by Calculated Risk on 10/11/2019 11:22:00 AM

Friday, October 11, 2019

Leading Index for Commercial Real Estate Increased in September

From Dodge Data Analytics: Dodge Momentum Index Posts Gain in September

The Dodge Momentum Index moved 4.1% higher in September to 143.6 (2000=100) from the revised August reading of 137.9. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

The gain in September was due entirely to an 8.9% increase in the commercial component, while the institutional component fell 4.8%.

For the third quarter, the overall Momentum Index averaged 140.1, a scant increase of 0.7% from its average in the previous quarter. Compared to the third quarter of 2018, however, the Momentum Index is 8.6% lower with the commercial component 3.7% lower than a year ago and the institutional component down 16.2%. While the dollar volume of projects in planning is certainly lower than it was a year ago, the index has moved more sideways than downward over the last two quarters.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 143.6 in September, up from 137.9 in August.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". After declining late last year, this index has moved mostly sideways in 2019.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 10/11/2019 09:05:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 5 October

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 29 September through 5 October 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 30 September through 6 October 2018, the industry recorded the following:

• Occupancy: -3.9% to 68.1%

• Average daily rate (ADR): -3.8% to US$129.21

• Revenue per available room (RevPAR): -7.5% to US$88.00

STR analysts attribute significant performance decreases in many markets to the Rosh Hashanah calendar shift. Travel and conference schedules during the comparable time period last year were not affected by the Jewish holidays.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will now increase during the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, October 10, 2019

House Prices to National Average Wage Index

by Calculated Risk on 10/10/2019 04:18:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

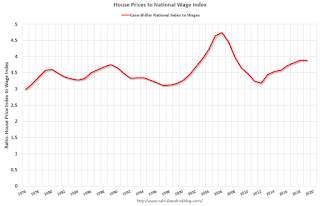

For this graph I decided to look at house prices and the National Average Wage Index released today for 2018 from Social Security.

Note: For a different look at house prices and income, see this post (using median income).

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2018, house prices were somewhat above the median historical ratio - but far below the bubble peak.

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Note: The national wage index for 2019 is estimated using the median increase over the last several years.

Houston Real Estate in September: Sales up 9.5% YoY, Inventory Up 7%

by Calculated Risk on 10/10/2019 01:35:00 PM

Another hot regional market in September.

From the HAR: The Houston Housing Market Shows no Letup in September

Houston home sales registered the seventh positive month of 2019 in September as consumers continued to take advantage of low mortgage interest rates, keeping a market that normally slows down this time of year buzzing. According to the latest monthly report from the Houston Association of Realtors (HAR), sales of single-family homes across the Houston area totaled 7,035 in September. That is up 9.5 percent year-over-year and marks the second largest one-month sales volume of the year. On a year-to-date basis, home sales are running 3.8 percent ahead of 2018’s record volume.Total active inventory was up 7.3% YoY to 44,172 properties from 41,174 properties in September 2018. Sales are on pace for a record year.

...

Buyers have had a more plentiful supply of homes from which to choose in 2019 compared to last year. In September, housing inventory edged up to a 4.1-months supply versus 4.0 months in September 2018. So far this year, the peak of inventory was reached in June and July when it registered a 4.3-months supply.

“I cannot recall a fall in Houston when home sales and rentals were quite this brisk,” said HAR Chair Shannon Cobb Evans with Better Homes and Gardens Real Estate Gary Greene. “Historically low interest rates and a strong overall local economy have drawn more buyers than usual to the market and kept Realtors like myself extremely busy. We remain on track for another record year.”

emphasis added

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in September, Core PCE below 2%

by Calculated Risk on 10/10/2019 11:09:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (3.0% annualized rate) in September. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for September here. Motor fuel was down 25% annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was unchanged (0.3% annualized rate) in September. The CPI less food and energy rose 0.1% (1.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 3.0%, the trimmed-mean CPI rose 2.3%, and the CPI less food and energy rose 2.4%. Core PCE is for August and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.0% annualized and trimmed-mean CPI was at 1.9% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

Cost of Living Adjustment increases 1.6% in 2020, Contribution Base increased to $137,700

by Calculated Risk on 10/10/2019 09:37:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2020.

