by Calculated Risk on 11/14/2019 10:34:00 AM

Thursday, November 14, 2019

MBA: "Mortgage Delinquencies Fall to Lowest Level in Nearly 25 Years"

From the MBA: Mortgage Delinquencies Fall to Lowest Level in Nearly 25 Years

The delinquency rate for mortgage loans on one-to-four unit residential properties decreased to a seasonally adjusted rate of 3.97 percent of all loans outstanding at the end of the third quarter of 2019, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate was down 56 basis points from the second quarter of 2019 and down 50 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the third quarter fell by four basis points to 0.21 percent.

"Mortgage delinquencies decreased in the third quarter across all loan types - conventional, VA, and in particular, FHA," said Marina Walsh, MBA's Vice President of Industry Analysis. "The FHA delinquency rate dropped 100 basis points, as weather-related disruptions from the spring waned. The labor market remains healthy and economic growth has been stronger than anticipated. These two factors have contributed to the lowest level of overall delinquencies in almost 25 years."

Added Walsh, "Looking ahead, we do continue to monitor the credit profile of new FHA loans, as changes to this profile can have a noticeable impact on future delinquency rates."

...

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding to the lowest level since the first quarter of 1995. By stage, the 30-day delinquency rate decreased 42 basis points to 2.20 percent, the 60-day delinquency rate decreased six basis points to 0.75 percent, and the 90-day delinquency bucket decreased 8 basis points to 1.02 percent.

...

The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 0.84 percent, down six basis points from the second quarter of 2019 and 15 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the fourth quarter of 1985.

...

The seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.81 percent - a decrease of 14 basis points from last quarter - and a decrease of 32 basis points from last year. This the lowest seriously delinquent rate since the third quarter of 2000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Delinquencies decreased in Q3.

The percent of loans in the foreclosure process continues to decline, and is now at the lowest level since 1985.

Weekly Initial Unemployment Claims increased to 225,000

by Calculated Risk on 11/14/2019 08:36:00 AM

The DOL reported:

In the week ending November 9, the advance figure for seasonally adjusted initial claims was 225,000, an increase of 14,000 from the previous week's unrevised level of 211,000. The 4-week moving average was 217,000, an increase of 1,750 from the previous week's unrevised average of 215,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 217,000.

This was above the consensus forecast.

Wednesday, November 13, 2019

Thursday: PPI, Unemployment Claims, Fed Chair Powell Testimony

by Calculated Risk on 11/13/2019 06:48:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 211,000 last week.

• At 8:30 AM, The Producer Price Index for October from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the House Budget Committee, Washington, D.C.

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in October, Core PCE below 2%

by Calculated Risk on 11/13/2019 01:33:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in October. The 16% trimmed-mean Consumer Price Index rose 0.3% (3.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for October here. Motor fuel was up 53% annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.4% annualized rate) in October. The CPI less food and energy rose 0.2% (1.9% annualized rate) on a seasonally adjusted basis.

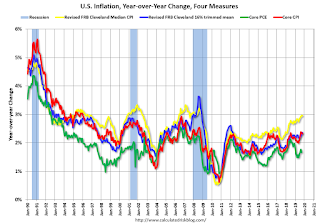

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 3.0%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.3%. Core PCE is for September and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.3% annualized and trimmed-mean CPI was at 3.6% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

NY Fed Q3 Report: "Household Debt Continues to Climb in Third Quarter as Mortgage and Auto Loan Originations Grow"

by Calculated Risk on 11/13/2019 11:16:00 AM

From the NY Fed: Household Debt Continues to Climb in Third Quarter as Mortgage and Auto Loan Originations Grow

he Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $92 billion (0.7%) to $13.95 trillion in the third quarter of 2019. This marks the 21st consecutive quarter with an increase, and the total is now $1.3 trillion higher, in nominal terms, than the previous peak of $12.68 trillion in the third quarter of 2008. The Report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

…

“New credit extensions were strong in the third quarter of 2019, with auto loan originations reaching near-record highs and mortgage originations increasing significantly year-over-year,” said Donghoon Lee, research officer at the New York Fed. “The data suggest that households are taking advantage of a low-interest rate environment to secure credit.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Mortgage balances shown on consumer credit reports on September 30 stood at $9.44 trillion, a $31 billion increase from 2019Q2. Balances on home equity lines of credit (HELOC) have been declining since 2009, and this quarter’s decline of $3 billion brings the outstanding balance to $396 billion. Non-housing balances increased by 64 billion in the third quarter, with increases across the board, including $18 billion in auto loans, $13 billion in credit card balances, and $20 billion in student loans.

New extensions of credit were strong for the third quarter. Auto loan originations, which include both newly opened loans and leases, remained high in the third quarter, at $159 billion, a small increase from the last quarter’s volume but the second highest ever observed. Mortgage originations, which we measure as appearances of new mortgage balances on consumer credit reports and which include refinances, were at $528 billion, a notable jump from the $445 billion seen in the same quarter last year. Aggregate credit limits on credit cards also increased, by $27 billion, continuing a 10-year upward trend

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate increased in Q3. From the NY Fed:

Aggregate delinquency rates worsened in the third quarter of 2019. As of September 30, 4.8% of outstanding debt was in some stage of delinquency, a 0.4 percentage point increase from the second quarter due primarily to increases in early delinquency buckets. Of the $667 billion of debt that is delinquent, $424 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have previously been charged off that the lenders continue to attempt collection).There is much more in the report.

