by Calculated Risk on 11/01/2019 01:31:00 PM

Friday, November 01, 2019

Comments on October Employment Report

The headline jobs number at 148 thousand for October ex-Census (128K total including temp Census hires and layoffs) was above consensus expectations of 93 thousand, and the previous two months were revised up 95 thousand, combined. The unemployment rate increased to 3.6%.

Earlier: October Employment Report: 148,000 Jobs Added ex-Census, 3.6% Unemployment Rate

In October, the year-over-year employment change was 2.093 million jobs including Census hires (note: this will be revised down in February with the benchmark revision).

Seasonal Retail Hiring

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 137 thousand workers (NSA) net in October. Note: this is NSA (Not Seasonally Adjusted).

This is more than last year in October.

Average Hourly Earnings

Wage growth was below expectations. From the BLS:

"In October, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $28.18. Over the past 12 months, average hourly earnings have increased by 3.0 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.0% YoY in October.

Wage growth had been generally trending up, but has weakened recently.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was increase in October to 82.8% from September at 82.6%, and the 25 to 54 employment population ratio was increased to 80.3% from 80.1%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 4.4 million, changed little in October. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in October to 4.438 million from 4.350 million in September. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.0% in October.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.264 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.314 million in September.

Summary:

The headline jobs number was above expectations, and the previous two months were revised up. The headline unemployment rate increased to 3.6%; and, wage growth was below expectations. Factoring in the temporary Census fires, the GM strike, and the upward revisions to prior months, this was a solid report.

In 2019, the economy has added 1.662 million jobs through October 2019 ex-Census, down from 2.256 million jobs during the same period of 2018 (although 2018 will be revised down with benchmark revision to be released in February 2020). So job growth has slowed.

Construction Spending Increased in October, Down 2.0% YoY

by Calculated Risk on 11/01/2019 11:20:00 AM

From the Census Bureau reported that overall construction spending increased slightly in August:

Construction spending during September 2019 was estimated at a seasonally adjusted annual rate of $1,293.6 billion, 0.5 percent above the revised August estimate of $1,287.1 billion. The September figure is 2.0 percent below the September 2018 estimate of $1,319.7 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $961.7 billion, 0.2 percent above the revised August estimate of $959.9 billion. ...

In September, the estimated seasonally adjusted annual rate of public construction spending was $331.9 billion, 1.5 percent above the revised August estimate of $327.2 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 25% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 2% above the previous peak in March 2009, and 27% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 4%. Non-residential spending is down 6% year-over-year. Public spending is up 7% year-over-year.

This was above consensus expectations.

ISM Manufacturing index at 48.3 in October

by Calculated Risk on 11/01/2019 10:05:00 AM

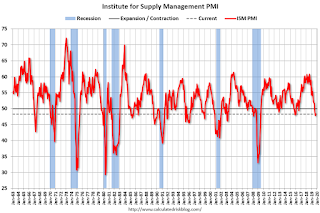

The ISM manufacturing index indicated contraction in October. The PMI was at 48.3% in October, up from 47.8% in September. The employment index was at 47.7%, up from 46.3% last month, and the new orders index was at 49.1%, up from 47.3%.

From the Institute for Supply Management: October 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in October, and the overall economy grew for the 126th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The October PMI® registered 48.3 percent, an increase of 0.5 percentage point from the September reading of 47.8 percent. The New Orders Index registered 49.1 percent, an increase of 1.8 percentage points from the September reading of 47.3 percent. The Production Index registered 46.2 percent, down 1.1 percentage points compared to the September reading of 47.3 percent. The Backlog of Orders Index registered 44.1 percent, down 1 percentage point compared to the September reading of 45.1 percent. The Employment Index registered 47.7 percent, a 1.4-percentage point increase from the September reading of 46.3 percent. The Supplier Deliveries Index registered 49.5 percent, a 1.6-percentage point decrease from the September reading of 51.1 percent. The Inventories Index registered 48.9 percent, an increase of 2 percentage points from the September reading of 46.9 percent. The Prices Index registered 45.5 percent, a 4.2-percentage point decrease from the September reading of 49.7 percent. The New Export Orders Index registered 50.4 percent, a 9.4-percentage point increase from the September reading of 41 percent. The Imports Index registered 45.3 percent, a 2.8-percentage point decrease from the September reading of 48.1 percent.

