by Calculated Risk on 10/30/2019 06:57:00 PM

Wednesday, October 30, 2019

Thursday: Personal Income & Outlays, Unemployment Claims

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 212,000 last week.

• Also at 8:30 AM, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 48.0, up from 47.1 in September.

FOMC Statement: 25bp Decrease

by Calculated Risk on 10/30/2019 02:01:00 PM

Information received since the Federal Open Market Committee met in September indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports remain weak. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-1/2 to 1-3/4 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. The Committee will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against this action were: Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range at 1-3/4 percent to 2 percent.

emphasis added

Q3 GDP: Investment

by Calculated Risk on 10/30/2019 10:07:00 AM

Investment was weak again in Q3, although residential investment picked up (increased at a 5.1% annual rate).

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased in Q3 (5.1% annual rate in Q3). Equipment investment decreased at a 3.8% annual rate, and investment in non-residential structures decreased at a 15.3% annual rate.

On a 3 quarter trailing average basis, RI (red) is up slightly, equipment (green) is slightly negative, and nonresidential structures (blue) is also down.

I'll post more on the components of non-residential investment once the supplemental data is released.

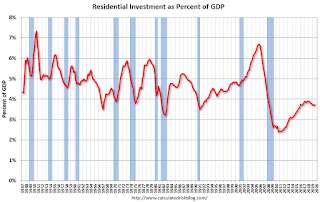

Residential Investment as a percent of GDP increased in Q3, however RI has generally been increasing. RI as a percent of GDP is close to the bottom of the previous recessions - and I expect RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

BEA: Real GDP increased at 1.9% Annualized Rate in Q3

by Calculated Risk on 10/30/2019 08:34:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2019 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 1.9 percent in the third quarter of 2019, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.0 percent. ...The advance Q3 GDP report, with 1.9% annualized growth, was slightly above expectations.

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), federal government spending, residential fixed investment, state and local government spending, and exports that were partly offset by negative contributions from nonresidential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the third quarter reflected decelerations in PCE, federal government spending, and state and local government spending, and a larger decrease in nonresidential fixed investment. These movements were partly offset by a smaller decrease in private inventory investment, and upturns in exports and in residential fixed investment.

emphasis added

Personal consumption expenditures (PCE) increased at 2.9% annualized rate in Q3, down from 4.6% in Q2. Residential investment (RI) increased at a 5.1% rate in Q3. Equipment investment decreased at a 3.8% annualized rate, and investment in non-residential structures decreased at a 15.3% pace.

I'll have more later ...

ADP: Private Employment increased 125,000 in October

by Calculated Risk on 10/30/2019 08:19:00 AM

Private sector employment increased by 125,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in tota ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 139,000 private sector jobs added in the ADP report.

...

“While job growth continues to soften, there are certain segments of the labor market that remain strong,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The goods producing sector showed weakness; however, the healthcare industry and midsized companies had solid gains.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth has throttled way back over the past year. The job slowdown is most pronounced at manufacturers and small companies. If hiring weakens any further, unemployment will begin to rise.”

The BLS report will be released Friday, and the consensus is for 93,000 non-farm payroll jobs added in October.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 10/30/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 25, 2019.

... The Refinance Index decreased 1 percent from the previous week and was 134 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“The 10-year Treasury rate rose slightly last week, as markets expected more progress toward a trade deal between the U.S. and China. Mortgage rates increased for the second straight week as a result, with the 30-year fixed rate climbing to 4.05 percent – the highest level since the end of July,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Mortgage applications were mostly unchanged, with purchase activity rising 2 percent and refinances decreasing less than 1 percent. Purchase applications continued to run at a stronger pace than last year, finishing a robust 10 percent higher than a year ago. Considering how much lower rates are compared to the end of 2018, purchase applications should continue showing solid year-over-year gains.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.05 percent from 4.02 percent, with points decreasing to 0.37 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity - but declined a little recently with higher rates. Mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

Tuesday, October 29, 2019

Wednesday: GDP, FOMC Announcement, ADP Employment

by Calculated Risk on 10/29/2019 08:51:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 139,000 jobs added, up from 135,000 in September.

• At 8:30 AM, Gross Domestic Product, 3rd quarter 2019 (advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3, down from 2.0% in Q2.

• At 2:00 PM, FOMC Meeting Announcement. The Fed is expected to lower the Fed Funds rate 25bps at this meeting..

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 10/29/2019 04:24:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

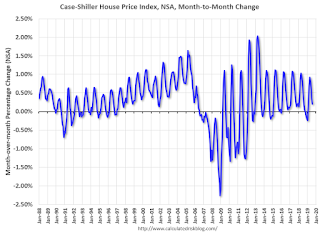

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through August 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

HVS: Q3 2019 Homeownership and Vacancy Rates

by Calculated Risk on 10/29/2019 11:42:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2019.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. he Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

"National vacancy rates in the third quarter 2019 were 6.8 percent for rental housing and 1.4 percent for homeowner housing. The rental vacancy rate of 6.8 percent was not statistically different from the rate in the third quarter 2018 (7.1 percent) and virtually unchanged from the rate in the second quarter 2019. The homeowner vacancy rate of 1.4 percent was 0.2 percentage points lower than the rate in the third quarter 2018 (1.6 percent) and was 0.1 percentage points higher than the rate in the second quarter 2019 (1.3 percent).

The homeownership rate of 64.8 percent was not statistically different from the rate in the third quarter 2018 (64.4 percent), but was 0.7 percentage points higher than the rate in the second quarter 2019 (64.1 percent)."

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 64.8% in Q2, from 64.2% in Q3.

I'd put more weight on the decennial Census numbers. However, given changing demographics, the homeownership rate has bottomed.

The HVS homeowner vacancy increased to 1.4% in Q3.

The HVS homeowner vacancy increased to 1.4% in Q3. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

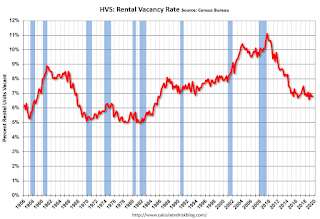

The rental vacancy rate was unchanged at 6.8% in Q3.

The rental vacancy rate was unchanged at 6.8% in Q3.The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate is close to the bottom for this cycle.

NAR: "Pending Home Sales Rise 1.5% in September"

by Calculated Risk on 10/29/2019 10:08:00 AM

From the NAR: Pending Home Sales Rise 1.5% in September

Pending home sales grew in September, marking two consecutive months of increases, according to the National Association of Realtors. The four major regions were split last month, as the Midwest and South recorded gains but the Northeast and West reported declines in month-over-month contract activity.This was above expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, rose 1.5% to 108.7 in September. Year-over-year contract signings jumped 3.9%. An index of 100 is equal to the level of contract activity in 2001.

...

Regional indices in September were mixed, with the Northeast experiencing the smallest change of the four regions. The PHSI in the Northeast fell 0.4% to 93.9 in September, but is still 1.3% higher than a year ago. In the Midwest, the index increased 3.1% to 104.4 in September, 2.7% higher than September 2018.

Pending home sales in the South increased 2.6% to an index of 127.5 in September, a 5.7% jump from last September. The index in the West declined 1.3% in September 2019 to 95.1, which is an increase of 3.4% from a year ago.

emphasis added