Fed Chair Powell: The Economic Outlook

by Calculated Risk on 11/13/2019 10:54:00 AM

Testimony from Fed Chair Jerome Powell Before the Joint Economic Committee, U.S. Congress, Washington, D.C.: The Economic Outlook. Excerpts:

The U.S. economy is now in the 11th year of this expansion, and the baseline outlook remains favorable. Gross domestic product increased at an annual pace of 1.9 percent in the third quarter of this year after rising at around a 2.5 percent rate last year and in the first half of this year. The moderate third-quarter reading is partly due to the transitory effect of the United Auto Workers strike at General Motors. But it also reflects weakness in business investment, which is being restrained by sluggish growth abroad and trade developments. These factors have also weighed on exports and manufacturing this year. In contrast, household consumption has continued to rise solidly, supported by a healthy job market, rising incomes, and favorable levels of consumer confidence. And reflecting the decline in mortgage rates since late 2018, residential investment turned up in the third quarter following an extended period of weakness.

…

Inflation continues to run below the Federal Open Market Committee's (FOMC) symmetric 2 percent objective. The total price index for personal consumption expenditures (PCE) increased 1.3 percent over the 12 months ending in September, held down by declines in energy prices. Core PCE inflation, which excludes food and energy prices and tends to be a better indicator of future inflation, was 1.7 percent over the same period.

Looking ahead, my colleagues and I see a sustained expansion of economic activity, a strong labor market, and inflation near our symmetric 2 percent objective as most likely. This favorable baseline partly reflects the policy adjustments that we have made to provide support for the economy. However, noteworthy risks to this outlook remain. In particular, sluggish growth abroad and trade developments have weighed on the economy and pose ongoing risks. Moreover, inflation pressures remain muted, and indicators of longer-term inflation expectations are at the lower end of their historical ranges. Persistent below-target inflation could lead to an unwelcome downward slide in longer-term inflation expectations. We will continue to monitor these developments and assess their implications for U.S. economic activity and inflation.

emphasis added

Houston Real Estate in October: Sales up 6% YoY, Inventory Up 7%

by Calculated Risk on 11/13/2019 10:37:00 AM

Another solid regional market in October.

From the HAR: Buyers Maintain Demand for Houston Housing in October

Continued low mortgage interest rates kept consumers in a buying mood in October, powering home sales to a fourth consecutive positive month. According to the latest monthly report from the Houston Association of Realtors (HAR), sales of single-family homes across the greater Houston area totaled 7,231 in October. That is up 8.1 percent compared to a year earlier. On a year-to-date basis, home sales are 4.2 percent ahead of 2018’s record volume, making it ever more likely that 2019 will establish a new record for local real estate.Total active inventory was up 6.9% YoY to 43,468 properties from 40,675 properties in October 2018. Sales are on pace for a record year.

...

Sales of all property types climbed 6.2 percent in October, totaling 8,579 units. Total dollar volume rose 7.9 percent to $2.4 billion.

…

In addition to the incentive that lower mortgage rates create, buyers benefited from a slightly larger supply of homes on the market with housing inventory up to a 4.0-months supply in October versus 3.9 months in 2018. So far this year, the peak inventory was reached in June and July when it grew to a 4.3-months supply.

“Consumers continue to take advantage of attractive buying conditions, between low interest rates, a healthy supply of homes on the market and a strong overall Houston economy,” said HAR Chair Shannon Cobb Evans with Better Homes and Gardens Real Estate Gary Greene. “Interest rates are currently forecast to remain low into the new year, so it’s possible that we get through the holidays without too much of a seasonal slowdown in home sales, but we’ll just have to see how things go.”

emphasis added

BLS: CPI increased 0.4% in October, Core CPI increased 0.2%

by Calculated Risk on 11/13/2019 08:33:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in October on a seasonally adjusted basis after being unchanged in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment.Core inflation was at expectations in October. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.2 percent in October after increasing 0.1 percent in September.

...

The all items index increased 1.8 percent for the 12 months ending October, a slightly larger rise than the 1.7-percent increase for the period ending September. The index for all items less food and energy rose 2.3 percent over the last 12 months.

emphasis added

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 11/13/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 8, 2019.

... The Refinance Index increased 13 percent from the previous week and was 188 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 15 percent higher than the same week one year ago.

...

“Mortgage applications increased to their highest level in over a month, as both purchase and refinance activity rose despite another climb in mortgage rates. Positive data on consumer sentiment, and growing optimism surrounding the U.S. and China trade dispute, were behind last week’s rise in the 30-year fixed mortgage rate to 4.03 percent,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Refinance applications jumped 13 percent to the highest level in five weeks, as conventional, FHA, and VA refinances all posted weekly gains. With rates still in the 4 percent range, we continue to expect to see moderate growth in refinance activity in the final weeks of 2020.”

Added Kan, “Last week was a solid week for homebuyers. Purchase applications increased 2 percent and were 15 percent higher than a year ago. Low supply and high home prices remain a key characteristic of this fall’s housing market, which is why the largest growth in activity continues to be in loans with higher loan balances.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.03 percent from 3.98 percent, with points decreasing to 0.31 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

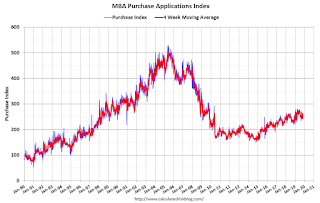

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year.

Tuesday, November 12, 2019

Wednesday: CPI, Fed Chair Powell Testimony, Q3 Quarterly Report on Household Debt and Credit

by Calculated Risk on 11/12/2019 07:10:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

• At 11:00 AM, NY Fed: Q3 Quarterly Report on Household Debt and Credit

• At 11:00 AM, Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Congress