by Calculated Risk on 10/29/2019 09:12:00 AM

Tuesday, October 29, 2019

Case-Shiller: National House Price Index increased 3.2% year-over-year in August

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Las Vegas Drops Out Of Top Three Cities In Annual Gains According To S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.2% annual gain in August, up from 3.1% in the previous month. The 10-City Composite annual increase came in at 1.5%, down from 1.6% in the previous month. The 20-City Composite posted a 2.0% year-over-year gain, no change from the previous month.

Phoenix, Charlotte, and Tampa reported the highest year-over-year gains among the 20 cities. In August, Phoenix led the way with a 6.3% year-over-year price increase, followed by Charlotte with a 4.5% increase and Tampa with a 4.3% increase. Seven of the 20 cities reported greater price increases in the year ending August 2019 versus the year ending July 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.2% in August. The 10-City and 20-City Composites did not post any gains for the month. After seasonal adjustment, the National Index recorded a 0.3% month-over-month increase in August. The 10-City Composite posted a 0.1% decrease and the 20-City Composite posted a 0.2% decrease. In August, 11 of 20 cities reported increases both before seasonal adjustment while 17 of 20 cities reported increases after seasonal adjustment.

The U.S. National Home Price NSA Index trend remained intact with a year-over-year price change of 3.2%” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “However, a shift in regional leadership may be underway beneath the headline national index.

“Phoenix saw an increase in its YOY price change to 6.3% and retained its leading position. However, Las Vegas dropped from number two to number eight among the cities of the 20-City Composite, falling from a 4.7% YOY change in July to only 3.3% in August. Meanwhile, the Southeast region included three of the top four cities. Charlotte, Tampa, and Atlanta all recorded solid YOY performance with price changes of 4.5%, 4.3%, and 4.0%, respectively. In the Northwest, Seattle’s YOY change turned positive (0.7%) after three consecutive months of negative YOY price changes. The 10-City Composite YOY price change declined slightly from July to 1.5%, while the 20-City Composite YOY price change remained steady at 2.0%. San Francisco was the only city to record a negative YOY price change (-0.1%).”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.8% from the bubble peak, and down 0.1% in August (SA) from June.

The Composite 20 index is 4.4% above the bubble peak, and down 0.2% (SA) in August.

The National index is 13.8% above the bubble peak (SA), and up 0.3% (SA) in August. The National index is up 53.9% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 1.6% compared to August 2018. The Composite 20 SA is up 2.1% year-over-year.

The National index SA is up 3.2% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, October 28, 2019

Tuesday: Case-Shiller House Prices, Pending Home Sales

by Calculated Risk on 10/28/2019 07:12:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Near 3-Month Highs

Mortgage rates increased again today as lenders continued to get caught up with 2 days of bond market weakness. … With the early October lows representing a modest increase from the early September lows, there's a risk that a bigger-picture shift is taking place. Simply put, the long-term trend of falling rates that began roughly 1 year ago could be in the process of shifting toward a trend of rising rates. [Most Prevalent Rates 30YR FIXED 3.75-3.875%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 0.2% decrease in the index.

• At 10:00 AM, The Q3 2019 Housing Vacancies and Homeownership report from the Census Bureau.

FOMC Preview

by Calculated Risk on 10/28/2019 02:43:00 PM

Expectations are the FOMC will cut the Fed Funds rate 25bp at the meeting this week.

Here are some comments from Goldman Sachs chief economist Jan Hatzius:

We expect the FOMC to deliver a third and final 25bp rate cut at the upcoming meeting. … We believe the mixed growth data since the last meeting more closely resembles the Committee’s baseline forecast than the downside scenarios under discussion. … We expect a somewhat hawkish rewording, with “act as appropriate to sustain the expansion” replaced by a reference to recent easing and the less committal “will act as needed to promote its objectives.”For review, here are the September FOMC projections. In general the data has been close to expectations, suggesting a rate cut at this meeting (since the projections mostly assume a rate cut).

