/06/2019 09:34:00 PM

Weekend:

• Schedule for Week of October 6, 2019

Monday:

• At 3:00 PM, Consumer Credit from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 17 and DOW futures are down 140 (fair value).

Oil prices were down over the last week with WTI futures at $52.65 per barrel and Brent at $58.11 barrel. A year ago, WTI was at $74, and Brent was at $85 - so oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.64 per gallon. A year ago prices were at $2.91 per gallon, so gasoline prices are down 27 cents year-over-year.

Hotels: Occupancy Rate "Dipped" Year-over-year

by Calculated Risk on 10/06/2019 12:07:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 28 September

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 22-28 September 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 23-29 September 2018, the industry recorded the following:

• Occupancy: -0.4% to 71.2%

• Average daily rate (ADR): -0.5% to US$136.63

• Revenue per available room (RevPAR): -0.8% to US$97.26

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will now increase during the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, October 05, 2019

Schedule for Week of October 6, 2019

by Calculated Risk on 10/05/2019 08:11:00 AM

The key report this week is the September CPI on Thursday.

Fed Chair Jerome Powell speaks on data dependence on Tuesday.

3:00 PM: Consumer Credit from the Federal Reserve.

6:00 AM: NFIB Small Business Optimism Index for September.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

2:30 PM: Speech, Fed Chair Jerome Powell, Data Dependence in an Evolving Economy, At the 61st National Association for Business Economics (NABE) Annual Meeting - Trucks and Terabytes: Integrating the 'Old' and 'New' Economies, Denver, Colorado

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS.

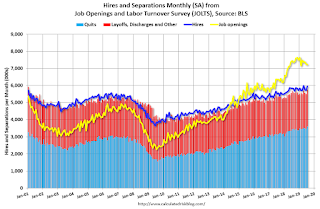

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 7.217 million from 7.248 million in June.

The number of job openings (yellow) were down 3% year-over-year, and Quits were up 3% year-over-year.

2:00 PM: FOMC Minutes, Meeting of September 17-18, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, down from 219,000 last week.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for October).

Friday, October 04, 2019

AAR: September Rail Carloads down 7.0% YoY, Intermodal Down 4.6% YoY

by Calculated Risk on 10/04/2019 04:56:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

There’s still no relief in sight for U.S. rail traffic. Total originated U.S. rail carloads fell 7.0% in September 2019 from September 2018, their eighth straight year-over-year decline. In the third quarter, total carloads were down 5.4%; for the year through September, they were down 3.8%.

…

Intermodal was weak too — originations were down 4.6% in September, down 5.8% in the Q3 2019 (the biggest quarterly percentage decline since Q3 2009); and down 4.1% for the year to date.

…

Most economists would probably also agree that returning to some semblance of order on the international trade front is the single most important thing that would push the seesaw to the faster growth side. That would also help railroads, of course, because, as we discussed last month, the ongoing trade war and accompanying uncertainty has had the most direct impact on manufacturing and commodity related industries that are heavily served by railroads.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the year-over-year changes in U.S. Carloads.

U.S. rail traffic continues to falter. Total carloads originated were 992,542 in September 2019, down 7.0%, or 74,172 carloads, from September 2018. It was the eighth straight monthly year-over-year decline and the second biggest percentage decline in those eight months. In the third quarter, total carloads were down 5.4%. For the first nine months of 2019, total U.S. carloads were down 3.8%, or 384,418 carloads, from 2018.

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):Rail intermodal remains weak too. Total originations in September were 1.06 million, down 5.9% (65,989 containers and trailers) from September 2018. Weekly average intermodal originations in September 2019 were 265,371, the lowest for September since 2016. Intermodal was down 5.8% in Q3 2019 from Q3 2018; that’s the biggest quarterly percentage decline for intermodal since Q3 2009. In 2019 through September, intermodal was down 4.1% (441,953 units) from last year, though year-to-date intermodal volume through September (10.39 million units) was the second highest ever (behind 2018).

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 10/04/2019 02:42:00 PM

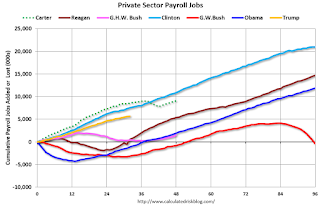

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (32 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 821,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 382,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,979,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,890,000 under President Obama (dark blue).