“Comments from the panel reflect an improvement from the prior month, but sentiment remains more cautious than optimistic. October was the third consecutive month of PMI® contraction, at a slower rate compared to September. Demand contracted, with the New Orders Index contracting marginally, the Customers’ Inventories Index moving into ‘about right’ territory and the Backlog of Orders Index contracting for the sixth straight month (and at a faster rate). The New Export Orders Index surged into expansion territory, likely contributing to the slowing contraction of the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted, due primarily to lack of demand, but contributed positively (a combined +0.3-percentage point increase) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in October, due primarily to supplier delivery contraction offset by improvements in inventories. This resulted in a combined 0.4-percentage point net improvement in the Supplier Deliveries and Inventories indexes. Imports contraction quickened. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are more confident that materials received will be consumed in a reasonable time period. Prices decreased for the fifth consecutive month, at a faster rate.”

“Global trade remains the most significant cross-industry issue. Food, Beverage & Tobacco Products remains the strongest industry sector and Transportation Equipment the weakest sector. Overall, sentiment this month remains cautious regarding near-term growth,” says Fiore.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations of 49.0%, and suggests manufacturing contracted further in October.

October Employment Report: 148,000 Jobs Added ex-Census, 3.6% Unemployment Rate

by Calculated Risk on 11/01/2019 08:44:00 AM

From the BLS:

Total nonfarm payroll employment rose by 128,000 in October, and the unemployment rate was little changed at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in food services and drinking places, social assistance, and financial activities. Within manufacturing, employment in motor vehicles and parts decreased due to strike activity. Federal government employment was down, reflecting a drop in the number of temporary jobs for the 2020 Census.

...

Federal government employment was down by 17,000 over the month, as 20,000 temporary workers who had been preparing for the 2020 Census completed their work.

...

The change in total nonfarm payroll employment for August was revised up by 51,000 from +168,000 to +219,000, and the change for September was revised up by 44,000 from +136,000 to +180,000. With these revisions, employment gains in August and September combined were 95,000 more than previously reported.

...

In October, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $28.18. Over the past 12 months, average hourly earnings have increased by 3.0 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 148 thousand in October ex-Census (private payrolls increased 131 thousand).

Payrolls for August and September were revised up 95 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.093 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in October to 63.3%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate increased in October to 63.3%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 61.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in October to 3.6%.

This was well above consensus expectations of 93,000 jobs added, and August and September were revised up by 95,000 combined. A strong report, especially considering the GM strike, Census layoffs, and the upward revisions.

I'll have much more later ...

Thursday, October 31, 2019

Friday: Employment Report, ISM Manufacturing, Construction Spending

by Calculated Risk on 10/31/2019 07:06:00 PM

Note: It appears temporary Census hiring will have little impact on the October employment report.

My October Employment Preview: Take the Under

Friday:

• At 8:30 AM ET, Employment Report for October. The consensus is for 93,000 jobs added, and for the unemployment rate to increase to 3.6%.

Note: The GM strike and supplier cutbacks (now settled) will probably subtract close to 75,000 jobs in October.

• At 10:00 AM, ISM Manufacturing Index for October. The consensus is for 49.0%, up from 47.8%.

• At 10:00 AM, Construction Spending for September. The consensus is for 0.2% increase in spending.

