by Calculated Risk on 10/17/2019 11:15:00 AM

Thursday, October 17, 2019

Philly Fed Manufacturing shows slow Growth in October

From the Philly Fed: Current Manufacturing Indexes Suggest Growth in October

Manufacturing activity in the region continued to grow, according to results from the October Manufacturing Business Outlook Survey. The survey's broad indicators remained positive, although their movements were mixed this month: The general activity and shipments indicators decreased from their readings last month, but the indicators for new orders and employment increased. The survey’s future activity indexes remained positive, suggesting continued optimism about growth for the next six months.This was at the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity fell 6 points this month to 5.6, after decreasing 5 points in September.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

These early reports suggest the ISM manufacturing index will probably be weak again in October.

Industrial Production Decreased in September

by Calculated Risk on 10/17/2019 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production fell back 0.4 percent in September after advancing 0.8 percent in August. For the third quarter, industrial production rose at an annual rate of 1.2 percent following declines of about 2 percent in both the first and the second quarters.

Manufacturing production decreased 0.5 percent in September, with output reduced by a strike at a major manufacturer of motor vehicles. Excluding motor vehicles and parts, the overall index and the manufacturing index each moved down 0.2 percent. Mining production fell 1.3 percent, while utilities output rose 1.4 percent.

At 109.5 percent of its 2012 average, total industrial production was 0.1 percent lower in September than it was a year earlier. Capacity utilization for the industrial sector decreased 0.4 percentage point in September to 77.5 percent, a rate that is 2.3 percentage points below its long-run (1972–2018) average.

emphasis added

Click on graph for larger image.

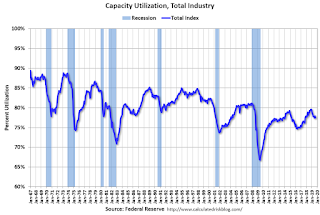

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.5% is 2.3% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in September to 109.5. This is 26% above the recession low, and 3.9% above the pre-recession peak.

The change in industrial production and increase in capacity utilization were below consensus expectations.

Housing Starts decreased to 1.256 Million Annual Rate in September

by Calculated Risk on 10/17/2019 08:44:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in September were at a seasonally adjusted annual rate of 1,256,000. This is 9.4 percent below the revised August estimate of 1,386,000, but is 1.6 percent above the September 2018 rate of 1,236,000. Single‐family housing starts in September were at a rate of 918,000; this is 0.3 percent above the revised August figure of 915,000. The September rate for units in buildings with five units or more was 327,000.

Building Permits:

Privately‐owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,387,000. This is 2.7 percent below the revised August rate of 1,425,000, but is 7.7 percent above the September 2018 rate of 1,288,000. Single‐family authorizations in September were at a rate of 882,000; this is 0.8 percent above the revised August figure of 875,000. Authorizations of units in buildings with five units or more were at a rate of 470,000 in September.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were down in September compared to August. Multi-family starts were down 5.1% year-over-year in September.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last several years.

Single-family starts (blue) increased in September, and were up 4.3% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in September were below expectations - mostly due to a decline in the volatile multi-family sector - however starts for July and August were revised up combined.

I'll have more later …

Weekly Initial Unemployment Claims increased to 214,000

by Calculated Risk on 10/17/2019 08:33:00 AM

The DOL reported:

In the week ending October 12, the advance figure for seasonally adjusted initial claims was 214,000, an increase of 4,000 from the previous week's unrevised level of 210,000. The 4-week moving average was 214,750, an increase of 1,000 from the previous week's unrevised average of 213,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 214,750.

This was close to the consensus forecast.

Wednesday, October 16, 2019

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg, Industrial Production

by Calculated Risk on 10/16/2019 07:16:00 PM

Thursday:

• At 8:30 AM, Housing Starts for September. The consensus is for 1.300 million SAAR, down from 1.364 million SAAR.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 210,000 last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of 7.1, down from 12.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decline to 77.8%.