From Social Security: Social Security Announces 1.6 Percent Benefit Increase for 2020

Social Security and Supplemental Security Income (SSI) benefits for nearly 69 million Americans will increase 1.6 percent in 2020, the Social Security Administration announced today.Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (1.6% increase) and a list of previous Cost-of-Living Adjustments.

The 1.6 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 63 million Social Security beneficiaries in January 2020. Increased payments to more than 8 million SSI beneficiaries will begin on December 31, 2019. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $137,700 from $132,900.

The contribution and benefit base will be $137,700 in 2020.

The National Average Wage Index increased to $52,145.80 in 2018, up 3.6% from $50,321.89 in 2017 (used to calculate contribution base).

Weekly Initial Unemployment Claims decreased to 210,000

by Calculated Risk on 10/10/2019 08:36:00 AM

The DOL reported:

In the week ending October 5, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 219,000 to 220,000. The 4-week moving average was 213,750, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 212,500 to 212,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 213,750.

This was lower than the consensus forecast.

BLS: CPI unchanged in September, Core CPI increased 0.1%

by Calculated Risk on 10/10/2019 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in September on a seasonally adjusted basis after rising 0.1 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment.Core inflation was below expectations in September. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.1 percent in September after increasing 0.3 percent in each of the last 3 months.

...

The all items index increased 1.7 percent for the 12 months ending September, the same increase as for the 12 months ending August. The index for all items less food and energy rose 2.4 percent over the last 12 months, also the same increase as the period ending August.

emphasis added

Wednesday, October 09, 2019

Thursday: CPI, Unemployment Claims

by Calculated Risk on 10/09/2019 08:35:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, down from 219,000 last week.

• Also at 8:30 AM, The Consumer Price Index for September from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

FOMC Minutes: "More concerned about risks associated with trade tensions and adverse geopolitical developments"

by Calculated Risk on 10/09/2019 02:25:00 PM

From the Fed: Minutes of the Federal Open Market Committee, September 17-18, 2019. A few excerpts:

Participants generally viewed the baseline economic outlook as positive and indicated that their views of the most likely outcomes for economic activity and inflation had changed little since the July meeting. However, for most participants, that economic outlook was premised on a somewhat more accommodative path for policy than in July. Participants generally had become more concerned about risks associated with trade tensions and adverse developments in the geopolitical and global economic spheres. In addition, inflation pressures continued to be muted. Many participants expected that real GDP growth would moderate to around its potential rate in the second half of the year.

...

Participants generally judged that downside risks to the outlook for economic activity had increased somewhat since their July meeting, particularly those stemming from trade policy uncertainty and conditions abroad. In addition, although readings on the labor market and the overall economy continued to be strong, a clearer picture of protracted weakness in investment spending, manufacturing production, and exports had emerged. Participants also noted that there continued to be a significant probability of a no-deal Brexit, and that geopolitical tensions had increased in Hong Kong and the Middle East. Several participants commented that, in the wake of this increase in downside risk, the weakness in business spending, manufacturing, and exports could give rise to slower hiring, a development that would likely weigh on consumption and the overall economic outlook.

...

Participants judged that conditions in the labor market remained strong, with the unemployment rate near historical lows and continued solid job gains, on average, in recent months. The labor force participation rate of prime-age individuals, especially of prime-age women, moved up in August, continuing its upward trajectory, and the unemployment rate of African Americans fell to its lowest rate on record. However, a number of participants noted that, although the labor market was clearly in a strong position, the preliminary benchmark revision by the Bureau of Labor Statistics indicated that payroll employment gains would likely show less momentum coming into this year when the revisions are incorporated in published data early next year. A few participants observed that it would be important to be vigilant in monitoring incoming data for any sign of softening in labor market conditions.

emphasis added