Fannie Mae: Mortgage Serious Delinquency Rate increased slightly in September

by Calculated Risk on 10/31/2019 04:42:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency increased slightly to 0.68% in September, from 0.68% in August. The serious delinquency rate is down from 0.82% in September 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.53% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.24% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

October Employment Preview: Take the Under

by Calculated Risk on 10/31/2019 01:35:00 PM

Special Notes on GM Strike and Decennial Census: The GM strike has ended, but 48,000 workers were on strike during the BLS reference week. There was probably some spillover to suppliers and others - and the strike will probably reduce October employment by close to 75,000 jobs. The strike is over, and these jobs will return in November. No worries.

Over the last two months, the Census Bureau increased the number of temporary workers by 26,000. This phase of the Decennial Census was supposed to end mid-October, and it is possible that some of these workers were let go prior to the BLS reference week. If so, the headline number should be adjusted for these hires, see: How to Report the Monthly Employment Number excluding Temporary Census Hiring

Given these special events, it is possible (but unlikely) that we will see a negative headline employment number for October.

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus is for an increase of 90,000 non-farm payroll jobs in October, and for the unemployment rate to increase to 3.6%.

Last month, the BLS reported 136,000 jobs added in September (including 1,000 temporary Census hires).

Here is a summary of recent data:

• The ADP employment report showed an increase of 125,000 private sector payroll jobs in October. This was below consensus expectations of 139,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM Manufacturing and non-manufacturing reports have not been released for October.

• Initial weekly unemployment claims averaged 215,000 in October, up from 213,000 in September. For the BLS reference week (includes the 12th of the month), initial claims were at 218,000, up from 210,000 during the reference week the previous month.

This suggest a few more layoffs (during the reference week) in October than September..

• The final October University of Michigan consumer sentiment index increased to 95.5 from the September reading of 93.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker was weak in October suggesting 41K jobs lost in October.

• Conclusion: Based primarily on the BofA job tracker, and the GM strike, I expect job gains below expectations.

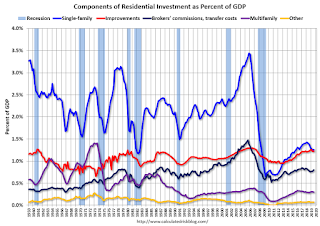

Q3 2019 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/31/2019 11:22:00 AM

The BEA has released the underlying details for the Q3 initial GDP report.

The BEA reported that investment in non-residential structures decreased at a 15.3% annual pace in Q3.

Investment in petroleum and natural gas exploration decreased in Q3 compared to Q2, and was down 16% year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices increased in Q3, and is up 6% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 37% year-over-year in Q3 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q3, but lodging investment is up 6% year-over-year.

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top, however it is close between single family and home improvement.

Even though investment in single family structures has increased from the bottom, single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases.

Investment in single family structures was $272 billion (SAAR) (about 1.3% of GDP)..

Investment in multi-family structures decreased in Q3.

Investment in home improvement was at a $264 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.2% of GDP). Home improvement spending has been solid.

Personal Income increased 0.3% in September, Spending increased 0.2%

by Calculated Risk on 10/31/2019 08:49:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $50.2 billion (0.3 percent) in September according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $55.7 billion (0.3 percent) and personal consumption expenditures (PCE) increased $24.3 billion (0.2 percent).The September PCE price index increased 1.3 percent year-over-year and the September PCE price index, excluding food and energy, increased 1.7 percent year-over-year.

Real DPI increased 0.3 percent in September and Real PCE increased 0.2 percent. The PCE price index decreased less than 0.1 percent. Excluding food and energy, the PCE price index increased less than 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through September 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income, and the increase in PCE, was at expectations.

PCE growth was decent in Q3, and inflation was below the Fed's target.

Weekly Initial Unemployment Claims increased to 218,000

by Calculated Risk on 10/31/2019 08:38:00 AM

The DOL reported:

In the week ending October 26, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 212,000 to 213,000. The 4-week moving average was 214,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 215,000 to 215,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 214,750.

This was higher than the consensus forecast.