During the first 32 months of Mr. Trump's term, the economy has added 5,696,000 private sector jobs.

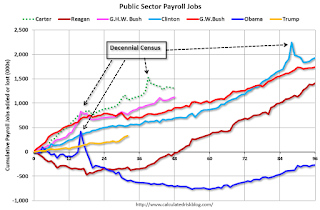

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 269,000 jobs).

During the 32 months of Mr. Trump's term, the economy has added 331,000 public sector jobs.

After 32 months of Mr. Trump's presidency, the economy has added 6,027,000 jobs, about 640,000 behind the projection.

Note: Based on the preliminary Benchmark revision, there will be 501,000 fewer jobs in March 2019 after the Benchmark revision is released in February - so job growth is probably over 1.1 million behind the projection.

Q3 GDP Forecasts: Just Under 2%

by Calculated Risk on 10/04/2019 12:05:00 PM

From Merrill Lynch:

These data edged down 3Q GDP tracking by a tenth to 1.7% qoq saar. [Oct 3 estimate]From Goldman Sachs:

emphasis added

We also lowered our Q3 GDP tracking estimate by one tenth to +1.9% (qoq ar). [Oct 3 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.0% for 2019:Q3 and 1.3% for 2019:Q4. [Oct 4 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 1.8 percent on October 4, unchanged from October 1. [Oct 4 estimate]CR Note: These estimates suggest real GDP growth will be just under 2.0% annualized in Q3.

Trade Deficit increased to $54.9 Billion in August

by Calculated Risk on 10/04/2019 10:50:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $54.9 billion in August, up $0.9 billion from $54.0 billion in July, revised.

August exports were $207.9 billion, $0.5 billion more than July exports. August imports were $262.8 billion, $1.3 billion more than July imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in August.

Exports are 26% above the pre-recession peak and unchanged compared to August 2018; imports are 13% above the pre-recession peak, and unchanged compared to August 2018.

In general, trade had been picking up, but both imports and exports have moved more sideways recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $54.13 per barrel in August, down from $56.48 in July, and down from $62.64 in August 2018.

The trade deficit with China decreased to $31.8 billion in August, from $38.6 billion in August 2018.

Comments on September Employment Report

by Calculated Risk on 10/04/2019 09:07:00 AM

The headline jobs number at 135 thousand for September ex-Census (136K total including temp Census hires) was below consensus expectations of 145 thousand, however the previous two months were revised up 45 thousand, combined. The unemployment rate declined to 3.5%; the lowest rate since 1969.

Earlier: September Employment Report: 136,000 Jobs Added, 3.5% Unemployment Rate

In September, the year-over-year employment change was 2.147 million jobs including Census hires (note: this will be revised down significantly in February with the benchmark revision).

Average Hourly Earnings

Wage growth was below expectations. From the BLS:

"In September, average hourly earnings for all employees on private nonfarm payrolls, at $28.09, were little changed (-1 cent), after rising by 11 cents in August. Over the past 12 months, average hourly earnings have increased by 2.9 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.9% YoY in September.

Wage growth had been generally trending up, but has weakened recently.

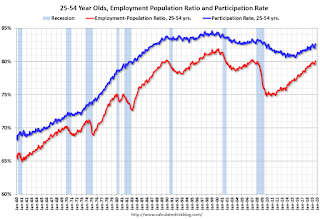

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in September at 82.6% from 82.6% in August, and the 25 to 54 employment population ratio was increased to 80.1% from 80.0%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 4.4 million in September. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in September to 4.350 million from 4.381 million in August. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 6.9% in September. This is the lowest level for U-6 since 2000.

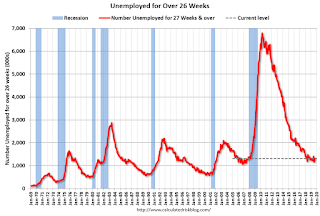

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.314 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 1.243 million in August.

Summary:

The headline jobs number was below expectations, however the previous two months were revised up. The headline unemployment rate declined to 3.5%; the lowest since 1969. However, wage growth was below expectations.

This was mixed jobs report.

The economy added 1.419 million jobs through September 2019 ex-Census, down from 1.979 million jobs during the same period of 2018 (although 2018 will be revised down with benchmark revision to be released in February 2020). So job growth has slowed.