Everyone will be looking for hints of a fourth rate cut - or if the Fed thinks this is the end of the "mid-cycle" rate cuts as Hatzius thinks.

Q1 real GDP growth was at 3.1% annualized, Q2 at 2.0%, and Q3 is projected to be around 1.7%. So GDP is probably close to expectations.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Sept 2019 | 2.1 to 2.3 | 1.8 to 2.1 | 1.8 to 2.0 |

| Jun 2019 | 2.0 to 2.2 | 1.8 to 2.2 | 1.8 to 2.0 |

The unemployment rate was at 3.5% in September. So the unemployment rate is lower than projected for Q4.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Sept 2019 | 3.6 to 3.7 | 3.6 to 3.8 | 3.6 to 3.9 |

| Jun 2019 | 3.6 to 3.7 | 3.5 to 3.9 | 3.6 to 4.0 |

As of August 2019, PCE inflation was up 1.4% from August 2018 So PCE inflation is on the low end of projections.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.8% in August year-over-year. So Core PCE inflation is at the top end of the projected range.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 to 2.1 |

Dallas Fed: "Pace of Texas Manufacturing Expansion Slows"

by Calculated Risk on 10/28/2019 10:36:00 AM

From the Dallas Fed: Pace of Texas Manufacturing Expansion Slows, but Outlook Improves

Texas factory activity continued to expand in October, albeit at a markedly slower pace, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell nine points to 4.5, suggesting a moderation in output growth in October.This was the last of the regional Fed surveys for September.

Other measures of manufacturing activity also suggested slower expansion in October, and demand declined. The new orders index turned negative for the first time in three years, falling 11 points to -4.2. The growth rate of orders index also fell into negative territory, coming in at -5.9. The capacity utilization index retreated from 12.0 to 3.6, reaching a three-year low. The shipments index fell nine points to 6.0.

Perceptions of broader business conditions were mixed in October. The general business activity index fell from 1.5 to -5.1, returning to negative territory after two months of positive readings. The company outlook index continued to increase, inching up to 8.8 this month. The index measuring uncertainty regarding companies’ outlooks remained slightly elevated at 12.1.

Labor market measures suggested slower growth in employment and work hours this month. The employment index remained positive but retreated from 18.8 to 11.0, a reading still above average.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index for October will be weak again.

Chicago Fed "Index Points to Slower Economic Growth in September"

by Calculated Risk on 10/28/2019 08:44:00 AM

From the Chicago Fed: Index Points to Slower Economic Growth in September

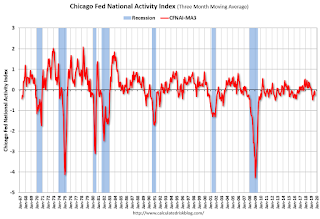

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.45 in September from +0.15 in August. Three of the four broad categories of indicators that make up the index decreased from August, and all four categories made negative contributions to the index in September. The index’s three-month moving average, CFNAI-MA3, decreased to –0.24 in September from –0.06 in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in September (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, October 27, 2019

Sunday Night Futures

by Calculated Risk on 10/27/2019 06:59:00 PM

Weekend:

• Schedule for Week of October 27, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for September. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3 and DOW futures are up 42 (fair value).

Oil prices were up over the last week with WTI futures at $56.75 per barrel and Brent at $62.07 barrel. A year ago, WTI was at $67, and Brent was at $78 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.59 per gallon. A year ago prices were at $2.81 per gallon, so gasoline prices are down 22 cents year-over-year.

October 2019: Unofficial Problem Bank list Decreased to 71 Institutions

by Calculated Risk on 10/27/2019 12:20:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for October 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for October 2019. During the month, the list declined by three to 71 banks after three removals. Aggregate assets were little changed finishing the month at $55.3. A year ago, the list held 75 institutions with assets of $56.3 billion. This month, the OCC terminated its action against Eastern Savings Bank, FSB, Hunt Valley, MD ($324 million). The other two removals were through failure. Both Louisa Community Bank, Louisa, KY ($30 million) and Resolute Bank (f/k/a Bank of Maumee), Maumee, OH ($27 million) were closed by their chartering authority. In what might be viewed as an action to “paper the file” before a post-mortem review, the OCC issued a Prompt Corrective Action order on October 2, 2019 to Resolute Bank less than a month before its failure. The other item of interest is that it has been more than four years since two banks were closed on the same day. It last occurred on October 2, 2015 when The Bank of Georgia, Peachtree City, GA ($294 million) and Hometown National Bank, Longview, WA ($5 million) were closed.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and then steadily declined to below 100 institutions.