CAR on California Housing: Low Rates "Bolster" Sales in September

by Calculated Risk on 10/16/2019 12:54:00 PM

The CAR reported: Greater buying power amid historically low rates bolsters September home sales,

C.A.R. reports

Amid the most favorable mortgage interest rates in nearly three years, California’s housing market recorded a third consecutive year-over-year sales increase as month-over-month sales remained essentially flat, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that this is the third consecutive YoY decrease in inventory in California since early 2018.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 404,030 units in September, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

September’s sales figure was down 0.5 percent from the 406,100 level in August and up 5.8 percent from home sales in September 2018 of a revised 382,040. The year-over-year sales increase was the largest in two-and-a-half years.

“The housing market has been performing better so far in the second half of 2019, with both sales and prices up as mortgage rates remain near their three-year lows,” said C.A.R. President Jared Martin. “Additionally, pending sales have been on an upward trend with a near-10 percent increase over a year ago, making it the largest gain in three years. The solid improvement in pending sales suggests that the market may see more sales gains in the coming months.”

...

After 15 straight months of year-over-year increases, active listing fell for the third straight month, dropping 11.8 percent from year ago. The decline was the largest since December 2017.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was 3.5 months in September, up from 3.2 in August and down from 4.2 months in September 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.2% | 19.2% |

| Mar-19 | 1.8% | 13.4% |

| Apr-19 | 1.7% | 10.8% |

| May-19 | 2.1% | 7.4% |

| Jun-19 | -0.05% | 2.4% |

| Jul-19 | -1.0 | -2.1% |

| Aug-19 | -2.6 | -8.9% |

| Sep-19 | NA | -11.8% |

NAHB: "Builder Confidence Hits 20-Month High"

by Calculated Risk on 10/16/2019 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 71 in October, up from 68 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Hits 20-Month High

Builder confidence in the market for newly-built single-family homes rose three points to 71 in October, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Sentiment levels are at their highest point since February 2018.

“The housing rebound that began in the spring continues, supported by low mortgage rates, solid job growth and a reduction in new home inventory,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn.

“The second half of 2019 has seen steady gains in single-family construction, and this is mirrored by the gradual uptick in builder sentiment over the past few months,” said NAHB Chief Economist Robert Dietz. “However, builders continue to remain cautious due to ongoing supply side constraints and concerns about a slowing economy.”

…

All the HMI indices posted gains in October. The HMI index gauging current sales conditions increased three points to 78, the component measuring sales expectations in the next six months jumped six points to 76 and the measure charting traffic of prospective buyers rose four points to 54.

Looking at the three-month moving averages for regional HMI scores, the Northeast posted a one-point gain to 60, the Midwest was up a single point to 58, the South registered a three-point increase to 73 and the West was also up three points to 78.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.

Retail Sales decreased 0.3% in September

by Calculated Risk on 10/16/2019 08:41:00 AM

On a monthly basis, retail sales decreased 0.3 percent from August to September (seasonally adjusted), and sales were up 4.1 percent from September 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $525.6 billion, a decrease of 0.3 percent from the previous month, but 4.1 percent above September 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.2% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.7% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.7% on a YoY basis.The increase in September was below expectations, however sales in August were revised up.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 10/16/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 11, 2019.

... The Refinance Index increased 4 percent from the previous week and was 199 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

“The ongoing interest rate volatility is impacting a borrowers’ ability to lock in the lowest rate possible. Despite a slight rise in mortgage rates last week, refinance applications increased 4 percent and were 199 percent higher than a year ago,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Purchase applications slowed for the second week in a row. While near term economic uncertainty is still a factor, other fundamental issues, such as a lack of housing inventory in many markets, is preventing purchase activity from meaningfully rising. However, purchase applications were still much higher than a year ago. This is a reminder that the purchase environment in 2019 continues to be stronger than in 2018.””

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 3.92 percent from 3.90 percent, with points decreasing to 0.35 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity. Mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 12% year-over-year.

Tuesday, October 15, 2019

Wednesday: Retail Sales, Homebuilder Survey

by Calculated Risk on 10/15/2019 08:04:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for September will be released. The consensus is for a 0.3% increase in retail sales.

• At 10:00 AM, The October NAHB homebuilder survey. The consensus is for a reading of 68, unchanged from 68 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.