Saturday, October 26, 2019

Schedule for Week of October 27, 2019

by Calculated Risk on 10/26/2019 08:11:00 AM

The key report this week is the October employment report on Friday.

Other key indicators include the October ISM manufacturing index, Personal Income and Outlays for September, and Case-Shiller house prices for August.

For manufacturing, the Dallas Fed manufacturing survey will be released this week.

The FOMC meets this week and is expected to lower rates 25bps.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for August.

9:00 AM ET: S&P/Case-Shiller House Price Index for August.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

10:00 AM: Pending Home Sales Index for September. The consensus is 0.2% decrease in the index.

10:00 AM: The Q3 2019 Housing Vacancies and Homeownership report from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 139,000 jobs added, up from 135,000 in September.

8:30 AM: Gross Domestic Product, 3rd quarter 2019 (advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3, down from 2.0% in Q2.

2:00 PM: FOMC Meeting Announcement. The Fed is expected to lower the Fed Funds rate 25bps at this meeting..

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 212,000 last week.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 48.0, up from 47.1 in September.

8:30 AM: Employment Report for October. The consensus is for 93,000 jobs added, and for the unemployment rate to increase to 3.6%.

8:30 AM: Employment Report for October. The consensus is for 93,000 jobs added, and for the unemployment rate to increase to 3.6%.Note: The GM strike and supplier cutbacks (now settled) will probably subtract close to 75,000 jobs in October.

There were 136,000 jobs added in September, and the unemployment rate was at 3.5%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In September, the year-over-year change was 2.147 million jobs.

A key will be the change in wages.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 49.0%, up from 47.8%.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 49.0%, up from 47.8%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 47.8% in September, the employment index was at 46.3%, and the new orders index was at 47.3%

10:00 AM: Construction Spending for September. The consensus is for 0.2% increase in spending.

Friday, October 25, 2019

My Slide Deck: "2020 Economic Forecast featuring the UCI Paul Merage School of Business"

by Calculated Risk on 10/25/2019 01:05:00 PM

On Wednesday, I spoke at the Newport Chamber of Commerce 2020 Economist Forecast. It was sold out - thanks to all who attended (parking was a problem).

Here is most of the slide deck I presented.

I discussed the two most frequent questions I'm asked: Are house prices in a new bubble? And will there be a recession in the next 12 months.

I also discussed some commercial real estate sectors (but I was limited to 20 minutes).

The short answers are:

House prices might be a little elevated based on fundamentals, but there is very little speculation - and there is no Bubble 2.0.

And on a recession: Don't freak out about the yield curve - especially when the Fed is cutting rates, and housing activity is fine - so I don't expect a recession in the next 12 months.

Best to all

Q3 GDP Forecasts: Under 2.0%

by Calculated Risk on 10/25/2019 12:30:00 PM

The advance estimate for Q3 GDP will be released on Wednesday, October 30th. The consensus is real annualized GDP increased 1.6% in Q3.

From Merrill Lynch:

We expect the advance 3Q GDP report to reveal moderation in growth to 1.5% qoq saar from 2.0% in 2Q. [Oct 25 estimate]From Goldman Sachs:

emphasis added

we left our Q3 GDP tracking estimate unchanged at +1.6% (qoq ar). [October 24 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.9% for 2019:Q3 and 0.9% for 2019:Q4. [Oct 25 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 1.8 percent on October 24 [Oct 24 estimate]CR Note: These estimates suggest real GDP growth will be under 2.0% annualized in Q3.